In this episode, we cover down payments, cash flow, investing in condo hotels, building a rental on the side of your own house, selling your properties, and whether it’s better to buy actual properties or REITs.

Erin asks:

Would you ever put 30% down (or more) in order to make a rental property cash flow positive?

Ayv asks:

In 4-5 years, I’d like to have a rental property for diversification and passive income. Is it better to stick with the plan to buy rentals, or should I go into REITs?

Additionally, if I want to invest in rentals, where should I look?

Rod asks:

Could you tell me if investing in condo hotels as a rental property is a good idea? I’m 10 years away from retirement, and I was thinking of buying one in Las Vegas, since I plan to move there when I retire.

Being a traditional landlord doesn’t appeal to me – I don’t want to deal with the hassle of bad tenants or repairs when I’m retired. I’m hoping a condo hotel might be a way for me to get income from a rental property without all the hassle. What are the pros and cons I should consider?

Tom asks:

I want to build a small two-bedroom house on the side of my personal residence (located in Texas) to use as a rental. What advice can you offer to help me execute this plan?

Sandra asks:

I live in California, and 5 years ago I purchased 3 properties free-and-clear in Memphis, TN. While they’ve been working great for me, I think they have much more potential, but I’m no longer interested in managing them, or my property managers. It’s too much for me as I changed careers; I’m now going in a much different direction. All I want is to cash out and invest that money into my new business, as that’s more fulfilling to me.

I know to sell them cash is the first choice but investors are in the game of low-balling – way too low. Selling retail is an option, but it’ll take longer, and I don’t know if the market is in my favor. Seller financing drags things out, and lease options are not great for me, so I’m interested in your feedback.

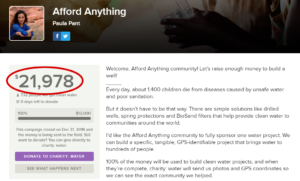

WE DID IT!!!!!

We raised enough money to bring clean drinking water to more than 400 people!! We’re sponsoring a water project as the Afford Anything community!!

Thank you thank you thank you thank you!! Listen to the last 10 minutes of this episode for all the details!!

Much love!

Resources Mentioned:

- Suze Orman ringtone for Android and iPhone

- How to Calculate Cap Rate – Afford Anything article

- Suze Orman podcast episode transcript:

Afford Anything wins Podcast of the Year – Plutus Award!

Thanks to our sponsors!

Gusto

Gusto makes payroll, benefits, and HR easy for modern small businesses. In fact, 72% of customers spend less than 5 minutes to run payroll! If you sign up at gusto.com/paula, you’ll receive 3 months free once you run your first payroll.

Freshbooks

Save time by using Freshbooks, an easy-to-use, cloud-based accounting system that takes the stress and hassle out of bookkeeping and, especially, invoicing. You can create an invoice in a few seconds, and Freshbooks’ automated system will handle the rest. Visit Freshbooks.com/paula for a free 30-day trial. Please mention this show when they ask how you heard about them.

Radius Bank

Do you want your money to make more money? Then check out Radius Bank’s free high-interest checking account. You earn 0.85% APY on balances of $2,500 and up – 12x the national average of 0.04% APY! To get started, head over to radiusbank.com/paula!

Away Travel

The luggage that you use when traveling can make a big difference in your trip, and Away makes a perfect suitcase. There are plenty of interior compartments, it has built-in USB chargers (how awesome is that?), and it’s made from high-quality materials. Get $20 off your luggage by going to awaytravel.com/paula and entering code paula at checkout.