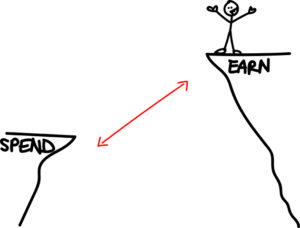

In today’s episode, we’re focusing on how you can grow the gap between what you earn and what you spend.

In today’s episode, we’re focusing on how you can grow the gap between what you earn and what you spend.

Many people in the personal finance space argue about whether it’s more important to earn more vs. save more.

This argument is like chocolate vs. vanilla. Cats vs. dogs. Pepsi vs. coke.

You get the idea. Everybody takes a side.

I want to circumvent that issue and focus on what matters, which is growing the gap between your earning and your spending.

Let’s start with the spend less side of the equation.

The problem is that most people try to tweak around the margins. Here are some examples (do any sound familiar?):

- You go to a restaurant, and the entree you really want to order is $18. There’s a cheaper option for $14, and even though it’s not the one you want the most, it looks good enough, so you order that.

- The server asks if you want anything to drink. You look at the wine list. The cheapest glass is $7, so you get that. Your friend orders a glass that’s $11, and even though you don’t say anything, you think to yourself, whoa.

- You take out a load of laundry, but you leave the dryer sheet in because you figure you can use it twice.

- You’re at the airport, you’re super hungry, and you forgot to pack the snacks you normally take with you. Rather than spend $9 on a burrito, you stay hungry for the next 3 hours until your flight lands.

Those are examples of moves that’ll make you feel better about your finances — but won’t make much of a spreadsheetable, trackable dent.

The better approach is to focus on the big four:

- Housing

- Taxes

- Transportation

- Food

That’s how you spend less. In this episode, I dive into strategies about how to save on the Big Four.

Okay, so that’s the saving side of the equation. What about the income side?

You can learn about earning more by listening to episode 85, where Nick Loper describes various types of side hustles.

To quickly summarize that episode, you can start with side hustles in the gig economy, which include things like:

- Driving for Uber or Lyft

- Renting out a space on Airbnb

- Renting out your car on Turo

You can also try a side hustle in the expertise economy. These feature high-skill work, such as consulting, freelancing or coaching within your area of expertise. Some examples of websites that offer these services are:

- Clarity.fm

- Wyzant

- Thumbtack

Then there’s the stuff economy, which involves delivering physical goods, such as:

- Etsy

- Amazon FBA Program

For more details about that, you can go back and listen to episode 85.

Enjoy!

– Paula

P.S. Want the slides from my WDS presentation? Click the button below to download them.

Resources Mentioned:

- How to Side Hustle Your Way to Success, with Nick Loper

- Freshbooks – Bookkeeping for Small Businesses

- Why “Earn More” vs. “Save More” is the Wrong Debate – Afford Anything article

- Small Business Credit Cards

Thanks to our sponsor, Freshbooks!

You’re busy. You don’t need to junk up your schedule with mundane tasks.

Here’s a question: if you’re an entrepreneur or someone with a side hustle, how much time do you spend organizing invoices, chasing your clients down for late payments, and messing with receipts and reimbursements?

Yeah — more than you’d like to.

Save time by using Freshbooks, an easy-to-use, cloud-based accounting system that takes the stress and hassle out of bookkeeping and, especially, invoicing. You can create an invoice in a few seconds, and Freshbooks’ automated system will handle the rest. They’ll help you get paid faster, with less hassle.

Wanna try them for free?

Visit Freshbooks.com/paula for a free 30-day trial. Please mention this show when they ask how you heard about them.