Let’s see a show of hands: how many of you actually make a budget?

Let’s see a show of hands: how many of you actually make a budget?

(Silence. Crickets chirping.)

Yeah, I thought so.

One of the most overplayed pieces of financial advice is “make a budget.”

There are a small handful of nerds who jive with this idea. You dig data. You love crunching numbers. Good for you.

Budgeting is a great tactic for people who stick with it.

The problem is, most of us don’t stick with it.

And there’s good news: We don’t need to.

Budgeting is tedious and time-consuming. I’m a finance enthusiast, and even I think that budgeting is arduous, so I can only imagine how “normal” people must feel.

We all know that we “should” budget. That doesn’t change anything.

We “should” drive the speed limit. We “should” wear sunscreen every time we leave the house. We “should” floss our teeth daily.

Let’s get real.

In this post, I’m going to suggest an alternative for the Afford Anything readers who embrace the reality that they’ll never stick to a budget. It’s my anti-budget, and it’s simple:

- Decide how much you want to save.

- Pull this off the top.

- Relax about the rest.

See how easy that is?

There’s no need to track how much you’re spending on groceries, electricity, restaurants and clothes. You don’t need to line-item your sunglasses, toothpaste, and that time you dropped $80 at the bar.

Let’s face it, you were never going to line-item those purchases, anyway. And you read financial blogs! If you’re not going to do it, who will?

No one. And that’s the point.

The purpose of a “budget” is to make sure you’re saving enough. So cut to chase: pull your savings from the top, and whatever is leftover is the amount you can spend. End of story.

When I say “save,” I’m referring to any activity that boosts your net worth, including:

- Crushing debt

- Creating investments

- Literal savings (in the bank)

I use “save” as a shorthand for improving your financial health — regardless of whether that means stockpiling cash or aggressively wiping out your credit card debt.

Q: How much should I save?

I believe EVERYONE should save at least 20 percent of their income. If your goal is financial independence, aim for 50 percent.

Q: That’s insane.

Boost your savings by one percent this month. To calculate one percent, look at your income and move the decimal point two spaces left.

- If you earn $4,000 per month, one percent is $40.

- If you earn $6,000 per month, one percent is $60.

- If you earn $8,000 per month, one percent is $80.

Next month, boost your savings by one more percent. And the following month, one more. Within a year, you’ll be saving 12 percent more than today’s rate. Within two years, you’re saving 24 percent more.

After 4 years — even if you’re starting at zero — you’ll be saving 50 percent of your income.

Chat with other people who are doing this in the Facebook Group, or on our private community platform here.

Q: “I can’t save! I need every dime!”

You’re telling me that you earn $3,021 per month and your expenses come to exactly $3,021 per month? Somehow, I doubt that.

If you feel like you can’t save anymore, start with one percent. Alternately, you could also earn an extra one percent every month.

Let’s say you earn $5,000 per month. One percent is $50. How can you earn an extra $50 this month? Could you pick up an online freelance gig? Could you tutor a few neighborhood kids?

Next month, can you boost that by an extra $50? And the following month, $50 more? You’ve just boosted your savings by an extra three percent (compared to your current pay), without making any cuts to your lifestyle.

Q: What should I do with these savings?

Here’s a step-by-step plan:

- Get your 401k employer match (if applicable).

- Save a small emergency fund (roughly $500).

- Wipe out any debt with an interest rate greater than 8 percent.

- Boost your emergency fund to represent 3-6 months of expenses.

Split the rest of your savings between retirement, other investments (like rental properties), and awesome long-term life goals (like traveling through South America for six months.)

Q: What tools help?

The Facebook Group or our private community is an incredible resource, filled with smart, interesting people brimming with ideas on how to cut costs, earn more and invest like a badass. Check it out.

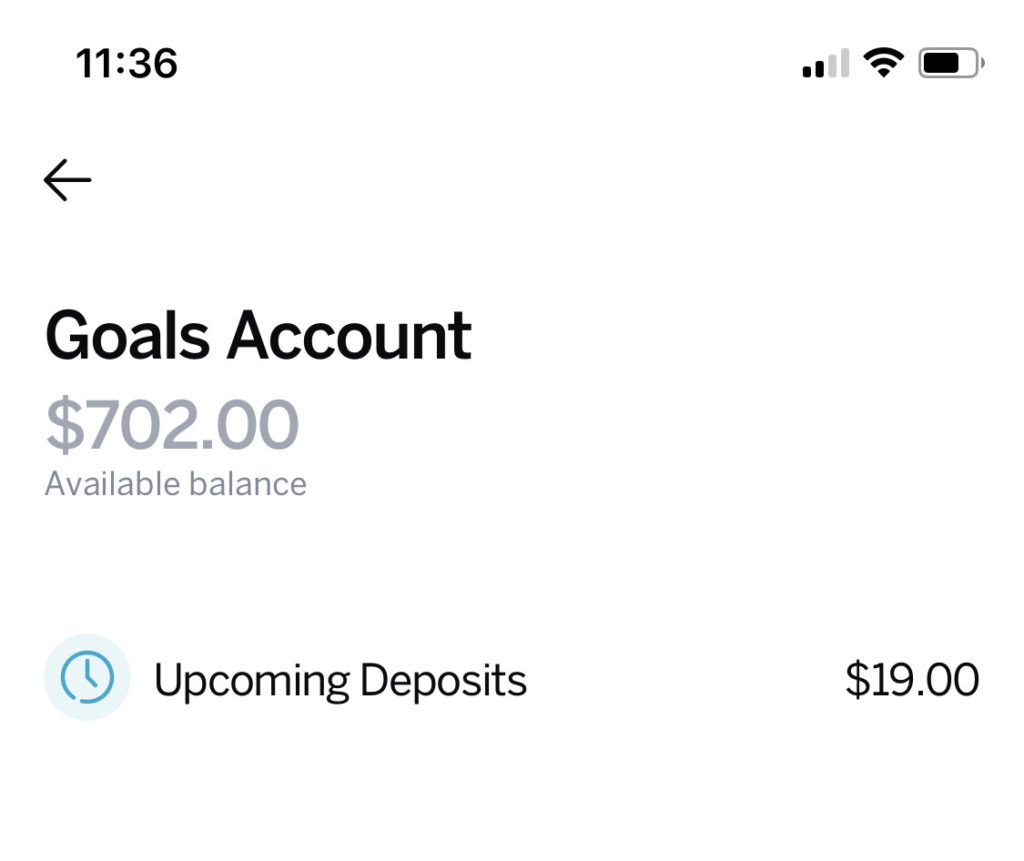

I’m also a big fan of Qapital. It meshes perfectly with my casual money-management style. Qapital monitors your spending habits and automatically places tiny amounts of money into “invisible” savings.

Within months, it managed to find $702 to stash away.

I never felt the pinch. If you want to practice the anti-budget, I recommend checking out Qapital. It is a paid service, but I don’t recommend anything I don’t personally use. Plus, if you use the code ‘paula’, you’ll get a bonus $25 after you make your first deposit — score!

Want to go the manual savings route? The Anti-Budget philosophy requires “pulling your savings off the top,” so I’d recommend auto-transferring part of your paycheck into a savings account or a different bank account every payday.

If you’re a dual-income couple, you can mentally earmark one person’s income for “spending” and the other person’s income for “saving.” If that’s too extreme, earmark every-other-paycheck from one person’s income as savings; then start increasing in one percent increments.

And … that’s it! You don’t need a trillion tools. Keep it simple.

Don’t complicate your life with intricate budgets and millions of tools and services. Simplify. Pare down. Lop your savings off the top, and enjoy the rest.