In today’s episode, I answer two questions about financial independence and the FIRE movement, followed by four questions about rental property investing.

In today’s episode, I answer two questions about financial independence and the FIRE movement, followed by four questions about rental property investing.

Matt asks:

I’m interested in achieving financial independence, and I want to encourage my friends to pursue the same goal. What podcast episodes provide a light, digestible introduction to the world of financial independence and retiring early?

Daniel asks:

Do you have any opinions on the saturation of financial independence blogging and podcasting pursuit. It seems like everyone who pursues FIRE has a blog or a podcast. It almost seems like making extra money by blogging or podcasting about FIRE is a necessary step to achieving financial independence. This seems contradictory. What’s the point?

Tom asks:

I’m a consultant with a California-based LLC. My consulting company doesn’t hold many assets under the LLC’s name.

As my wife and I start to purchase rental properties, should we hold these properties in my existing LLC? I know there are general benefits to owning property inside of an LLC, but I’m wondering if it makes sense to combine this with other active income, like consulting income. Thoughts?

Anonymous asks:

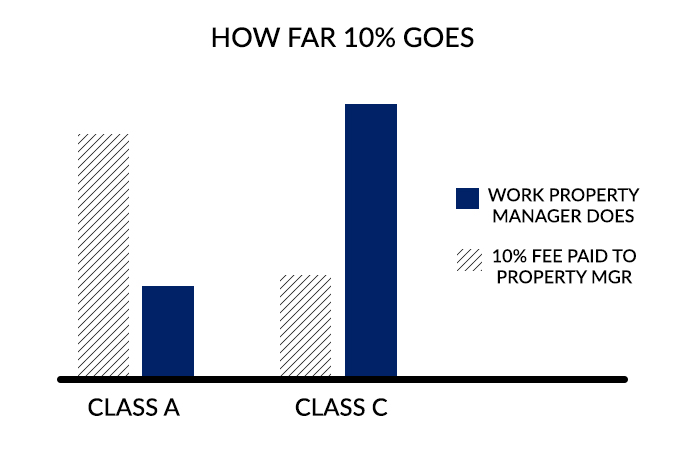

What factors go into your decision on whether or not to use a property management company? How should I estimate the cost of repairs and maintenance? And how should the tax benefits of rental properties play a role in choosing a property?

Brett asks:

I own a fully-paid-off rental property in Las Vegas. I bought it for $105,000 in 2011, and it’s currently worth $235,000 – $240,000 today. I’m renting this property for $1,200 per month, which is a good return on investment, but not a good return on equity.

This property was my primary residence until December 2017. If I sell it in the next couple of years, I can avoid paying capital gains tax, which will be at least $15,000.

I want to invest more in real estate. If I sold the property, I would want to use all of that money (along with additional funds) to invest in real estate in a new market.

I’m not a leverage person. I don’t want to take out a HELOC or refinance. I want to pay cash for my future properties when possible.

Should I continue to hold my current rental property, or should I sell and invest in a new market with better returns?

Anonymous asks:

I’m an Indian citizen who lives in California on an H1-B visa. I own two rental properties in Texas.

There’s a chance that my visa won’t be renewed, which means I’ll need to move back to India. What should I do with my rental properties?

Right now, I’m managing my properties from out-of-state. In the future, I’ll have to manage it from out-of-country. How should I prepare? What should I do before I leave the U.S.?

I have minor children who are U.S. citizens. My hope is that they’ll manage the properties when they become adults, which will happen in 15 years.

Can I manage my properties from another country? If so, should I purchase more?

I answer these six questions in today’s episode. Enjoy!

— Paula

Resources Mentioned:

Question 1:

- Afford Anything – Escape eBook

- Ep. #65 – How to Improve Your Relationship With Money

- Ep. #39 – The Seven Stages of Financial Independence, with Joshua Sheats

- Ep. #87 – Money Myths – Are Your Ideas Holding You Back?

- Ep. #89 – Imagine You Only Have 10 Years to Live…

Question 2:

- Ep. #139 – How I Save Half of My Income as a Firefighter, While Living in an Expensive City, with Kim E.

Question 3:

Question 4:

Other Resources:

Thanks to our sponsors!

Freshbooks

Save time by using Freshbooks, an easy-to-use, cloud-based accounting system that takes the stress and hassle out of bookkeeping and, especially, invoicing. You can create an invoice in a few seconds, and Freshbooks’ automated system will handle the rest. Visit Freshbooks.com/paula for a free 30-day trial. Please mention this show when they ask how you heard about them.

ZipRecruiter

ZipRecruiter learns what you’re looking for, identifies people with the right experience, and invites them to apply to your job. In fact, 80% of employers who post a job on ZipRecruiter get a quality candidate through the site in just one day. Give it a try and post your job listing for free by going to ZipRecruiter.com/Afford.

Gusto

Gusto makes payroll, benefits, and HR easy for modern small businesses. In fact, 72% of customers spend less than 5 minutes to run payroll! If you sign up at gusto.com/paula, you’ll receive 3 months free once you run your first payroll.

Beachbody On Demand

Have any fitness goals you’re working toward? Then check out Beachbody On Demand, an online streaming service that gives you unlimited access to over 600 highly effective, world-class workouts. I’ve been using Beachbody On Demand for a few weeks now – the core workout from the T25 program is my favorite. To get a full-access free trial membership, text Paula to 303030.