“Don’t buy lattes.”

“Don’t buy lattes.”

This classic snippet of personal finance advice isn’t specifically anti-Starbucks. “Lattes” are a metaphor for the tiny expenses that leak money from our pockets, often without us realizing how much we’re spending.

Your “latte” could be a pile of subscriptions: HBONow, YouTube Red, Spotify Premium, Netflix, Hulu Plus, the CostCo membership that you haven’t used in two years, and — for that matter — the gym membership that you also haven’t used in two years. (Ahem.)

Your “latte” could be buying bottled water and snacks at the airport, or absentmindedly shopping online when you’re bored, or ordering restaurant take-out or delivery too often.

Your “latte” might be spending too much on trinkets and souvenirs during your vacations, when photographs would capture the memory.

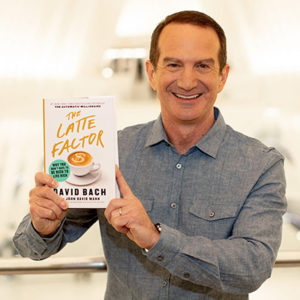

David Bach is the New York Times bestselling author who created the phrase “don’t buy lattes.” His inspiration for this phrase was a conversation with a young woman who insisted that she didn’t have enough money to save for retirement, even though she was holding a cup of Starbucks in her hand.

Bach calculated that saving a $5 daily latte and biscotti at Starbucks would translate into saving $2,000 per year. (Technically, $5 per day, 365 days per year, is $1,825, but you can cut out a few Diet Cokes and candy bars to round up.)

If you invest $2,000 annually into a tax-deferred retirement account, Bach points out, you’ll have a decent chance of having $1 million or more upon retirement, depending on the age at which you start investing and market returns.

“The so-called small things on which we waste money every day can add up in a hurry to life-changing amounts,” he wrote in his bestselling book, The Automatic Millionaire.

The “don’t buy lattes” catchphrase has become so popular that it’s inspired a wave of public discussion, as personal finance enthusiasts debate whether we should focus on trimming the corners or chasing larger but less-certain wins.

Lattes are a metaphor for life.

It’s fitting, then, that David Bach’s final personal finance book, The Latte Factor, is written as a parable. He introduces us to a main character named Zoey Daniels, a 27-year-old New York magazine editor who believes she doesn’t earn enough to amass savings, despite her decent-but-not-spectacular income.

David joins us on today’s podcast episode to share Zoey’s story and describe how to grow wealth at any income level. He also describes the radical sabbatical that he’ll embark on next.

Thanks to our sponsors!

Freshbooks

Save time by using Freshbooks, an easy-to-use, cloud-based accounting system that takes the stress and hassle out of bookkeeping and, especially, invoicing. You can create an invoice in a few seconds, and Freshbooks’ automated system will handle the rest. Visit Freshbooks.com/paula for a free 30-day trial. Please mention this show when they ask how you heard about them.

Radius Bank

Do you want your money to make more money? Then check out Radius Bank’s free high-interest checking account. You earn 1.00% APY on balances of $2,500 and up. There are free ATM’s worldwide, no monthly fees, and they’ll rebate ATM fees charged by other banks! To get started, head over to radiusbank.com/paula.

Capterra

Capterra is the leading, free online resource to help you find the best software solution for your business needs. With over 700,000 reviews of products from real users, you can easily find the right tools to make this year the year for your business. Visit capterra.com/paula today to get started!

Quip

One of the most important things we do for our health on a daily basis is brush our teeth, yet most of us don’t do it properly. With Quip, you won’t brush too hard, you’ll brush for the right amount of time, and brush heads are automatically delivered on a dentist-recommended schedule. Go to getquip.com/paula to get your first refill pack for free.