In a hectic world, stillness is the key to a calm, enjoyable life.

In a hectic world, stillness is the key to a calm, enjoyable life.

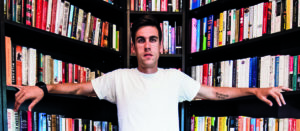

That idea comes from Ryan Holiday, author of Stillness is The Key.

Stillness is finding flow, staying present, and being impervious to the pressures of the outside world. It doesn’t mean removing yourself from society and sitting in a forest; to the contrary, many CEOs and world leaders have practiced remarkable stillness during times of crisis.

Stillness exists within, regardless of the frenetic pace of the outside world, and irrespective of the pressures that you face at the moment.

In today’s episode, bestselling author Ryan Holiday discusses actionable tips on how to practice the art of stillness, as well as its applications to the pursuit of financial independence.

Here are six takeaways from this conversation:

#1: Stillness requires movement.

The mind and body are connected, and one of the best ways to practice mental stillness is by taking long walks, runs, swimming, or other physical movement.

“One of the paradoxical things about stillness is that sometimes movement is the best way to get it,” Holiday says.

#2: Don’t believe everything you think or feel.

Plenty of thoughts and emotions pass through our mind. Many are counterproductive. We don’t need to accept, or agree with, everything we think. We can simply observe those thoughts and feelings as they arise, and then let it go.

#3: You already have enough. You already are enough.

Enough said.

#4: Focus on the process, not the results.

You can’t control results or outcome. Enjoy the process, and let the results unfold as they may.

“If you’ve decided that the results make the effort worthwhile, what happens if you get a really bad break?,” Holiday says.

Let’s apply this idea to the pursuit of financial independence (FI).

If you think, “I’ll be happy once I reach FI,” that happiness might never come. Once you reach FI, you’ll set another goalpost.

If you think, “I don’t like the way I’m living, but I’m grudgingly doing this just for the results,” then you might grow disillusioned or unmotivated if some external force — like an emergency — delays those results.

But if you enjoy the actual process of reaching FI, such as efficient living, minimalism, and entrepreneurship and side hustling, then you enjoy the lifestyle itself. The reward is living the FI lifestyle, and if eventually that leads to a specific result, that’s great too, but you’re satisfied along the way.

#5: Create routines, plural.

Don’t create a routine. Create routines, plural.

Create routines that adapt to the circumstances of your environment, such as workday vs. non-workday or at-home vs. traveling.

#6: True success is autonomy over your time.

And that, in a nutshell, is the philosophy of financial independence.

__

These six takeaways come from this conversation with Ryan Holiday.

Enjoy!

Resources Mentioned:

- Stillness is the Key, by Ryan Holiday

Thanks to our sponsors!

Gusto

Gusto makes payroll, benefits, and HR easy for modern small businesses. In fact, 72% of customers spend less than 5 minutes to run payroll! If you sign up at gusto.com/paula, you’ll receive 3 months free once you run your first payroll.

Radius Bank

Do you want your money to make more money? Then check out Rewards Checking, from Radius Bank. You earn 1.00% APY on balances of $2,500 and up, there are no fees, and it offers unlimited one percent cash back on debit card purchases. To get started, head over to radiusbank.com/paula.

Noom

Noom is a habit changing solution that can help you develop a new, better relationship with food – without a restrictive diet. The app is super convenient and helps you get in shape by improving your overall lifestyle. Give it a try – go to noom.com/paula for a trial.

Candid Co

Want to have a photo-ready smile in time for the holidays? Candid Co has invisible aligners that can help you get there. They cost 65 percent less than bracers, are removable, comfortable, and they can help straighten your teeth faster than traditional wire braces. Go to candidco.com/paula and use code ‘paula‘ to get $75 off!