The excellent, the normal, and the terrible. Two weeks ago, I saw them all.

I’d like to share the harrowing story. It’s a story of triumph, resilience, and late-night burritos. A story that immersed three days of my life — and is now over, chapter closed, with nothing else needed for at least another year.

It’s the story of three rental units:

- One that’s excellent

- One that’s normal

- One that’s everybody’s worst nightmare

Let’s start with the horror story first.

Imagine this:

It’s May 31st. Your tenant is moving out of one of your rental properties. Your new tenant moves in tomorrow. You’ve got 24 hours to fix any problems.

And the place is a dump. Like — a stinky, uninhabitable dump.

What do you do?

… You take command of the situation, remind yourself that you’re a badass, and create a TV-worthy total home makeover in 24 hours. Duh.

Here’s the backstory:

I’m back in Atlanta, overseeing the turnover of two rental units. (We have property managers for our lower-end units, and self-manage the higher-end units.)

This is my first rental property-related trip to Atlanta in three years. Seeing the properties again, after a three-year separation, fills me with incredible nostalgia. These properties were a huge part of my life. I talk about them all the time, but I haven’t seen them in years. It’s surreal to walk through them again. To step inside. To smell them. It feels strange to reunite.

But I couldn’t revel in nostalgia for too long. There was work to be done.

So it’s May 31st and I’m managing two turnovers on the same day. These are both for properties with long-term tenants. One set of tenants, a group of medical students, had lived in the unit for three years. They moved out because they were starting their residency in various far-flung states. They left the home in normal, ordinary condition. Here are a few photos:

Remember when I said I’d tell you a story of three rental units — one excellent, one normal, and one terrible? This is a normal turnover. This is how our units are usually returned to us. This is expected. This is average. This is boring. This is the norm.

But it’s not the end of the story.

I oversaw another turnover, in a different home, on the same day. This home was occupied by a tenant who had lived in the unit for two years. He had a great credit score and steady income. He paid rent early. He was an accountant.

But he had made a terrible mistake. He allowed someone to sublet the home, without approval. And his subletter trashed the place. I’ll let the photos speak for themselves:

Yeah. That happened.

We don’t allow subletting, but our tenant broke the rules. The subletter trashed the place, and the tenant — who is on the lease — is responsible for the damage.

I could tell the tenant felt guilty. He didn’t realize the extent of the subletter’s damage until the morning of move-out. I could hear the stress and pain in his voice. I felt sorry for him. I reassured him that there were no hard feelings; this wasn’t personal.

Now it was time to hustle.

So it’s May 31st, I have new tenants moving in the next day, and the place is an abominable s**thole. The home smelled like a sewage plant had vomited into an abandoned greenhouse. Ugh. And I’m standing there thinking, “Ohhh, this is the “what if” worst-case scenario that scares others from investing!”

Then I sprang into action.

First, I called my contractor, whom I’ve worked with for years.

“Dude, it’s an emergency,” I told him, after texting him a few photos. He showed up immediately with a crew. Together, we triaged the situation. The most important tasks were:

- Patch drywall holes

- Remove/replace stinky carpet and padding

- Paint the whole house

- Clean, clean, clean

Two guys on the crew started drywall patching, sanding, and painting the house, covering everything with a 5-gallon bucket of beige. One other guy started ripping out carpet. The head contractor and I went to Lowe’s to pick up the cheapest carpet and padding they carried.

I brought the crew dinner at around 9 pm. We sat on the bare floor, eating together as a team. We were connected. And we were going to power through.

The crew painted until 1 a.m. When they finished, the walls looked gorgeous. The transformation was stunning. The head contractor drove home, napped for a few hours, then showed up at 7 a.m. to keep working. By noon, he’d finished re-carpeting every bedroom. By 3 pm, he’d finished trash/debris haul-off and cleaning. We were ready to check in the new tenant by 4 pm.

We had done it. We pulled off a paint-and-carpet renovation in 24 hours. BOOM. By the time the new tenants arrived, the place looked amazing.

I’ll let the photos speak for themselves:

I haven’t received the final invoice from my contractor yet, but I’m guessing this cost around $4,000, rough ballpark. (It would’ve been cheaper if it wasn’t an emergency.) The tenant’s security deposit covers around half the cost, and his early termination fee covers roughly the other half. We may end up out-of-pocket, but only by $1,000-ish or so.

That may sound like a long story, but it only occupied 24 hours of my life. Afterwards, though, I started to get nervous. How are my other properties doing?

I decided to initiate a surprise visit.

I sent an email to my property manager, who oversees the lower-end rentals.

“Hey there!,” I wrote to her. “I’m in Atlanta for a few days, and I’d like to do an owner walk-thru of [addresses here]. There’s no specific purpose behind this walk-thru. I just want to see the place once every few years.”

Because I’d given her short notice, she could only arrange a tour of one property. Fortunately, it was the lowest-end property — House #2 — which we purchased for $21,000 and invested $10,000 getting it rent-ready for the first tenant. It’s outside the metro area, in a place that could more accurately be described as “Georgia,” rather than “Atlanta.”

I felt nervous as I drove there. What condition would this property be in?

The answer, it turns out, is AMAZING. Holy moly. The tenants keep this house in fantastic condition. They treat it better than I would. Here, I’ll let the photos tell the story:

“Wow,” I told the property manager, as we left the house. “Keep these tenants forever, please.” She nodded in agreement.

That’s my tale of three rental units — one that’s enjoying the benefits of excellent tenants, one that was returned in normal condition, and one that experienced the scale of disaster that scares would-be investors away.

And I experienced it all over the span of about three days.

Here’s a YouTube video of myself telling the story:

(Note: You can watch the video at 1.5x or 2x speed. Click on the “settings” icon at the bottom-right corner of the YouTube video to adjust the speed.)

It feels fitting that I offer three lessons from this TV-worthy escapade:

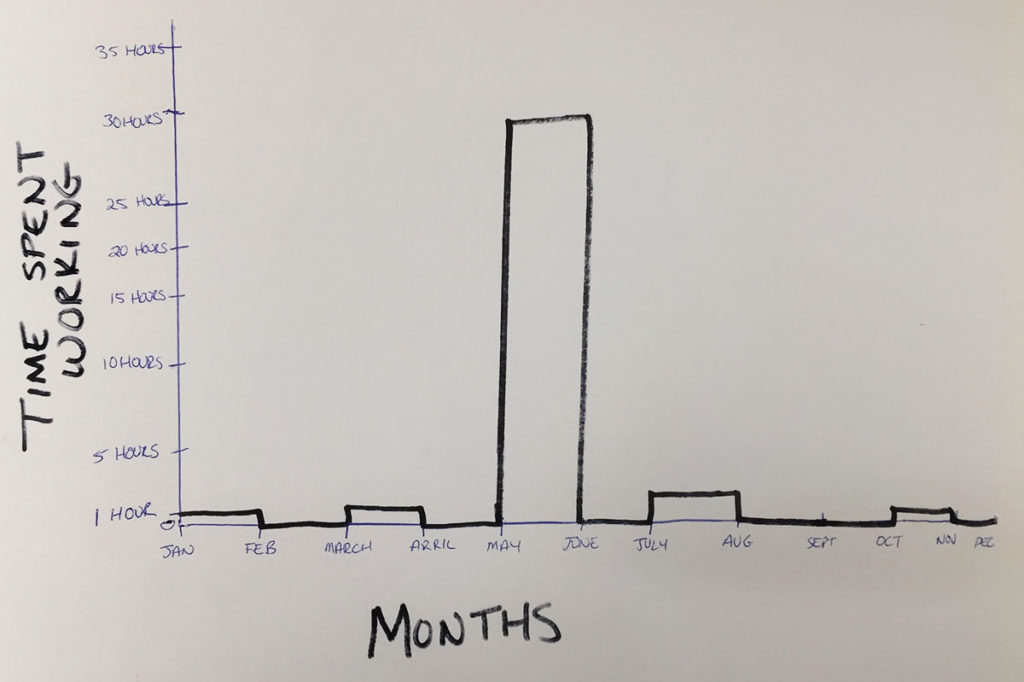

#1: This graph says it all.

As a rental property investor, the workload is as follows:

We’ve kept the same tenants in these units for two years and three years, respectively. During that time, we’ve barely had to lift a finger.

Eventually, the tenants were ready to move on, so I processed two turnovers on the same day. One turnover was easy, and required only a few minutes of my time. The other demanded a rapid-fire remodeling effort. It was 24 hours of intense work, but it was only 24 hours. And then it was done.⠀

That’s why I love rental properties. I spent years doing almost nothing for this property. Then for 24 hours, I was immersed in it. And now, barring any major calamity, I can relax again for at least another year.⠀

#2: Don’t do anything you don’t want to do.

This experience made me pause and ask myself: “Do I want to manage these units? Or should we hire a property manager?”

We could expand our property manager’s scope of work to all 7 units. During those intense 24 hours, I contemplated that option. But then I decided, “nah.”

As I’ve written many times (and as I’ve repeated on the podcast), I’m a firm believer in analyzing properties as though you’re outsourcing everything. Err on the side of profitability. You’re buying an investment, not a job.

If I change my mind, I’ll hand all 7 units to our amazing property manager. But at the moment, we have enough flexibility and free time to handle the nicer, expensive units ourselves. And, honestly, I enjoy it. It’s sporadic, low-commitment side work with an easy escape hatch. It’s a nice break from clacking on the keyboard of a laptop.

It’s good to get tested, so I could ask myself, “is this what I want?” — and discover that the answer is yes.

#3: Take the long view.

We’ve had rental properties for 7 years, and we currently have 7 units. We’ve experienced many, many turnovers. Most have gone smoothly.

Yet humans have a negativity bias. We can have a dozen great experiences and one sour experience, and we’ll dwell on the sour experience. That’s how our brains are wired.

The key, therefore, is to take the long view. There’ll be a few bad apples in the bunch. That’s a fact of life, and in the bigger picture, it’s okay.

When I was an Airbnb host, I hosted more than 42 guests. Among these, 41 were excellent, and one was terrible.

Don’t let the extreme end of the bell curve paralyze you with fear.

If you play sports, you’ll have a few injuries. If you invest — whether in the stock market or rental properties or starting businesses — you’ll have a few failures. If you have relationships with family and friends, you’ll have a few arguments.

The key isn’t to avoid problems. It’s to manage them well.

That’s my tale of three rentals: excellent, normal, and terrible. And these are three lessons that emerged. If I could distill this into one soundbite, it’s this:

Relax.

You’re resilient. You’re the boss. You can handle it.

Smile. Go forth and invest.