Hey everyone —

I’ve been deliberating for months — nah, years — about whether or not I should open the books to my rental property business, giving everyone a behind-the-scenes look at all the numbers.

Getting financially naked is scary. But I think it’s necessary.

As much as this terrifies me — What if my tenants read my blog? — I’m feeling a sense of civic responsibility.

Almost nobody on this planet writes about real estate investing with radical transparency. Plenty of people extoll the virtues of real estate, but nobody opens up their own books.

Let’s change that.

There are many negative misconceptions about rental property investing:

- Your tenants might trash your place.

- You spend all your time fixing toilets.

- Your insensitive friends call you a ‘slumlord’ no matter how nice your properties are.

Sketchy get-rich-quick real estate gurus on late-night TV counteract those fears with hype and over-promises:

- You’ll be an instant zillionaire!

- If your rent covers the mortgage, you’re set!

- Drinks for everyone! This round is on me!

The truth? It’s not as bad as the Naysayer Brigade fears. It’s not as good as Sketchball Late Night Gurus claim. Reality is balanced in the middle.

By opening up my books, I hope I can demonstrate the real-life inner workings of this business.

The other day, I read a comment written by some idiot on Quora who obviously has zero experience with real estate investing. He posited the usual fear-monger arguments: “I’m a renter, and my landlord just replaced our HVAC. That wiped out a year of profits. Oh, and the guy before me spilled bleach on the carpet.”

These intellectually lazy arguments detract from the discourse. They cherry-pick examples without framing them into a comprehensive context.

My goal is to provide that context.

Of course, money is half the story; time is the other half. In addition to tracking and reporting my income, I’m also sharing exactly how much time we spend on this business.

Just how passive is this — as measured by hours, please?

C’mon Paula, Please Cut to the Chase

Here’s what I’m trying to say:

“Hey there. My name is Paula, and I run a small rental property business.”

“Here’s my exact income. Here are my expenses. Here’s how much time I spend on this project.”

“Review these facts. Then decide for yourself whether or not this path is for you.”

With that said, here’s my report for October 2015.

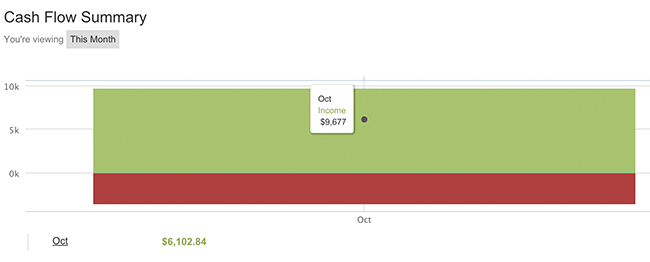

The green bar represents income; the red bar represents expenses.

Gross Income: $9,676.87

Expenses:

- Mortgages: $3,524.83

- Repairs: $50

- [Pending Expenses: Lots; see comments below.]

Net Income: $6,102.84

Total time: 3 hours.

How Did We Spend That Time?: My partner happened to be in Atlanta when he received a text message from a tenant, saying there’s a squirrel in the attic. He spent three hours chasing the damn squirrel before he realized he needed to hire a professional. We’ll pay that bill next month.

Hourly Rate: $2,034.28 per hour

![]()

Comments:

- This is an unusually good month. You won’t see this again.

- This month is so good, in fact, that I hesitate to start publishing reports now. I don’t want to create wild expectations. Keep reading these reports; you’ll see the roller coaster.

- We didn’t handle any renovations or repairs this month. (We spent $50 on squirrel traps).

- Because it’s October, we’re in that maintenance sweet spot: No lawn mowing, but too early for gutter cleaning. You’ll see more maintenance in coming months.

- We own a couple of houses in cash; we don’t pay monthly escrow for those properties. You’ll eventually watch us pay a full year’s worth of property taxes and insurance in one big check. That’ll make the monthly report look Shakespearean-tragic.

- We’re in the process of switching the payment structure on the loan for House #3 from a semi-annual to a monthly payment basis. In October, we didn’t need to make a payment for that house, but you’ll see future months with higher expenses reflected for that property.

- Property management expenses (when applicable) are deducted from the top-line gross revenue. (The top-line is after management fees.)

This is my first Radical Transparency Report, so nobody’s asked questions yet. But here are the FAQ’s that I imagine y’all might ask:

Q: “That’s not much.” // “That’s a lot.”

A: Um, that’s not a question.

But in seriousness, I understand what you’re saying. I’m betting that some readers will think this sounds like a hefty sum; others will think this isn’t much, relative to the upfront work it took to get here.

I encourage you to read these reports month-after-month so that you can get an idea of long-term cash flow. (One month is too short of a sample size.)

After that, you can decide for yourself whether or not it’s worth your time and energy.

Q: “Are most months this easy and lucrative?”

A: Nope. October was uncommonly good. Keep reading to get an accurate picture over the long-term.

Q: “How much work did it take to reach this point?”

A: Massive amounts. There’s a substantial learning curve associated with finding, buying and renovating properties, followed by hiring a team.

It’s taken me five years of trial-and-error, plus a lot of reading and mentoring, to reach this point. I’m sharing this with you in the hopes that you can learn from my experience.

Think of this as me giving you a five-year headstart. 😉

Passive income isn’t free money. It’s characterized by working hard upfront so that you can enjoy rewards in the future. In that regard, it’s the opposite experience of those scam-o-rific late-night guru claims.

Q: “Is this your primary source of income?”

A: Nope, most of my income comes from providing content marketing services for small to mid-sized businesses.

In 2010, I began full-time freelance writing. Over time, these writing services morphed into full-scale turnkey content marketing packages. I added clients; I hired a small team; I watched my profits grow.

I aggressively saved that income like a maniac on crack, dumping this cash into creating a rental property portfolio. That’s the portfolio you’re seeing today.

Q: “Okay, how much do you make in total?”

A: Sigh. One of the drawbacks of opening up my books is that I’m inviting If-I-Give-A-Mouse-A-Cookie Syndrome.

Once I reveal part of my income, people start wanting to know ALL of my income. And my credit score. And my weight. And do I prefer paper or plastic?

I’m happy to share real-estate-related numbers so my readers can decide whether or not rental investing is worthwhile. But I don’t see any educational value in sharing unrelated numbers.

There’s a fine line between educational content vs. financial porn. I’m not interested in becoming the Hugh Hefner of finance. Deal?

Q: “Taxes, taxes … some question about taxes?”

A: When I replace a roof, windows or appliances, I can’t write-off the expense during the year it’s incurred. I have to depreciate those items over their IRS-approved lifespan. “Profits,” in the tax sense, are different than cash flow. You’re reading a cash flow report.

Q: “I’m out of questions.”

A: That’s okay, you’re a figment of my imagination anyway.

Q: “Well, you’re rather unimaginative.”

A: Dammit, now my own mind is trolling me.

I don’t always hang out at the equator. But when I do, I’m upside-down.

What’s Next?

I’m going to use this Radical Transparency Report as a chance to share general behind-the-scenes updates:

Airbnb: I’m no longer running The Airbnb Experiment; I converted that unit back to a long-term rental when I moved from Atlanta to Vegas. I wrote an article that shares the final wrap-up, including all the numbers and lessons.

I meant to publish that final Airbnb Report months ago, but I’ve been distracted by my insane travel schedule. Speaking of which …

Travel: This month I visited San Diego, New York, Ecuador and Colombia. Yes, all during the month of October. It’s exhilarating, but also exhausting.

My excursions to San Diego and Colombia were purely for fun, laughing with family and friends. I traveled to New York and Ecuador ostensibly for “work” (speaking gigs), but those these trips were so awesome that it feels silly to refer to them as anything other than sheer playtime, with an occasional burst of productivity thrown in.

When I was younger, I traveled for the sights, sounds and smells of my new surroundings. But as I’ve aged, I’ve discovered that the most meaningful aspect of traveling isn’t the setting; it’s the people. I could care less about traipsing through some Ecuadorean jungle; the real magic comes from hanging out with two dozen blog readers around a lukewarm hot tub.

I’ve spent less than 7 total days at home this month; I’m publishing this blog post from the Bogota airport.

While I love the nomadic lifestyle, everything’s best in balance. I’m anticipating home sweet home this November, where I’ve made strict plans to indulge in some hard-earned nap time.

Course: Under works! I’m more excited about this project than almost anything I’ve done recently. Hop on the VIP List to hear early announcements about the release, and get special access to pre-launch goodies.

By the way — While I’m starting this month’s real estate income report on a strong note, I want to re-emphasize that (1) it took a bunch of work to get here, and (2) not every month is this awesome. I’ve repeated this several times, but hey, here’s one more for the road.

Aaannnd … That’s all, folks! Thanks for reading all the way to the end. If you have any questions, please feel free to drop these into the comments.

UPDATE: Real FAQ’s!

Update Oct 29, 2015 and Beyond: Wow — what an awesome discussion in the comments section! Here’s a response to real FAQ’s that I’ve heard from several readers:

Q: “How many properties and/or units does this represent?”

A: I own 7 units across 5 properties: one triplex and four single-family homes.

Q: “Can you break down this income by property?”

A: Sure, here we go:

- Triplex, Unit 1: $2,750

- Triplex, Unit 2: $1,490

- Triplex, Unit 3: $1,295

- House #2: $482.03 (reflects higher property management fees this month due to re-signing of lease)

- House #3: $1,273

- House #4: $1,500

- House #5: $886.84 (this property tends to have irregular monthly numbers due to late fees, etc.)

Total: $9676.87

Q: “What accounting software do you use?”

A: You’re seeing screenshots from Less Accounting, which I used at the time. I have now switched to using Quickbooks Online for real estate, but if you run a small business, you could also check out Freshbooks.

Q: “How do you organize receipts, etc.?”

A: All checking account deposits, credit card expenses, etc., automatically get pulled into the bookkeeping software.

If I have any physical receipts, I’ll scan these and upload them into a Dropbox folder, labeled “Real Estate Shoebox 2015.” If needed, I’ll also upload these into my bookkeeping platform.

One HUGE passive barrier is using poor-quality equipment, like a flatbed or weak all-in-one scanner, which requires you to feed receipts and documents excruciatingly slowly. This scanner is lighting-fast, rarely jams, and feels like you can feed it a pile of crumpled trash and still get clean scans on the other side.

Q: “Can you retroactively share the past 1-5 years of financial data?”

A: That would be a gigantic pain-in-the-ass, due to the following factors:

Factor #1: Blurred Lines from Living in the Triplex

One of the reasons I waited until now to start reporting the data is because we lived in the triplex until July 2015. That makes the accounting messy.

Under normal circumstances, people would simply use data from 2/3rds of the triplex, noting that we occupied the other 1/3rd. But to complicate matters, we lived in the triplex with roommates, so really, we occupied — maybe 1/8th of the building? Or 1/9th of the building?

And should that be measured by dividing the number of bedrooms in the building, or is it measured proportionately by square footage?

What about home maintenance costs — what fraction of that rightfully should come from our own personal pockets, and what fraction should be included as operating overhead? How about shared utility costs, like water?

Our CPA figured this out from a tax perspective, but like I said, taxable profits are very different from actual cash flow.

Given these variables, and given how “sloppy” the math becomes when you’re living in part of the home (and thus consuming the opportunity cost associated with not renting that portion of the home to a paying tenant), I decided that I couldn’t accurately display information about our numbers while we’re living in the triplex.

The best way to report these numbers to the public is by first creating a clean division between “personal” and “business,” by moving out of the triplex. This allows 100% of the income to come in the form of cash (rather than coming in the form of a “free place to live,”) and 100% of the expenses to be pure operational overhead. In short, it makes the numbers simpler, cleaner, and easier to make an apples-to-apples comparison.

That’s why I’ve chosen to start disclosing numbers effective now, and that’s why any data that I’m choosing to share with my readers will start on this date and extend into the future, rather than the past.

Factor #2: Reconciling Different Bookkeeping Methods

In 2015, we switched our accounting software to a new platform, which is the data you’re seeing above. Creating the cash flow reports for this series is incredibly different than tax accounting that we’ve done in the past.

Retroactively scanning through all of our files, and trying to square our tax-accounting-data with this new style of cash-flow-data, would require dozens of hours of additional effort.

I believe my readers will get sufficient benefit from seeing monthly data in the upcoming series, without requiring me to spend days buried under a pile of five-year-old spreadsheets and lengthy tax documents.

To me, the prospect of generating all of this old data sounds like as fun as …. doing five years worth of taxes and bookkeeping all over again. 🙂

Q: “What did you pay for each of these properties? What’s the ROI?”

A: I’ve outlined the Cap Rate (a measure of real estate ROI) for each property in the articles that I wrote about each purchase: House #5, House #4, House #3, House #2, and House #1.

The cap rate fluctuates each year, of course, depending on changes in operating overhead, property value and rent prices. The numbers that you’ll read in those blog posts give you a snapshot of the cap rate that I accepted at the point-of-purchase.