This recent reader email struck a chord:

I’m a software engineer trying to plan my plunge [into freedom]. I’m young, so I figured I would grind it out, save a lot, and retire early.

But after a health scare, I realize mini-retirements might trump early retirements, and I want to achieve a lifestyle similar to yours.

It’s difficult to figure out what I should be prioritizing, however. Side hustles, remote work, rentals, starting a business?

Oohhh!! I love this email.

On the surface, it’s a tactical “how-to” inquiry: Should I launch a business? Buy a rental property?

But under the surface, this reader hints at a deeper question: What’s the optimal lifestyle?

Mini-retirements? Early retirement? Something else?

Mini-Retirements vs. Early Retirement

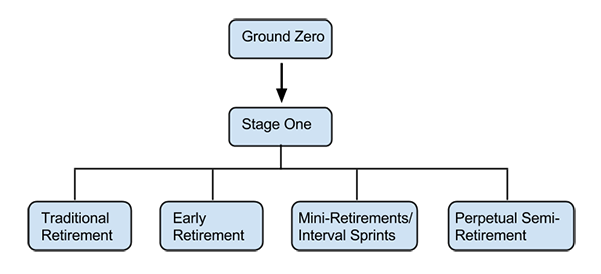

We’ll define ‘retirement’ as escaping the daily grind. It comes in four varieties:

Early Retirement – Escaping the grind at ages 25 – 55.

- Advantage: Obvious.

- You’re financially free (a concept we’ll describe below).

- Your freedom is permanent.

- You enjoy this while you’re young.

- Disadvantage: Trade a Decade

- You devote your 20’s, 30’s or 40’s towards a lifestyle that starts later.

- You defer life (travel, passions, etc.) for 10-20+ years.

- None of us know how long we’ll live. (I’m sorry, but we don’t.) We need to simultaneously plan as though we’ll live to be 100, and also plan as though these are our final months. There’s a wisdom to carpe diem.

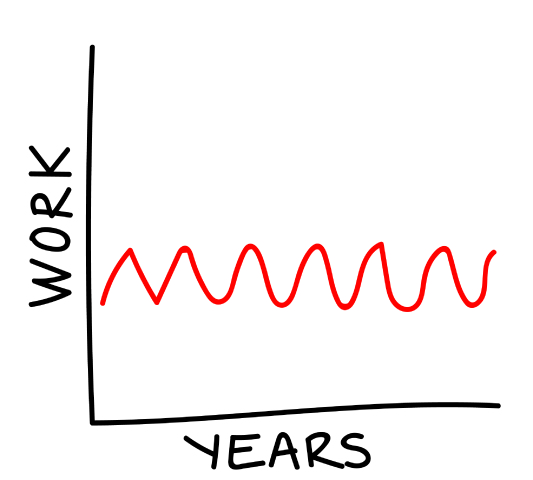

The work life of an early retiree.

Traditional Retirement – Escaping the grind at age 55+

- Advantage: Life at a leisurely pace.

- Your freedom is permanent.

- You’re financially free (eventually).

- You’ll only need to save 15-18% of your income towards retirement (rather than the 50-75% that the Early Retirement camp saves).

- Everyone else is doing it.

Disadvantage: Obvious.

- Retiring at 60 is different than retiring at 35.

- You might spend decades living a suboptimal lifestyle.

- By retirement, your health might have faded. (That’s true of any age, but the likelihood increases as you age.)

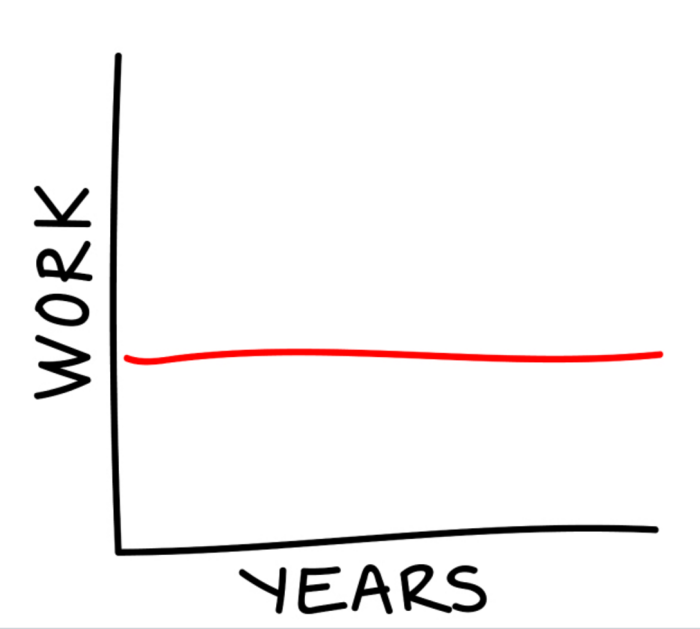

The traditional working life, followed by retirement at 55+.

Many people assume these are the only options.We’re taught “work” is a permanent condition, until we reach “retirement,” which is also a permanent condition.

We’re taught that both exist in binary, mutually exclusive states.

But there are other roads, as well.

Mini-Retirements and Semi-Retirement

Mini-Retirements – The “interval” approach to work and life. It’s characterized by alternating intense work with rest and fun.

This is the career equivalent of running sprints: Sprint, rest, sprint, rest.

Some freelancers who work on a project-by-project basis can fall into this category.

Example: Work for 6 months; adventure for the next 3-6 months. Surf, lay on the beach, write your novel, play guitar, learn to tango.

Return to work for another 6 months. Quit and repeat.

Advantage: Freedom at all ages.

- There’s a wisdom to not deferring life for too long.

- Start now.

- You’ll enjoy rest more after an interval of hard work. (It’s like eating a delicious meal after a hard workout — it tastes better.)

- You’ll return to work feeling fresh and re-invigorated.

- You can cherry-pick the projects that fascinate you the most.

Disadvantage: No “permanent” escape.

- You’ll have to return to trading-time-for-money.

- You’re not financially free.

The look of sprinkling mini-retirements throughout your life.

Semi-Retirement – This is a perpetual state of semi-working.

If “mini-retirements” is like running sprints; “semi-retirement” is like strolling a marathon … with breaks for donuts.

Lifestyle entrepreneurs and part-time workers can both fall into this category.

Example: Work 15 – 25 hours/week. Spend the rest of your time surfing, skiing, sailing or scuba-diving.

Advantage: Start this year.

- Rather than deferring your dreams by a decade+, you can launch a semi-retired life within a few months.

Disadvantage: No “permanent” escape.

- You still trade time for money.

- You’re not (necessarily) financially free.

Your work life, in a permanent state of semi-retirement.

You might be thinking: “Wow, sounds like rich people talk.”

“This is great in theory. But I need help paying my bills.”

If so, keep reading.

Stages in Your Financial Life

“Hold on, Paula. You’re saying I can launch a semi-retired life this year? I can barely pay for a bottle of shampoo.”

Your financial life happens in stages.

You need to conquer Ground Zero and Stage One before you can think about optimizing.

Ground Zero

Many people start at Ground Zero — often during college or immediately after graduation, though sometimes this happens mid-life due to job loss, divorce, illness or other challenges.

At Ground Zero, your day-to-day life includes:

- Hyperventilating because the rent is due.

- Stressing out because your electric bill is $15 higher than you budgeted for.

- Listening to your stomach rumble, because you forgot to pack lunch and can’t spend $6 on a burrito.

- Living with 6 roommates in a three-bedroom apartment.

- Keeping the thermostat at 55 degrees all winter.

At Ground Zero, you shop at thrift stores, eat pasta and rice, and squint because you can’t pay $70 for eyeglasses.

Don’t worry. You’re not alone. I’ve been there. Millions of us have been there.

We’ve gotten through it. So can you.

If you’re at Ground Zero, you’re not ready to optimize. You’re on the first step of your financial journey — not the last.

- Boost your income with a side hustle.

- Drop your expensive cell phone plan.

- Cut the cable TV.

- Join the One Percent Challenge.

You’ll build yourself to Stage One.

Stage One

At Stage One, you have a small emergency fund (perhaps 2-4 weeks of expenses).

You’re free from most credit card debt. You contribute roughly 5 percent into a retirement fund.

You have enough money visit grandma for Christmas, own a smartphone and buy red meat at the grocery store.

You’re still not ready to launch mini-retirements (or semi-retirements), but you’re closer.

Stage One is where you get your financial house in order.

- Read the Beginner’s Guide to Financial Awesomeness.

- Build solid cash reserves (3-6 months of expenses).

- Repay high-interest debt (anything above 8 percent APY).

- Boost your retirement balance.

Done? Good. Now it’s time to optimize.

This is where choosing-your-optimum-lifestyle comes into play.

At this point, the questions are:

- Which one should I choose? Early? Mini? Semi?

- How do I start?

Crucial questions, but in order to answer, let’s chat about one last definition.

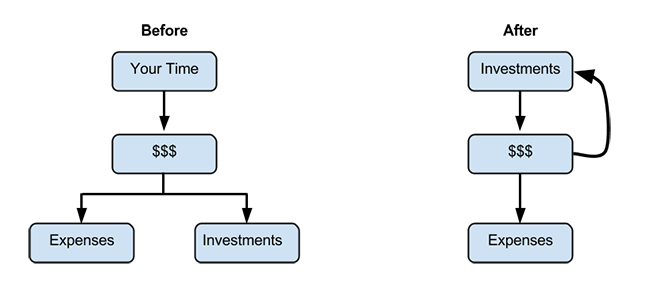

Financial Freedom

The ultimate goal. The apex of everything.

Financial freedom comes from creating multiple streams of passive income that fund your lifestyle — while demanding minimal time.

You achieve this by creating systems in which your money earns money.

These systems include (but are not limited to):

- Rental properties

- Royalties from software, books, art, music, etc.

- Businesses that you’ve established but your employees/contractors manage

- Stock dividends

- Bond and Treasury bill payouts (meager, but I have to include it)

Financial freedom is my definition of “wealth.”

Wealth is measured in time, not dollars. If you must trade time for money, you’re not wealthy, even with a million-dollar portfolio.

“B.S. I don’t think anyone is financially free.”

Really? What about retirees?

Anyone who reaches “permanent retirement” is financially free. They’re living on their assets.

This is true regardless of the age at which that person retired: 35, 45, 65.

Starting Now …

By contrast, you can enjoy mini-retirements or semi-retirements now — without being financially independent.

You can lounge on a Caribbean beach or hike in the California redwoods.

You can surf in Brazil or snowboard in Switzerland.

You can spend time at home with your family.

You can read books and work on passion projects.

You’ll have to eventually return to the workforce, at least for awhile, until you “cash up” and repeat.

Back to the Original Question …

Let’s go back to the original statement:

“After a health scare, I realize mini-retirements might trump early retirements …”

Let’s pause here.

Mini vs. Early are apples and oranges: both delicious fruits, both part of a balanced diet.

>> Approach this with a “both/and” mentality, rather than an “either/or.” <<

Don’t delay your passions for decades. None of us know our Final Expiration Date.

If we’re called to pursue some passion, pursue it, even if it makes no financial sense.

Spend a year traveling Southeast Asia, tour the nation with your band, or live in the countryside and paint.

These goals make no financial sense, but they’re amazing, life-changing decisions. (Just avoid debt.)

As I mentioned on Facebook a few weeks ago, traveling the world at 25 is different from traveling at 35, 45, 55, and beyond.

It’s not better or worse — it’s different.

Here’s why:

1) Your interests, values, abilities and limitations will change.

2) The outside world will change. The world in 2016 is radically distinct from the world in 2026, 2036 and 2046.

Don’t delay.

Enjoy mini-retirements (or semi-retirement) at all ages, not just after you retire.

By taking mini-retirements, you can experience more of the world — and those experiences will forever shape your life, work and career.

“How Can I Create Mini-Retirements?”

Side hustles (side businesses) are one of the fastest and most effective ways to launch a mini-retirement lifestyle.

I’m a firm believer that everyone should have a side hustle, even if you intend to stay in your 9-to-5 forever.

Layoffs happen. Don’t keep all your “income eggs” in one basket. Diversify your income.

Erika, for example, earns an extra $20,000 per year through her side hustle — enough money to travel to Costa Rica, New York, San Francisco, Seattle, San Diego and Las Vegas.

“Extra money sounds great, but my boss won’t let me take 4 months off.”

Then fire your boss.

While you’re still employed at your 9-to-5, launch a side hustle that you can run from your laptop.

Work on this before work, after work, during days off. Scale this until it can cover your living expenses. Then ditch the 9-to-5 and live on laptop-based self-employment.

Location independent work (remote work) is the result of a side hustle blooming into a “full-time” gig.

(“Full-time” refers to the income supporting you 110%, rather than some arbitrary number of hours per week.)

Once you can support yourself through laptop-based work, you’re ready to travel anywhere — Bali, Bolivia, Belize — as long as you have an internet connection.

Limit your working hours (to whatever you’d like), and hire assistants to shoulder the remainder.

Living in a low-cost area makes a huge difference. If you want to stay in the U.S., I recommend avoiding expensive centers like NYC, D.C., L.A., and S.F., unless you have hacks that help you live there cheaply.

If you love large cities, check out major U.S. cities with a low cost of living, like Las Vegas, Miami and Atlanta.

For best results, move overseas. Thailand, Colombia and Indonesia are among the many countries where you can live like royalty for a fraction of the cost-of-living in the U.S.

You’ll also find a vibrant ex-pat community (Americans living abroad), with incredible new friends.

“What about Rental Properties?”

Rentals are hyper-effective for crossing the ultimate finish line (financial freedom).

But they’re terrible for creating immediate mini-retirements.

If you’re aiming for near-term results, prioritize launching a laptop-based lifestyle business first.

Use the proceeds from this business to invest in rentals and pave your road to financial independence.

“What Type of Lifestyle Business Should I Start?”

You’ll need a skill. You don’t need a diploma, you just need a skill.

Ideally, this skill should be unique, niche and hard-to-replace.

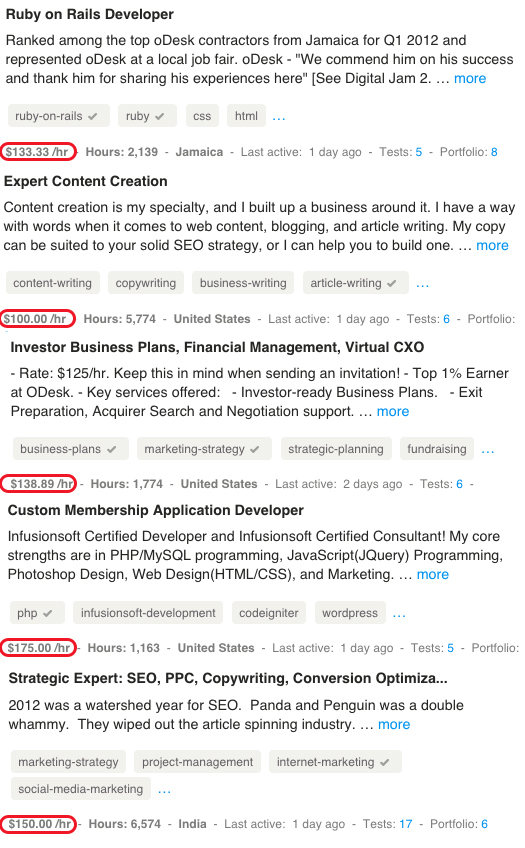

Upwork.com has an (unfair) reputation as a website where freelancers get bottom-of-the-barrel rates. That’s an oversimplification.

If you’re competing with workers in the Philippines, Pakistan and India who are willing to work for $4 per hour, and you’re competing on price, you’ll earn pennies.

Don’t compete on price. Compete on quality and niche.

If you search freelancing websites, you’ll notice that contractors with niche skills can command $100/hr or more.

(You can command higher rates if you find clients through word-of-mouth referrals.)

Let’s imagine:

- You command $100/hr

- You work 18 billable hours per week (3 hours per day, 6 days per week)

- You spend 7 hours per week on administration/marketing/emails (1 hour a day)

- You hire a virtual assistant at $12/hr to help with repetitive tasks, 5 hours/week

You’re netting $90,480 per year (after expenses), working a 25-hour week.

“$100 an hour sounds way too high!”

Really?

Here are images from Upwork showing contractors billing hundreds of hours at that rate or higher.

Their skills range from SEO and copywriting to business planning to design to development.

(I found this in less than 5 minutes.)

If the limiting beliefs in your mind struggle with this suggestion of prosperity, ease into the idea by chopping that rate in half.

Let’s walk through the math:

You bill clients at $50 per hour. The above assumptions stay the same. (You work 25 hours per week; your assistant earns $12).

How much will you make?

You’ll earn $43,680 per year (after expenses) — working part-time from your laptop.

Can you achieve this on Day One? No. First you’ll need to develop a niche skill, such as:

- Programming in a specific language

- Writing about a particular topic, or with a specialized voice or style

- Consulting in a niche field

Books and blogs are my favorite (classic) ways of learning new specific skills, though you can also take online training classes.

Check websites like Khan Academy, Code Academy, Udemy and Coursera, and look for bloggers who offer online courses, if you like their writing and teaching style.

Skill-development is Step One.

Next, your first few months will be dedicated to hustling.

You’ll look for clients, focus on marketing, and think about creating systems.

You might spend 20 to 30 hours marketing during the first month. You’ll also price yourself lower, perhaps at $15 to $20 per hour, to gain experience and confidence.

By Month #3, you spend only 10 to 15 hours marketing, and raise your rates to $25 – $35 per hour.

By Month #6, your lifestyle business is rolling. You’ll have regular clients that form your “income base,” and you’ll raise rates on future projects.

You’ll have client testimonials and word-of-mouth recommendations. You hire your first assistant.

And then … hit the beach. It’s time for a mini-retirement.

Your life is waiting for you.