You know that expression: “Whatever your renovation budget … double it?”

That happened a few months ago. I predicted that renovating one of my rental units would cost about $5,500 and would raise the rent by an extra $150 per month. I was waaayy off base.

In reality, the remodel cost $17,021 (boo!), but I collect an additional $300 per month (hooray!). I’ll recoup the initial investment in 5 years and double my initial investment in 8 years. That’s the equivalent of earning a 9 percent compounding return in the stock market.

My projections were off, but my outcome was successful.

Now I’m at it again. Each remodel I’ve done has been more ambitious (and expensive) than its predecessor. My newest adventure is no exception.

This time, I’m remodeling the unit that I live in. Here’s a description of what’s happening, followed by a juicy breakdown of the numbers.

“Free House with Purchase of Land!”

As long-time Afford Anything readers know, we bought a triplex in one of the most desirable neighborhoods in Atlanta. (A triplex is like a duplex, but with three units.)

We snagged the house for a jaw-dropping steal. A vacant lot of similar size one block away sold for $190,000. The free market, in other words, believes the underlying land is worth $190,000.

What did we pay for a nearly 3,000-sq. foot building in the same neighborhood? Only $225,000, or $76 per square foot. That’s absurd. No contractor could reconstruct this building for $76 per sq. ft.

In essence, we bought the land and got the house thrown in as a bonus. “Free house with purchase of land!”

Why did we get such a steal? Three reasons.

#1: Timing.

Our timing was ideal: The owner was heading towards foreclosure and willing to accept a low price.

Does that make us “sharks”? Absolutely not. The owner wanted to AVOID foreclosure, and accepting our offer allowed that to happen. We created a win-win: both of us walked away from the closing table with the best possible outcome.

#2: Be a Rebel …

We bought this house in 2010, when investors were still skittish. This underscores the point: Don’t follow the herd. Normal sucks. Rebellion pays.

#3: Do What Others Won’t.

The building is in total disrepair.

Look, for example, at this photo. This is the bathroom that we’ve been using for the past year. The black line between the bathtub and the wall-surround hints at mold growth:

Wanna rip out the wall and peek behind? Really? It’s gross. Fine, I warned you:

In case you’re wondering, the black stuff is mold, mold, mold.

And that’s just the tip of the iceberg.

In the year since we moved into the unit, we’ve noticed a cockroach problem that no quantity of bait can solve. When we tore out the kitchen floor, we discovered why:

This is a pictorial way of saying that the house is – at best — habitable. Maybe. If you don’t mind cockroaches, rot and mold.

It gets worse. The foundation is collapsing. The cabinets are water-logged. The countertop is peeling. The kitchen drywall is – you guessed it! – covered with mold. There’s so much more wrong with this house that I have to use a mobile punch list to keep track of it all.

We need to spend thousands to gut the kitchen and baths. This isn’t discretionary; it’s a must. (Remember, we bought the house for a screamin’ deal because of its shoddy condition.)

The Kitchen Was Designed Before Women Could Vote

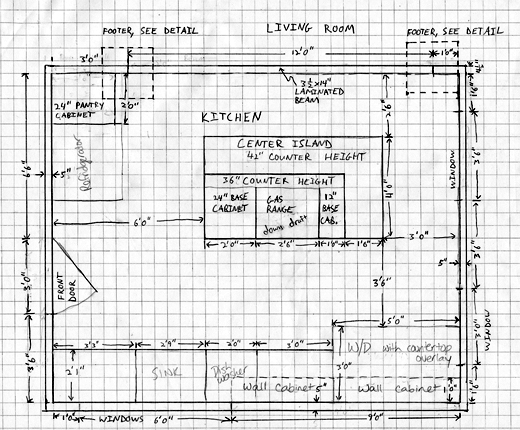

The cheapest option would be to “remove and replace.” That means we’d keep everything in its same footprint: Same layout. Same walls. Same appliance locations.

But that footprint doesn’t make sense in a modern home. This house was built exactly 100 years ago, in 1912. Back then, William Howard Taft was President. Archduke Ferdinand was alive and well. Arizona and New Mexico weren’t states yet.

And people designed homes differently. The kitchen, for example, was sequestered off as servant’s quarters. It was an afterthought, crammed into the back of the house.

There’s no point in executing a project halfway, we decided. If we keep the same footprint and layout, this unit will remain mediocre. But if we radically re-imagine the space, we can convert this ugly old afterthought into a beautiful arena.

Throughout the past year, we’ve envisioned ways to modernize the flow of the space while respecting the 1912 heritage and charm. (By the way, if you’re interested in design principles, I highly recommend the book A Pattern Language. It’s brilliant, perceptive and timeless.)

Since we’re too cheap too hire an architect/designer, we hand-drew a blueprint. Here’s an image of the first draft; we’ve altered it several times since.

Now we’re watching our plans come to life.

Our tenants/roommates moved out at the end of September. Demolition began in early October. The crew gutted the kitchen and bath, ripped out walls and flooring, and reinforced the shoddy foundation. Here’s what our kitchen has looked like for the past month:

So What’s Next?

“Remove and replace” – the cheapest option – would have probably cost about $15,000, rough ballpark estimate. (We’d still need to reinforce the house’s foundation, which is not an incidental cost.)

The redesigned space will cost about $30,000, according to the estimate from my contractor. In other words, the difference between “mandatory” and “optional” is roughly $15,000.

Based on that data, if this upgrade allows us to raise the rent by $200 a month, I’ll be satisfied.

This unit is a 3-bed, 2-bath. In its current condition (terrible), it rents for $1,650 – $1,750 per month, which speaks highly of the location. Performing basic, necessary maintenance — the “remove and replace” plan — won’t merit higher rent.

If I can redesign the space and raise the rent of every bedroom to $650 (or the unit as a whole to $1,950), this will be an acceptable investment. I’ll recoup the cost differential in 6.25 years (which is 7+ years once you factor for vacancies.)

If I can raise the rent to $2,000 a month or higher, this will be a stellar investment — on par with the house I bought for $21,000 that rents for almost $900 a month. That house has a 5.6 year payback period.

But “projection” is just a fancy word for “guess.” What will happen? I have no idea. I’m taking a risk. I’m curious to see how this will play out.

I’ve been playing it safe for awhile. I’m ready for a $30,000 experiment.

****

Side Note: It’s tough to say exactly what this unit would fetch on the open market, since we live in one of the bedrooms. Our roommates each pay $550 per bedroom, or $1,100 total. If we match that price when we pay ourselves rent, the unit would go for $1,650/mo in total.

But our room is worth about $100/mo more, since it’s the “master” bedroom with a private office, walk-in closet, attached bathroom, private entrance and French doors opening to the patio. That’s $1,750 for the unit in total.

The Naysayer Brigade likes to argue that we shouldn’t consider the fair market value of the room we occupy, since we’re not “collecting” rent. That’s ridiculous. We’re taking the spot of a rent-paying tenant. We can’t charge ourselves $0, charge someone else $550 or $650, and call it an apples-to-apples comparison.

Remember the Afford Anything Law: ALWAYS PAY YOURSELF, whether its for the hours you work or the space you occupy. Never pay yourself $0.

****

UPDATE 2014: The rooms rent for $850 per bedroom! We’re collecting $1,700 from our two roommates/tenants, plus the value of the room that we occupy. Wowza!

Read this post to see the updated rental house cash flow stats.