How much can you earn from a rental property?

The sketchy late-night-TV gurus claim you’ll be blowing your nose with $100 bills.

The naysayers claim you don’t earn jack-diddly-squat.

Reality is in the middle.

My goal is to paint a hyper-realistic picture of how much you can earn from rental properties. And I’m going to achieve this, in part, by opening up my books.

Here’s a full breakdown, if you want to read a month-by-month overview. This article will focus on this previous month (November 2015) for a close-up look behind the scenes.

Before we jump into this …

Why am I Sharing My Rental Property Numbers?

As I’ve touched on above, I’m doing this for a few reasons:

- To answer people who claim: “You’ll be waking up at 2 a.m. to fix toilets.”

- To answer people who claim: “You’ll be richer than Warren Buffet and Kanye West combined!!”

- To hold myself accountable.

- To promote the value of transparency.

- To make money less of a taboo topic.

- To give you a realistic idea of BOTH the time AND the income that rental property investments can create.

“How is this Helpful?”

I want to be ultra-clear:

Before I publish an income report (this is only my second), I ask myself whether or not this information will genuinely help my readers.

That’s my litmus test for everything that appears on this website.

I’ve seen websites where people publish their top-line (gross) revenue on a specific date.

“Look! I made $10,000 in one day!”

Ugh.

These people are showing one isolated data point, without the benefit of context.

- They’re not showing expenses.

- They’re not showing the bottom line.

- They’re not showing the month-by-month rises and falls.

- They’re not contextualizing the information.

That’s not helpful. In fact, it’s downright misleading.

I don’t play that game.

My hope is that these income reports will accomplish the following:

#1: Help you make an informed decision about whether or not rental properties are right for you.

#2: Facilitate a mindset shift away from the extremes — both the naysayer extreme and the sketchy-late-night-TV-guru extreme.

#3: Pull back the curtain on the many, many expenses that unfold behind-the-scenes. Big revenue looks impressive, until you subtract the costs.

#4: Disrupt the myth that rental property investing requires “being handy.” I’m not swinging hammers, and these reports show how this decision affects both my time and my bottom line.

#5: Frame income into the context of time. I’m not interested in working 16 hours a day just so I can make money in my sleep. 🙂 These reports discuss both money and time.

#6: Provide consistent data. If you keep reading this website throughout the next year (and beyond), you’ll see profit volatility. I have great months, and I have sucky months. You’re going to witness both.

So — that’s why these articles exist. I hope I’m serving you well.

Quick Background

Are you a new reader? Here’s a quick background:

My name is Paula, I’m 32, and I live in Las Vegas. I own seven rental property units spread across five buildings, all located in metropolitan Atlanta, where I used to live.

When my partner and I first bought these properties, we made the classic novice mistake of doing most of the work ourselves. It quickly became a job, not an investment.

When we realized this, we devoted our energy to creating systems, building teams and turning this into a scalable business. We made ourselves redundant, and then we happily fired ourselves. 🙂

Today, we collect thousands every month while working less than one hour per week on our real estate business.

What do I mean by “thousands”? And what type of work do we handle?

Here are the exact details.

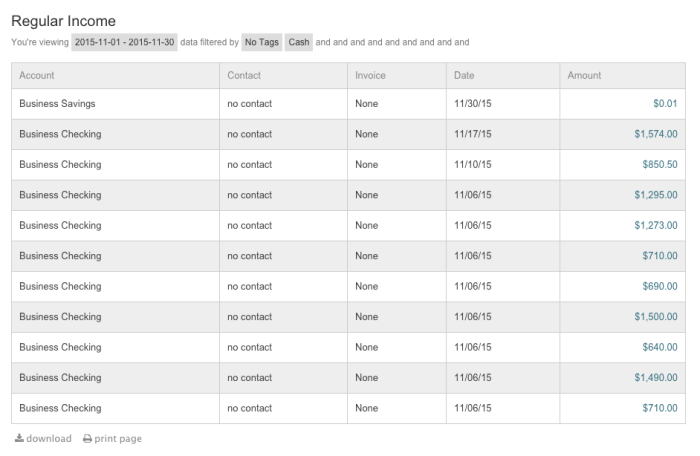

November Income: $10,732.51

Last month, we collected $10,732.51 in gross revenue after paying property management expenses (which gets taken-from-the-top, before the money hits our bank account).

Here’s how this breaks down:

- Unit #1: $2,750

- Unit $2: $1,490

- Unit #3: $1,295

House #2: $850.50

House #3: $1,273

House #4: $1,500

House #5: $1,574 (includes deferred income from previous month)

Ridiculously Tiny Interest Payment from Bank: $0.01

Total: $10,732.51

Here’s what it looks like (Please note that Unit #1’s rent is paid in four separate transactions):

Let’s keep in mind:

- Income is one-third of the story

- Expenses are another one-third.

- And TIME is the most crucial detail — especially if the goal is to create a stream of passive income.

Let’s take a closer look at this.

Time Investment: 2 Hours, 30 Minutes

Last month we spent a total of two hours, thirty minutes managing our rental properties. Here’s what this looks like:

- Triplex: One hour 30 minutes.

- House #2: Nothing.

- House #3: Nothing.

- House #4: Nothing.

- House #5: One hour.

Here’s exactly what we did during that time:

Triplex:

Remember that squirrel-in-the-attic problem I mentioned last month? He’s baaaack!

Last month, we hired a pest control company to chase the squirrel away. (We paid the bill this month.)

Their first attempt didn’t work, so we coordinated between the tenant and the pest control company for two more visits. Then we came to our senses and just put the tenant into direct contact with pest control company.

(Lesson: Look for every opportunity to stop being the bottleneck.)

Normally, I’m cautious about letting tenants have direct access to contractors. After all, I don’t want the tenant to link us to a financial commitment. But in this case, the pest control company charged a flat fee for a year’s service. In addition, they work with a lot of investors (we accessed them through a referral from another investor) and they understand the set-up.

(Lesson: There are contractors who specialize in working with owner-occupants, and contractors who specialize in working with investors. You want the latter.)

Total time: 1 hour.

In addition, we got a voicemail from a tenant saying that their glass shower door came off its tracks.

Coincidentally, on that same day, we happened to chat with our former next-door-neighbor. (We’re friends). The neighbor volunteered to drop by and fix it. He finished in 15 minutes.

(Lesson: Be friendly with your neighbors. That’s not just an investing lesson, but a good value for life.)

Total time: 30 minutes, including time to catch up with our neighbor. (If we didn’t have such an awesome neighbor, we would’ve just texted our handyman.)

Houses #2, #3 and #4:

We did nothing. 🙂 Passive income, baby!

House #5:

We got an email from our property manager that the refrigerator is broken again. We recently repaired it, so this time we decided to replace it.

We asked the tenant to measure the opening where the refrigerator stands (30 inches wide). Then we hopped onto the Internet, ordered a fridge, and arranged for delivery and haul-off.

Voilà — done and done.

(Lesson: Don’t over-optimize. My former self — the “old Paula” from five years ago — would have tried to penny-pinch the situation. “Wait! We can scrap the old fridge for parts! I bet we could get $50 on Craigslist!”

Then I clarified my values.

What’s my goal: maximize money or minimize time?

My priority is minimizing time — and means accepting the “free haul-off” offer, even though it carries the opportunity cost of not scraping the old appliance for a few bucks.

If your goal is to enjoy more free time, don’t over-optimize. Let go of tiny opportunities so you can be open to bigger ones.)

Total time: One hour, at least half of which was unnecessary.

(I wasted 30 minutes deliberating between a 28-inch vs. 29.5-inch refrigerator. What a waste of time. I easily could have handled this in 30 minutes, instead of 60 minutes, if I had been more decisive. I’m guilty of over-optimizing; it’s a bad habit from my hyper-frugal days.)

Annddd … that’s it!

Two hours and 30 minutes of work this month. Not bad, eh?

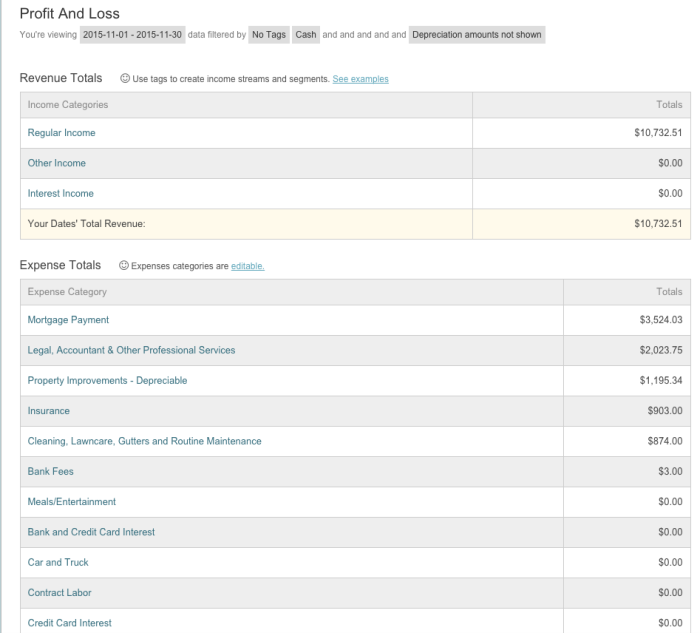

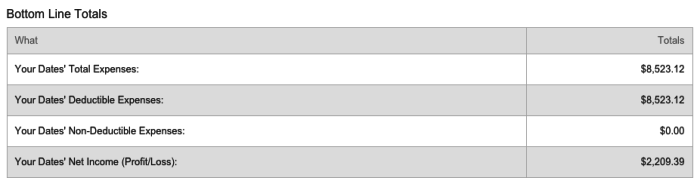

Cash in My Pocket: $2,209.39

$10,732 of gross revenue makes a better headline.

But I want to call your attention to the number that REALLY matters — the bottom line.

My ultimate cash-in-pocket (from rental property investments) came to $2,209.39 in November.

That’s not much. But on the bright side, I only spent two-and-a-half hours earning this money.

That comes to a rate of $883.75 per hour. 🙂 (We’ll chat about this in detail below.)

Here’s last month’s Profit and Loss Statement:

Here’s the play-by-play:

Mortgages: $3,524.03

- Mortgages consist of principal, interest, taxes and insurance (PITI). The final three categories are pure expenses, but the first category — principal — is additional “gain” (it builds net worth).

- That said, our houses are in the early amortization years. Principal contributions are small.

Legal and Accountant: $2,023.75

- After we moved to Vegas, we paid an attorney to advise us on whether to structure our business in Georgia or Nevada. They told us to keep the registration in Georgia, but foreign-register the entities in Nevada. That cost $623.75.

- The other $1,400 is the fee we pay our CPA for dealing with our taxes. Better him than us. 🙂

Property Improvements: $1,195.34

- The new refrigerator came to $612.27.

- The other $583.07 came from us reimbursing ourselves for a stove that we bought for House #4 a few months ago. (We accidentally used a personal credit card instead of the business card, so we paid ourselves back and made a note of the transaction.)

Insurance: $903

- We own two houses in cash, which means there’s no mortgage (escrow) on those properties. This is the annual insurance bill for one of those properties.

Routine Maintenance: $874.00

- We paid $850 to get that damn squirrel out of the attic. #StupidSquirrel

- The other $24 is the cost of lawn mowing. (The triplex needed one last mow before the winter.)

Total Expenses: $8,523.12

Cash Flow: $2,209.39

Yeee-ow! Remember last month, when I walked away with $6,102.84 in my pocket?

Notice how this month, my income is around $4,000 less? 🙂

Income rises and falls by a massive margin. Be neither excited about the highs nor disturbed by the lows.

Let’s review:

- Income: $10,732.51

- Expenses: $8,523.12

- Cash Flow: $2,209.39

- Time: 2 hours, 30 minutes

- Hourly Rate: $883.75 per hour

Look at Time, Not Just Money

These income reports are modest. I’m not making millions. But I’m also working two hours per month.

I’m trying to illustrate the concept of passive income.

Sure, I only made $2,209 last month from rental investments. That’s not much. But it’s just shy of $900 per hour. And that’s pretty sweet.

There are many people who have never held any income-producing investment. I’ll sometimes hear them say, “Yeah, I’m tired of trading-time-for-money.”

That’s great. But how are you going to build a bridge from your current wage/salary situation to something … different?

I don’t want to encourage you to sustain an hourly rate mentality. Building a business with strong systems will take time upfront. But eventually, this business can elevate you above the trading-time-for-money framework.

The best way to illustrate this with numerical data is to show you my current insane “hourly rates,” and hope that you reach the conclusion that I’ve surpassed the wage paradigm.

By contrasting investment income with wage/salary earnings potential, I hope you’ll see that these exist in different leagues.

Because nobody makes $883 per hour. Reality is far more nuanced. When I started investing in real estate, I made $0 per hour. Now I’m earning those dividends.

And I can ride this wave for decades.

How Much Did Your Properties Cost?

I updated last month’s article to answer several FAQ’s that came from the comments.

In a month or two, I’ll probably create a “Master FAQ” page that I can continually enhance.(I’m trying to avoid repeating myself in every update.) In the meantime, please check out that article for answers to several common questions. 🙂

I’d like to dedicate the rest of this article to answering one question that I heard several times last month: “How much did your properties cost?”

As usual, I’ll frame this into context.

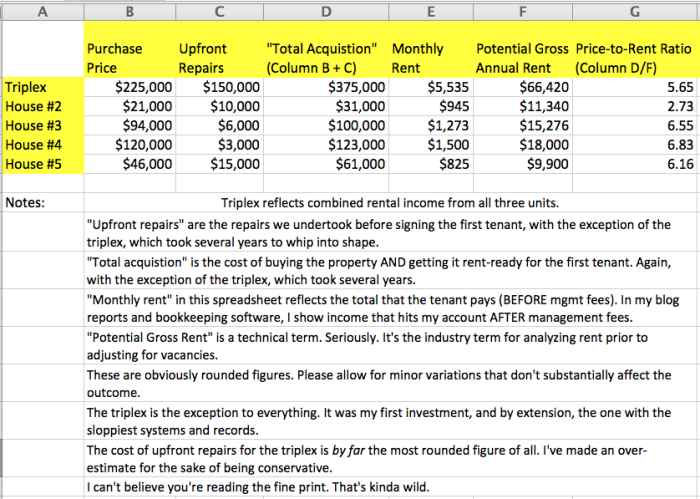

Here’s exactly how much I paid for each property: (I made this awesome spreadsheet)

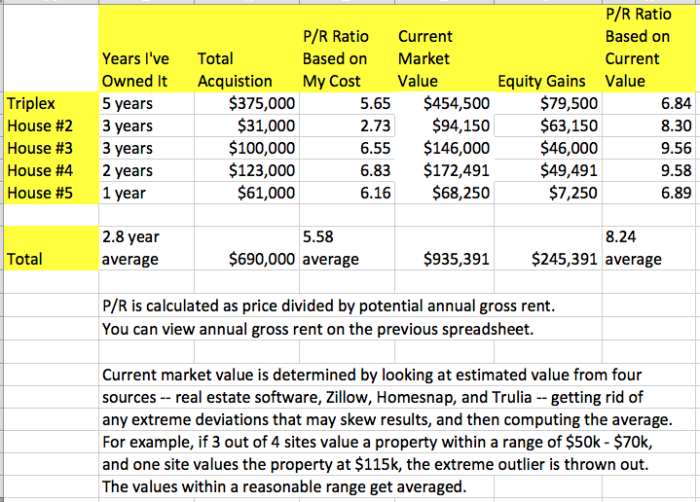

Let’s check out what these properties are worth today:

Over the past five years, I’ve grown $245,000 in additional equity — roughly $50,000 per year. But that’s just icing on the cake.

The REAL value of these investments isn’t the equity gains, it’s the cash flow.

“How Do You Find These Types of Returns?”

I think I’ve made a mistake.

I’ve dug in the trenches behind-the-scenes for years, hunting for investments with solid returns.

After I buy a property, I’ll write an article announcing the purchase.

For example, many of you heard me say, “Hey, we bought House #5! Check it out!”

But you didn’t hear me say:

“Hey, last week I looked at 100 listings online. I narrowed these down to fifteen that I toured in-person. I made offers on four.

“One of those offers was accepted, so I paid an inspector $400 to check it out. I spent an hour reading his report, followed by six hours of deep contemplation.”

“I found the inner strength to release my sunk cost fallacy. I decided not to purchase the property. Now I’m back to Square One.”

I didn’t want to pepper this website with articles titled “Here’s another house I didn’t buy.”

But in hindsight, maybe I should have.

Finding the right house is 90% of the game. This is where you win or lose. Spend lavish amounts of time and energy on this step. As I said in the “12 Essential Lessons” article: You make money going into the deal.

I cannot underscore this enough.

Buy the right property, and you can make a half-dozen mistakes along the road and still be okay.

Buy the wrong property, and no amount of management/tweaking/hoping will save you.

(By the way, I’m heading to Atlanta for the holidays. While I’m there, I’ll start looking for House #6, and this time, I’ll document every moment of the hunt. Stay tuned.)

So anyway —

You’re seeing strong returns in the above spreadsheet for a few reasons:

#1: I invested hundreds of hours into learning — through trial-and-error, networking, reading, listening, asking, etc.

#2: Each property represents many, many hours of behind-the-scenes sleuthing.

#3: I’ve purchased every property significantly below market value. My properties include two foreclosures, two short sales, and one estate sale. As a result, I get “immediate appreciation” at the closing table.

#4: In the past five years, I’ve remodeled seven kitchens. I’ve built or renovated six decks. I own 12.5 bathrooms, excluding my personal home (which brings the total to 14.5 bathrooms). That’s a lot of plumbing.

I’ve learned how to create home value.

Creating home value (the technical term is “forced appreciation”) is a skill, just like basketball and piano are skills. It comes with time and practice.

I made a mountain of mistakes when I managed my first renovation. Like many novices, I wandered into the rental property world without truly understanding the landscape. There are many real estate investors who own one or two properties, but can’t scale up. And the worst part is, they don’t even understand why they’re not making progress.

Some blame the system. Others blame the economy.

I prefer to direct blame inward — because this empowers me to change the situation.

I was on-track to becoming one of those people who couldn’t scale higher. But I caught myself. And I corrected course.

It took me half a decade to figure it out. But by the time I managed the seventh kitchen remodel, I had a tested, proven system.

Here’s the surprising truth that I learned:

It’s not about the “how to.” It’s about the “what to.”

Success doesn’t come from learning “how to build a deck.” It comes from learning whether or not to build a deck.

Success isn’t the result of knowing “how to remodel a house.” It comes from knowing whether or not to remodel that house.

Success comes from deciding where to pinpoint your time, energy and money.

People often tell me: “I want to invest, but I’m afraid of making mistakes.”

Here’s the thing:

It’s okay to make small mistakes.

As long as the Big Decisions — like choosing the right property — are correct.

____

Sign up for the free VIP List to get the first updates about when Your First Rental Property, our premier real estate investing course, opens for enrollment.

Not into real estate? That’s cool. Stay in touch on Instagram.