I love to read. If you share my enthusiasm, you might enjoy this variety of books about money, work and life that I recommend.

Feel free to scroll, or click on one of these links to skip ahead to your favorite section.

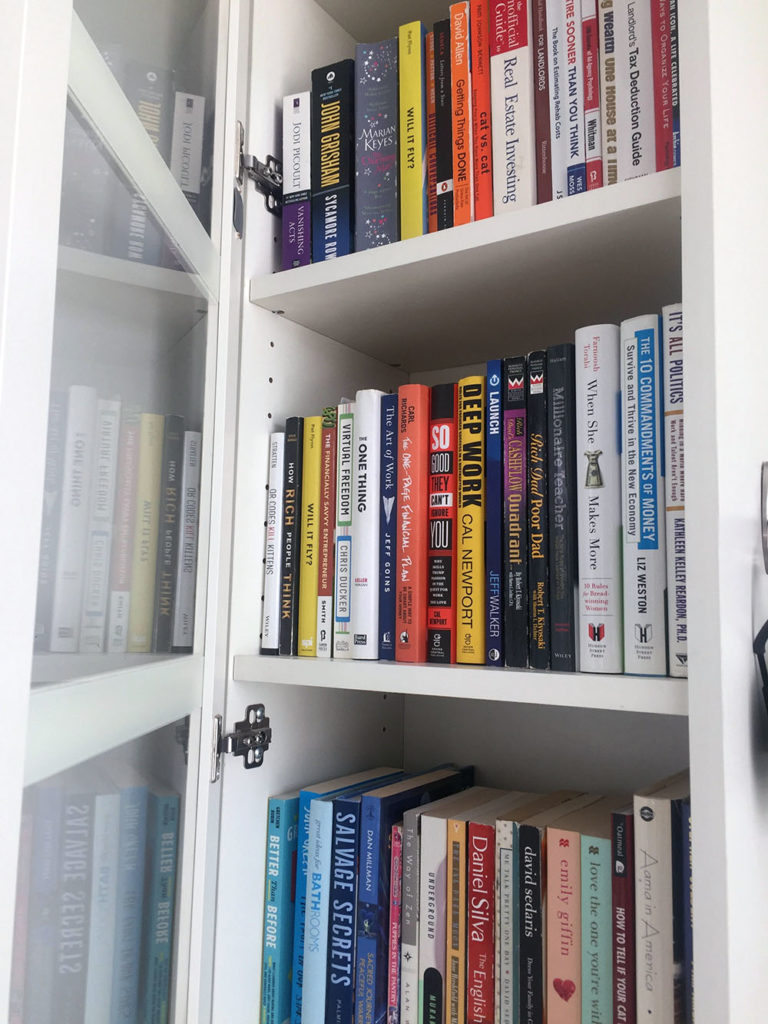

Productivity Books

Deep Work, by Cal Newport

I’ve raved about this book several times, and I’ve also interviewed Dr. Cal Newport on my podcast, where he shared his tremendous insight into productivity and focus.

If you’re tired of getting distracted by email, social media, and small tasks, read this book.

It’s easy to get trapped in an endless cycle of replying to emails, Slack chats, text messages and Facebook messages. You respond to dozens of tiny tasks and inputs throughout the day. The result? Deep work gets replaced with distraction.

Your ability to create something amazing, and to make major breakthroughs, gets replaced by the constant ding and buzz of incoming messages.

But you won’t make progress by living inside your Inbox. Progress comes from deep work — from focusing on the one thing that most moves the needle.

Deep work – focus – is abnormal. It’s rare. Since value comes from scarcity, deep work is the most valuable type of work that you can perform.

In this book, Newport explores the Deep Work Hypothesis, which states that deep work is both rare and valuable. He explains how to incorporate more deep, groundbreaking work into your life.

168 Hours, by Laura Vanderkam

Reading this book inspired me to track my time in 15 minute increments for a week. The result? I discovered that I waste enough time to cover a part-time job.

In 168 Hours, Laura explains that we have more time than we think we do. While we might feel like our schedules are jam-packed, they’re not.

Most of us have plenty of time left – after work and sleep – to spend time doing things we enjoy. We’re already time-rich. We just don’t know it yet.

Laura is a mom of four, and she’s no stranger to working long hours. But she finds time to exercise, socialize, and spend quality downtime alone.

Read this book if you feel overworked and exhausted at the end of the day, or if you don’t believe that you have much spare time.

I also interviewed Laura on my podcast; check it out.

Bonus Mentions:

- Getting Things Done, by David Allen. Classic book that taught me the importance of maintaining Inbox Zero, a goal that I reach about once every three to six months.

- The ONE Thing, by Gary Keller. In this book, Keller recommends that you start each day by asking yourself: “What’s the ONE thing I could do today, such that by doing it, everything else becomes easier or unnecessary?” By focusing on the highest-leverage opportunity, you create a life that’s easier and more productive.

- The Power of Habit, by Charles Duhigg. This book blew my mind. We’re ruled more by our habits than our decisions — and this means we can change our lives by changing our habits. This book explains how.

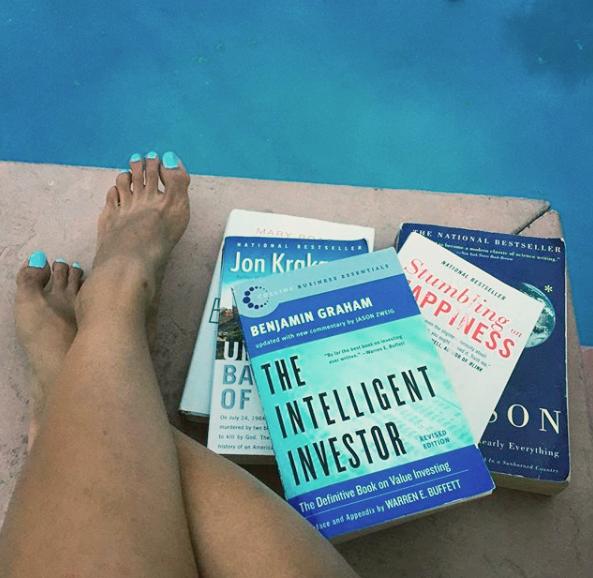

- Stumbling on Happiness, by Daniel Gilbert. I’ll never order a meal at a restaurant in the same way again. If you’re curious about why your mind operates in the way in which it does — and if you’d like to be aware of your cognitive biases so you can make better decisions — read this book.

Money Mindset Books

Millionaire Teacher, by Andrew Hallam

Andrew became a millionaire on a high school teacher’s salary. His book, Millionaire Teacher, explains how.

I’ve known Andrew since 2011, and he’s one of the sharpest minds in the index fund investing space. I interviewed him on my podcast, and Andrew was so prolific that I had to divide our conversation into two parts.

His writing is clear, simple, and jargon-free. His message is common sense, which is why it’s surprising that so many people don’t follow it.

- Read This If: You’ve uttered the words “I don’t earn enough to become a millionaire.”

- Don’t Bother Reading If: You’re an advanced investor.

How Rich People Think, by Steve Siebold

This is an easy read that cuts straight to the chase.

Steve structured this into 100 ultra-short chapters, each roughly two pages long.

Every chapter illustrates a high-level concept. Here are some examples:

- The middle class plays it safe. The rich take wise, calculated risks.

- The middle class thinks wealth is a solitary effort. The rich know it’s a team effort.

- The middle class thinks ambition is a sin. The rich think ambition is a virtue.

- The middle class assumes you must choose between family or money. The rich know you can enjoy both.

- The middle class sets low expectations to avoid disappointment. The rich set high expectations to stay excited.

There’s no need to read front-to-back. Feel free to skip around.

- Read This If: You want an overview on cultivating a wealth mentality.

- Don’t Bother Reading If: You want actionable specifics.

Your Money or Your Life, by Vicki Robin and Joe Dominguez

This is a financial independence classic.

Released in the 1990’s (and updated in 2018), this New York Times Bestseller popularized the financial independence movement. Here’s a big, 2,000+ word article I’ve written about this book.

The Millionaire Next Door, by Thomas Stanley and William Danko

The richest people in the U.S. don’t live on Park Avenue. They live next door.

These were the findings of two researchers who interviewed dozens of American millionaires in search of common threads

They discovered:

- The majority didn’t inherit anything from their parents, not even $1.

- Most have “cheap” tastes; they prefer Bud Light to fancy champagne.

- They drive used cars and live in middle-class houses.

- They own non-glamorous businesses. “We are welding contractors, auctioneers, rice farmers, owners of mobile-home parks, pest controllers, coin and stamp dealers, and paving contractors.”

- They are your next door neighbors. And you have no idea they’re rich.

Most millionaires invest their money, which is how they become (and stay) millionaires. The media loves to spotlight Kim Kardashian and Paris Hilton, but they’re the exception, not the norm.

- Read This If: You hold the limiting belief that you can’t be a millionaire.

- Don’t Bother Reading If: You want specific, actionable instructions.

Investing Books

The Little Book of Common Sense Investing, by Jack Bogle

Thinking of toying around with mutual funds and individual stock selection?

Don’t bother.

In this epic classic, Jack Bogle – the founder of Vanguard – throws down the gauntlet, explaining why index funds are the ultimate investment.

If you’ve wondered why so many personal finance bloggers are index fund enthusiasts, this book nails it.

- Read This If: You want to understand index funds.

- Don’t Bother Reading If: You love index funds and don’t need any further confirmation.

Common Stocks and Uncommon Profits, by Philip Fisher

There are two popular stock market investing philosophies: value investing and growth investing.

Value investors look for strong companies that are momentarily underpriced. They’re the bargain-hunters of the stock market world.

Growth investors focus on companies with tremendous growth potential. They’re willing to pay full retail price for a company that could be the Next Big Thing.

This book is written by the late Philip Fisher, known as the “Father of Growth Investing.” (Ironically, his son is a value investor.) His colleague, the late Benjamin Graham, is known as the “Father of Value Investing.”

If you want to understand these two theories, read one book from each author.

I read Common Stocks and Uncommon Profits several years ago, when I wanted to learn how to invest. I decided to stick with simple index funds (following the teachings of my favorite investor, Jack Bogle), so I’ve never needed to apply these ideas. This book helped me make more informed decisions.

- Read This If: You’re a finance enthusiast who wants to learn investing principles.

- Don’t Bother Reading If: You don’t care about learning theory. You just want to know what actions to take. (Buy index funds.)

The Intelligent Investor, by Benjamin Graham

Warren Buffet says that his philosophy is 85% Benjamin Graham and 15% Philip Fisher.

Don’t read one without the other.

If you’re interested in learning investing theory, read these two books together. (And then follow Jack Bogle’s advice.)

- Read This If: You’d like a foundation in stock investing ideas.

- Don’t Bother Reading If: You want to cut to the chase. (Stick with index funds. End of story.)

Real Estate Investment Books

From 0 to 130 Properties in 3.5 Years, by Steve McKnight

This is the first book about real estate investing I ever came across, and it planted the seed of an idea that led me to where I am today.

This book helped me learn how to think like a buy-and-hold real estate investor. It’s a mindset book, not an actionable “how to” instructional.

Huge disclaimer: The information about laws, taxes, banking, financing, etc., applies only in Australia. Read it for the high-level concepts, not the specifics (unless you’re also Australian).

- Read This If: You want to develop the mindset of a rental property investor.

- Don’t Bother Reading If: You want actionable, concrete information.

The Millionaire Real Estate Investor, by Gary Keller

Gary Keller, the co-founder of Keller Williams brokerage, writes about “myth-understandings” (myths and misunderstandings) about investments.

Specifically:

- Myth: Investing is risky.

- Reality: Investing is risky if you don’t know what you’re doing.

If you buy the wrong property, you’re screwed. If you buy correctly, however, you remove risk.

- Myth: Investing is complicated.

- Reality: Investing is only as complicated as you make it.

When you’re in kindergarten, 5th-grade math seems hard. It’s all about perspective.

- Myth: Good investors time the market.

- Reality: Good investors make the best of the current time.

Great investors don’t blame the market. They seize all current market situations for opportunity.

- Read This If: You want to develop an investor mindset.

- Don’t Bother Reading If: You want actionable steps. Also, don’t bother if you’re an advanced or experienced real estate investor. This is better for beginners.