Once a month, I share my rental property investment numbers.

I hope that this gives you more insight into whether or not buy-and-hold real estate investing is a path you want to pursue.

(Also, I’m trying something new this month by directly putting the net income — not the gross, the net — into the headline, along with the time that managing my rental properties took. Please let me know if this makes things more interesting, or more cheesy.)

Let’s dive into last month’s numbers.

February Revenue: $9,158.52

You might notice that February’s revenue is exactly the same as January’s (within 1 cent).

Here’s the funny thing about rental real estate income: the revenue mostly stays the same. Most other businesses have active day-to-day operations, which makes their revenue numbers fluctuate a lot more. There’s more activity and change.

In a rental property business, though, not much changes from month-to-month. Within a reasonable range, the top-line revenue stays roughly the same.

Volatility comes from expenses, not from earnings.

Here’s what I’m getting at: I hope these reports aren’t boring. Because you might be like, “Uh huh, I get it. Gross income somewhere between $9,000 – $10,000 …. AGAIN. Booorrrring.”

Maybe that’s the point. There’s no San Francisco venture capital funding; no New York 35th-floor conference room; no business class flights to London or Hong Kong. This isn’t a glamorous business with red carpets, galas and TV green rooms.

This project is much more straightforward: I purchase and maintain homes. Then I let people live there for money.

We can dive into the checklists, processes and systems — the “how to” — but when we step back to assess the big picture, the strategy is simple:

- Buy home

- Rent out

- Profit

Create a great tenant experience, which minimizes turnover and keeps customers happy. Manage this enterprise as efficiently and effectively as possible, because time is your most valuable asset.

Then move on with your life. Let your assets create income in the background while you spend time with your family, launch a different business, or travel more.

Anyway — here’s how February’s income breaks down:

Unit 1, Triplex: $2,750

Unit 2, Triplex: $1,490

Unit 3, Triplex: $1,295

House #2: $850.50

House #3: $1,273

House #4: $1,500

House #5: —– Still nothing! (See below)

Ridiculously Tiny Interest From Bank: $0.02

Total: $9,158.52

(Note: Gross income is after property management fees, when applicable. Check out the FAQ HQ for full details.)

The property manager who oversees House #5 sent me two months’ payments (in one transaction) at the end of February; it hit my account on March 3rd. She also sent an additional payment mid-March. You’ll be seeing higher revenue next month.

February Expenses: $3,554.03

- Mortgage: $3,524.03 — This is PITI for several properties.

- Lawncare: $27

- Stupid, stupid bank fee: $3

Total: $3,554.03

This is an unusually low-expense month; please don’t view this as the norm!

In January 2016, our expenses were $2,000 higher than they were in February 2016, and we’ve of course experienced some months in which we spent thousands on major capital expenses like installing new windows, siding or gutters.

The water/sewer bill pinged our account on March 1, so you’ll probably see two utility payments next month.

Remember that we have annual or biannual expenses (like CPA fees and legal fees) that hit our account in one big chunk, rather than monthly installments. You can see those in updates like November, where — wham! — there’s a $2,023 line-item.

That’s why we’re adamant about keeping strong cash reserves to pay for these irregular bills.

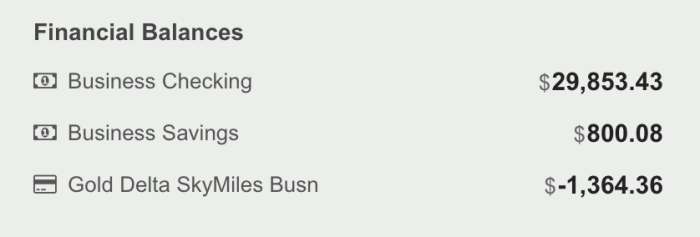

I like to keep three months of gross revenue (around $30,000) in cash reserves at all times.

(I know, I know. I should move this into a higher-yield account. I can hear the comments already. Wow, you sound just like my conscience. My interest-starved conscience.)

Why three months of revenue? There are two reasons:

- 50 percent rule-of-thumb

- Vacancy risk

Let’s quickly cover these:

The 50 Percent Rule

As a general rule-of-thumb, you’ll spend about half of your revenue on operating overhead.

This is a very broad rule-of-thumb and doesn’t reflect the specifics of any neighborhood, so please take this with a massive grain of salt — or a whole darn salt shaker. A salt processing plant, really. Maybe a rock salt mine, plus heavy machinery?

If your operating overhead equals 50 percent of your revenue, then three months of revenue covers six months of operating costs. This jives with the idea that people (and businesses) should maintain a six-month-emergency-fund.

(Jives? Did I just use the word “jives?”)

Okay, let’s move on before I embarrass myself further …

Vacancy Risk

All seven rental units could stay vacant for three months and we’d still be covered.

Of course, the chance of simultaneous vacancies in all seven units is far-fetched. The more units that you own, the more you protect yourself from vacancy risk.

- If you own one unit and it’s vacant, you have a 0 percent occupancy rate (for that month).

- If you own seven units and one is vacant, you still enjoy an 86 percent occupancy rate.

That said, my recommendation to any beginner investor is to move slow-and-steady; one property at a time. As a first-year investor, you’re going to make first-year decisions. Give yourself space to make mistakes and learn, and don’t let vacancy concerns scare you into buying too quickly.

The takeaway that I hope you get from my vacancy remark is that as your rental business grows, you enjoy more benefits-of-scale. You’ll also become more efficient and more confident.

But in fairness, you also experience the drawbacks-of-scale, as well. We have seven times more components that can fail: seven water heaters, seven A/C compressors, seven dishwashers.

We keep $30,000 in cash reserves because we like knowing that we can handle multiple vacancies plus repairs. If we have two or three vacant units at the same time that a roof leaks or a pipe bursts, we’ll still be okay.

(Note: Some investors advocate deploying ALL your cash. They argue that you should tap a home equity line of credit to handle repairs. I’d need an entire article to deconstruct that line of reasoning, but here’s my one-sentence Cliffs Notes response: debt is not a wise substitute for an emergency fund.)

Cash Flow: $5,604.49

One purpose of these reports is to show you that there’s no such thing as consistent cash flow.

In the five months since I’ve started posting these reports, you’ve seen net cash flow range from a low of $2,209 (November) to a high of $6,102 (October).

As we continue, you’ll see months where this dips into the negatives (the next time we replace a roof!), and you’ll hopefully also see months where we top $6,000 – $7,000+ for less than five hours of work.

Speaking of which, let’s tackle the final piece of this puzzle: How much time did we spend earning this $5,604?

Time: Five Hours

Okay, story time.

Have you ever thought: “This is probably a bad idea, but I’m going to do it anyway?”

Like ordering bacon cheddar cheese fries. Or the third donut. Or that time our society collectively decided that Pauly Shore should have a career.

Last month, we had one of those this-might-be-a-bad-idea-but-lets-try-it-anyway events. And hey, it worked out! #LessonNotLearnedYet

Let me set the stage:

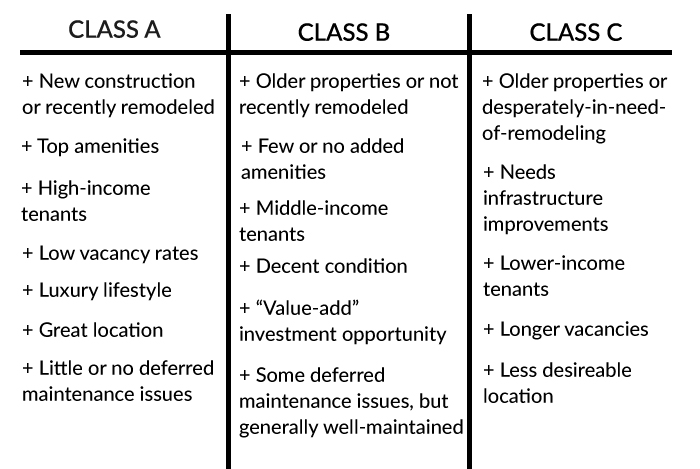

Rental properties are broadly classified as Class A, B, C, or D.

There’s no governing body that dictates this taxonomy. Judging “Class A” vs. “Class C” is like ordering a steak. Everyone has a subjective understanding of “rare” vs. “medium” vs. “well-done.” And yes, the boundaries between medium vs. medium-well can be fuzzy. But the system still works. Everyone is clear about whether a steak is rare or well-done.

Properties are the same. Our properties range from Class A to Class C.

Class A properties attract qualified tenants who typically:

- Pay rent on time

- Maintain the property

- Need minimum levels of management

Class C properties attract less-qualified tenants who sometimes:

- Pay rent late

- May create excess wear-and-tear, if not outright damage

- Need higher levels of management

I’m speaking in broad generalizations, but you get the idea.

Also:

- Class A properties charge higher rent.

- Class C properties charge lower rent.

Okay, I’ve set up this background/stage, here’s the … um, the punchline?

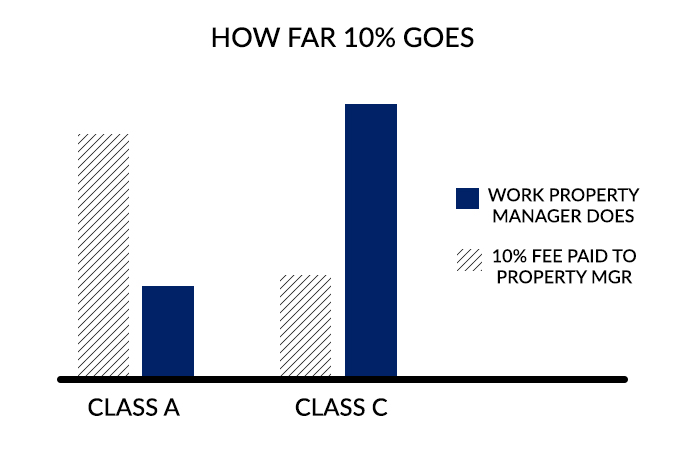

Property managers tend to charge 8 to 10 percent of the rental income — regardless of whether a property is Class A or Class C.

Do you see where I’m going with this?

- Class A properties cost the most to outsource, but require the least management.

- Class C properties cost the least to outsource, but require the most management.

(I’m over-simplifying this chart, but that’s the general idea.)

Let me put this in stark numbers:

Our Class A triplex brings in $5,535 in monthly rental income (among all three units combined). Outsourcing this management at 10 percent would cost $553 per month, plus typically another one-half to one months’ fee for new tenant placement.

And yet — as you can see from the previous monthly income reports — the triplex requires almost zero management. The tenants pay their rent on time. The units are in great condition.

We occasionally get a rouge pest-in-the-attic or a broken water heater, and whenever this happens we solve the issue with a simple text message to our contractor. At worst, we’ll place a few phone calls.

We spend only a couple hours per month managing this triplex, and we collect an extra $553 per month (in management savings) from this effort.

When we ask ourselves: “Is the reward worth the effort?,” the answer is yes.

One more slice of background: Our properties are located in Atlanta. We are not. When we moved to Las Vegas last year, we decided to try the following approach:

- Class A — Keep managing remotely

- Class B — We only have one Class B unit, and we’ll hand it to a management company in the future. We’ve had the same very-easy-tenant there since 2012 and we’ll continue managing it while that tenant remains.

- Class C — Hand these to professional management! (We already hired managers for these units, even when we lived in Atlanta.)

Yes, remote management is a risk. I’m okay with that.

We approached this as an experiment. We like testing hypotheses. And so far, it’s been working well.

This brings us to last month.

One of the tenants in our triplex is moving out. We need to find a replacement. We’re attempting this from across the country for the first time. Do you see why there’s a strange feeling in the pit of my stomach that says, “uhhh, are you sure this is wise?”

(I’d like to reiterate the disclaimer that this is an experiment.)

We have a few factors working in our favor:

- There’s strong rental demand in that area.

- We lived in the triplex ourselves for five years, so we know the property’s layout and condition inside-and-out. (Pun sheepishly intended.)

- We know the tenants personally; they were our neighbors.

Here’s how we pulled this off:

Step 1: We published advertisements on Zillow and Craiglist for the vacancy.

Step 2: We fielded emails, answering each one with a pre-written Canned Response (a free feature in Gmail).

Step 3: We fielded phone calls. We invested time to ask every prospect about the rental market. Their feedback was invaluable in keeping us informed about the current rental market, which at the moment is hot, hot, hot.

One woman, for example, told us that she’s been trying to move into this neighborhood for months, but every unit gets multiple applicants.

Step 4: We organized an Open House in which prospects could tour the unit. We told the current tenant that her only role is to allow access into the unit — we will personally answer all questions. In other words, the tenant isn’t “showing” the unit; she’s just allowing access. We correspond directly with each prospect.

Step 5: We stood by the phone during the Open House, in case prospects wanted to call with any questions.

Step 6: We received multiple applications, all submitted online through Cozy. The tenants pay the application fee directly to Cozy, so we don’t need to bother handling the funds.

Step 7: We reviewed the four applicants, chose one, and reviewed the lease with him over the phone. He signed the lease remotely and mailed his security deposit.

The last step — which we’ll handle in late March — is the actual move-in/move-out inspection, which we’ll need to handle in person.

Coincidentally, one of us needs to be in Atlanta at that time, so we can handle the task in-house. In the future, we’ll need to make a decision about whether it’s worth our time to do-it-ourselves or negotiate with a property manager to solely handle tenant placement without providing ongoing services. But we’ll cross that bridge later.

How long did this take? Here’s the breakdown:

- 30 min: Phone calls with current tenant (multiple phone calls, at 10 minutes per call)

- 60 min: Updating the advertisement for Zillow and Craigslist (we decided to give it a makeover)

- 60 min: Posting and re-posting the advertisement (combined total of multiple sessions)

- 30 min: Tweaking the Gmail Canned Response, and answering emails outside of the Canned scope

- 120 min: Fielding phone calls from prospects (note: We talked to them A LOT to gather market data. This could’ve been shorter, but we chose the more time-intensive route because we think it’s important to stay on top of the market.)

Total: 5 hours

(Houses #2, #3, #4 and #5 didn’t need any attention last month!)

As you’ll see in the next report, we spent another two hours in early March reviewing applications and signing the new tenant. Later this month, we’ll probably also spend a few hours processing the move-in/move-out inspection.

In total, I expect that this turnover will consume roughly 10 hours spread across two months (5 hours per month).

“You value your time. Why do you bother doing this yourself?”

A property manager would typically charge between one-half to one-full months’ rent for this service.

This unit rents for $1,490, which means it would cost us between $745 to $1,490 to outsource this tenant placement. If we handle it ourselves over the span of ten hours, our effective “hourly income” is between $74 — $149 per hour. (That’s lower than my hourly rate for coaching, but it’s also far less mentally and emotionally demanding.)

Again, I’ll repeat the disclaimer that I’m not advocating this approach. We’re testing the idea of a long-distance-turnover, and publicly sharing the results.

I’m 100 percent an advocate of outsourcing management on Class B and C properties, given their higher workload and lower cost-of-outsourcing.

By the way — as a “thank you” for making it to the end of this article, here’s a basic checklist for any rental Open House that you might run. You can download it here for free:

This is a simplified version of the checklist that’s included in the real estate course that I’m offering.

The enhanced version has word-for-word scripts that you can copy/paste/use, videos on exactly how to set this up, templates for every form, etc.

We have tons of resources in the course. If you want an A to Z solution on buying your first rental property, sign up for our VIP list here.

Thank you everyone!