This week, I tackle your questions with my good friend, recovering financial planner Joe Saul-Sehy. Here’s what we answer:

This week, I tackle your questions with my good friend, recovering financial planner Joe Saul-Sehy. Here’s what we answer:

1. I’m asking for a friend — no, really, I’m asking for a friend!

My friends are married and buried. They’re a married couple, buried in $500,000 of debt.

Some is federal student loans, some is private student loans, and some is credit card debt. They’re paying the minimum on their student loans, with the hope that these loans will be forgiven after 25 years. They’re also saving money in their retirement accounts.

Is this a terrible plan? Should they stop saving for retirement while they wipe out their student loans? If so, how can I convince them?

2. My husband and I are both 30 and live in Ft. Collins, Colorado. We don’t plan on having children.

We know that long-term care insurance gets more expensive as you age. Should we buy this insurance now? Or can we self-insure for this through adequate retirement/investment funds?

3. I own my home free-and-clear, and I’m buying a second home. Should I take a cash-out refinance on my primary home? Get a conventional loan from the bank? Or something else?

4. My wife, 4 children and I live in the San Francisco Bay Area. We have $5,000 in credit card debt, which we’ve paid down from $30,000 in the last two years. We owe $20,000 on a minivan and $18,000 on student loans, both of which have 2-3 percent interest rates. We have two IRA’s, one Traditional and one Roth. I also have about $20,000 in my company’s non-matching 401(k).

Should I focus my future investments on Traditional or Roth accounts? What accounts should I use when saving for my children’s college funds?

5. I’m curious about your own investments, Paula. What’s under the hood?

Thank you to everyone who left a comment after last week’s show. I’ll talk more about these amazing responses at the end of Episode 85 (next week’s episode.)

For now — enjoy today’s show!

Thanks!

Resources Mentioned:

- Stats on Food Waste – Food and Agriculture Organization of the United Nations

- Rap video: I Finished Paying Sallie Mae Back (Maybach!)

- Rap video: I Ain’t Got No Car Note

Thanks to our sponsors!

Does your email stress you the F out?

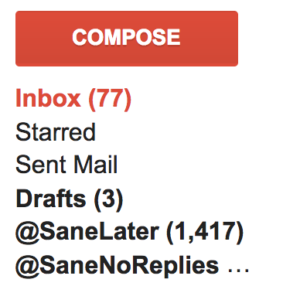

I have 3 email accounts — two business, and one personal. Keeping up with them is a daily struggle.

So I recently began using a service called Sanebox that makes sense of your inbox. Their algorithms separate actual important emails from noise, so that you can tend to what’s important first.

They also automatically track emails that you’ve sent to others that are still pending response, so that you know to follow-up.

The basic plan only costs $7 a month, and it’s brought relief to my email.

They’re offering both a free trial AND an additional $25 credit to anyone who signs up at https://www.sanebox.com/paula.

Do you spend more money at restaurants (or ordering take-out) than you’d like?

If so, check out Blue Apron. For less than $10 per person per meal, Blue Apron delivers seasonal recipes along with pre-portioned ingredients to make delicious, home-cooked meals.

Each meal comes with a step-by-step recipe card and pre-portioned ingredients and can be prepared in 40 minutes or less.

You can customize your recipes each week based on your preferences. Blue Apron has several delivery options so you can choose what fits your needs. And there’s no weekly commitment, so you only get deliveries when you want them.

You’ll love the convenience and ease of finding dinner ingredients on your doorstep. Give them a try. Get your first THREE meals FREE — with free shipping — at BlueApron.com/afford.