Moderation is not my strong suit.

I don’t just eat one chocolate-chip cookie — I either eat zero, or I eat the whole batch. I don’t just travel for a weekend — I either stay at home, or I hit the road for weeks/months/years.

And apparently, I can’t just buy one or two houses. Afford Anything Tribe, I’d like to introduce you to House #5, which is Rental Unit #7 in my ever-growing passive income portfolio.

NOTE: This article was last updated in 2015 (and all numbers reflect that year).

In this article, I’ll share the no-holds-barred, behind-the-scenes story:

- How I found this house.

- Why I choose this area.

- The NUMBERS! Yes, you nosy people — all $$ will be revealed. 🙂

But first … check out the pictures.

The “Before” Photos

UPDATE July 2015: These are the “Before” Photos. You’ll see the “After” photos … well … after this! Keep scrolling down!

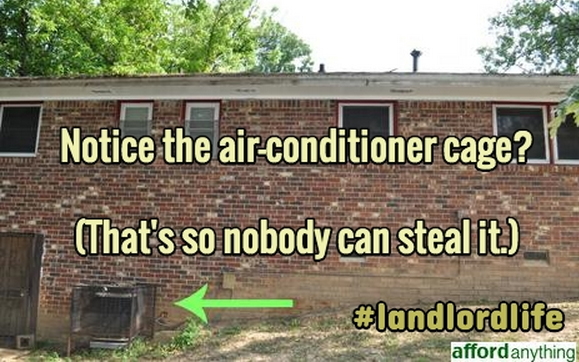

Ah, now that’s home security …

The stainless steel stove is a nice touch. Planning to add a dishwasher, though.

Thank goodness the tile and sink top are a neutral white color. Might swap the faucet for a modern chrome color.

The so-called “master” half-bathroom is small but in good condition.

How on earth do you snap an interesting picture of an empty bedroom?

Irrelevant cat photo. Because the Internet needs more cat photos.

The ‘After’ Photos

UPDATE 2015: Now for some “After” Photos!

White paint + old bricks = amazing new look.

New cabinets, countertops, backsplash, flooring and trim.

Pro Tip — White ceramic subway-style tiles are cheap cheap cheap, and make a place look instantly awesome-er.

Never underestimate the power of “a pop of red.”

We upgraded the bath vanity and mirror for less than $200.

Here’s a much better photo of the other bathroom.

Because every batch of real estate photos needs its #TokenKitten!

How Did You Find This Property?

It started with this website.

People who write about money tend to know each other. We hang out and swap stories about our websites, usually over (several) strong margaritas.

So about two years ago, I had dinner with a blogger named Lauren Bowling, who (at the time) had just launched a site called L Bee and the Money Tree.

(When we met, she immediately blurted out: “I thought you’d be taller!”)

Lauren was getting started in real estate investing. She and her fiancé purchased a fixer-upper in an “improving” neighborhood. Their plan: Remodel the home, live there for 5+ years, and enjoy equity gains as the rest of their neighborhood slowly beautified.

At least, that was the theory.

Instead, they broke up. Ouch.

But Lauren is a strong lady. She kept the house, oversaw a major renovation by herself, and — about a year ago — invited me to her “housewarming” party to celebrate its official unveiling.

As I drove past the ramshackle buildings that dotted the road to her first investment house, I’ll admit: My knee-jerk reaction was, “OMG Lauren, are you f***ing crazy?!”

Her neighborhood — at first blush — doesn’t seem like a place where you’d want to invest.

You can tell a lot about a neighborhood by the types of businesses located there. In cushy middle-class neighborhoods, you’ll see Starbucks, CostCo and Panera Bread.

In respectable working-class communities, you’ll see little “bodega”-style food marts, beauty salons, thrift stores, and the occasional used tire yard or emissions-testing station.

But Lauren’s neighborhood? Several storefronts were boarded up; vacant. Uh-oh. That’s not a good sign.

But any good investor looks at a neighborhood not for what it currently is, but for what it’s on track to becoming. Formerly-vacant buildings are beginning to fill. The area is turning around.

Lauren saw its potential — and urged me to develop my vision, as well.

I was dubious — (all investors should nurture healthy skepticism) — but I started digging for information. And the more I dug, the more I began to conclude that she was right.

How to Evaluate a Neighborhood

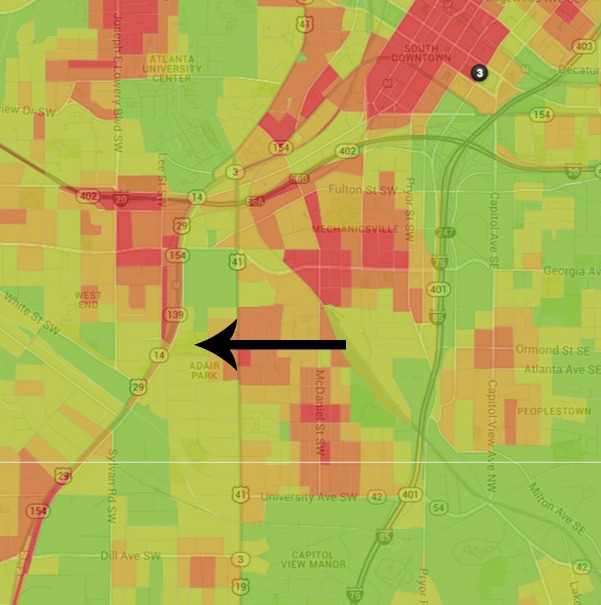

Lauren’s neighborhood is still a tad outside my comfort zone (she’s a very early adopter), but a nearby section of Atlanta, called West End / Adair Park, definitely suited my style.

This neighborhood used to be thriving, I discovered, but it fell during the 1970’s and 80’s and experienced ensuing blight. Here’s a crime map: “Red” indicates high-crime-risk; “Green” shows low-crime-risk. As you can see, I’m looking for houses in the “Yellow” zone.

Image courtesy Trulia.com/local

This area is now seeing a slow-but-steady revitalization.

Jobs and Business – It’s close to the airport and features easy public transit access, meaning that many airport workers (TSA officials, baggage handlers, etc.) live here. The surrounding area also holds other service jobs (manufacturing, delivery, etc.) which also keep this neighborhood alive. One strong vote of confidence: Ace Hardware opened a location here. (Hardware stores are an especially strong sign of neighborhood development — by definition, they’re the first type of business than a re-developing area needs.)

Transit – The Atlanta Beltline is a planned 33-mile loop of multi-use cycling/walking/jogging trails alongside 22-miles of light-rail tracks. Once complete, the Beltline will link the city’s neighborhoods together, improving accessibility and reducing Atlanta’s car-dependence. Fortunately, the Beltline runs directly through this neighborhood. In fact, a 2.4-mile section of the Beltline has already opened here. That’s a huge +1 for this neighborhood.

Greenspace — This neighborhood opened a new park in 2008, alongside the Beltline. Why does this matter? It’s good for home-price stability, quality of life, and it’s a symptom of smart urban planning.

Infrastructure — The local authorities recently invested $2 million in new sidewalks, streetlights, trees, and other neighborhood improvements. Awesomesauce.

Artists – Atlanta’s “what’s happening” magazine, Creative Loafing, called this area the “Best Neighborhood for Artists” — another strong sign that the area is improving. (Tip: Follow the artists.)

What Are Other Investors Doing?

Signs point to neighborhood improvement, so Step Two is to start chatting with other local investors.

I met one person who purchased a home in this neighborhood for $25,000 in spring 2013. He invested about $100,000 into renovating it, listed it for $192,000 in spring 2014 — and received multiple offers. 🙂

This tells me two things:

- The underlying land is cheap …

- … yet people want to live here.

That’s a perfect combination.

Why? Land is overhead. I don’t make money from the land; I make money from the building. The less I need to spend on the underlying lot, the more I can put into updating the cabinets / countertops / appliances. Cheap Land + Consumer Demand = Happy Investor.

Meanwhile, on the corporate builder/developer scene, this neighborhood just opened its first condo — “SkyLofts” — in a former abandoned Sears parking lot, and the units are selling quickly. Another +1 for the neighborhood, as it reflects growing demand.

Three Crucial Concepts About Real Estate Investing

Okay, so I’ve identified a neighborhood that’s (potentially) improving, and I’ve met other investors who are profiting nicely in this area. But why should I buy a house there? How does “Theory A” lead to “Conclusion B”?

Let me take a step back for a second, and quickly explain three critical concepts:

1) Risk is Tied to Reward

If you buy stocks, you carry more risk than someone who buys bonds. You also enjoy the potential for bigger rewards.

That’s simple enough, right? But it doesn’t end there. WITHIN the niche category of “U.S. stocks,” some investments are riskier/reward-ier than others.

A large company like Coca-Cola or Nike probably won’t collapse — but it also probably won’t experience double-digit growth. It’s low-risk, low-reward. Likewise, a tiny startup company might flop. Or it might become the next Tesla Motors. More risk, more (potential) reward.

Risk is tied to reward, both across categories as well as within categories.

Are you still with me? Okay, let’s apply this to rental properties:

An established neighborhood features:

- Low turnover

- Low vacancies

- Stable values

- Low-risk, low-reward.

An emerging neighborhood features:

- High-turnover

- High-vacancies

- Volatile values

- High-risk, high-reward.

And that leads us to the next point —

2) Judge Your “Risk-Adjusted Return”

Occasionally, I’ll get an email from a reader saying: “You’re only getting X percent returns? Ha! I get Y percent returns!”

But that information alone is meaningless. Investors need to judge reward in the context of risk.

The stock/bond market is an obvious example: Getting 10 percent returns from your Enron stock is different than getting 10 percent from a U.S. government bond — it’s not “the same” 10 percent. If you’re comparing two investments with different risk profiles, X does NOT equal X.

That’s why you need to understand investments within their risk framework.

In traditional stock-investing, this is referred to as “risk-adjusted return,” and analysts have devised all kinds of fancy algorithms to try to understand it.

You don’t need a finance degree, though — you just need to understand this broad concept, and apply it to your own personal choices.

And that brings us to our last point —

3) Diversify Your Holdings

If you have a 401k or IRA, you should split your money between some combination of U.S. stocks, international stocks, bonds, and cash.

I mean, duh. That’s basic.

The same applies to real estate investing. If you’re going to own a handful of rental properties, you should diversify enough so that you’ve spread your bets, but not so much that you lose track of what you’re doing.

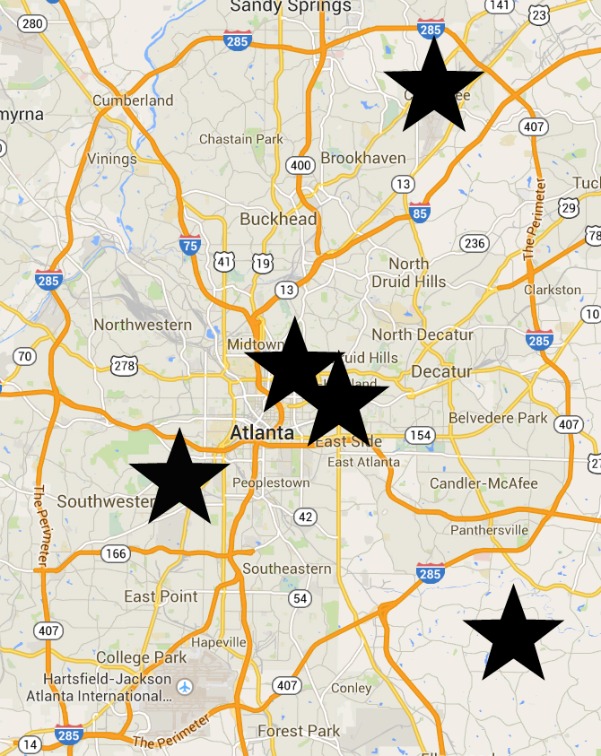

For example: I specialize in residential rental properties in metro Atlanta. That’s niche.

- I don’t flip houses.

- I don’t own retail space, offices, warehouses or mobile home parks.

- I don’t invest outside of metro Atlanta.

Am I missing out on plenty of great opportunities? Of course. But I can’t become an expert at everything, so I’ve narrowed my niche to a very specific property type and location.

I can’t do everything. I do ONE thing, and I do it well.

However, WITHIN that niche, I diversify. My properties are located in across the city, in neighborhoods that range from “trendy” to “suburban,” from “established” to “emerging.”

Here’s a map of my property locations:

Why This House?

Back to my original question: Why did I buy this house?

To diversify my holdings.

Most of my rental properties fall towards the conservative side of the risk-reward spectrum. I own properties in stable, well-established neighborhoods.

As a result, most of my properties (only) meet the One Percent Rule. They rarely exceed it. And they almost never double or triple it (with the exception of House #2).

But in the same way that an investor might put a small fraction of their portfolio in “frontier markets” like Ghana or Albania, I decided to put a small fraction of my portfolio into a “frontier neighborhood.”

And that leads us to House #5 / Rental Unit #7 —

- Stats: 4-Bedroom, 1.5-Bath

- Size: 1,625 square feet

- Style: Suburban Ranch House

- Condition: Good

- Built: 1972

Last Sold: $140,000 in October 2009

Foreclosure or Short Sale?: Of course! Everything I buy is a foreclosure, short sale or distressed sale. (That’s where you snag the best deals, y’all!) This house was a short sale, just like House #1 (my first investment). Houses #2 and #4 were foreclosures, and House #3 was a distressed sale / motivated seller.

UPDATE JAN 13, 2015: I’ve updated these numbers to reflect the actual (rounded) repair costs. We replaced the kitchen cabinets and countertops, bath vanities, carpet/padding, installed gutters and added a new A/C. We theoretically could have deferred the kitchen/bath upgrade for a few more years, but we decided not to procrastinate. Better property = better tenants. 🙂

What did I pay for this?

- Purchase Price: $46,000

- Repairs: $15,000

- “Total” Acquisition Cost: $61,000

What does that gross?

- Rental Income: $800 – $1,000 per month

- Does it Meet the One Percent Rule? Obviously.

What does that net?

- Mortgage: — (Paid-in-Cash)

- Taxes: $67.41 per month ($809/year) based on 2013 tax records

- Insurance: $58.33 per month ($700/year) estimated

- Vacancy: $75 per month ($900/year) at 92 percent occupancy, $900/mo rent

- Management: $90 per month ($1,080/year) at 10 percent fee, $900/mo rent

- Repairs/Maintenance: $50 per month ($600/year) based on “one percent of purchase price” rule-of-thumb

- Total Expenses: $340.74 per month

Cash Flow: $459.26 — $659.26 per month, or $5,511.12 — $7,911.12 per year

- $5,511.12 / $61,000 = 9.03 percent

- $7,911.12 / $61,000 = 12.96 percent

WTF does that mean?

In a nutshell:

- The “cap rate” (the “return on investment”) is between 9 to 13 percent. WAHOO!!!!!!!

- The “cash flow” (the $$ in my bank account) is $5,500 – $8,000 per year.

Another victory for the Financial Independence // Passive Income Brigade. This house offers uber-strong cash flow, a ridiculously awesome return, PLUS the potential for long-term equity gains (which is pure icing on the cake.)

Happy dance!!!!!

And with that …

FAQ’s:

Q: Is that literally the exact amount you’ll earn?

A: No, I’m not going to have precisely $600.00 in repairs annually, nor will I have exactly 92.00 percent occupancy. This is an educated estimate based on prior years’ tax records, current insurance rates, the maintenance history of my other properties, and an analysis of other rentals in the same neighborhood. In reality, real estate earnings will fluctuate every year — that’s why you should be prepared for a range. (Also, note that vacancy/management estimates are based on $900/mo rent.)

Q: How in the $%#&(&!@ did you pay cash for a house??

A: In 2012, we saved about 50 percent of our income. In 2013, we saved 77 percent of our income. My business continues to boom in 2014, and again, all of my after-tax income goes into savings.

This goes back to the mantra I keep repeating on this blog: grow the gap between your income and spending.

First, the more you earn, the easier it is to save. In 2008, I quit a job in which I had a salary of $31,000 per year. If I were still earning at that level, I couldn’t save 50-77 percent of my income. But I started my own business, which gave me better earning potential; this is crucial to allowing me to have a bigger savings rate. Higher income + flat lifestyle = larger gap between income and expenses, otherwise known as ‘savings.’

Second, here are the specific things that I do in order to have that flatlined, frugal lifestyle:

- Live with roommates.

- Drive used cars.

- Avoid fancy clothes / jewelry / furniture.

- Don’t have cable TV.

- Choose to live in cities that has a reasonable cost-of-living.

- Work-from-home (no commuting costs)

- By the way, if you’re in a similar situation and you’re in CA, IL, WA, AZ, NJ, PA, OR, or VA, check out car insurance with Metromile. Coverage starts at $29/month + a few cents for every mile you drive, so you could save hundreds every month. Speaking of insurance…

- “Self-insure” (buy cheap insurance with a high deductible; keep a huge emergency fund).

- Save tens of thousands on taxes by maxing out 401k, IRA and HSA accounts.

- Always, always, always have a side hustle. I’ve never had “just” one job.

So … lather, rinse, repeat, and you’ll eventually amass $50,000 in cash. Invest it, then re-invest the profits, and you’ll create a self-sustaining cycle.

Q: But I don’t want to buy a used car / cut my cable / live with roommates.

A: That’s a choice. You can afford anything, but not everything. You can choose to spend thousands buying a new car or keeping your guest room vacant — but that choice demands trade-offs.

Be deliberate about those trade-offs. Never confuse “I can’t” with “I choose not to.”

**For more FAQ, check this post out, where I summarize everything you need to know about all of our rental properties.**