Some people are addicted to booze; others gambling.

Me? Home renovation.

Three months ago, we finished a $13,000 remodel on Rental House #4. To celebrate, we told our contractor to demolish a kitchen in a different house.

Call it a victory lap. 🙂

We’re renovating House #2, and we’re coordinating everything — from demolition to final clean-up — through email, phone and text messages.

We haven’t set foot on the property.

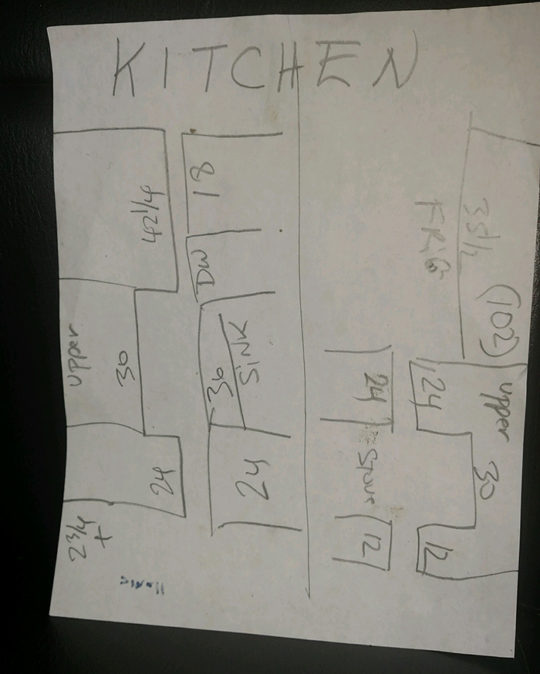

Our contractor texted us this drawing of the kitchen.

While our contractor is tearing out floorboards, we’ve been racking up frequent-flyer miles.

(By the way, scoring frequent-flyer miles is the best way to avoid paying for flights. Here’s an up-to-date list of the travel cards with the best sign-up bonuses; this list gets updated every week, and the cards that you’ll see at the top of that list will give you enough miles to fly for free, round-trip, to anywhere you want.)

We’re as far away from the properties as possible (without visiting Mars.)

(Yet.)

Here’s a recent sleep-deprived snapshot after a red-eye to Shanghai:

“Your property is under renovation, while you’re hailing taxis in Asia?”

Yep.

“But …. how?”

This is possible for two reasons:

Reason #1: Home owners and investors are not the same species.

I’ve watched my friends, in the middle of renovating their own homes, grapple with existential quandaries like, “what color should we paint the dog door? Olive or khaki?”

That’s a vexing question for your own home, to be sure. But investors think differently. We build systems rather than browse Pinterest.

For example, we’ve started using the same paint color on every property — a strategy that minimizes waste, reduces tracking and streamlines touchups.

Investors hone this approach for a simple reason: we don’t want to work more than necessary. My investments hum in the background while I focus on my true passions — reading, writing, traveling, staring absentmindedly into space.

I waste more time scrolling Twitter than I spend managing my investments.

Reason #2: Scope, Systems and Strong Team

The second reason is that I’ve focused on a simple formula:

- Hire talented people

- Give them a detailed scope of work

- Get out of their way

(This works best for remove-and-replace jobs. If you’re re-designing the floorplan/layout, you’ll need to make a trip.)

We’ve nailed this strategy (hehe, pardon the pun) many times. Two years ago, for example, we invested $15,000 into renovating House #5. We managed this project by text message from California and Brazil.

Today we’re managing the House #2 renovation from Nevada and Nepal.

Okay, “managing” is an overstatement. We listened to the contractor’s recommendations, approved everything that sounded reasonable, and … well, that’s about it.

Then we hopped on a flight to Kathmandu.

Meanwhile, this happened —

In today’s article, I’ll dive deep into how to save thousands on kitchen renovations. Well, kinda.

“Kitchen renovations” is a giant topic, and I’d rather go deep than wide. So this article will focus specifically on how to save hundreds on cabinets, countertops and flooring.

I’m excluding other components — like electrical, plumbing, etc. — to limit this article to less than 3,200 words. I’m aiming these tips at rental investors, although I hope that anyone can benefit.

I also disclose our past three months of rental income at the bottom of this article.

Here we go:

How to Save Hundreds on Granite Countertops

Granite countertops are synonymous with ‘fancy.’

But here’s a secret: you can install granite countertops for less than $500 in materials.

Granite pricing is influenced by four factors:

- Size

- Cut

- Style

- Edging

Let’s talk about how to optimize each one.

Size Matters

Granite is a natural stone that’s quarried from the earth. Large slabs of granite are a pain-in-the-butt to transport and install. Smaller pieces are easier.

Result? Granite slabs are expensive, but granite tile is an order of magnitude cheaper.

Here’s an example of a large slab. Imagine the cost of finding, quarrying and transporting this monstrosity:

You can get the granite “wow” factor for a fraction of the price by installing granite tiles, which are typically sold as 12×12, 16×16 or 18×18 inch squares.

We used granite tiles when we remodeled the Airbnb unit, for example. Here’s the result:

How much will this cost? Let’s calculate:

- The average kitchen holds 30 linear feet of countertop space.

- Add an extra 20% (36 linear feet) to prepare for waste/overages.

- This granite tile costs $2.69 per square foot (psf) as of the time of writing.

- Result? You could install granite tile in an average kitchen for $100 in materials (excluding mortar, backer board and bullnose).

Can I repeat that? $100. For a kitchen full of granite. Score.

In fairness, $2.69 psf is the cheapest example. I’ve found many colors/sizes at $5 to $7 psf, which would cost $180 – $252 in an average American kitchen.

Suggestions:

- Opt for the 16×16 or 18×18 squares. These create a nicer finish by minimizing seams.

- Lay the squares in a diamond pattern (also called diagonal layout). This also creates a more upscale finish.

- Use leftover tile to create a bullnose and backsplash.

Cut

If you want continuous (non-tile) granite countertops, you have two options: prefabricated or slab.

Pre-fab is the “off-the-rack” edition. It’s cut and polished overseas, holds more visible seams than a custom slab, and comes in fewer colors. But it’s significantly cheaper, while retaining a ‘wow’ factor that attracts tenants. It’s the better choice for a rental property. (And if you’re lucky, you might find clearance-sale prefab that’s cheaper than tile.)

Color

Common granite colors are called “builder grade.” (That’s slang; not an official title.) These are some of the most commonly quarried stones, and — due to their abundance — they’re inexpensive.

Examples include Baltic Brown, Ubatuba, Santa Cecilia, Venetian Gold, and my personal favorite, Blue Pearl (which looks amazing paired with white IKEA cabinets).

Edging

Countertop edges can be flat, rounded, sloped, or so-fancy-it-attracts-paparazzi.

Get the cheapest style. Don’t bother upgrading; it won’t yield rental returns.

As an investor, focus on the “80/20” upgrades. Laminate vs. granite can impact your revenue, but a standard edge vs. a flamboyant edge won’t do a damn thing to enhance your bottom line.

How to Choose a Durable Flooring Surface

Science lesson:

- If an object dragged across a floor is harder than the floor, then the floor will get scratched.

- If an object dragged across a floor is softer than the floor, then the object will get scratched — not the floor.

Eat it, Isaac Newton.

The takeaway? Since goal #1 is durability, choose dense flooring surfaces. Examples include:

- Porcelain tile

- Some ceramic tile (not all)

- Rubber vinyl / vinyl plank

- Natural stone (e.g. slate)

- Edge-grain bamboo (NOT face-grain bamboo)

- Solid hardwood

Awesome. These meet our durability standards. Next step: sort by cost.

Stone, hardwood and edge-grain bamboo are expensive, so we’ll eliminate these options. Porcelain, ceramic and vinyl plank are cheaper, so I have my contractor shop in those aisles. We’re using 6″ x 36″ porcelain tile planks in both House #4 and House #2. The price and durability of porcelain + the ‘wow factor’ of hardwood = score.

Here’s how this looks in House #4:

Where should you buy this stuff?

Hint: Not the big-box retail chains.

The big-box retailers are great for basic materials like 2×4’s, screws, plywood, backer board and mortar. But shiny surface materials that people notice — like carpet, tile, faucets, appliances — are typically cheaper elsewhere.

(Like, MUCH cheaper elsewhere.)

Here are a few of my favorite suppliers:

- Amazon — I’ve bought fans, faucets, and even a gorgeous kitchen sink here. Highly recommended.

- Overstock — Ditto, especially for lighting.

- Floor and Decor — Hands-down, this is my favorite flooring store.

- Sears Outlet — The keyword is “outlet.” They sell scratch-and-dent appliances at an excellent cost.

- Brandsmart — Worth checking out if you don’t live near a Sears Outlet.

- Habitat for Humanity ReStore — Nonprofit home improvement store. Can be a source of cheap deals, but not systematic or reliable.

- Local mom-and-pop discounters — Google the name of your area + “discount” + a specific item like carpet. You’ll often find hidden gems.

- Build [dot] com — Meh. It’s okay for higher-end fixtures. Avoid this for Class B or Class C rentals.

- IKEA — Avoid their granite and appliances. Heck yes to their cabinets.

Speaking of which …

The Best Place to Find High-Value Cabinets

Cabinets are sold in three tiers:

- Stock — Off-the-shelf supply. Cheapest.

- Semi-Stock — Shipped in a few weeks. Mid-price.

- Custom — Built to your specifications. Expensive.

Here’s a quick rundown on materials:

- Particleboard – Made from wood shavings pressed together. Cheap. Least-durable.

- MDF – Made from engineered wood. Mid-price. Durable.

- Plywood – Durable. Expensive.

Several years ago, I Googled the name of my area + “outlet” + “discount” + “kitchen cabinets,” and found a discount mom-and-pop supplier. They sold wood semi-stock cabinets at an equivalent price as IKEA’s stock particleboard cabinets.

Great find, right?

Eh … not so fast. Simple is better than complex. When applying this lesson to cabinets, remember that simple = in-stock; complex = shipping.

I learned this lesson the hard way. Anytime you order an item, you risk a possible delay. That’s not a risk that you should take lightly.

If the cabinet shipment is delayed, the entire project can stall for a week or two. And if a house rents for $2,000 per month, a two-week delay costs $1,000 in lost revenue. Ouch.

In-stock wins the day.

I tapped IKEA for the House #4 remodel. And holy moly — I’m hooked. They’re in-stock. They flat-pack. They deliver. They’re easy to install. The base cabinets have self-leveling legs, so your contractor won’t fuss with shims. The wall cabinets hang from a suspension rail. These cabinets could only get better if they cracked jokes, cooked dinner and had six-pack abs.

Long story short: IKEA cabinets save time, and time is money — especially when you’re paying a crew by the hour.

Lessons at the 30,000-Foot View

How should you make decisions about remodeling jobs?

This isn’t a rhetorical question. Framework matters more than strategy, and strategy matters more than tactics.

Here’s what I mean:

- Tactic = How to catch a fish.

- Strategy = How to optimize fishing.

- Framework = “Should I fish?”

Learning how to think about an issue (framework) is more important than deciding what to do (strategy), which itself is more important than knowing how to do it (tactics).

I’d rather teach you how to think than tell you what to think. Of course, there’s only so much I can impart in a single blog post. But I’ll start with two ideas:

#1: Don’t Be Afraid to Iterate.

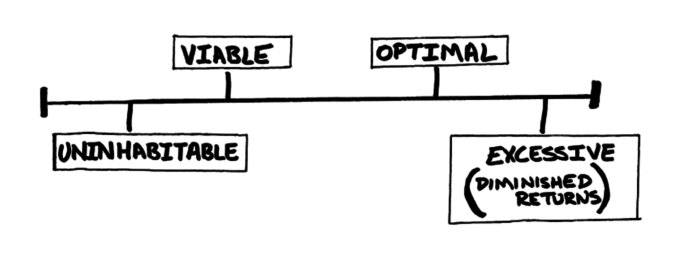

You can renovate to the standards of “viable,” “optimal,” or “excessive.”

Your choice between the top two options depends on (#1) your budget, (#2) your experience, and (#3) the strength of your team. It’s okay to create a “minimum viable” space now, and uplevel in a few years.

Four years ago, we executed a “minimum viable” remodel on House #2 to prepare the property for its first tenant. We installed cheap, flimsy carpet. We slapped laminate countertops atop 30-year-old cabinets. We didn’t build-to-last. We built-to-get-this-damn-thing-to-market.

Today, we have a stronger team, more knowledge and a more flexible budget. We’re renovating the house to a higher standard, and we’re coming at this from a position of strength.

Lesson? Don’t be afraid to iterate.

#2: Optimize for the Top of the Price Range — But Not Higher

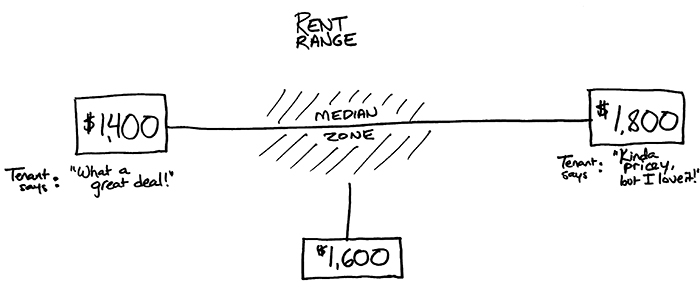

Properties don’t rent for a fixed price, they rent within a price range.

If someone says “this house could rent for $1,600 per month,” that house might rent for $1,400 – $1,800, depending on its condition, seasonality, lease term and a slew of other variables.

When you’re renovating a property, shoot for the top of this range — but not higher.

As an investor, your job isn’t to hammer nails — it’s to make decisions. Your first five-figure decision will be judging the line between “optimal” and “excessive.”

What’s worthwhile? And what’s a total waste?*

[*Tip: Don’t apply those questions to your dating history.]

Many investors try to solve this with a straight-line ROI calculation — “will this upgrade increase the rent?” But that thought process is too simplistic. Rent and occupancy are inversely correlated; if your rent is $1 per month, your occupancy will be 100 percent. Conversely, if you ask for $1 million per month, your occupancy will plummet to zero. (Unless you own an ultra-luxe house, in which case, call me.)

The question isn’t “could this upgrade increase the rent?” but rather — “could this upgrade make the property more competitive?” Even if you can’t increase the rent, could you lower vacancy? Attract higher-quality tenants? Get multiple applicants? Improve retention? Reduce turnover?

Those are tough questions. They require judgment and subjectivity. They can’t be deduced with spreadsheets.

This is the art of investing.

Rental Income Report – Aug, Sept and Oct

I could write for days about renovation cost-cutting, but I’ll pause here.

Let’s reveal the Rental Income Report from the past three months.

If you’re new to this website, here’s the background:

We own 7 rental units. These generate around $10,000 per month in top-line revenue. After expenses, the properties bottom-line (net cash flow) roughly $3,000 – $6,000 in a typical month (when we’re not renovating).

We average 3 to 5 hours per month (1 hour per week) managing this portfolio. You can read the history-at-a-glance here.

Rental properties give us the freedom to stop worrying about day-to-day expenses. We could retire in Bali tomorrow. Personally, I’m a Type-A serial entrepreneur — that’s how I’m wired — and now I can take risks and embrace failure, without feeling pressure to put food on the table. This peace-of-mind helped me build this website and my podcast, among other ventures.

I enjoy teaching others about the benefits of rental investing. But over the years, I’ve heard many readers voice misconceptions about rental investing, ranging from “that’s a full-time job!” to “wahoo, free money!” — neither of which reflect reality.

Rentals are neither as bad nor as good as many people assume.

To quash these myths, I decided to publicly disclose the income, expenses and hours per month that we spend managing our rentals. I hope this no-holds-barred case study helps paint a more realistic picture.

If you’re new to these reports, please read the FAQ HQ, which answers many more questions.

Here we go:

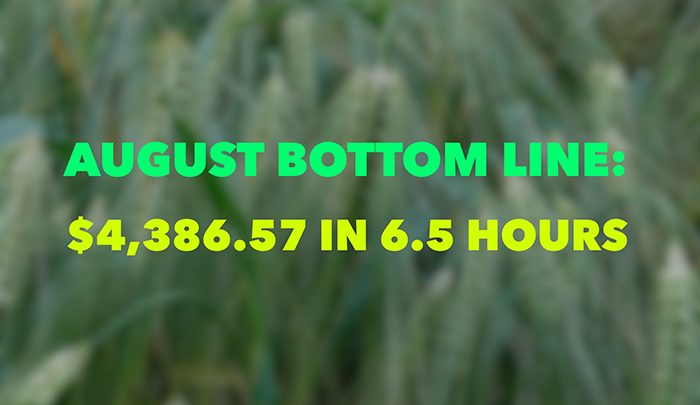

August 2016

In August, we netted around $4,400 (after expenses) with 6.5 hours of work. Wahoo! Here are the specifics (each link below opens the history of that property).:

Unit 1, Triplex: $2,915

Unit 2, Triplex: $1,490

Unit 3, Triplex: $1,330

House #2: $850.50

House #3: $1,273

House #4: $0 (listed on the rental market at the start of the month)

House #5: $707.00 (after minor maintenance deductions)

Total Income: $8,565.50

August’s gross income is $8,565.50, after management fees and small repair deductions. What about other expenses?

Mortgage, PITI for Multiple Properties: $3,182.64

Mortgage, Part II: $583.33

Lawn Care and Maintenance: $221.86

Water: $176.48

Home Depot: $14.62

Total Expenses: $4,178.93

This means ….

August 2016 Net Cash Flow: $4,386.57

Time Commitment: 6.5 hours

We finished renovating House #4 in July and started marketing the property in August. We spent 6.5 hours reviewing and updating our marketing materials — the listing, canned responses, open house material, etc., plus replying to a few emails about the triplex.

Overall, I’d call August a great month! Let’s move to September …

September 2016

Renovations started on House #2 in September. Dun-dun-dunnnn! Prepare for negative territory. We dug into the business coffers, spending several G’s upgrading House #2. Here are the numbers, laid bare for your amusement:

- Unit 1, Triplex: $2,915

- Unit 2, Triplex: $1,490

- Unit 3, Triplex: $1,330

- House #2: $763.38 (our property manager sent us the final payment)

- House #3: $1,273

- House #4: $0

- House #5: $840.00

Total Income: $8,611.38

September’s gross income is $8,611.38 after management fees. What about expenses?

- Mortgage, PITI for Multiple Properties: $3,182.64

- Mortgage, Part II: $583.33

- Property Taxes: $507.43 (partial payment for a house we own free-and-clear)

- Insurance: $116.00

- Lawn Care, Gutter Cleaning and Pest Control: $284.00

- Water: $139.52

- House #2 Contractor Labor: $5,300

- House #2 Materials: $4,536.92

- Credit Card Annual Fee: $95.00

Total Expenses: $14,744.84

This means ….

Cash Flow: $-6,133.46

Negative, baby!! It’s renovation season! Okay, what about time costs?

Time Commitment: 8 hours, 45 minutes

We spent an hour reviewing and updating the House #4 lease (and signed a new tenant!) We also invested 2.5 hours replying to emails and calls related to the newly-renovated House #4.

Meanwhile, House #2 became vacant, so we planned a kitchen, bath and whole-house-flooring upgrade. It’s a simple remove-and-replace job, which means we’re not changing the floorplan or layout. This makes the remodel much easier than House #4.

Given the limited scope of work, simplicity of the property and the fact that we’re fresh off another remodel (our skills are sharp!), we planned the House #2 remodel in just 2 hours. That’s a new record low. We spent another 2.5 hours coordinating specifics with our contractor, such as listing the precise item numbers he’d need at IKEA, etc.

Finally, we spent 45 minutes coordinating lawn care and pest control on House #1 (the triplex).

TL;DR — We spent 8.75 hours managing our rental portfolio in September, and we invested heavily in upgrades — leading to negative $-6,133 in September’s cash flow.

Ready for one more month? Here’s October:

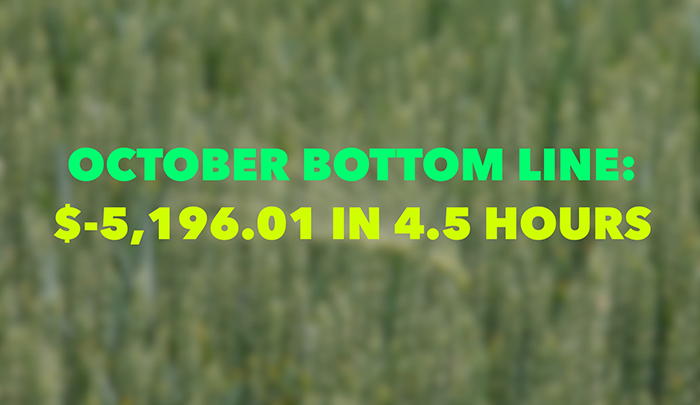

October 2016

- Unit 1, Triplex: $2,915

- Unit 2, Triplex: $1,490

- Unit 3, Triplex: $1,330

- House #2: $0 (under renovation)

- House #3: $1,273

- House #4: $1,795

- House #5: $0 (tenant late; our PM is handling everything)

Total Income: $8,803.00

What about expenses?

- Mortgage, PITI for Multiple Properties: $3,182.64

- Mortgage, Part II: $583.33

- Insurance: $199.44

- Lawn Care, Gutter Cleaning and Pest Control: $105.00

- Water: $164.16

- Office Supplies: $84.78

- House #2 Contractor Labor: $5,500

- House #2 Materials: $3,801.01

Total Expenses: $13,999.01

Leading us to …

Cash Flow: $-5,196.01

We’ve invested $20,000 into the House #2 renovation ($19,137, to be exact) in the past two months.

If you’re a longtime reader, you might remember that we bought House #2 for $21,000 and spent $10,000 improving it to viable, rent-ready condition. After these past two months, our total investment in House #2 is a cumulative $50,000.

Not bad for a property that rents for $945 per month.

Time Commitment: 4.5 hours, almost entirely coordinating with the contractor (and a little bit of chatter with the triplex tenants).

Bottom Line

Most real estate “gurus” only talk about top-line revenue. “I collect $10,000 in a month!,” they’ll proclaim.

Great, but how much do they spend?

I’m not a “guru;” I’m just an ordinary investor with access to the Internet. When I write, I prefer to show you a complete set of numbers — our income and expenses — and contextualize this with the time commitment that’s involved. You’ll get a fuller picture, I hope, through this first-person case study. And you can draw your own conclusions.

One word of commentary, though, about the past few months —

We’re reinvesting, and this yields negative cash flow in the short-term. Don’t let this scare you. Rentals are a long-term game. More accurately, ALL businesses and investments are a long-term game.

You might spend years building a website, product or service before it’s profitable. You might hold onto an index fund for decades. You might invest years into gaining the education and skills that evoke the promise of a better life.

Quick-hit, get-rich-fast promises are either risky, hollow, or both. The question I’d encourage you to ask yourself isn’t “what’ll get me a private jet the fastest?,” but rather, “what’s a solid long-term plan for my future?”

Maybe it’s rentals. Maybe it’s not. But as I said earlier in this article, your mental framework is far more important than any tactic.

You might not know the answers yet. And that’s fine — as long as you’re asking the right questions.

>> If you made it this far, you’re a little interested in rental properties. C’mon, admit it.

>> If you’re reading this, join the free VIP List. You’ll be the first to hear when enrollment opens again for Your First Rental Property, our premier real estate investing course. <<

____

Image courtesy Flickr.