What’s the purpose of money?

That’s not a rhetorical question. I’m inviting you to sit with this question for a moment. Ponder it. Pray / meditate / reflect on it.

Why do you want to create wealth on your life? What’s the ultimate purpose?

I’ve thought about this on a near-daily basis for the past decade.

Here’s my response to this question – and how it’s influenced a HUGE, game-changing, turning-point decision that I made six months ago.

Level 1: Survival

I know, I know. “Survival” sounds soooo dramatic. Cue the violins.

But in all seriousness, I’ve spent a decent chunk of my life in third-world nations. And I’ve seen that only one quality separates us from malnourishment and disease: money.

You, me, the poorest-of-the-poor: We’re the same people. Money is the only reason we’re not squatting in Calcutta’s worst slums or selling our kidneys on the black market. (Our other difference is nationality, which is significant insofar as it reflects our opportunity to earn a living, and family, which is significant insofar as they can provide housing, food, and good advice.)

At the most primitive level, everyone is struggling for survival.

<< Sorry, I didn’t mean to become such a buzzkill. >>

Fortunately, in the U.S., survival is incredibly easy to achieve. Even college students making $6.45 per hour can rent a shabby apartment with five roommates, eat Ramen noodles, and wear thrift-store sweaters. << #BeenThereDoneThat >>

We’ve mastered survival. And we have the luxury of asking: What’s next?

Level 2: Safety Net

My next priority — after immediate survival — is ensuring the security of my Future Self.

So I built savings.

And then I built more savings.

I later discovered that there’s a name for this: an “emergency fund.” Even without this snippet of jargon, it just makes intuitive sense to keep a cushion, a safety net.

I mean, duh. Right?

People sometimes ask: “How can I save this?”

The answer is simple: Earn more and spend less. When you compare your life to third-world villagers, you won’t feel so bad about working overtime, wearing faded clothes, or eating pasta instead of organic steak. You may not realize it, but you’re living large.

If you can then create a “safety net,” you’re waayyyy ahead of the game.

Which affords you to step into the next level of luxury —

Level 3: Short-Term Goals

After survival and a safety net, you can relax and have a bit of fun.

But beware. In many narratives, this is where the protagonist falls off the rails.

“Then I blew tens of thousands, without realizing it, just by letting my lifestyle creep up …”

Before you start classifying new cars as “normal” (rather than a luxury), pause for a second.

Close your eyes. (Well, not now – you’re reading.)

Ask yourself: What’s on my 5-Year Bucket List? What goals or dreams do I want to achieve in the next 5 years?

Direct your money accordingly.

For example:

- Spend 6 months in Paris.

- Spend 6 more months in Bali.

- Buy a house.

- Launch a business.

- Scale back your working hours.

- Switch into a lower-paying but more-satisfying career.

- … etc.

Notice what’s not on the list. For many people, “I want to drive a new car” isn’t anywhere on there. Neither is “I want to wear brand-name clothes” or “I want to upgrade my smartphone.”

By the way, there’s nothing wrong with those ambitions. If you are:

- A tech geek who dreams about the day you’ll upgrade your phone

- A car aficionado who reads about every vehicle on the planet

- A foodie who wants to experience fine restaurants across the nation

Awesomeness! You know your answer. You’ve pinpointed your dreams and created your 5-Year Bucket List. Embrace it.

The bottom line: Spend lavishly on your bucket list. Slash everything else.

Level 4: Freedom from Paycheck Dependence

Level Four is the ultimate level of financial-actualization: Freedom from paycheck dependence, also known as “financial freedom.”

Financial freedom, as many of you know, is the state in which your passive income covers your entire cost-of-living. You never need to work again.

You can choose to work (you can choose to do anything!), but you’ll never be forced to work.

Because this is such an Awesome & Audacious goal, I strongly recommend enjoying some Level Three Bucket List mini-victories along the way.

I’m a big advocate of living in both the present and also for the future. Pursuing freedom from paycheck dependence is awesome, but it’s going to take some time. Unless you’re exceptional (e.g. you sell a business, create royalties, etc.), freeing yourself from the shackles of paycheck dependence will take at least 10 years, maybe more.

You can’t defer your life during that journey. You’ll never again experience this current decade (your 20s, 30s, 40s, 50s). And, let’s face it, none of us are sure how long we’ll be around.

<< Wow, I’m a real buzzkill today. >>

So … How much money do you need in order to reach financial freedom?

That’s a tricky question, because “enough” is a moving target. It depends on the size of your family (child-free or eight children?), your location (Manhattan or Nebraska?), and your preferred lifestyle (canned spaghetti or caviar?)

I decided to peg my personal definition of “Financial Freedom” to an external benchmark: the median U.S. household income.

According to the U.S. Census Bureau, the median household in the U.S. earns $51,107 per year, as of 2012, the most recent year for which there’s complete data.

“That sounds low.”

Yeah, I agree. But half of all U.S. households earn less than this. If this figure sounds low, it highlights the fact that “enough” is a moving target – and therefore demands an external benchmark.

How I’m Following This 4-Step Path

As many longtime Afford Anything readers know, I’ve been chasing financial freedom for three years.

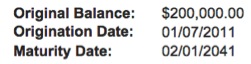

When I was 27, I got a mortgage. And then another. And then another.

I renovated the houses. I found tenants. I learned a sh**load about real estate investing by reading books, blogs and meeting hundreds of other investors.

By age 29, I created $35,000 annually in completely passive income. (That’s after paying for management, repairs, and all other active tasks.)

It’s awesome.

But it’s bothering me.

During the first year, I only made the minimum payments. I reinvested cash into buying and renovating more houses.

Then one day, I logged into my account … and nearly had a heart attack.

Hold on a sec. The loan matures in 2041 … when I’ll be 57 years old?!

Ugh. I don’t think so.

The concept of a 30-year loan sounds fine, in theory. It’s abstract and distant. But the concept that I’ll be 57 and still making payments on a house that I bought when I was 27? That sounds tragic.

Like, Shakespearean-level tragic.

So on the same month I turned 30 (and traveled to my 30th country), I tossed an extra $4,000 towards the mortgage.

<< #WeirdestReactionToTurning30Ever >>

And I’ve been continuing nonstop ever since.

“Hold on. WTF? Where are you getting an extra $4,000 every month?”

Most of it (about $3,000/mo) comes from the passive income that the rental properties create. Another $1,000 or so comes from my day-to-day active income (I run a content marketing consulting business from my laptop).

“But why payoff the mortgage? Can’t you earn more money investing?”

Yes, in theory. I could invest that cash instead, and (potentially) create a higher return. There’s a lost opportunity cost.

But let’s turn back to our conversation about goals. In “Level Three,” I asked people to name their five-year bucket list.

My 5-Year Bucket List has three items:

- Live overseas again. Move to Bali, backpack Europe, spend some time in Buenos Aires.

- Scale back my hours (in my consulting practice) by handing more of my daily tasks to contractors and assistants. I’ll “quarterback” the process, but I want my business to run itself, via employees.

- Achieve total financial freedom in the next five years. I define this as creating at least $51,000 (the U.S. median household income) in completely passive income.

If all of my mortgages are paid-in-full, I’d collect between $55,000 – $65,000 in passive income annually (depending on what assumptions you make for vacancy, repairs, etc.)

These goals point towards one clear conclusion: Pay off the mortgages. Now.

Yes, I could theoretically invest more, which means I’d have the potential to collect bigger cash flow in my 50’s. But that comes at the expense of my early 30’s.

There’s a tradeoff. Do I want financial freedom now? Or the possibility of more money later?

I’m shooting for now.

Here’s my personal plan:

- Max out retirement accounts. Why? Yes, this runs contrary to the stated goal above. But the tax advantage is use-it-or-lose-it.

- Buy one more house. (Just one more! Yes, I know that’s what addicts say. But I’ve been planning to buy ‘just one more’ for a long time, and I have the cash set aside.)

- Direct all future money towards turbocharged mortgage payoff.

Is this the “right” choice? There’s no such thing.

People like to look at investments in a vacuum. We have complicated formulas. We add, multiply, divide, amortize. We express “values” through percentages and ratios and rates.

That’s necessary. But it’s not sufficient.

Cash is a tool; like a hammer, it’s used for building and creating and crafting our stories.

The size of the reward isn’t the happy ending; it’s the backdrop. The real story unfolds when our money aligns with our meaning.