Last month, I pocketed $7,461.43 from my rental properties — after expenses — and spent 5.5 hours looking after these investments. That’s $1,356 per hour.

That story is below.

But before we dive into those details, I’d like to highlight one event that made last month special.

Nope, it’s not the income.

Nope, it’s not the weather.

It’s the fact that last month, I fired a sucky property manager. I hired another property manager to replace him.

I coordinated all of this from 2,000 miles away.

And it was much, much easier than I’d imagined.

Buckle up.

In this article, I’ll unleash everything I know about hiring and firing property managers. If you’re a rental property investor, I hope you’ll bookmark this as an in-depth reference on managing your managers.

We’ll start in a second.

But first — here’s a backstage peek at last month’s numbers.

Every month, I divulge the income and expenses within my rental business so you can see its actual cash flow.

My hope is that this gives you a realistic, hype-free understanding of the type of cash flow that a person might encounter with a rental property portfolio like mine.

I also document the time that we spend managing these properties, so you can get an idea of how passive this enterprise is.

Here we go:

*Note: Management fees, when applicable, are ‘taken from the top’. The revenue you’re reading below is the after-fee remainder. If you’re a new reader, check out the FAQ HQ for full details.

March Revenue: $11,321.82

We own 7 rental units. Here’s how this income breaks down:

Unit 1, Triplex: $2,750

Unit 2, Triplex: $1,490

Unit 3, Triplex: $1,295

House #2: $850.50

House #3: $1,273

House #4: $1,500

House #5: $2,163.30

Ridiculously Tiny Interest From Bank: $0.02

Total: $11,321.82

“Heeeyy, House #5 pulled in more than usual!”

Yep. Remember how I didn’t collect any House #5 payments in the past two months? (Ahem — that’s one of the reasons I fired the property manager.) We caught up on past due amounts in March, including late fees.

Next, let’s chat expenses.

**Note: As I repeat in every monthly update, this report is a snapshot of current activity. Annual costs like CPA fees, etc., and irregular expenses like renovations, get reported the month in which they’re debited. If you’re new to these updates, read the FAQ HQ.

Mortgage: $3,524.03 — This is PITI for multiple properties.

Utilities: $291.36 — Two months’ worth of water bills, both of which we paid in March.

Lawn Care: $30

Ordering New Checks: $15

Total Expenses: $3,860.39

Cash Flow: $7,461.43

Last month, we earned $7,461 (net) from our rental properties, with 5.5 hours of work.

Sweet! This is the highest on record since I started writing these monthly reports.

We can attribute this to two factors —

(1) We collected on past-due rent payments, and

(2) Our expenses are around $600 less than normal, since the lenders deposited our monthly mortgage check for House #3 at the start of April. You’ll see higher-than-usual expenses next month.

How did we spend our time?

Here are Will’s activities in March 2016:

- 30 min — Reviewing the lease and other documents for new Unit #2 tenants

- 10 min — Onboarding phone call with new Unit #2 tenants

- 5 min — Opening lease on Cozy.co

- 120 min — Opening a new business bank account so we can stop paying those stupid monthly fees!! Wahoo!!

- 90 min — Meeting with departing Unit #2 tenant (including move-out inspection) and incoming tenant (including move-in inspection).

Will’s March 2016 Total: 4.25 hours

Here are my activities:

- 10 min — Talked to Will about decision to fire House #5 property manager. Emailed other manager to coordinate a phone meeting.

- 30 min — Phone call with House #2 manager, in which I asked her to also represent House #5.

- 5 min — Sent 30-day termination notice to House #5 manager, letting them know I’ll be moving on.

- 15 min — Miscellaneous emails to my preferred manager, sending documents like the property deed, current lease, owner disclosure, and walk-through report.

My March 2016 Total: 1 hour

(Combined) Total Time: 5.5 hours.

The single most interesting piece of data (for me) that’s come from writing these monthly reports is the time-tracking. Frankly, I’m surprised March’s time commitment was so short. After all, we handled two projects —

- We handled a turnover

- I fired and replaced one of my property managers

The turnover was routine and, therefore, quick.

But replacing a property manger isn’t routine. I’ve never fired a PM.

And I’m happy to say it was faster and easier than I expected.

How to Fire a Property Manager

Here’s a bit of backstory:

I use property managers for my Class C properties only. We manage the Class A properties ourselves. (I discuss this here.)

I hired the property manager (PM) for House #2 based on a recommendation from a friend/landlord. After extensively checking her out, I chose this PM for several reasons:

- She specializes in the neighborhood where that property is located. This means she has a solid grasp of issues, benefits, prices, etc., specific to that location.

- She was highly recommended by someone who holds several properties in that same neighborhood.

- She conducts herself professionally. She answers emails and phone calls ASAP. She uses proper grammar and complete sentences. Her listings are well-written. She appears attentive-to-detail.

- She speaks highly of her team. When you hire a PM, the “face” of the company is typically not the person carrying out day-to-day functions. It’s important to be confident not just in the ringleader, but also in the team she hires.

Notice that I didn’t mention price. My goal is to hire the best, not the cheapest.

Sure, there might be property managers who charge 8 percent instead of 10 percent … and I don’t care. Not in the least. Knowing that a skilled, attentive professional is nurturing my expensive asset is worth the extra few percent.

I’ve been her client for 3 years, and I think she’s EXCELLENT.

But when I needed to hire a PM for House #5, I decided to try someone new. I had two reasons:

- This property is in a different neighborhood, and I wanted a PM with specific zip code expertise.

- I reasoned that if I hired two managers, I could compare-and-contrast my experience, and then choose the best.

I asked several area investors for recommendations, but oddly, most of them dodged the question.

So instead, I Googled “national association of residential property managers,” looked at the list of volunteers who serve on the executive board of the local chapter, and chose the highest-ranking one who specializes in the neighborhood where House #5 is located. I screened and interviewed him, and he appeared impressive.

My reasoning? If a PM is motivated enough to volunteer for a leadership role in an industry professional group, he probably takes his business seriously. Or so I thought.

Unfortunately, in my case, that logic didn’t pan out.

I first had an inkling of trouble when the PM took terrible photos of the vacant unit for the listing.

Let’s be clear: I have realistic expectations. I know a PM isn’t a professional photographer. But there were basic deficiencies in these photos. Here — I’ll show you. Here are the images they posted on the rental listing:

Yes, they published this blurry bathroom photo. Seriously. I’m not joking. This is ‘advertising’ material. Can you believe this?

Why wouldn’t you take 5 seconds to open that other window blind? I mean, seriously?

Well, I hope those images didn’t ruin your afternoon.

Here are the images I took of the same property, in the same week:

SAME bathroom. See the difference?

Hey, as long as we’re looking at bathroom photos …

Okay, last bathroom photo. I posted this on Instagram.

See the benefit of opening the window blinds?

They only featured ONE photo of the kitchen. My photo batch included 8 kitchen images.

I have zero photography training. My photos pale in comparison to what a real photographer could create. But geez, at least I tried.

After I saw the PM’s terrible images, I drove to the property, snapped better photos and asked the PM to update the listing. I let a few days tick by, since websites need time to crawl for updates. And when I double-checked the listing, I noticed they were still using the old pictures. Grrr.

So … yeah. Attention to detail isn’t their thing.

But fine, I’ll play ball. After the PM signed the House #5 tenant, I let them continue running the show. Maybe advertising is their weak spot, I figured, but perhaps their tenant management practices are strong.

Um … nope.

Remember the November 2015 income report, when I mentioned that the refrigerator broke in House #5? Remember how I mentioned that we asked the tenant to measure the opening where the fridge stands (30 inches), and then we ordered the appliance and arranged for delivery?

Yeah … that’s the property manager’s job. Not ours.

Remember the January and February 2016 income reports, when I still hadn’t collected the December rent payment from House #5, despite the fact that the PM collected funds from the tenant?

Yeah … they should be faster at sending payments. Or at least communicate better.

I never had any idea when to expect payment. When I emailed them to ask, they didn’t reply. Several times.

They haven’t done anything wrong, as far as I know. They haven’t misplaced funds; I’ve received everything I’m owed. They’re legit and above-board. They just don’t display the professionalism and attention-to-detail that I prefer. I get the sense that they’re doing the bare minimum.

I’m glad I hired two PM’s, so I could compare their performance. One PM is excellent; the other is mediocre.

But I’ll admit: I procrastinated on firing the mediocre PM because it felt scary. There were several times I came close to firing him, but I thought: “just one more month.”

That was silly. In hindsight, I should have realized that my excellent PM is a powerful ally.

She reviewed my PM agreement and confirmed my understanding: I’m free to leave the mediocre PM with a 30-day notice. After I gave that notice, she handled the next steps.

Long story short, she took care of everything.

I didn’t have to do anything, other than send a two-sentence email saying, “Hi there, this is my 30-day notice to terminate our relationship; I’ve CC’ed the property manager who will be replacing you. Please coordinate with her directly.”

Easy as pie.

(Is pie easy?)

How to Hire a Property Manager

After dealing with this, I’ve thought a lot about how I find, screen, hire (and fire!) property managers.

While no approach is fool-proof, there are ‘best practices’ that you can take to recruit awesome PM’s to your team.

Here are 10 lessons for anyone curious about how to hire a property manager.

#1: Ask for recommendations.

This is hands-down the #1 way to find a good PM. Of course, in order to get recommendations, you’ll need to meet other landlords. Here’s how to meet them:

- Search the name of your city/state, followed by “apartment owners association” or “landlord association.” (If you search “property owners association” you’ll most likely get HOA-related results.) Check to see if they host networking meetings.

- Search the name of your city/state, followed by “real estate investors association,” “REIA,” “RE investors club,” or “REI.” In most metro areas, this will point you towards local investor meet-ups. The meetings will be a mishmash of flippers, wholesalers, etc., so check their website to see if they have a sub-group of buy-and-hold investors.

- Check Meetup.com to find local real estate investing or rental property investing meet-ups.

- Ask your own landlord — or your friends’ landlords — if they’re aware of local networking groups. I stumbled across one of my favorite investor meet-ups as the result of knowing-someone-who-knows-someone.

#2: Look at neighborhood listings.

This is what I should have done to find the original House #5 manager.

Search online as though you’re a prospective tenant. Look only at the neighborhood where your rental property is located.

Take a look at the listings. Make note of which listings are well-written, updated, and professional. You’re not judging the property itself; you’re only looking at the quality of the written listing.

Every listing has the manager’s contact information. If you see a PM with several well-crafted listings, contact them and introduce yourself.

#3: Check professional groups.

When I couldn’t find recommendations for a PM in the specific neighborhood where House #5 is located, I decided to search the National Association of Residential Property Managers to see who’s active. Despite my anecdotal experience, I still believe this is a sound tactic.

Alternately, you could try the Institute of Real Estate Management >> Find a Professional. Beware, their website sucks.

Okay. Once you identify a few property management candidates ….

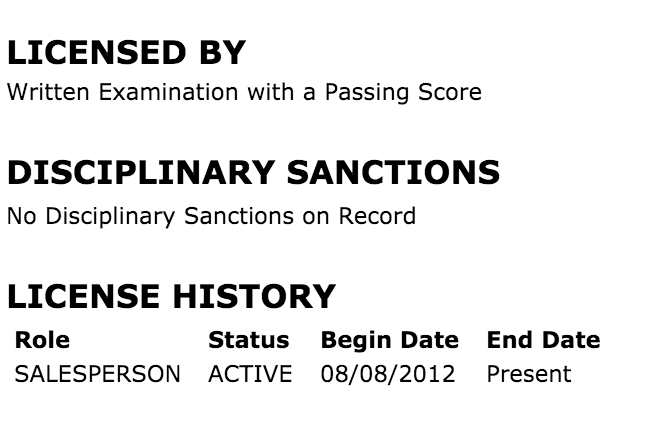

#4: Make sure they’re licensed.

Duh.

Look up their license to make sure it’s in good standing. Here’s how to do this:

When you talk to the PM, ask for their full name and license number. After the call, search the name of your state + “real estate commission” + the phrase “license lookup,” “license search” or “license verification.”

In Georgia, for example, you’d find a page that looks like this. Once you input the relevant data, you should see their name and license number appear in the site’s search results.

You may need to click again on that license number to open a detailed report, which will show whether or not they’ve faced disciplinary actions.

#5: Tour their listings.

** This tip is critical!! **

If they’re hosting an “open house” in which potential tenants can tour the property, show up!

Remember, you’re not there to judge the merits of the property with regard to layout, size or features. It doesn’t matter if the property has granite vs. laminate countertops, stainless vs. white appliances, or two-bedrooms vs. four-bedrooms. That’s outside of the management’s control.

You’re there to observe:

(1) If the property is clean and well-maintained;

(2) If the PM opened the curtains/blinds and turned on lights before the showing;

(3) How they interact with potential tenants;

(4) Whether or not they have copies of the application on-hand for the showings;

(5) How well they know basic property facts, like the pet policy and estimated utilities;

(6) How they ‘sell’ the less-desirable features of the property. “The kitchen is very European!” = that’s a nice way to say the kitchen is small, but cute. You want a PM who says something like this rather than, “Meh, the kitchen is cramped. Oh well, you get what you pay for.”

Don’t use false pretenses when you arrive at the open house. Let the PM know that you’re a local landlord interested in their services. Any good PM will recognize that you’re a potential client and will be happy to take the time to talk to you.

After you tour their listings in-person, set up an appointment to talk on the phone. During that call, ask them ….

#6: Ask how many units they represent, and where these are located. Ideally you want a PM who specializes in the same neighborhood or zip code where your property is located.

#7: Ask if they own any rentals themselves. This isn’t a deal-breaker, but a “yes” answer helps. (There are some investors who argue that it’s better if a PM doesn’t own rentals, so they won’t compete with yours. I disagree. Properties are unique; if a tenant likes yours, they’ll choose yours. I’d prefer to hire a PM who has walked in my shoes.)

#8: Ask for a sample of the type of monthly report they send. This report will detail income, fees, and expenses. You want to make sure it’s clear and easy-to-read.

#9: Ask about their process for handling maintenance requests and late payments. The process itself (assuming it’s reasonable) is less important than the confidence and fluency with which they describe it. You want someone who’s nailed their system.

#10: Ask if they perform any routine inspections (other than the move-in/move-out inspection). My PM handles a routine walk-through around three months after a new tenant moves into the property. If they spot any red flags, like extra residents or pets who aren’t on the lease, they can nip this in the bud at the beginning.

Other things to review:

- The termination clause within the agreement that you sign with the PM. Make sure you understand the process and deadlines.

- Who gets what fee. Do they keep 100% of the late fees that they collect? 50 percent?

- The ‘lease renewal fee.’ How much do they charge for re-signing the same tenant for another year?

- Maintenance up-charges. Do they add an extra fee to maintenance and repair calls?

- Dispossessory and eviction charges. Do they charge an extra fee (outside of filing costs) to handle evictions?

- Lease terms. Are they willing to sign a tenant to a two-year lease (thus reducing your lease renewal costs)?

- Check their businesses’ Yelp and Facebook reviews.

I know this sounds daunting.

But here’s the good news: If you pick the right property manager, you’ll only need to do this once.

That’s what passive income is all about: Handle the hard work once, so you can enjoy rewards for years to come.

One final thought: Make your hiring decision based on professionalism and skill, rather than price. My excellent PM is more expensive than my mediocre one, but I’d gladly take the trade-off for the talent that she brings to the team.

Okay. That’s all for now.

____________

If you enjoyed this material and want more, join our VIP list for our premier real estate investment course, Your First Rental Property. You’ll be the first to hear when enrollment opens again, and you’ll get a 7-day sneak peek at the course material.

Your First Rental Property is the course that I would have wanted when I started investing in real estate. The course that would have saved me from the many mistakes I made along the way.

I hope that this course can be a game-changer for you, in the same way that (slowly) gaining confidence and skill as a rental property investor over the years has been a game-changer in my life.

Thanks so much. I appreciate you for joining me on this adventure!

– Paula

P.S. Here’s the VIP List signup link, if you want special access to exclusive real estate content and course announcements.

(This is an epic 3,000-word article that covers a lot of material. Grab the PDF to keep these tips on-hand.)