Welcome to another round of Reader Mail: Earn More Edition!

Today’s letter comes from Carolyn in Georgia.

You may remember Carolyn from an earlier post when she asked about creating passive income and traveling the world. Today she asks about becoming “location independent” – working from anywhere on the planet, as long as you have an Internet connection.

Carolyn says:

“I turned down two job offers in D.C. because I knew that wasn’t the lifestyle I wanted. There’s nothing that I could want more than to write on my own and become location independent. That’s why I took the easy day job in June to figure out how to make this possible.

So here’s the question that I’ve hesitated to ask but am dying to know the answer – How do you do it financially? I’m sure people ask you all the time, and I feel like I’m asking some huge secret to success. I’ve seen the few advertising spots on the footer of your pages, and I know you do one-on-one coaching, but certainly there’s more?”

I like that you put the phrase “huge secret to success” in your question. There’s no secret – although you might say there are plenty of secrets, plural.

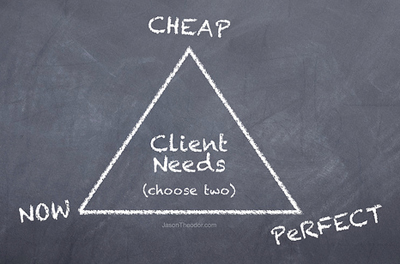

Our cultural myth says there’s one solution: the Silver Bullet. The Holy Grail. Prince Charming.

This myth is convenient: Problem, solution. Villain, hero. Life will be great as soon as we find Superman / Sherlock Holmes / the winning lottery ticket.

Thanks to this myth, we say things like “I need to invest in the Next Hot Stock,” when in reality we need to invest in 500+ stocks, the majority of which grow profits and shoot out dividends.

We say “I need an awesome real estate investment,” when in reality we need to create several awesome real estate investments and invest in the market and earn a kick-butt income and not spend too much and legally minimize our taxes.

Funding my location independent life is a bit like finding college scholarships: I enjoy multiple streams of income.

{UPDATE 2015: I now generate enough passive income — via real estate investments — that this money alone can totally support my cost-of-living. The rest of this article, below, was written back when I relied on my freelance/online income to pay the bills. If you’re in that boat, enjoy this article – I hope it helps. 🙂 }

One client pays me to edit their weekly newsletter. Another client pays me to write two articles per week. There’s even a print magazine that asks me to write one story per year, during the holiday season when they need all hands on deck. It adds $600 to my pocket each December — enough for a plane ticket to somewhere warm.

Our mind can only track a limited number of tasks. The key this successful juggling act is that I charge what I’m worth. I won’t waste my time on projects that pay a pittance.

Run Your Life Like It’s A Catering Company

Imagine that you run a catering company. Each year you cater some massive event like the Wimbledon Championship parties or the SuperBowl box seats.

This annual event earns your business all the revenue it needs for the year: enough to pay your staff, pay yourself, and cover your overhead.

You could cruise the easy road and not look for any other jobs. You could bust your butt one month a year and relax the other 11 months.

But this would be foolish. Your company’s success or failure would depend on a single client. If they drop your contract, you’re screwed.

So you diversify your income. You start catering weddings, graduations, reunions. They’re less lucrative contracts — more work for less money — but they provide a buffer. If Wimbledon drops you, your company will survive.

Any business owner would do this to protect his company. So why don’t individuals do this to protect themselves?

Why do we put all our eggs in one basket — relying on one employer for 100% of our income — rather than diversifying into multiple income streams?

Here’s The Huge Secret …

Most of the world sees self-employment – and a location independent life — as unstable. Most of the world is wrong.

People who have only one source of income — their full-time job – stand on shaky ground. Every dime hinges on just one “client,” their boss. If they get fired or if their company collapses, they’re screwed.

I have multiple streams of income. I’m diversified. I could lose a client and be fine.

But there’s a paradox that comes into play. It’s called the Pareto Principle. This principle – also known as the 80/20 rule – states that 80 percent of your results come from 20 percent of your efforts.

In other words, 80 percent of your income will come from 20 percent of your clients.

There’s a natural tendency for this to happen. I have a few high-dollar clients – my 20 percent – that pay substantially better than the rest. I put a high priority on making sure these clients are happy. But I also pad my income enough so that I’m not dependent on them.

Losing my best clients would be a bummer. But I’d be fine because I minimized my dependence on these clients – minimized my risk – in advance.

At heart, this post is about risk management. There’s no Silver Bullet or Superman.

The Bottom Line:

A single income creates dependence. Multiple streams of income gives you flexibility.

****

Read a Related Post: The Time Paradox: A Surprising Way to Prioritize Your Life.

Thanks to Scott Feldstein and Jason Theodor for the photos.