There’s a scene in a classic 1950’s TV show, The Jack Benny Program, in which a mugger points a gun at the title character.

“Your money or your life,” the mugger says.

Jack Benny is silent.

“I said, your money or your life!” the mugger repeats.

“I’m thinking it over!,” Jack replies.

The scene is funny because it’s absurd. When we face a choice between our money or our life, of course we’d rather live.

But day-to-day, most of us exchange our precious hours for a paycheck. We prioritize money over our life. And in that regard, the scene is also funny because it’s true.

In the early 1960’s, a scrawny New Yorker named Joe Dominguez decided to opt out of the rat race.

Joe grew up in Harlem, raised in a bilingual household that received “welfare cheese.”

“He was a runty guy, and wicked smart,” says his partner, Vicki Robin. “He couldn’t use brawn to survive, so he became the brains of his gang.”

Although he never graduated from college, he maneuvered his way into a Wall Street firm, where he developed some of the finest technical analysis tools of the early 1960’s. Joe held the singular goal of retiring by age 30.

He retired at age 31 with a nest egg of about $100,000, according to his obituary in the New York Times. (That’s around $697,600 in today’s dollars.) He lived on $6,000 per year, equivalent to $40,700 in today’s dollars.

In the early 1970’s, Joe met Vicki, and a lifelong partnership began. Vicki had graduated with honors from Brown University and was working in New York when the two of them crossed paths. They discovered that their purposes and direction were well-matched, and they started teaching, writing and speaking about the concept of financial independence, or “FI.”

In 1992, they co-authored the book Your Money or Your Life, the culmination of their decades-long collaboration. The book sold more than one million copies and laid the groundwork for the modern FI movement.

Joe died of cancer in 1997, at age 58. Two days before he passed away, he wrote cards for his family and friends that said: “Joe Dominguez has been given a clean bill of death. Please direct your attention to the living and to the things that need to be done.”

Vicki, now 72 and herself a recent cancer survivor, continues to do exactly that.

Your Money or Your Life is not a book about managing money. It’s a book about transforming your relationship with money.

Vicki and Joe start by examining the concept of money:

- Material: Money is cash, credit cards, the stuff of daily transactions.

- Psychological: Money represents our fears and desires.

- Cultural: Money represents our beliefs about our self-worth, about good and bad, winners and losers.

- Life energy: Money is the concept for which you trade your time.

“Money is like a mirror that allows us to see ourselves,” the authors write.

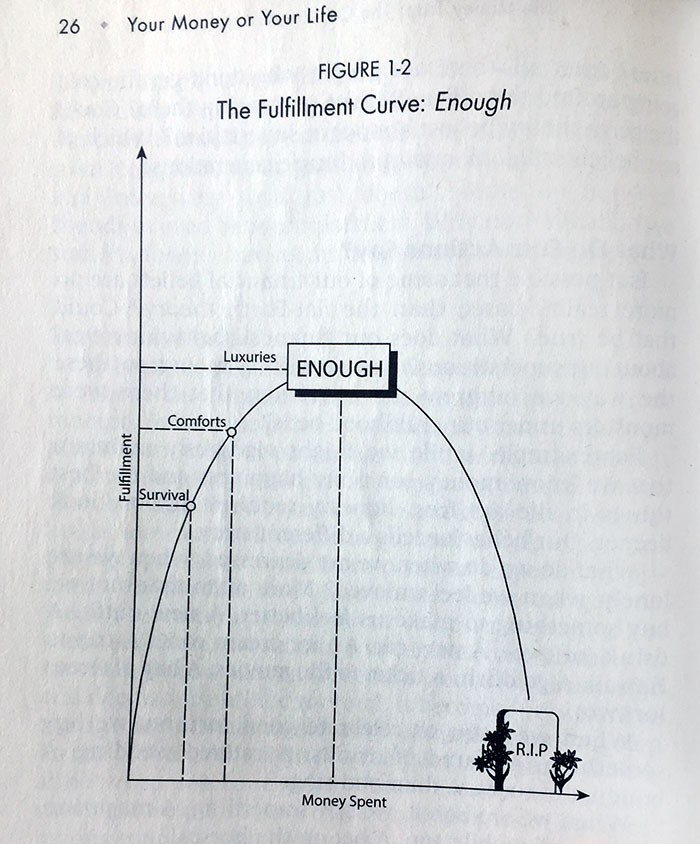

Next, they introduce the concept of enough.

Society teaches us that more = better, but the truth is that after a tipping point, more = clutter, distraction and noise.

“Some people would say that once we’re above the survival level,” the book says, “the difference between prosperity and poverty lies simply in our degree of gratitude.”

How much is enough? Vicki and Joe describe four components of enough:

- Accountability: Understand how much money is flowing in and out of your life.

- Yardstick: Find an internal yardstick of fulfillment that reflects your values, not social pressures and expectations.

- Purpose: Develop a purpose in life that involves contribution, rather than acquisition.

- Responsibility: Extend love and care into the world, and you’ll realize that having “enough” is closer than it may appear.

They outline 9 steps towards achieving financial independence:

Step 1: Make peace with your past.

First, find out how much money you’ve earned in your lifetime. (They describe in-depth strategies for unearthing this figure, but as a shortcut, you can check your lifetime earnings at ssa.gov).

Find your net worth. (They describe in-depth strategies for calculating this, but as a shortcut, you can use this free net worth tracker.)

Finally, view your lifetime earnings compared to your net worth. What do you have to show for the money you’ve made?

If you’ve invested well, your net worth might be higher than your lifetime earnings. If you’ve endured debt, your net worth might be lower than your lifetime earnings. No matter what your answer — no shame, no blame. Don’t judge yourself. Start with an honest understanding of where you are today.

Step 2: Calculate your real hourly wage.

Find out how much you earn per hour. (Here’s a shortcut: knock three zero’s off your annual salary, then divide by 2. If you earn $80,000 per year, you make $40 per hour.)

That’s your theoretical hourly wage.

Next, subtract the costs of working, including commuting, buying office clothes, coffee and meals on-the-go, decompressing with happy hour specials or escapist entertainment, and paying for job-related illnesses.

Add the hours that you spend on all of the above — commuting in bumper-to-bumper traffic, ironing your pants, polishing your wingtip loafers, picking up the dry-cleaning.

Readjust your numbers. You may work 40 hours a week, plus spend 15 hours per week commuting / dry-cleaning / meal-prepping / ironing. That’s a 55-hour work-related week.

You might earn $80,000 annually, but spend $5,000 per year on vehicle wear-and-tear, gasoline, office outfits, lunches and carpal tunnel treatment.

Now calculate your real hourly wage:

Time: 55 hours/week * 50 weeks/year = 2,750 hours per year

Money: $80,000 income – $5,000 job-related costs = $75,000 income

Real Hourly Wage: $75,000 / 2,750 = $27.27 per hour

Next time you’re tempted to drop $30 on a round of martinis, ask yourself if it’s worth an hour of your life.

(I explore this exercise in my free e-book, Escape.)

Psst. If you’ve already reduced your commute, or work from home, you can save even more. Check out Metromile – car insurance that starts at $29/month + a few cents for every mile that you drive. Get a free quote – it’s risk-free. Only available in CA, VA, WA, OR, IL, PA, NJ, and AZ.

Step 3: Track your expenses, then convert into hours.

You can track your income and expenses in a few ways:

If You Prefer Cash: You could practice the “envelope system,” in which you spend cash from envelopes that you fill at the start of each month. Alternately, you could write your expenses in a notebook, or track it through an app like Evernote.

If You Prefer Credit or Debit Cards: Pay for everything with a credit or debit card, and link your account to an online program like Mint or Personal Capital that will sort it into categories.

Next — and this is critical! — convert your expenses into the hours of your life energy that it consumed.

If you spent $350 at restaurants last month, and your real hourly wage is $27.27, those fancy dinners cost nearly 13 hours of your life.

Ouch.

Remember — no shame, no blame. The goal is to face reality, not chastise ourselves.

Step 4: Ask yourself three questions.

Next, figure out if you’re spending money in a way that’s aligned with your values. To arrive at a deeper understanding of this, ask yourself three questions:

1: Did I receive fulfillment, satisfaction and value in proportion to life energy spent?

2: Is this expense of life energy aligned with my values and purpose?

3: How might this change if I didn’t have to work for money?

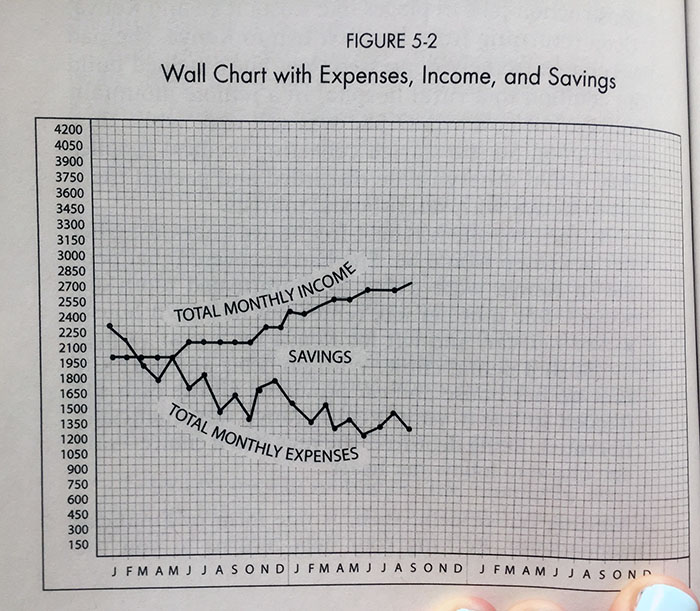

Step 5: Chart your money.

Create a visual chart of your total monthly income and expenses. Hang this in a prominent spot, where you’ll see it everyday. Pay attention to the gap between these two lines.

Step 6: Spend less.

“Frugality is enjoying the virtue of getting good value for every minute of your life energy and from everything you have use of,” the authors write. “Frugality means enjoying what we have … waste lies not in the number of possessions but in the failure to enjoy them. Your success at being frugal is measured not by your penny-pinching but by your degree of enjoyment of the material world.”

In other words, gratitude is the antidote to want.

Step 7: Redefine work.

“Our jobs now serve the function that traditionally belonged to religion,” the authors write. “They are the place where we seek answers to the perennial questions ‘Who am I?’ and ‘Why am I here?’ And ‘What’s it all for?'”

Redefine work. Your work is survival and income, yes, and it’s also your contribution to humanity, and it’s also the enjoyment of your free time.

Work is not always income-producing. Work includes the effort you invest into your health, your relationships and your community.

Value your time and life energy. Don’t sell yourself short. Ask yourself probing questions, such as “how could I double my income without compromising my health or integrity?”

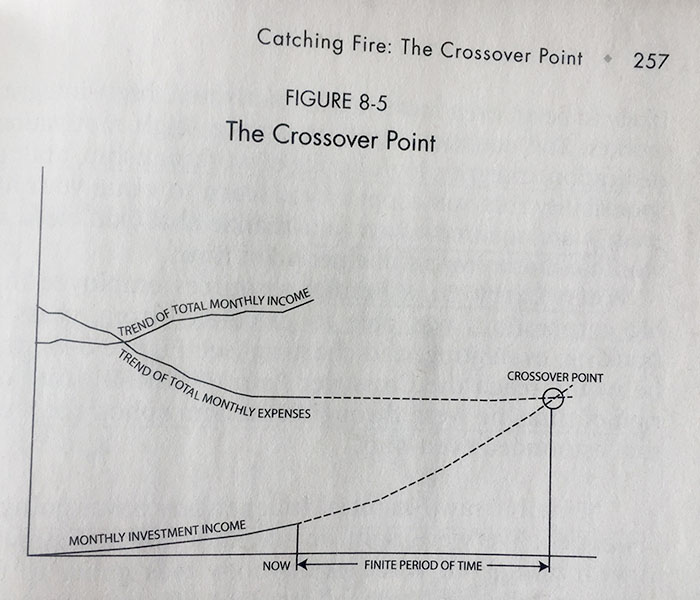

Step 8: Find your crossover point.

Your “crossover point” is the point at which the income from your capital is enough to cover your expenses.

The authors give the following formula:

[capital x current long-term interest rate] divided by 12 = monthly investment income

For example:

[$1,500 x 4%] / 12 = $5 monthly investment income

You can invert this to find out how much money you’ll need to cover your expenses. For example, if your expenses are $3,000 per month:

[$3,000 x 12] / 4% = $900,000 total assets

You’ll reach the crossover point (financial independence) when your investment income covers your basic expenses.

(Note: This merits a longer discussion about interest rates, and other types of investments. If you want to learn more about investing, read this or this.)

Step 9: Invest

You can earn investment income in five ways, the authors write:

- Interest

- Dividends

- Capital gains

- Rents

- Royalties

Vicki has multiple income streams: socially responsible index funds, bonds, rental properties, Social Security, local lending, and her “side hustle” as an author.

“While writing a book is an elephant of a side hustle,” she says, “it also fits here because it’s episodic, snugs into my diverse life activities, and could disappear without crashing my financial independence.”

Learn about long-term, income-producing investments, she says, and choose the ones that align with your values.

Most financial advice is based on the idea that more-is-better. Your Money or Your Life is based on the idea that enough is enough.

Most financial advice is based on the idea that more-is-better. Your Money or Your Life is based on the idea that enough is enough.

This was a radical idea in 1992, when Vicki and Joe published the first edition of their groundbreaking book. This radical idea continues to thrive today — and fortunately, the idea is spreading further and faster.

Vicki joined me as a guest on the Afford Anything podcast to talk about the next evolution — moving from financial independence to financial interdependence. I recommend spending an hour of your life listening to this episode.

But first, answer one question:

Your money? Or your life?

Jack Benny needed to think about the answer. We all need to think about the answer. Because implicit within this question is a hidden, second layer:

How much is enough?