Here’s the thing:

Many people think that I focus on real estate investing. They assume that blogging (and now podcasting) is a hobby that I handle on the side.

In reality, the opposite is true.

Real estate investing takes up almost none of my time. It hums along in the background.

The cash flow I collect through real estate gives me the freedom and flexibility to jump into whatever new project catches my attention.

For example, back when I started podcasting, I invested a bajillion hours into launching it. (I didn’t track my time, but it’s a lot.) My former cohost and I hired a producer, purchased equipment, and even experimented with Facebook ads.

(Hey, they say that young people experiment with crazy stuff!)

We knew this project might not work out. Launching the podcast was a risk.

My real estate investments are the reason I can take these risks.

I can work on a new project — dumping time and money into something that might fizzle — and feel unfazed about the prospect of moderate loss.

If the project doesn’t work out, that’s fine! I’ll chalk it up to a learning experience and move on.

Sure, failure would be embarrassing at the emotional level. But it’s manageable at a logistical level. My bank account can handle a few controlled failures.

My confidence — not practical considerations — is my biggest limiting factor.

My real estate investments provide a safety net. They give me cash flow that I can fall back on if my other projects fall apart.

Fortunately, I’ve never needed to fall back on my real estate income. I stockpile it into savings, and then use those savings to either (1) buy another property, (2) upgrade a current property, or (3) make extra mortgage payments.

But that’s a choice. And it’s nice to know that if my other entrepreneurial ventures fall apart, I have the security of this passive income stream.

So with that being said — let’s take a look at January’s real estate cash flow report, shall we?

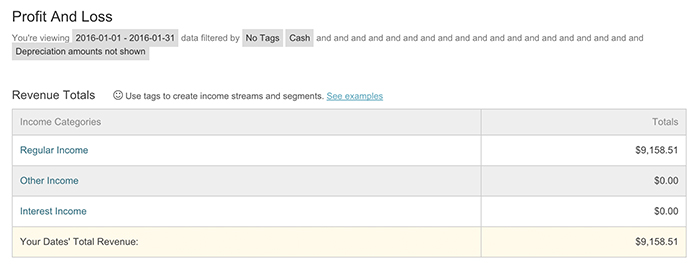

Gross Income: $9,158.51

[If you’re a new reader, check out the Ultimate Real Estate FAQ Page for the backstory behind these monthly reports.]

Here’s the top-line revenue from January:

- Unit 1: $2,750

- Unit 2: $1,490

- Unit 3: $1,295

House #2: $850.50

House #3: $1,273

House #4: $1,500

House #5: —– Nothing

Ridiculously Tiny Interest From Bank: $0.01

Total: $9,158.51

The tenant in House #5 paid rent late. Guess who didn’t have to spend a single minute dealing with it?! (Points to self and grins!)

My property manager collected the late payment in full, plus an additional $165 late fee. (Ouch!) They sent me a mid-month email with a full report — the date of collection, the amount, etc.

My workload for chasing down the rent? Nothin’.

I spent the month focused on three things: running this website, launching the podcast, and creating the real estate course.

The rental payment for House #5 should appear in my account next month.

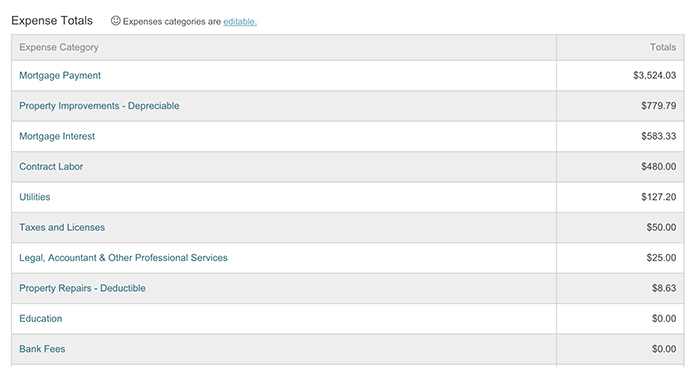

Expenses: $5,577.98

On with the spending spree!

Mortgage: $3,524.03 — This is PITI for multiple properties.

Mortgage, Part II: $583.33 — This is an interest-only payment for House #3

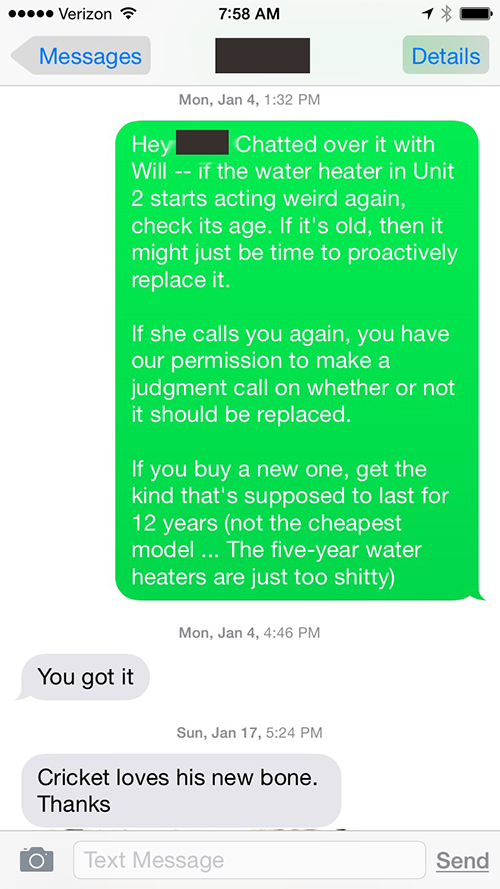

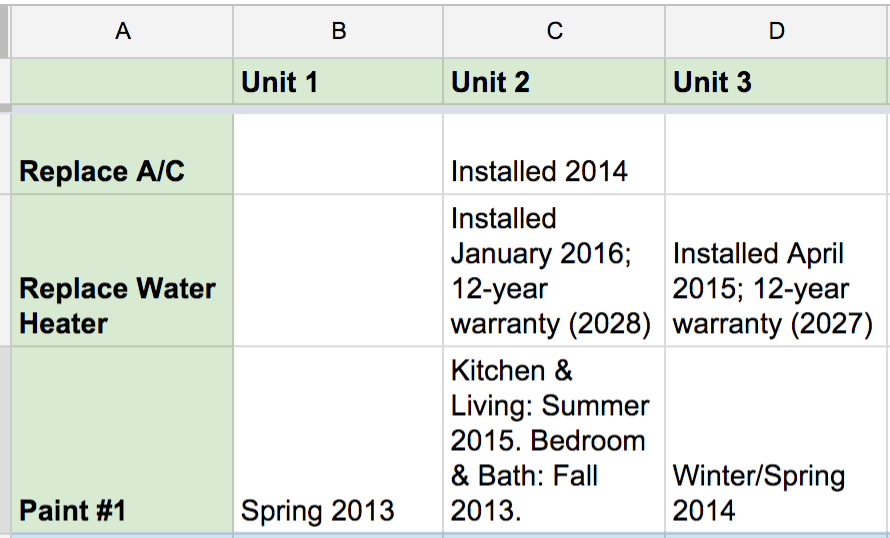

Property Improvements: $779.79 — We replaced a water heater for Triplex, Unit #2. (You know what’s crazy? Owning seven water heaters.)

We manage the triplex ourselves. I normally wouldn’t recommend this, but we lived in the triplex until a few months ago, so we have close relationships with the tenants. We also know every square inch of that building, since we lived there for five years.

A few months ago, our tenant complained about water heater issues. Our contractor fixed the issue, but we suspected it might flare up again.

Actually, you might enjoy peeking behind-the-scenes at how we manage this.

Here, I’ll show you the text message chain [Caution: Profanity]:

Boom — just like that, the water heater got replaced.

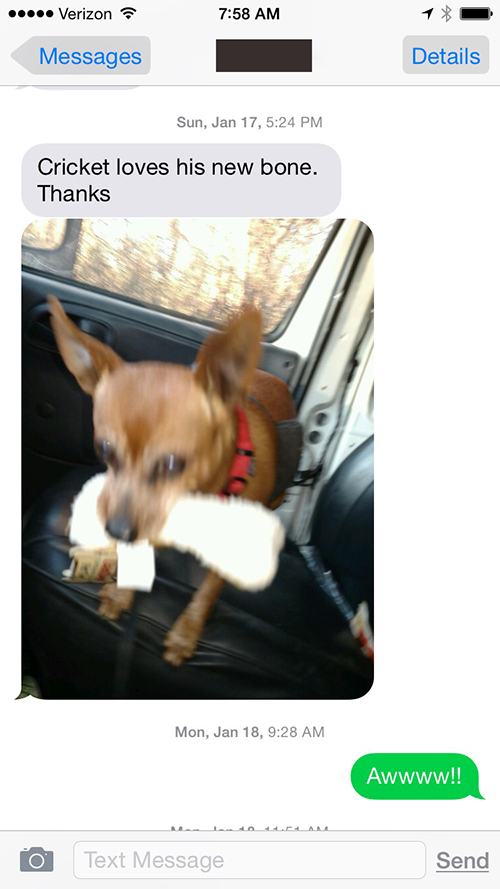

And my contractor’s dog enjoyed his Christmas present.

This is the reason I emphasize building an all-star team if you want to create a scalable business.

Hire the best. Hire people with integrity; people whose judgment you trust. Don’t cheap out. Don’t start nickel-and-diming your staff. Find people who do great work, and treat them well.

Oh — and when they replace the water heater, track it in a spreadsheet:

By popular demand, here’s the spreadsheet template I use to track my rental property maintenance so you can use it as well:

Wait, where were we? Oh yeah — I was in the middle of detailing expenses.

On with the show!

Contract Labor: $480 for my contractor’s time.

Utilities: $127.20 — The water bill for the triplex.

Taxes and Licenses: $50 — Annual LLC renewal

Legal and Accounting: $25

Property Repairs: $8.63 — Felt pads from Amazon to protect the hardwood floors.

Total Expenses: $5,577.98 (including mortgages)

Subtract expenses from income, and this month we’re left with a cash flow of …

Net Cash Flow: $3,580.53

Please keep in mind that this is a cash flow report, designed to show month-by-month volatility. Occasional expenses like vacancies and capital improvements are reported as they happen, in real-time.

Check out the FAQ page, which is a one-stop-shop to answer all the questions I get about rental property investing.

How passive is this? How much time did it take?

Total Time: One Hour

Here’s the work that Will and I both handled this month.

Will:

- Sent a total of 8 text messages to contractor.

- Had a 10-minute phone call with contractor.

- Ordered felt pads on Amazon.

- Had 1-minute conversation with me about replacing water heater.

- Me: “Hey, that thing is probably old. Should we just replace it?”

- Him: “Sure.”

- Total: Approx. 30 minutes

Paula:

- Sent a total of 3 text messages to contractor.

- Reviewed financial statements from property managers. (10 minutes)

- Bookkeeping. (10 minutes)

- Total: Approx. 30 minutes

Combined Total: One hour

So … that’s $3,580.53 for one hour of work. Not bad!

I’m being facetious when I say that the $3,580.53 is payment for one hour of work.

The reality is that we did a whole bunch of work upfront, years ago, and now we’re seeing the reward.

It’s like when people say, “I get paid $5,000 to give a one-hour speech!” Yes, the speech itself is only an hour. But in reality, you’re getting paid for years of preparation that got you to this point.

I want to debunk the myth that buy-and-hold real estate investing is a “second job.”

Being a contractor is a job. The guy who replaced the water heater — he’s working hard.

One hour of work per month is NOT a job, and it’s inaccurate to lump long-term real estate investing into the same bucket as traditional employment.

But by the same token, I want to emphasize that this isn’t free money that fell from the sky.

Sure, I only handled one hour of work in January 2016, but that’s because we took the time to look at property after property after property — often for months — before pulling the trigger.

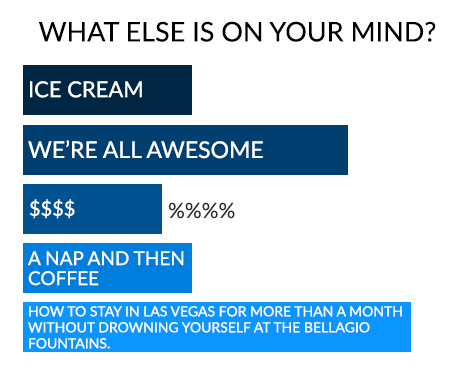

You Talked. We Listened. Now Let’s Get Ice Cream.

**This section was last updated in 2016. As of 2020, over 1,000 students have enrolled in Your First Rental Property. You can still join our VIP list for updates and additional knowledge!**

My other major focus — the focal point of this year — is creating a kick-booty, awesome rental property investing course.

About 1,700 of you have currently joined the VIP List, where I send special announcements and updates about this course.

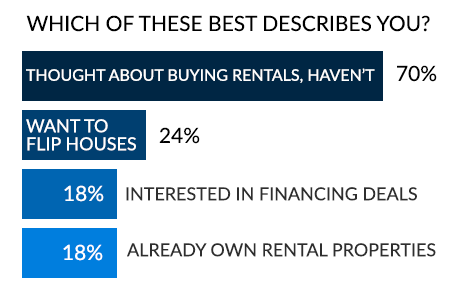

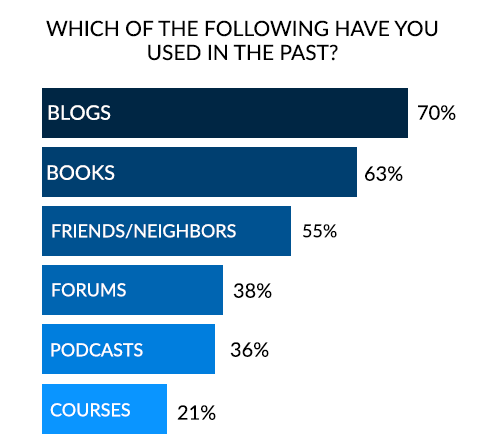

Over the past two months, my team and I designed five surveys, which we sent to the VIP List.

We emailed these in five “waves” — with every new survey building upon the responses collected from the previous survey.

Here’s what we found out.

The typical Afford Anything VIP Lister:

- Thinks about investing in real estate, but hasn’t made a move yet. (A few are “accidental landlords.”)

- Reads blogs and books about real estate investing.

- Is interested in rental properties.

VIP Listers also:

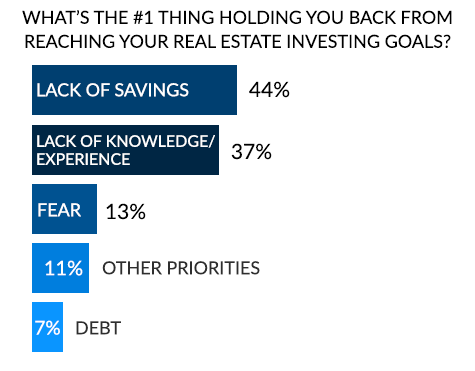

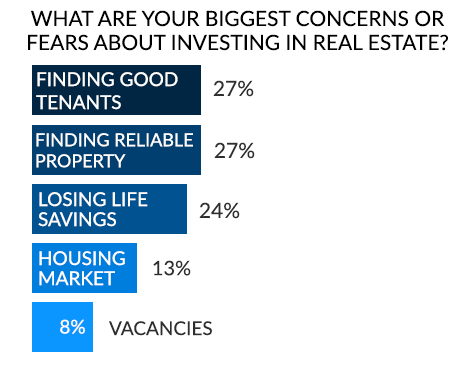

- Feel held back because they’re not saving as much as they’d like.

- Feel unsure about what to do.

- Feel fear.

Finally, the VIP Listers:

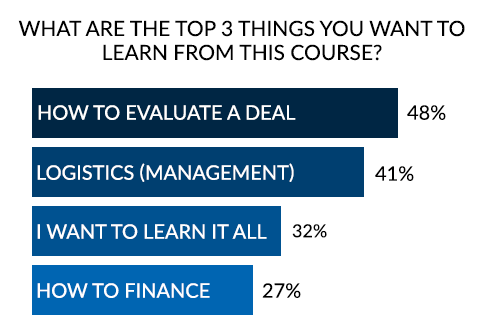

- Want to learn how to evaluate a deal.

- Want to know how to manage a real estate business

- Want to learn how to finance deals.

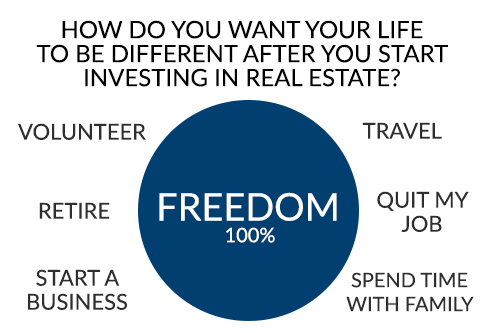

- Are motivated by freedom.

They say that you attract the audience that reflects you. This survey is quantifiable evidence that’s true.

The more I read through the survey results, the more I’m like, “Holy moly!! I’m writing to an audience of ME!”

I write about long-term, cash flow investing, so I’ve attracted a community that shares that interest.

I’m motivated by freedom, rather than fancy things, so I’ve attracted a community that shares those values.

Meanwhile, the aspiring Fancy McFancyPants aren’t interested in my message. They’re drawn to real estate gurus who promise flashy cars and diamond toenails.

(I was going to say “necklace,” but diamond toenails are such a better visual, don’t ya think?)

Many of you share my offbeat sense of humor, too. This was my favorite survey result:

Hmmm.

Well, I can easily answer that question about Vegas.

Just spend your time here —

Thanks everyone! This week has been AWESOME!

Join the VIP List for a backstage pass to this awesome real estate investing course!

You’ll get a behind-the-scenes look and a 7-day mini-course on real estate investing 101.

Thanks!

(And if you’re like, “nah, not interested,” join the fun on Instagram or check out the new podcast.)