Back in March 2015, I had asked new Afford Anything subscribers to answer two questions:

- What’s your wildest dream?

- What’s keeping you from getting there?

After reading through thousands of responses, I heard a theme emerge:

“I don’t know how to invest, and I’m afraid of making expensive mistakes.”

Let’s tackle that today.

As a disclaimer, today’s article is NOT about real estate investing. This article is targeted at people who DON’T want to be real estate investors.

It’s aimed at everyone who’s staring at their 401k in confusion, wondering what the heck they’re supposed to be doing.

Unfortunately, most of us don’t learn about investing in school.

Fortunately, you take initiative to learn. You’re self-motivated. You seek out information. You’re awesome. 🙂

I’m going to answer this question in two phases:

- The 100-Word Summary: My five-sentence answer.

- The Geeky Way: The in-depth, geeky response.

The first section is ideal for readers who are like: “Just tell me what to do.”

The second section is for readers who are thinking: “I want to develop a profound understanding of why.”

Investing: The 100-Word Summary

Here’s the five-sentence answer:

- Invest in index funds.

- Buy one stock fund that represents your country, one stock fund that represents the rest of the world, and one fund that represents your nation’s bond market.

- Hold these in tax-advantaged accounts, such as your 401(k), IRA and HSA. Switch to taxable accounts only after: (1) you’ve exhausted these other options, or (2) you need to access the funds within the next 5-10+ years but before retirement.

- Keep investing regularly (weekly, biweekly or monthly), regardless of whether the market is up or down.

- Feel neither excited about highs nor depressed about lows; trust in this process.

That’s it. That’s all you need to know. You can stop reading now.

“Uh … thanks. But that was too quick.”

That’s what she said.

“Are you serious? You have the maturity of a 13-year-old.”

Guilty as charged.

Anyway, back to investing — Read on.

How to Start Investing (The Geeky Version)

“How do I start investing?”

Here are 5 steps:

- Get your full employer match.

- Invest in a Roth IRA.

- Hack your HSA.

- Max out other investments.

- Wow, you’re seriously a baller. Go be awesome.

Let’s walk through these.

Step #1: Get Your Full Employer Match

Find out if your employer offers a retirement plan – like a 401(k), 403(b) or SIMPLE IRA — with a company match. If the answer is yes, contribute as much as possible to get the maximum match.

I can’t stress that last sentence enough. If you walk away with only ONE takeaway lesson from this article, it’s this: Get your full company match.

To be clear, I’m not referring to exercising your company stock options. I’m only referring to the matching contribution into your retirement account.

“Huh? What’s that?”

Let’s assume that you earn $50,000 per year. Your employer offers you a dollar-for-dollar company match, up to a 5 percent maximum, on 401k contributions.

What does this mean?

It’s simple: Five percent of your salary equals $2,500.

If you contribute $2,500 into a company 401k, your employer will ALSO contribute another $2,500.

“So what?”

You’ll have $5,000 in your 401k … even though only $2,500 of this came from your own pocket.

Cha-ching!

Many jobs will either offer 50 cents for each dollar (you contribute $2,500; they’ll chip in $1,250) or dollar-for-dollar matching. Both are great.

This is the only “guaranteed return,” so to speak, in the world of investing.

“I’m not getting my full company match.”

Drop everything you’re doing, sprint to your employer, and make this happen.

“Sprint? Can’t I drive?”

Whatever. Just make it happen.

“I have high-interest debt. Should I accept my full company match? Or should I repay the debt first?”

Is the interest rate on your debt more than 50 percent?

“Uh … I don’t know.”

I’ll answer that question for you: No. No, it’s not. Your interest rate, even on the World’s Worst Credit Card, is not 50 percent.

“So what?”

Let me ask you something: Imagine that someone came to you and said: “Here are two investments. Both are guaranteed. One carries a 50 percent return. The other carries a 20 percent return.” Which would you prefer?

“The higher return, obviously.”

There’s your answer. Even if your debt carries a super-high-interest rate, it’s not going to be as large as the ‘guaranteed return’ on every dollar you contribute towards an employer match.

The exceptions are:

- If you have non-financial reasons for prioritizing the debt (like emotional satisfaction)

- If you have a huge life change on the horizon (like a new baby), and you prioritize cash flow more than long-term assets

- If your employer offers an exceptionally terrible match, like 10 cents on the dollar

“I don’t trust the stock market, so I don’t want to put money in my 401k.”

Your 401k and the stock market are not the same thing.

- Your 401k is an account.

- The stock market is the stock market.

#NotTheSame

“Huh?? How is that possible?”

We’re dealing with two concepts: your accounts and your investments.

- Your account is a coffee mug.

- Your investments are the coffee itself.

When you contribute to a 401k, IRA or HSA, you’re buying coffee mugs. These are vessels; nothing more.

You choose how to fill these mugs. If you don’t like coffee, you’re free to choose tea, water, lemonade, or tequila-with-a-splash-of-lime.

Don’t confuse the coffee with the mug. They’re distinct items.

“Should I pick individual stocks — like Google, Apple, Nike, Facebook?”

No, not with the majority of your money. Your best bet is low-fee index funds.

Index funds track the overall broad market, which means they’re designed to create results that are as good as the overall economy — no better, no worse.

Historically, over the long-term, the overall U.S. economy has produced returns of around 7 to 9 percent. Statistically speaking, most fancy-suit-and-tie managers who try to “beat the market” underperform (do worse).

To add insult to injury, the fancy-suit-and-tie managers collect high fees, regardless of the fact that they underperformed.

Ouch.

Most people are better off aligning themselves with the market, instead of trying to beat it.

Index funds don’t carry exorbitant fees, unlike many mutual funds. And they don’t carry the risk of individual stock-picking.

“Are there any rules-of-thumb for how to divide this money between stocks vs. bonds?”

The easy rule-of-thumb:

- Your age minus 10 = the percentage you invest in bond funds, with the rest in stock funds. For example:

- If you’re 50, put 40% in bond funds and 60% in stock funds.

- If you’re 40, put 30% in bond funds and 70% in stock funds.

- If you’re 30, put 20% in bond funds and 80% in stock funds.

- If you’re 20, put 10% in bond funds and 90% in stock funds.

Of course, that’s just a rule-of-thumb. Feel free to play around.

- If you love risk, adjust this to your age minus 20.

- If you’re conservative, adjust this to “your age in bonds.”

“Um … I don’t think of my investments as percentages. I just see dollars.”

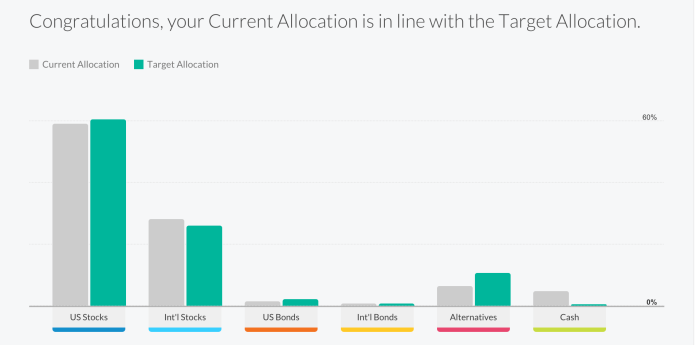

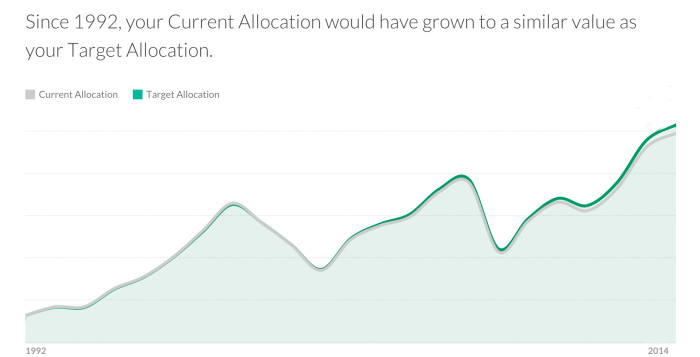

Hook up your accounts to Personal Capital (free), which shows you your percentages at-a-glance across all of your accounts (IRA, HSA, 401k).

(That’s an affiliate link, even though it’s free.)

“What about those big-name companies like Vanguard, TD Ameritrade and Schwab? Where do they fit in?”

They’re called “brokerages,” but don’t let that official-sounding name scare you. They’re just fancy warehouses that store your coffee mugs.

“Are you drinking coffee while you’re writing this?”

Duh. Of course.

Move to Step #2:

- If your company doesn’t offer a match – OR –

- If you’re self-employed – OR –

- After you’ve maxed out your employer match

Step #2: Invest in a Roth IRA

You’re eligible to invest in a Roth IRA (in 2016) if:

- You earn less than $132,000 if you’re single or head-of-household

- You earn less than $194,000 if you’re married filing jointly

Random notes:

- By “earn,” I’m referring to adjusted gross income (AGI).

- Tax benefits start phasing out at AGI’s of $117,000 and $184,000, respectively.

Contribute until you hit the maximum allowable level (as of 2016):

- $5,500 per year if you’re 49 and under

- $6,500 per year if you’re 50 and older

A Roth IRA is a coffee mug. You’ll need to store this mug in a warehouse – officially called a “brokerage.”

You can open a Roth IRA at a huge number of brokerages, but my three favorites are:

Vanguard is a co-op, which means it’s owned “by the people, for the people.” It also holds index funds with rock-bottom-low-fees. It’s my personal favorite – though Schwab and Fidelity are also awesome.

(None of those are affiliate links.)

“But you get what you pay for. Shouldn’t I put my investments into an expensive brokerage with a fancy lobby and gilded stationary?”

**Forehead slap.**

Please don’t ever say that again.

“But … but … those places with the Italian couches and complimentary bottled water and Renaissance artwork seem so RICH. They must have made it all in the stock market. Where else could their money have come from?”

**Face palm**

Gee, that’s a great question. Hmmm. Where else did their money come from?

Let’s Pause for a Quick Tangent

[Quick tangent about Traditional vs. Roth IRA’s. If you’re not interested, skip ahead to Step 3.]

“What’s the difference between a Traditional IRA and a Roth IRA?”

A Traditional IRA holds pre-tax dollars. You don’t need to pay income taxes on your contribution. But you’ll pay a boatload of taxes on the gains and dividends in retirement.

Example:

- You earn: $50,000

- You contribute: $5,000 to a Traditional IRA

- You get taxed on: $45,000

- Later you get taxed on: The other $5,000 in income, PLUS the gains and dividends that compounded over the years

(Obviously this is a highly-oversimplified example that ignores other tax deductions. I’m illustrating the difference between Traditional vs. Roth IRA’s through a hypothetical.)

A Roth IRA holds after-tax dollars. You’ll pay taxes on your contributions, just as you normally would. But your capital gains and dividends are gloriously, deliciously tax-free.

Example:

- You earn: $50,000

- You contribute: $5,000 to a Roth IRA

- You get taxed on: $50,000

- Later you get taxed on: Nothing, suckers! Boo-yeah!

It’s the best legal tax avoidance in the country. (Other than moving to Nevada, of course.)

“Why is it called a ‘Roth’?”

In honor of William Roth Jr., the former Senator from Delaware who created the Roth IRA. Fun fact: his dad owned a beer brewery in Montana.

“That’s a fun fact?”

Hey, who doesn’t love the intersection between beer and tax planning?

“When should I contribute to a Traditional IRA instead of a Roth IRA?”

I believe most of you should stick with a Roth IRA, especially if you’re under 50, broke, or both.

In some cases, a Traditional IRA might be better, including but not limited to:

- If your income will plummet in the future.

- If you’re earning a bazillion bucks this year. (In this case you’re not eligible for a tax-deductible Traditional IRA anyway, so it’s a moot point.)

- If you’re going to retire within the next 10 years AND your income will plunge during retirement. (If you’re retiring from a crappy cubicle job but replacing this with other ordinary income that’s comparable to your current paycheck, this is also a moot point.)

If you’re under age 50, the Roth IRA is typically the sexier option.

As a general practice, I’d say that when you’re 10 to 15 years away from retirement, it’s time to meet with a CPA to chat about specific tax-planning strategies. Note: Don’t meet with a stockbroker; meet with a licensed accountant. Big difference.

“I’m retiring soon, and my income will nosedive. Why might a Traditional IRA be better?”

You can execute a “backdoor Roth conversion” after your income drops. This allows you to convert your Traditional IRA to a Roth IRA when you’re in a lower tax bracket.

Note, however, that you can’t convert everything in one lump-sum. You need to convert a proportionate share of your pre-tax IRA accounts, including your SIMPLE and SEP IRA balances. This has two implications:

#1: If you have significant assets in SIMPLE, SEP or Traditional IRA accounts, you’ll be one sad, sad puppy.

How I feel when I can’t execute a backdoor Roth conversion …

#2: You’ll need to hire a CPA to calculate this. If he’s anything like mine, he’ll strangle you for making this request, because now he’ll be working overtime instead of watching the game. (Just kidding! Kinda.)

Here’s a fantastic super-nerdy article on the backdoor Roth conversion, by Michael Kitces.

Move to Step #3:

- If you’re not eligible to contribute to a Roth IRA – OR –

- After you’ve made IRA contributions

Step #3: Hack Your HSA

Check to see if your health insurance policy is HSA-compatible.

You’ll know this because the policy description will say something unambiguous like: “HSA? Yes.”

If you’re not sure, ask human resources (if you’re employed) or call your plan directly (if you’re not).

If your plan is HSA-compatible, open an HSA and max out your contributions (in 2016):

- $3,350 for single-individual plans

- $6,750 for family plans

- $1,000 extra (on either plan) if you’re 55 and older

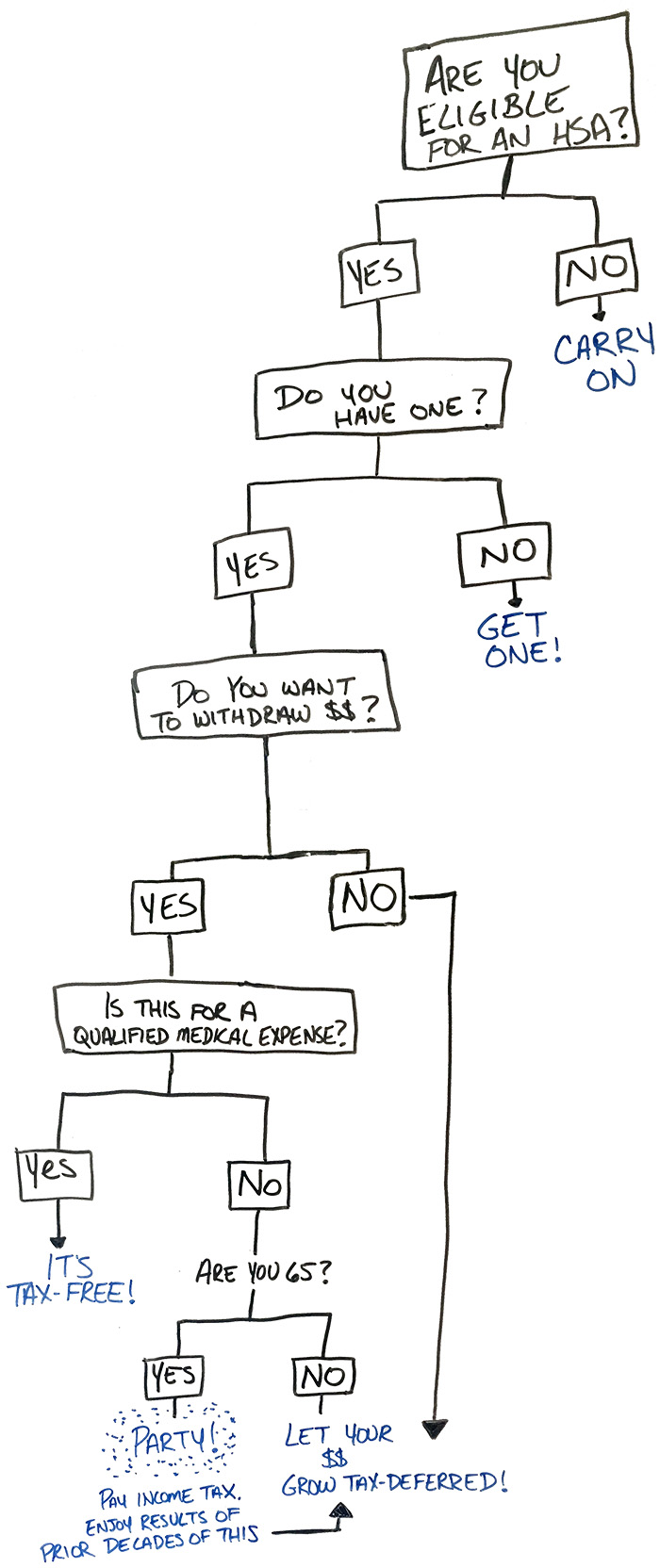

“An HSA is meant for paying medical bills, right?”

Ahhh, this is where we start using kick-ass lifehacks.

Yes, the ‘official purpose’ of an HSA is that it’s an emergency fund for medical bills. If you’re broke – e.g. if money is tight and you’re scraping by – use your HSA for its intended purpose.

But if you want to hack the system, read on.

Here’s how to win the HSA game:

#1: Max out your HSA. That’s tax-deferred money. Score!

#2: Grow that money tax-deferred.

#3: Pay out-of-pocket for your qualified medical bills. This is the kicker. Spend after-tax dollars (regular ol’ pocket money) on your medical bills.

#4: Save the receipts. I stick mine in a Dropbox folder labeled “HSA.”

#5: Forget the receipts exist. Your goal is to retire without opening that Dropbox folder. (Weird goal, I know.)

You want to AVOID reimbursing yourself for medical costs, so that your HSA investments can continue their streak of tax-deferred growth.

Here’s the key point:

You can use those receipts to reimburse yourself for those expenses anytime.

Two years? Five years? Ten years? Sure. As long as you have the receipts, you can reimburse yourself whenever you want.

If you don’t need the money, let your HSA investments continue their tax-deferred growth.

#6: Turn 65. Yeah, we’re long-term planners around here. Once you turn 65 (or get disabled, or die), the IRS lets you withdraw HSA money penalty-free — even if there are NO receipts to back it up.

In other words:

— If you’re reimbursing yourself — This is tax-free money you can tap anytime.

— If you’re NOT reimbursing yourself — You can withdraw it penalty-free when you’re 65 or older. You’ll pay income tax, just like you would on a 401k or Traditional IRA.

#7: Throw a wild spending rampage filled with champagne and caviar. You’re going to have the biggest blowout 65th birthday bash in history. You’re welcome.

Here, I made you a fun flowchart:

You effectively have an extra IRA account in the form of an HSA.

Do you understand how ridiculously, insanely monumental this is?

- Your money is tax-deferred going in …

- … and tax-free coming out, if you spend it on qualified medical bills …

- … plus it holds the liquidity of a medical emergency fund …

- … and penalty-free withdrawals after you’re 65!

You get the liquidity plus tax advantages!!!!

“Does this really merit 4 exclamation points?”

Yes!!!!

Note: Make sure you have an HSA, not an FSA.

- HSA — or Health Savings Account — is the topic we’re describing.

- FSA — or Flexible Spending Account — is “use-it-or-lose-it.” Your money can only stay there for one year; then it disappears.

Move to Step #4:

- If your health insurance plan isn’t HSA-compatible – OR –

- After you’ve hacked your HSA

(Huge thanks to my buddy Brandon at Mad FIentist for popularizing this HSA hack.)

Step #4: Max Out Other Investments

Assuming you DON’T want to be a real estate investor, this is the step where you max out the rest of your company retirement account.

If you have a 401(k) or 403(b), you can contribute (in 2016):

- $18,000 if you’re 49 and under

- $24,000 if you’re 50 and older

“Wait, wait … you’ve got me repeating steps here.”

Yes.

“First I max out my 401k employer match. Then my IRA. Then my HSA. Then back to my employer?”

Yep!

“Why don’t I max out my employer account at the beginning, and THEN move on to other accounts?”

Here are four good reasons. Unless you’re lucky, your employer-sponsored retirement account probably features:

- Fewer options

- Higher fees

- A traditional structure rather than a Roth structure

- Less flexibility than an HSA

“What does that mean?”

It’s more expensive and it also sucks.

“What if I’m self-employed?”

Create either a Solo 401k (also called an Individual 401k) or a SEP-IRA.

“Why not both?”

You’re not allowed. Your company can sponsor one or the other, but not both.

Exception: if you run two companies, you can have a Solo 401k from one company and a SEP-IRA from the other.

There are solid arguments in favor of either option (SEP-IRA vs. Solo 401k). Personally, I prefer the Roth Solo 401k, which is a 401k with a Roth tax structure.

I set up my Roth Solo 401k through Vanguard.

- The drawback is that their user interface is confusing. You’ll need two accounts – a personal account and a “small business” account –with two usernames, two passwords.

- The benefit is that:

- They’re low-cost.

- They’re a co-op.

- It’s easy to get a human on the phone.

- I couldn’t find another brokerage that offered the Roth version of the Solo 401k, so they were my only known option.

Move to Step #5 if:

- You’ve made it this far!!

Step #5: Holy crap, you have a lot of money to invest.

At this point, you’ve made some insane contributions:

- $26,850 (maxed-out 401k, IRA and single-plan HSA, age 49 and under)

- $38,250 (maxed-out 401k, IRA and family-plan HSA, age 55 and older)

- In-between that range (depending on where you fall in this mix)

Congratulations – your retirement savings are mind-boggling.

You’re not just ahead of the curve, you’re beyond the bell curve.

But you’re tireless. Insatiable. Ambitious. You want to invest even more. What next?

- The market option: A tiny, appetizer-sized portion of individual stocks or industry/theme stocks. If you choose this route, use a low-cost platform like Motif Investing for industry/theme stocks. But don’t go too wild. Keep this at less than 5 to 10 percent of your total portfolio.

- The hustler option: Buy or launch your own business.

- The awesome option: Rental properties. If you want cash flow and passive income, this is where it’s at. (Interested in learning more about real estate investing? Join my early-bird VIP List for special announcements about my new rental property investing course, launching soon.)

Wow. You made it to the end of this article.

Congratulations. Pour yourself a coffee. You’re ready to start investing.

Oh — and let me know when you throw that 65th birthday blowout bash. I’m bringing my friends.