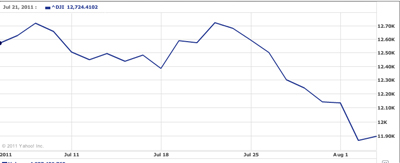

Anyone with a pulse – your co-workers, your neighbor, your third-grade teacher – is fretting that stocks nosedived this week.

Actually, “nosedived” is an understatement. It plummeted. Plunged. Tumbled. Crashed. You get the picture.

From the Associated Press:

Gripped by fear of another recession, the financial markets suffered their worst day Thursday since the crisis of 2008. The Dow Jones industrial average fell more than 500 points, its ninth-steepest decline ever.

The talking heads on television are whipped into frenzy, issuing the usual Armageddon advice: Brace yourself! Stuff cash under your mattress! It’s 2008 all over again!

This is the typical scaredy-cat, knee-jerk advice you should ignore.

The Chinese word for “crisis” is the same as the word for “opportunity” (At least I assume that’s true; I learned it on The Simpsons.) You might want to apply that thinking to the stock market.

Here are 4 tips on what to do when the market is in free fall:

Tip #1: Remember It’s Easier to Lose Than Gain.

I don’t just mean that it’s easier to lose money than to make money in a general sense (though that’s also true!). I mean that when stocks sink 50 percent, they have to rise 200 percent just to break even.

“Huh?,” you might be thinking. “How is that possible?”

Let’s say you have $100 in the stock market. The market declines 50 percent. Now you only have $50 in the market.

To get back to your original $100, the value of your $50 stocks now have to DOUBLE – in other words, the market has to rise 200 percent.

What does this mean for you? First: its a reminder that there’s no such thing as easy money in the stock market. (As if you needed another reminder!)

More importantly, it’s illustrates: Don’t lock in your losses. Stocks rise and fall. In 2007 the Dow traded above 14,000. By 2009 it collapsed to 6,500 – yes, a decline of more than 50 percent.

A lot of people feared that doubling their money was impossible. They pulled out when the Dow was at 6,500 and locked in their loss.

Within two years, the market doubled to 12,700. What happened in the last two weeks – the quick pullback to 11,300 — is just a dip in the big picture.

If you held onto your original 2007 stock – never selling, never panicking, never trying to “time” the market – you’d endure a bumpy ride, but you’d ultimately be okay. Your portfolio, at least as of July 2011, would be close to where it stood in 2007.

But if you panicked and sold in 2009 when the market was low, you would have locked in your losses and missed the rebound.

In the end, you are your own biggest threat to your portfolio. The best way to avoid the “threat of yourself” is to stay the course. Which leads me to Tip #2 …

Tip #2: Stay the Course.

Don’t forget the fundamental rule of investing for the long-run: Stay the course. Don’t get scared.

Sure, the market is dropping now. But compared to where it was one year ago, it’s still doing very well:

As this chart shows, a year ago — on August 4, 2010 — the Dow Jones traded at 10,680. It went on a bumpy ride, sinking in September, but over the long haul it’s been steadily climbing.

Let’s look at the last two years:

Again, it’s been a rough ride, but the market has rewarded people who have stayed the course.

“But we’ve been in a recovery for the past two years!,” I can hear you protesting. Okay, fair enough. Here’s the past 5 years:

On August 7, 2006, the Dow Jones traded at 11,088 … close to where it’s trading now, five years later.

This means your initial investment will have “held steady,” so to speak, over the last five years, and the DIVIDENDS you earned on that money would have accumulated throughout. If you started investing 5 years ago — at the beginning of one of the worst periods of U.S. stock market history — you’d still emerge with a gain.

Tip #3: Use “Averaging” to Your Advantage.

Let’s say you invest $200 per month in a mutual fund. When the market is low, like it is now, $200 will buy 40 shares of XYZ Fund. In six months, when stock prices are high again, that same $200 will only afford 30 shares of XYZ Fund.

In other words: by being consistent, you automatically take advantage of sales. When prices are low, as they are right now, you pick up an “extra” 10 shares.

I’m a huge fan of ETFs, which are like mutual funds, except that they have lower fees (which means you get to keep more of what you make).

One drawback to ETFs, though, is that you have to buy them in “whole” shares. You can’t just contribute $200 a month; you have to buy 1 share, or 5 shares, or 10 shares, regardless of the cost.

In this case, buy a consistent number of shares at regular intervals.

Let’s say I buy 10 shares at the top of the market for $40 per share, and 10 shares at the bottom of the market for $20 a share. On average, I’ve paid $30 per share. My risk of buying at the “wrong time” is minimized.

Tip #4: Take Advantage of Sales.

You’re eager to take advantage of sales at Macy’s – why should buying stocks be any different?

You’ll never be certain whether or not you’re at the bottom of the market. That would require predicting the future, which is impossible.

But when you see that stocks are plummeting -– when the price of gold shoots up, bonds soar, and all the talking heads on TV are crying “the sky is falling!” -– it might be a good time to buy some stock.

Tip #4 – Part 1: Now – this is important – ONLY buy stock in a down market IF you have the patience to hold it for a long, long time. Like 10 years or more. This is a long-term strategy.

Tip #4 – Part 2:Also, don’t buy all at once. Ease in slowly. Maintain your “averaging” technique – buy 10 shares a day, or 10 shares a week, over time. This will help minimize your risk of making a huge purchase before the market plummets another 5 percent.

Tip #4 – Part 3:Third, ignore individual stocks unless you’re extremely well-versed in this arena. Individual companies can fail — just look at Washington Mutual. Minimize your risk by sticking to broad-market index funds or ETFs, which track a huge basket of stocks.

Tip #4 – Part 4:Finally, only do this with a small portion of your total portfolio: what I call “fun money.” This can be a few hundred to a few thousand dollars that you set aside for snapping up extra ETFs when the market makes a historic plunge.

Hey, the stock market is having a clearance sale right now. If you’ve got some “fun money” and you’re willing to stay in for the long haul, then this isn’t a crisis. It’s an opportunity.

********

For a little historic perspective: Do you remember the ONE WEEK in March 2011 when the market plunged from 12,200 to 11,600 and then skyrocketed back to 12,100, all the the span of the same week? Read about it here.

Joanne Courville of New Orleans committed the classic error of getting scared and missing the rebound. Read about it here.

Quiz: What’s Your Risk Tolerance? Find out here.