After four years of development, I’m ready to make the announcement.

The rental property investing course, Your First Rental Property®, is ready.

Here’s everything you need to know about this course: the who, what, where, when, why and how.

Okay, now for the details…

Who Should Enroll?

Your First Rental Property® is designed for beginner, first-time real estate investors in the United States who want to buy-and-hold residential rental property. It takes you through, step-by-step, all of the processes you need to know in order to go from beginner to investor.

“Will this course help me if I own rental properties, but have no idea how to manage them?”

Yes. If you’re an accidental landlord, or you don’t feel well-equipped to manage your existing rentals, or if you want to invest in more properties but don’t know where to start, then the material in the course will help. Basically, if you’ve been winging it as a landlord, this course will give you more confidence to manage your rental property business.

That said, because Your First Rental Property® is specifically aimed at beginners who are buying their first or second rental property, we don’t recommend it for experienced real estate investors. There are no secrets shared in the course, and you won’t find any overly-advanced strategies.

You will find a framework from which to think about rental property investing, but if you’re comfortable with your current strategy, you likely don’t stand to benefit from this material.

“I want to invest out-of-state. Should I enroll?”

Yes. This course is designed for both local and out-of-state investors. Our only assumption is that you live in the U.S. and that you want to invest in residential rental properties anywhere inside the U.S.

People outside of the U.S. are welcome to enroll in the course, and can learn the concepts and high-level critical thinking. But specifics about taxes, laws, banking and resources will be U.S.-based. For example, I don’t know the capital gains tax rate in Sweden. I don’t know the average cost of replacing an asphalt-shingle roof in South Korea. I don’t know about lending requirements from banks and credit unions in Malaysia. Our assumptions within this course are U.S.-centric.

“I’d like to buy a rental property in the next 2-3 years, but I don’t have a downpayment saved yet. Should I enroll?”

Yes, and congratulations on getting a head start. This is an excellent time to learn how to analyze, find and finance deals. If you start learning 2-3 years before you’re ready to buy, you’ll be super-knowledgeable and confident by the time you’ve saved your downpayment. And if you’re ready to buy a rental property soon (like this year), then this is a critical time to learn how to choose a great rental property.

“I’m up to my eyeballs in credit card debt, and I don’t have an emergency fund. Should I enroll?”

Heck NO!! If you are financially struggling, please do not enroll in this course. If you’re stressed about bills and you’re in a tough financial situation, this course is not right for you at this time.

I’ve published hundreds of free articles on my website and more than 180+ free podcast episodes that can help you save money, earn more, start a side hustle, and get out of high-interest consumer debt. If you’re financially struggling, stick only with my free material. Stabilize yourself first.

“How many Your First Rental Property® students buy their first property right after taking the course?”

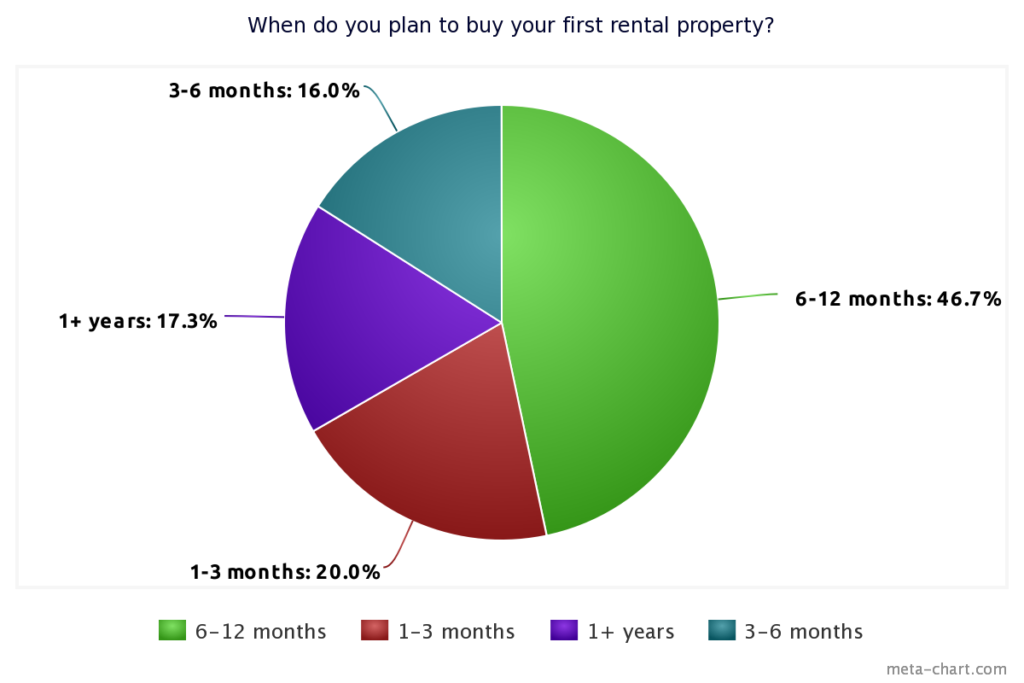

Great question! We have a handy chart that answers this. We surveyed our students on when they plan to buy their first rental, and they said…

As you can see, most of the students in the course don’t plan on buying their first rental property right away. This makes it hard to answer the question, “How many students have purchased their first property after taking the course?” as many are still in the research and planning stages.

Further, buying the right property is crucial to this process. Rushing to buy a property for the sake of having one goes against everything I teach in the course.

What’s Inside This Course?

The course consists of educational videos, audio, transcripts, quizzes, worksheets, forums, checklists for your business systems and processes, word-for-word scripts that you can use when you make calls, canned responses that you can use when you send emails, and direct access to me through twice-weekly live Q&A Office Hours.

Here’s a 5-minute video that explains what’s inside the course. This video is part of the Welcome and Orientation portion of the course.

What Will This Course Cover?

This 12-minute video explains it well. The video is part of the Welcome and Orientation portion of the course, and within this video, I discuss why the course modules are arranged in the order in which they are. When you watch it, you’ll get strong insight into what’s inside the course — and why it matters.

By the end of this course, you should be able to:

- Evaluate properties to see whether or not they’re a good deal

- Find properties that most “retail buyers” aren’t finding

- Understand a wide variety of different types of financing options

- Negotiate for properties with improved skill

- Understand the process of closing on a property

- Understand the components of a house and be fluent in “contractor-speak”

- Estimate repair and renovation costs

- Build a team: agent, contractors, property managers

- Screen and evaluate tenants

- Set up a methodical system for tenant turnover (such as move-in // move-out processes)

- Understand business and tax information related to rental property investing

You WILL NOT learn about:

- Flipping houses

- Commercial properties (such as investing in mobile homes, offices, retail space, apartment complexes greater than 5+ units)

- Lease-purchase options

Where and When?

The course is online-only. You can access it from any device, at any time.

Enrollment will open on November 30th, 2020. If you’re interested in updates, then you can sign up to our VIP list here!

When you enroll, you’ll receive a video lesson, quiz and/or other prompt 5 days per week for 11 weeks. Please set aside roughly 30 minutes per day, or 2.5 hours per week, to learn the material.

Of course, you have unlimited lifetime access to the class, including all future updates. The group pacing is an option, not a requirement. You’re welcome to revisit the lessons anytime you’d like, or take the class at a self-directed pace.

Many students find themselves getting off-sync with the student cohort midway through the material, usually after they get sick, take a vacation or get busy at work — and that’s normal and expected. In fact, we even have a special spot in the forums for our self-paced students. We call it “Turtle Power.” You’ll see. 🙂

Why Should I Join?

To save yourself from making an expensive mistake. (I’ve made plenty of those!) You can learn from the school of hard knocks, or you can learn in an online classroom.

Tuition for Your First Rental Property® is $997, about the cost of ordering two housing inspections. It’s significantly less than you’d pay for a single class at a 4-year college or university. It’s substantially less than the fees and closing costs of just one refinance.

If this class can save you from losing/forfeiting $5,000 in an earnest money deposit, or if it can teach you to negotiate for an extra $7,000 in closing cost concessions, or if it can prevent you from taking out the wrong type of loan and spending $3,000 in refinancing fees, it will have more than paid for itself. As you continue to make smart decisions about rental property investing, this course will pay for itself over and over again.

If this class can spare you from buying the wrong rental property, just once, it could save you from making a six-figure mistake.

How Can I Enroll?

We’re re-opening for enrollment on Monday, November 30th! If you’re interested and want more details, please join our VIP list! That’s the place to go for any and all Your First Rental Property updates. 🙂

— Paula

P.S. “When will you be offering the class again?”

We’re opening for enrollment on Monday, November 30th! Again, if you’re interested, you can join the VIP list using that link, and you’ll start receiving updates on the course.

P.P.S. “Is there a refund policy?”

Yes! The course has a 14-day money-back guarantee. If, during the first 14 days, you decide it’s not for you, let us know and you’ll receive a full refund – no questions asked.