Forget fancy-pants calculus.

The most important math is the stuff you learned in fourth grade.

How do you know if an income property (rental property) is a good investment?

In this article, I’m going to share three formulas I use when I’m analyzing rental properties.

Keep a copy of this article as a free PDF so that you can refer to these formulas later, when you’re looking at your own deals. You can download this for free here:

Formula #1: The One Percent Rule

Start with The One Percent Rule: Does the monthly rent equal one percent of the purchase price or more?

- A $100,000 property should rent for at least $1,000 per month

- A $200,000 property should rent for at least $2,000 per month

- A $300,000 property should rent for at least $3,000 per month

If the property meets (or almost meets) the One Percent Rule, it merits further consideration.

Otherwise, ignore the property and move on.

Note: When I say “purchase price,” I’m referring to total acquisition cost, which includes upfront repairs to make it rent-ready.

You might buy a $245,000 home that needs $100,000 in immediate repairs, which is why it doesn’t make sense to only count the sales price of the home.

Should All Properties Get Measured by the Same Yardstick?

Some investors believe that One Percent is too lenient. These investors shoot for the “Two Percent Rule,” which means they collect $2,000 per month in gross rent for every $100,000 of house.

Those types of properties tend to exist in high-risk neighborhoods. There’s a tradeoff between risk and reward.

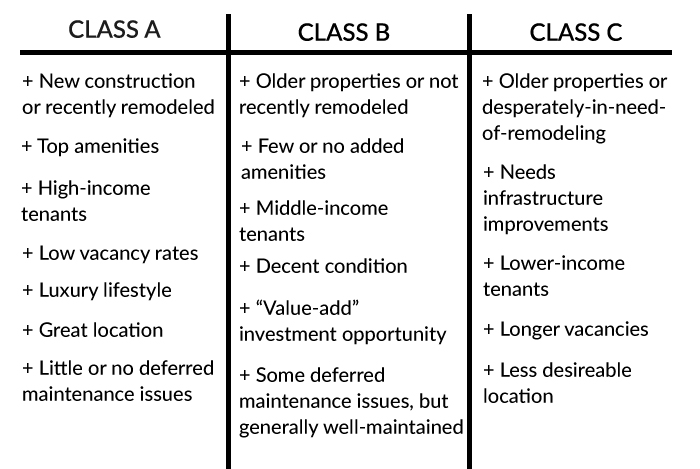

Properties are classified as Class A, B, C, or D:

- Class A: High-quality-tenants; safe neighborhoods; low turnover and vacancy.

- Class B: Mid-quality-tenants; moderate neighborhoods; some turnover and vacancy.

- Class C: Low-quality-tenants; crime-plagued neighborhoods; high turnover and vacancy.

- Class D: Boarded up and vacant storefronts; not much business.

Class A properties should meet the one percent rule. Class C properties should meet the Two Percent Rule. Avoid Class D unless you’re a seasoned professional.

Example:

Excellentville is a stable neighborhood with high rental demand. Most tenants have high incomes, stables jobs and perfect credit. Many are saving for their own home, or choose to rent so their career/romance opportunities can remain flexible.

The tenant risk is lower, so your returns will also be lower. Look for the One Percent Rule here.

CrapTown, in contrast, holds a high crime rate. Most tenants have bad credit and bankruptcies; many bounce from job-to-job every few months. Many houses are vandalized and robbed.

The tenant risk is higher, so your returns should also be higher. Demand at least the Two Percent Rule in these areas.

Why Use the One Percent Rule?

Where did the One Percent Rule come from? Why do we use it?

- If a property grosses 1 percent of its value per month,

- And if there are 12 months per year,

- Then the property grosses 12 percent of its value per year.

(I hope you follow me so far.)

Now, let’s introduce another concept called the 50% Rule-of-Thumb. This concept says that 50% of your gross revenue will get consumed by operating overhead, such as taxes, insurance, utilities, management, maintenance, repairs, vacancies, turnover costs, pest control, administration, etc. This is a generalized rule, intended for a back-of-the-envelope calculation.

You won’t literally pay 50% every calendar year; you’ll enjoy years in which your repair bills are $0. But you’ll also experience years in which you spend $50,000 replacing the roof, windows, gutters, siding, appliances, deck and flooring.

(Tip: Pay for these with a rewards card that gives you either airline miles or cashback. Your renovations could fund your family vacation.

Here are a couple that I recommend: the Chase Sapphire Preferred gives you the equivalent of $750 to spend on travel, as long as you spend $4,000 within the first three months of opening the account. If you’re spending on home renovations, hitting that minimum spend is waaayyy-super-easy. The Capital One Venture gives you 60,000 bonus miles if you hit the minimum spend, which is enough to get two round-trip airline tickets to somewhere awesome. And there are a ton of other great bonuses and signups, as well. You can check them out here.)

As a long-term annualized average, the 50% rule-of-thumb is the typical standard among investors.

So:

- If a property grosses 12 percent of its value per year,

- And approximately half of this consumed by operating overhead,

- Then the property nets 6 percent of its value per year.

Still with me? Good. Okay, final step:

There are two ways that investments create returns:

- Appreciation

- Cash flow

Stocks, for example, create returns by rising in value (appreciation) and paying a dividend to its shareholders (cash flow).

Real estate follows the same lead: it creates returns by rising in value (appreciation) and creating an income stream (cash flow).

We’ve established that if the house meets the One Percent Rule, the net operating income will be approximately 6 percent. We also know, historically, that real estate typically rises at the level of inflation, around 3 percent.

So:

- If we generate 6 percent returns via cash flow,

- And we create 3 percent returns via appreciation,

- Then we enjoy a total return of 9 percent.

There’s one more piece of data you must consider.

The U.S. stock market historically returns 9 percent over a long-term average (1871 – 2015). Over the past 30 years (1985 – 2015), the market returned 11 percent. Keeping this in mind:

- If a property meets the One Percent Rule, it holds a strong chance of matching or beating an investment in a broad market index fund.

- If a property doesn’t meet the One Percent Rule, ask yourself: why wouldn’t you just put that money into an index fund, instead?

A few disclaimers:

- This is a quick back-of-the-envelope calculation. If you want to drill down into the real meat of an investment, calculate the Cap Rate (which I explain below).

- There are other reasons why you’d invest in real estate over an index fund; even if total returns are comparable, real estate cash flow might be stronger than stock dividend yield, which matters if your goal is passive income. Real estate also offers tax benefits. Real estate also gives you the opportunity to use leverage, which may introduce additional benefits (as well as additional risk); we discuss that in more detail below.

- The One Percent Rule’s strongest intention is to force you to consider whether or not a property is worth your time. Index funds are easier and more liquid; don’t stray from those unless you find a property that gives you a good reason to invest your money elsewhere.

Formula #2: The Cap Rate

If a house passes the One Percent Test, I look at a measure called the capitalization rate, or “cap rate.”

The cap rate measures your cash flow, relative to property value. Cap rate equals annual net operating income divided by the acquisition price.

“Uh, what?” – Don’t worry, that sounds like gibberish to me, too (and I wrote it!) Let’s walk through an example.

Let’s say that you’re looking at an investment property that you could rent for $1,200 per month. First, let’s calculate the potential rent at full occupancy. This is the best-case-scenario.

Then we subtract a reasonable vacancy estimate. This gives us our “Effective Gross Rent.”

- Potential Gross Rent: $1,200 per month, or $14,400 per year

- Less Vacancies: ($720 per year) at a 5 percent vacancy rate

- Effective Gross Rent: $13,680 per year

Next, we’ll add any other income sources that are associated with the property, such as pet fees or coin-operated laundry income. Let’s say that this comes to $500 per year. We’ll add this to the Effective Gross Rent, and we now have a new yardstick: the Gross Operating Income.

- Effective Gross Rent: $13,680 per year

- Plus Other Income: $500 per year

- Gross Operating Income: $14,180

Next, we’ll subtract the operating overhead. These are the expenses associated with running the property, such as utilities, water, trash, repairs, management and maintenance. It doesn’t include the principal and interest on your mortgage (I’ll explain why below), but it does include insurance and property taxes.

For the sake of example, let’s say these expenses come to $6,180 per year.

- Gross Operating Income: $14,180

- Less operating overhead: ($6,180 per year)

- Net operating income (NOI): $8,000 per year

Congrats, you know your net operating income, also known as “NOI.”

To find the cap rate, divide $8,000 (your NOI) by the total acquisition price of the house. Let’s assume your house cost $200,000, including closing costs and upfront repairs.

$8,000 / $200,000 = 0.04

Multiply your answer by 100 to convert it into a percentage. The $8,000 in cash flow you’re receiving translates to a 4 percent cash flow return on your property value.

Meh. Yawn.

I’m not excited about that.

Let’s change one variable: Let’s assume you bought the house for only $100,000.

$8,000/$100,000 = 0.08, or 8 percent.

Much better! At that rate, you’re getting cash flow that exceeds most high-dividend stocks. Assuming the property value keeps pace with inflation (around 3 percent annually), your total return is around 11 percent per year, two-thirds of which come in the form of cash flow.

Properties with an excellent cap rate also meet the One Percent Rule.

Take another look at the example above:

If you buy a house for $200,000 and collect $1,200 monthly rent, you won’t meet the One Percent Rule. But if you buy it for $100,000 and collect $1,200 monthly rent, you exceed the One Percent Rule. Winner!

If It’s Not Worth Owning in Cash, It’s Not Worth Owning

Notice that we’re calculating “net operating income,” not “net revenue.” This sounds like an inconsequential distinction, but it carries a crucial implication: We subtract operating expenses, but not debt servicing or equity-building expenses.

That last sentence is so important that I’ll repeat it again:

Operating Overhead is the cost of running and maintaining the property. It’s NOT the cost of financing the property.

Net Operating Income is the money leftover after you’ve paid operating overhead. Don’t confuse this with your cash flow (after paying the mortgage); these are not the same.

“You mean, I should exclude the mortgage from this calculation?”

Not exactly.

Mortgages consist of four parts: Principal, Interest, Taxes and Insurance. These are collectively called PITI.

When you calculate NOI, you subtract the cost of T&I (taxes and insurance), because they’re part of your operating overhead. This is a permanent cost associated with homeownership. Death and taxes, right?

You don’t subtract the cost of P&I (principal and interest), because these build equity and service debt, respectively. These are not operating expenses; these are temporary financing and equity-building expenses.

“Okay, I understand not subtracting for principal repayments. But why wouldn’t you subtract the interest?”

We’re trying to evaluate the asset itself — the property — not the attractiveness of the loan.

#1: Let’s use an extreme example, for the sake of illustration: All properties will look terrible with a 99% interest rate. Many properties will look awesome with a 0% interest rate. We want to judge the property itself, not the strength of the financing.

#2: The ultimate goal is to own the properties free-and-clear. (Even if you’re a debt-hungry, no-money-down advocate, you’ll want to pass your properties to your children and grandchildren free-and-clear). You’ll need to ask yourself: Is this property WORTH owning in cash?

If a property isn’t worth owning in cash, it’s not worth owning. If it doesn’t yield at least a 7-9 percent total return (which means it needs a Cap Rate of at least 5%), you’re better off searching for a different properties that does.

First evaluate the property, then find good financing. Don’t conflate the two.

Quick Cap Rate Hack

Here’s another quick, back-of-the-envelope way to eliminate properties based on cap rate:

Multiply the cost of the property by 0.05. This is your yardstick. [You can create a yardstick with any measure. If you only want 7% Cap Rate properties, for example, multiply the cost of the house by .07.]

Then:

Step 1: Add the monthly operating costs.

Step 2: Subtract that figure from the monthly rent.

Step 3: Multiply the result by 11.5, which assumes two weeks per year of vacancy. (Multiply by 11, or even 10, if the property is in a high-vacancy area). Compare this to your yardstick.

If Step 3’s number is bigger than the yardstick, pursue the property. If not, drop it.

Here’s a hypothetical example:

Property: $125,000

Yardstick: $6,250 (= $125,000 x 0.05)

Step 1: $100 insurance + $200 taxes + $50 maintenance + $100 management + $100 miscellaneous = $550

Step 2: $1000 monthly rent – $550 expenses = $450 monthly net income

Step 3: $450 x 11.5 = $5,175 per year NOI

The number in Step 3 doesn’t measure up to the yardstick; therefore this property might not be the best use of time and money.

(Notice also that a $125,000 house, renting for $1,000 per month, doesn’t meet the One Percent Rule.)

Don’t Drink the Kool-Aid.

Formula #3: The Cash-on-Cash Return

There’s one more formula that you’ll need to know, but I want you to be ultra-cautious about the way in which you use this. This is one type of return in which you may want to limit your upside.

The formula is called cash-on-cash return. It’s calculated as your cash flow divided by cash-out-of-pocket.

Let’s look at an example:

I buy a house with a $20,000 downpayment. After paying all the bills (including financing), I’m left with $3,000 per year.

$3,000 / $20,000 = 0.15, or 15 percent! Holy moly!

That’s … almost too good to be true!

This formula illustrates why real estate is so powerful: it’s one of the safest ways to leverage your dollars. A minor investment can yield 15% – 25+% cash-on-cash returns (or more). And, admittedly, leveraging into real estate (which is a relatively stable asset) is safer than leveraging into stocks or small businesses.

These are also the reasons why real estate attracts a bunch of debt-loving weirdos.

No other type of investment gives the average Mom and Pop Investor access to this much leverage. As a result, real estate attracts people who espouse a more-is-better attitude towards debt.

“If my downpayment is zero, my returns are … infinity!!!!!! Wheeee!”

Don’t be a debt-loving weirdo.

Take the cash-on-cash formula with a gigantic grain of salt. (Heck, take it with a whole damn salt shaker.) When used indiscriminately, cash-on-cash-return is a dangerous equation. It rewards people who take out the biggest possible mortgage, without contextualizing its results relative to risk. You don’t want to fool yourself into ignoring the inherent risks that come from six-figure debt.

“Yeah, I have zero equity and $872,490 in debt. One vacancy, coupled with a large repair bill, could wipe me out. I’d destroy my credit, lose my life savings and move into Cousin Joe’s basement.

“But I’ve been an investor for four months and I haven’t hit rock-bottom yet!

“And my cash-on-cash returns are quadruple-digit!!”

There are experienced investors. And there are over-leveraged investors. But there are no experienced, over-leveraged investors.

Eventually, the debt-loving, over-leveraged weirdos get wiped out of the game.

If you use the cash-on-cash-return formula, decide on an optimal range. You don’t want your returns to be too high.

I occasionally hang out at real estate investor meetups. One afternoon, a new guy walked into the room. He was in his mid-20’s, and he had just bought his first investment property.

“I only put down $600 of my own money!,” he boasted.

“Why’d you put down that much?,” another guy replied.

Ughhh. *Forehead slap.*

Don’t start a pissing contest about who made the smallest downpayment. “Mine is smaller than yours!”

Nobody wants to see that.

Don’t drink the cash-on-cash Kool-Aid.

If you use the cash-on-cash-return formula, set strict parameters. Pick an optimal range, and recognize that some returns are waaayy too high. The higher your leverage, the higher your risk of default. This is one formula in which you can have too much of a good thing.

The Bottom Line

Of all these formulas, the One Percent Rule is the easiest and most intuitive.

Cap rate is the most comprehensive.

Cash-on-cash is great if it’s used wisely.

Use them all. Your success (or failure) as a real estate investor happens before you buy.

Note: This article was updated in 2015 & 2016 to address FAQ’s.