It’s a story that led GameStop, a brick-and-mortar company that sells physical video games (remember when games came on 5.25-inch floppy disks?), to skyrocket its share price by 700 percent in two weeks.

It’s a story that explains why multiple brokerages — including Vanguard, Schwab, Robinhood, TD Ameritrade, RBG Direct Investing, ThinkorSwim, Webull, E-Trade, and more — had such high volume and demand on Wednesday that these trading platforms briefly shutdown, or had intermittent service.

It’s a story that explains why AMC Theaters rose 264 percent, um, YESTERDAY.

It explains why overlooked retailers such as Nokia, Blackberry and Bed, Bath and Beyond rose by approximately 35 to 45 percent yesterday (as of 3:30 pm Eastern, half an hour before market close).

And it’s a story that explains why Express rose 166 percent in a single day, with such heavy trading volume that several brokerages halted all trades of its stock simply because the platforms couldn’t keep up with the firehose of orders.

It’s a story of short selling, of high-frequency trading, and of individual investors who harbor deep anger towards hedge funds.

It’s a story of social media vs. Wall Street …

… and the innocent bystanders who get caught in the crossfire.

It’s a story of stonks, stimmies, tendies, and the rise of meme stocks. It’s a story of market manipulation and the reality that a subreddit can move markets faster than the Treasury Department.

That was the story that unfolded on Wednesday.

And that’s what we talk about in today’s PSA Thursday.

Enjoy.

— Paula

Resources Mentioned

- Robinhood

- Alternatively, I also recommend just hiding in a cave until this is all over.

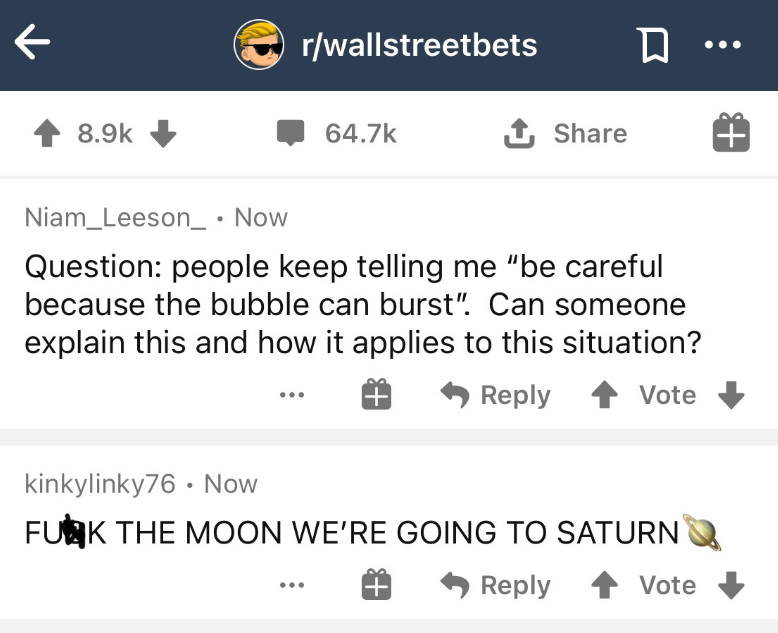

P.S. By the way, if you want any evidence that this is a bubble, well, here ya go: