Hi there!

This post is an illustrated, pared-down version of my recent “Inflation, Explained” podcast episode.

It was created as a simple, easy-to-digest guide to help you understand the current inflationary environment in the US.

Ready? Let’s dive in!

What is inflation?

Simple definition: too much money chasing too few goods.

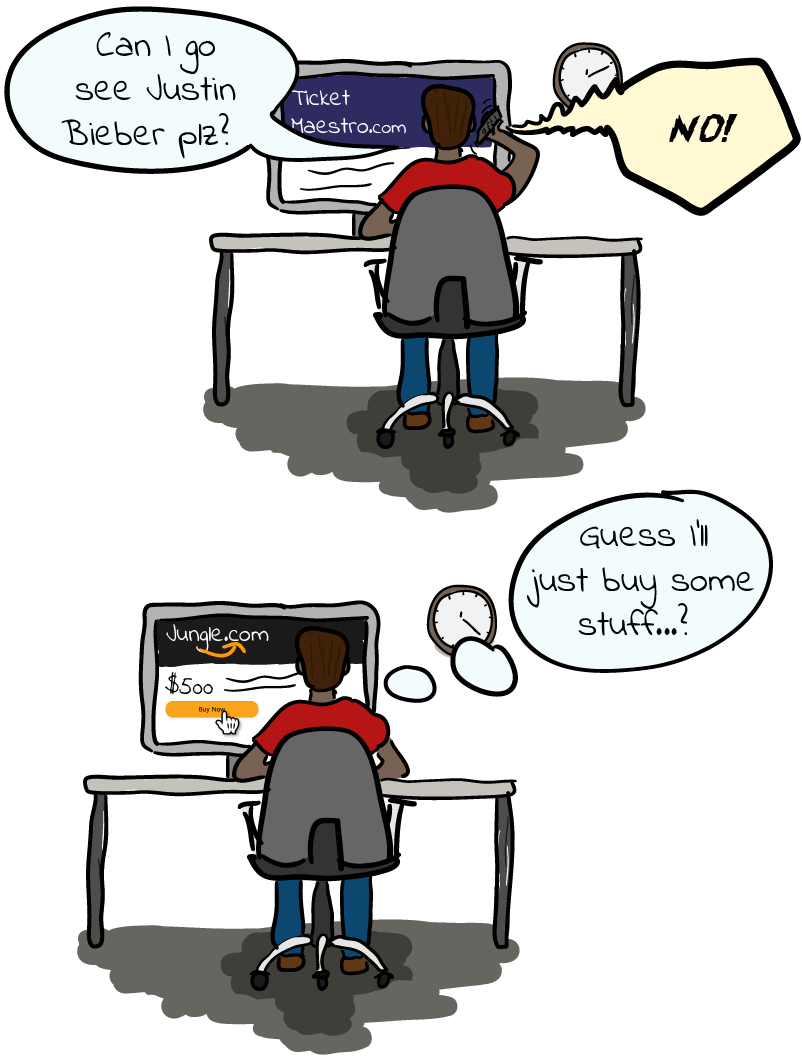

– a.k.a. this: –

When Does it Happen?

1.

When the growth of the money supply outpaces the growth of the economy

The money supply grows from…

– Printing & issuance of new money

– The government loaning money into banking system by purchasing government bonds

– The government deciding to legally devalue currency*

(*the U.S. dollar has only been deliberately devalued once, in 1933-1934)

2.

When demand outpaces supply, (aka too much money chasing too few goods) which causes prices to rise.

What this can look like…

– Higher demand for goods that can’t quickly or easily increase in supply. (More on this in a minute.)

– Manufacturers and retailers facing higher production costs due to external factors driving up the cost of raw materials or manufacturing. These higher costs get passed down to the end consumer.

Fun fact!

There’s also something called the “wage price spiral.”

It takes place when…

1. Prices begin to rise,

2. Causing life to get generally more expensive,

3. And so workers ask for higher salaries,

4. Which employers pay,

5. And then the employers have to raise the price of **their own goods and services** to pay those increased labor costs!

6. …Which then cycles back to step 1 and compounds, pushing prices up further.

(If this sounds familiar, it’s because this has been our reality for the past 2 years!)

What the wage price spiral has looked like these past couple years:

Services were unavailable (e.g. concerts, restaurants, travel, etc.) so people turned their attention towards goods.

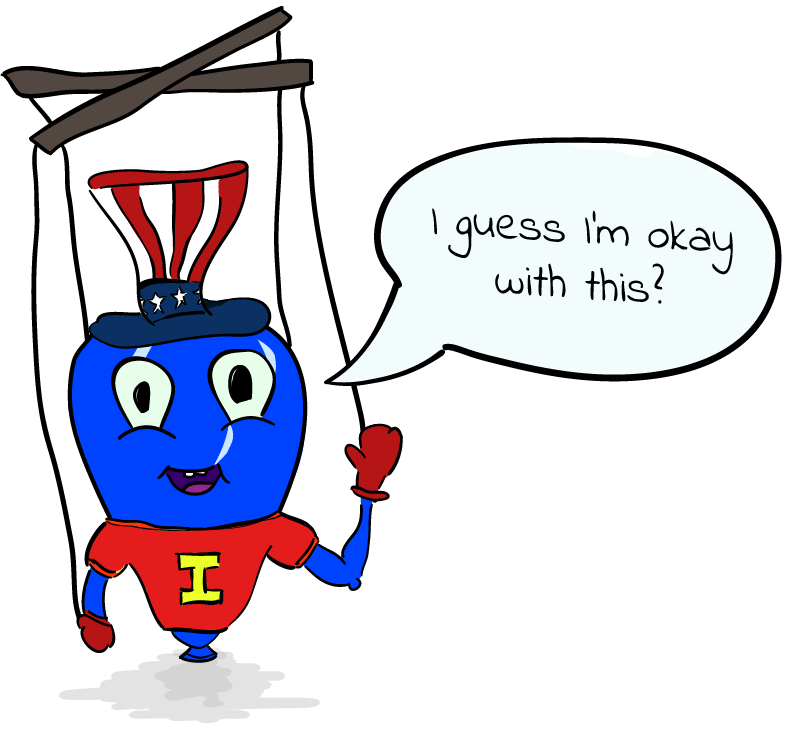

Meanwhile, stimulus checks increased money supply and kept consumer confidence high…

But at the same time, the supply chain capabilities couldn’t meet all the added demand for goods.

Fun fact!

In many sectors, producers must make large capital expenditures in order to increase production capacity. (For example: lumber millers.) These heavy CapEx investments require a long lead time, often multi-year.

Many producers lack either the capital to invest, or the confidence that the increased demand will persist. They don’t want to invest in CapEx for fear that two years down the line they’ll be overproducing for lower demand.

On top of all this, there are a lot of people opting out of the work force, whether for home schooling, general Covid concerns, caring for a family member, relocation, etc.

This further compounds the wage price spiral.

What are the effects of inflation?

Background info…

1. Some degree of **controlled inflation** is desirable for the economy, because it causes investors to look for investments to outpace inflation.

(📈 Investment activity = ⛽️ Fuel for the economy)

2. Controlled inflation also encourages consumers to spend now since tomorrow’s cash is worth less than today’s.

(💸 Money changing hands = ⛽️ More fuel for the economy)

The takeaway here…

All this is to say that inflation can be a good thing.

But!!! It needs to be managed carefully.

Fun fact!

For developed economies, around 2 percent inflation is the targeted “sweet spot” amount.

For developing economies, the targeted amount is usually higher. For example, India targets 4 percent. (+/- 2%)

With that background info out of the way, let’s move on to…

“How does inflation affect me?”

Who inflation is good for…

1. Borrowers

Once the banking system has money (from the government buying bonds), they’re able to loan it out.

The people who are able to get these loans are poised to benefit *significantly* as inflation picks up, especially the borrowers who were able to get fixed-rate loans.

Why?

If you have a fixed-rate loan with a rate that’s *lower* than inflation, it means that over time you repay that loan with cheaper and cheaper dollars.

2. Exporters

Inflation is good for exporters because they pay lower production costs associated with a weaker USD and sell their products in a stronger currency.

Who inflation is bad for…

1. Savers

Your dollar can buy less stuff, and the value of your cash gets eroded the longer you hold it.

2. Importers

The weaker USD means foreign-made goods are effectively more expensive.

How different assets are affected by inflation

Tangible assets

Tangible assets (that are valued in currency) are strong inflation hedges.

These allow you to store monetary value in something other than currency.

Examples include real estate (residential, commercial, land), commodities (oil, natural gas, precious metals, wheat and corn), art, and jewelry.

As inflation increases, often so could the value of these assets.

How to get a triple win!

If you were to take out a fixed-rate mortgage to buy real estate, you’d have a fantastic setup for an inflationary environment.

Here’s why:

1. You’d own an asset that historically has performed incredibly well in inflationary periods

2. You’d have a locked-in fixed-rate mortgage that you secured before interest rates rise further.

3. You’d repay your mortgage with cheaper dollars over time

(Check out my free “2023 Real Estate Inflation & Recession Guide” for an in-depth overview of real estate investing in our current inflationary environment.)

What about stocks?

Historically, stocks and real estate have been great hedges against inflation.

But not all stocks are equally strong in inflationary periods.

Growth Stocks = 👎

Growth stocks are stocks that look promising for the future but don’t have particularly great numbers right now.

(e.g. Amazon, Facebook, Netflix, etc.)

Growth stocks usually take a hit during high-inflation environments. 💩

Value Stocks = 👍

Value stocks are stocks for companies that are doing well today but that investors believe are underpriced in the market relative to their performance.

Value stocks historically have done well in high-inflation environments. 📈

Fun fact!

Many (but not all) tech stocks are growth stocks, and several tech stocks (the “FAANG” stocks — Meta, Amazon, Apple, Netflix, Alphabet) also represent the largest cap stocks in the index.

This is one reason why we’ve seen such huge swings in the overall stock market lately…

Investors have been reassessing what they’re willing to pay for potential future returns on growth stocks in light of our high inflationary environment. When the Fed tightens the money supply, there’s a risk of recession, which means battling inflation necessarily holds a degree of recession risk. This makes investors more cautious.

Said another way…

Lots of growth stocks being sold + those stocks representing a large percentage of the total market cap = volatility in the stock market

Takeaways and next steps

Hopefully you now have a better foundational understanding of inflation and how it affects you.

Here’s what to do next…

1.

Stay Calm

Don’t get too wrapped up in headlines.

Don’t blow up your entire strategy and portfolio.

Remember that you’re in this for the long game, and that smart investing is about being patient and strategic, NOT trying to time the market.

2.

Evaluate your portfolio

Take a look at your portfolio and ask yourself how your portfolio will fare if this inflationary environment lasts 2, 3, or even 5 years.*

(*Note: Historically in the U.S., it’s taken an average of slightly over two years — 27 months — for inflation to reach its ideal 2 percent target, as measured from the inflation rate at the start of a recession).

3.

Know thyself

Start with the end in mind. Before you make changes to your portfolio, think about your investment goals, timelines, risk tolerance and risk capacity.

Fun fact!

If you’re interested in real estate investing, your next step is to check out my 2023 Real Estate Inflation & Recession Guide.

You’ll get answers to questions like…

– “How do rising interest rates affect real estate investing?”

– “If there’s a recession in 2023, will housing prices tank like they did in 2008?”

– “Can good deals still be found, or have I missed the boat?”

– “How should I set up my portfolio to handle inflation and a recession?”

Just let me know where I should send it…

4.

What NOT to do

Don’t dump all your money into any asset that you’re not ready for.

Don’t panic-buy a house because you’re afraid of getting priced out of the market.

Don’t blow up your entire portfolio.

Don’t radically change your investing style, asset mix and timeline. Remember to think in decades; invest for the long-term.

Aim for balance and flexibility, and the right amount of liquidity for your lifestyle needs.

Thanks for reading!

If you have a friend or family member who could use some clarity about inflation, I’ll love you forever (as will they!) if you share this post with them.

And if you’re interested in real estate investing, be sure to check out my 2023 Real Estate Inflation & Recession Guide.

Stay calm out there,

— Paula