? Hey there! FYI, this post is part of our First Principles series.

About the series…

When most people talk about money management, they discuss tactics. Occasionally, you’ll encounter someone who elevates the discussion to strategy, rather than simply scattershot tactics.

But what’s missing from both conversations — both tactics and strategy — is a wider-lens look at how to become a better thinker; how to become a crisp, clear decision-maker.

How to think from first principles. How to better your brain. How to cultivate the wisdom to know the next move.

This series is an attempt to bring first principles thinking into the conversation around money. Welcome to the inaugural post.

[Quick recap] If you read the first issue of this series, you know I’m hyped about rethinking the FIRE philosophy into four pillars:

Financial psychology — This is the foundation of everything.

Investing — Let’s be honest: technically, you don’t need the “RE.” You can stop at “FI.” If you master your inner psychology and invest in your 401k, IRA and other brokerage accounts, you can live a wealthy and wonderful life. The “FI” is mandatory for everyone; the “RE” is optional.

Real estate — It’s a hybrid between owning an investment and running a business, so the “R” fits perfectly between “I” and “E.” Did someone say “mashup?”

Entrepreneurship — The last on the list because it’s the toughest, but this is where near-infinite potential lives. You’ll want to focus on F, I, and mayyyybe R first, before you tackle this tough cookie.

Financial Psychology

We recently re-ran one of my favorite episodes on the podcast: an interview with behavioral economist Kristen Berman, who states – among other things – that habits are overrated.

Wait … what? Habits are overrated? But … but … aren’t habits the cornerstone of, like, everything?

Nope, according to Berman. Habits are an excellent second choice.

Automation is more powerful than habits. The best upfront use of your time is to set up systems — e.g. automatic transfers and deposits. Habits are a fallback option for anything that can’t be automated.

Systems are likely to stick longer. Your automations don’t crack when you take a two-week beach vacation. Your habits, by contrast, might take the holidays off.

Systems rely on software. Habits depend on humans.

And in the end, the robots always win.

Investing

Successful investors tend to fall into two camps: those who are great at making returns, and those who are great at keeping their returns.

Those who are great at making huge returns are the ones who risk it all; they bet big on a handful of individual stocks, or they bought crypto in huge quantities during the early days, and their speculation paid off.

Our collective sense of survivorship bias applauds them.

But their risky behavior doesn’t stop. They double down again and again, until eventually they lose much of their returns.

Easy come, easy go.

By contrast, the investors who are great at keeping their returns often invest with a methodical, long-term, wide-lens approach.

It takes them decades, rather than mere years, to build their wealth. But once built, they tend to be more adept at keeping it.

SPOTLIGHT ON…

What tools are kick-ass at financial automation?

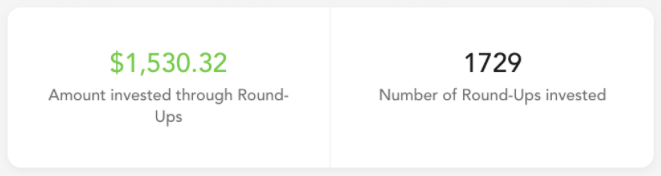

One of my favorites is Acorns, which automatically rounds up your purchases and invests the difference.

If you spend $1.73 on a coffee (wait, can you still get coffee for $1.73?? okay fine, if you spend $1.73 on … um … a bag of peanut M&M’s?), the tiny robots will round your purchase up to $2 and invest the difference, $0.27, into your Acorns account.

You can choose your favorite investing style (aggressive, moderate, conservative), or double the round-ups if you’re feeling spicy.

My personal tally? Welp, here it is:

So if I’m spending too much, or too often … at least I’m investing, too.

Check out Acorns here (you’ll also get a $5 bonus).

Real Estate

Many people have some variation of the following question:

“I’d like to buy an investment property. And I’d like to _____ [insert personal use here] _____ when it’s not rented out.”

For example, “I’d like to …”:

- … use it as a summer/winter home.

- … use it for a month or two every year.

- … have my aging grandparents or parents live there.

- … turn it into a home office temporarily or seasonally, like during the summers.

- … let my kids live there after they move out.

- … provide a home to my brother or sister while they’re getting back on their feet.

That’s fantastic. But that’s not an investment property.

There’s a difference between buying an investment property vs. monetizing a property while it’s not in use.

The former requires cold, hard math. Your personal preferences don’t enter the picture. You make spreadsheet-based decisions with Spock-like reason.

The latter’s existence is based on your personal preferences. Every decision, from location to layout to square footage, is influenced by your homeownership ideals.

On the surface you’re performing the same act. You’re purchasing a property, and then renting out said property. You’re advertising the vacancy, collecting rent checks, performing routine maintenance and repairs, and paying taxes as a landlord.

But there’s a huuuuge difference between the decisions you make when you’re selecting each type of property.

Many homebuyers get smacked upside the head with problems when they don’t understand which set of objectives they’re chasing.

They take their cues from the wrong group. They use the wrong formulas. They play the wrong game, follow the wrong rules, track the wrong scoreboard.

The home they purchase ends up being the wrong candidate for the job.

And that’s a six-figure mistake.

In our course, Your First Rental Property, we teach our students how to clarify exactly what they want in an ideal property, so that they never take cues from the wrong voices.

Entrepreneurship

Let’s keep this simple:

- “Do I need business cards?”

- No.

- “Do I need a business plan?”

- Meh. Maybe something that’s simple enough to scrawl on a napkin.

- “Do I need a suit?”

- Why, are you a funeral director?

Stop playing business. You’re not a little kid on a playground; starting a business by printing business cards is a grown-up version of make believe.

No matter what type of business you’re running — whether you’re dog-walking for extra income or freelance coding for the local university — you need two things:

- Either a product or service

- Someone who thinks your product or service is valuable enough to purchase

That’s it. Forget the business cards. Focus on (1) figuring out what product or service you can offer the world, and (2) telling the world* about it.

*You’ll want to narrow down “the world” into something more targeted. Like, tell Bob. Especially if Bob has a dog that needs walking, or if Bob hires freelance coders for the local university.

Wahoo!! You’ve finished reading Issue #2 of the First Principles series!

I hope this series inspires you to think, learn and take massive action.

Click here if you want future posts like this straight to your inbox with more thoughts, ideas and insights on a new take on FIRE.

See you soon!