Ready to rumble?

There’s a fight brewing. Two contenders have climbed into the ring.

Both are clawing for victory. Only one will survive.

In one corner: Crush Your Mortgage, and his team of anti-debt advocates.

In the other corner: Keep Your Mortgage, and his cheering crowd of leveraged investors.

Who will take home the title?

Pay Off Your Mortgage or Invest the Cash?

In all seriousness: “Should I pay down the mortgage? Or should I invest?” is a hot question.

There are SOLID arguments on both sides.

It’s been consuming my thoughts recently.

At the risk of sounding obsessive, I’ll admit: I think about this everyday.

I ponder this while I’m cooking. While I’m showering. While I’m running gnawing chocolate-chip ice cream straight from the pint.

Why deliberate so much?

- It’s complex.

- It demands a decision (and it needs one now).

- It influences hundreds of thousands of dollars. (And I thought being an adult would be easy.)

And since I have three mortgages, that’s three times the fun. ☺

Let’s take a look at some of the factors at play.

NOTE: This article is written for owner-occupants who would otherwise invest in the market.

The discussion and big-picture lessons apply to real estate investors, as well. But the “target audience” for this article is owner-occupants.

The Reigning Champ: The “Keep the Mortgage” Fighter

The reigning champion in the ring, returning to keep his heavyweight title, is the “Keep the Mortgage” fighter.

He’s the champ because most of America supports him. Most people spend 30 years paying off a 30-year mortgage. (Not that most people are investing that money, but …)

Keeping the mortgage is the norm.

But Afford Anything rebels don’t blindly side with the majority. We’re radical free-thinkers. So let’s think.

Here are the benefits to Keeping the Mortgage:

1) Investment Gains > APR on Loan

The top reason why rebels keep the mortgage? They believe their investment gains could outpace their loan APR.

This is a simple concept: You borrow money at a low interest rate. You invest it for a higher return. You pocket the spread.

- Banks borrow from the Fed at a low rate; lend to the general public at a higher rate.

- Travelers earn in dollars or euros; spend in Thai bhat or Colombian pesos.

And whether or not you’re consciously aware of it, every person who holds a mortgage and invests also plays this game.

So – Could your investments really outpace your mortgage APR? Probably. From 1990 to 2010, the S&P 500 returned 9.14 percent as a long-term annualized average.

“WTF does that mean?”

If you dumped a bunch of cash into an S&P 500 index fund in 1990 and didn’t touch it for 20 years, you would have earned 9 percent annual returns over the long-haul.

“But those were unusually great years. Right?”

Nope. Those two decades include the dot-com burst of 2001, plus the Great Recession of 2008. (Notice that the timespan ends mid-recession, before the recovery.)

“Oh, so I could earn 9 percent. Then why are we having this conversation? Isn’t keeping your mortgage a no-brainer?”

Nope. In finance, there’s a concept called “risk-adjusted return.” It’s a fancy way of saying that you can’t just stare at your returns in a vacuum – you have to look at returns within the context of risk.

- Earning 10 percent on Facebook stock is different than earning 10 percent in a savings account.

- Earning 12 percent on a dingy rental property in a high-crime area isn’t the same as earning 12 percent on a sparkling rental property in a high-end, luxury resort.

- Borrowing money to invest in the stock market isn’t the same as paying off a loan.

“But I’m not borrowing to invest!”

Yes, you are – in the form of opportunity cost.

But we’re getting off-track. In this section, we focus on arguments in favor of Keeping the Mortgage. So let’s look at the second reason:

2) Compound Interest > Simple Interest

Alright, this one gets a little more complex. Hang with me:

When you invest, you earn compounding interest.

- Year 1: $100 * 10 percent = $110

- Year 2: $110 * 10 percent = $121

- Year 3: $121 * 10 percent = $133

By the end of Year 3, your original $100 has grown by 33% of its value. Wowza.

Mortgage interest … well, if Facebook had a relationship category for mortgage interest, it would be “It’s Complicated.”

Mortgage interest is calculated as simple interest, meaning that it’s a straight-line rather than a compounding figure.

- Year 1: $100,000 * 5 percent = $5,000

- Year 2: $100,000 * 5 percent = $5,000

- Year 3: $100,000 * 5 percent = $5,000

Seems “simple” by definition, right?

But there’s a curveball: Mortgage interest is “amortized,” which means that during Year 1 of a 30-year mortgage, the vast majority of your payments are applied to the interest, rather than the principal. In other words, you barely make any equity gains as a result of mortgage pay-down.

In Year 29, the tables are turned: You’ve repaid almost all the interest, and the bulk of your payments are now used for equity paydown.

This gets complicated quickly, so let’s use charts and a calculator to illustrate it:

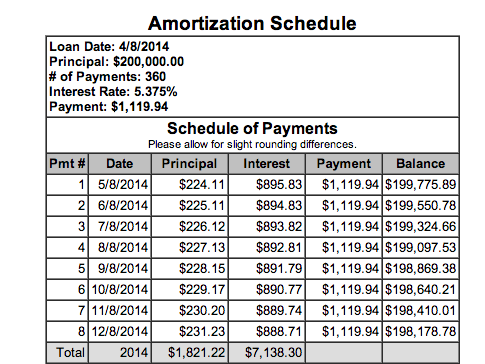

Here’s the situation illustrated in the chart:

- Loan: $200,000

- Term: 30 Years

- Interest: 5.375%

- Tax and Insurance: $250/mo

This tracks the first 8 months of the mortgage. Notice how the bulk of the payments are applied to interest, with only a tiny sliver going to the principal?

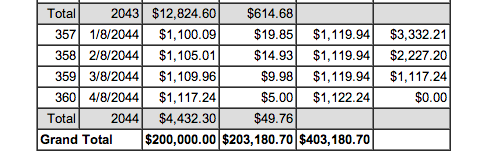

Okay, now climb into our Time Machine, speed ahead to the year 2044, and look at our payments.

Notice how the majority of payments are applied towards principal, with only $5 on interest at the end?

(Yeah, this is how I spend my Saturdays. #NerdAlert)

Let’s recap:

- If you invest, you earn compound interest, which is sexy.

- If you pay mortgage interest, you’ll only pay simple interest (yay!!), but you’ll pay on an amortized schedule (boo!!).

If your head hasn’t exploded yet, check out the next “Keep the Mortgage” argument:

“‘Cuz We Are Living in an Inflationary World”

(Sung to the tune of Madonna’s Material Girl)

If you have a fixed-rate loan, inflation is your best friend.

Thanks to inflation, you’ll repay your loan in cheaper-and-cheaper dollars over time. Today, your monthly mortgage payment is $1,400. That same $1,400 could buy you roundtrip airfare from New York City to Christchurch, New Zealand.

In 2044, your mortgage payment will still be $1,400, but thanks to inflation, that money will only cover a quick hop from New York to Chicago.

Major point in favor of keeping the mortgage intact, and investing instead.

(P.S. Actually, your future mortgage payment will be a little higher due to taxes and insurance. But since those expenses will burden you regardless of whether you carry a mortgage or not, we’ll leave them out of the equation. Death and taxes, right?)

Speaking of taxes …

Mortgage Interest Deduction on Taxes

First, an important Public Service Announcement:

Never spend money for the sole purpose of a tax deduction. You’d spend $1 for the sake of saving 33 cents.

That said, I’d be remiss if I didn’t at least mention that your mortgage interest is tax-deductible, which lowers the “effective” interest rate on your loan.

For the sake of a simple example, let’s say you paid $10,000 in mortgage interest this year, and your overall tax rate is 25 percent. (Not your top marginal bracket, but your overall rate.) You’d save $2,500 in taxes.

(This is a rough number — there are more complex factors that come into play.)

You’ll get the biggest tax-deduction impact when your mortgage is fresh and new. Your tax deduction will shrink as you progress along the amortization clock.

The Contender in the Ring: Crush Your Mortgage ASAP

The dark-horse contender fighting in the ring, eager to claim championship victory for himself, is the “Crush Your Mortgage” contender.

This fighter has fervent supporters among a minority niche.

If you fight for the Anti-Debt Army, mortgage freedom is the ultimate victory.

Mortgage freedom is rare. When most people say “I’m debt-free,” they mean: “I’m debt-free except for my mortgage.”

In America, it’s assumed that every homeowner carries a mortgage until age 55-65+. Breaking free is a defiant act of rebellion.

But should you crush your mortgage?

Let’s look at the arguments in favor:

#1: Lower Debt-to-Income Ratio

Let’s assume you’re a rental property investor. You have a mortgage at 5 percent. New 15-year mortgages are being offered at 3 percent, and you’re hungry for a slice.

You have two choices:

a) Refinance your current mortgage.

b) Decimate your mortgage so that you can qualify for a new mortgage (on a new house) at 3 percent.

Both are solid options. If you can wipe out your current mortgage in a short timespan (before rates will rise), you might be better off clearing the slate so that you can qualify for another mortgage.

“Um, Paula, WTF?”

I know, I know. It sounds ridiculous to crush debt in order to take out more debt. So let’s move to Reason #2 —

#2: Better Cash Flow

Crush your mortgage, and your cash flow will skyrocket. (Wheeee!)

- If you’re an owner-occupant, you’ll keep a huge chunk of your paycheck.

- If you’re a real estate investor, you’ll keep a massive chunk of your rental income.

You win, either way.

You can then invest every dime of the money that would have gone to mortgage payments. In an index fund, you may make long-term 7-9 percent returns without the added risk. (Or you can buy your next rental property in cash.)

This is one of the most compelling arguments I’ve ever heard for crushing your mortgage. And so is the next one —

#3: Humans are Imperfect.

It’s grand to ask, in theory, “Should you pay off your mortgage or invest?”

In reality, though, how many people will actually invest that money? How many will spend the cash on steak dinners, pedicures, brand-new cars, handbags, and trips to Aruba?

Furthermore — (and this is the argument that really gets me) — will you then feel guilty while you’re enjoying those activities? Will you surf the waves in Costa Rica while thinking, “I’m borrowing for this trip, via opportunity cost?”

BTW: You can’t think this way. You’ll drive yourself nuts. #AskMeHowIKnow.

Ironically, the only way to stay sane is by embracing a little economic irrationality.

Speaking of economic irrationality …

#4: Would You Invest a HELOC?

Ready for some cognitive dissonance? (Am I ever!!)

Would you borrow a home-equity line of credit (HELOC) or a cash-out refinance, and put that money in the stock market?

“Heck no!”

Really? Why not?

What’s the difference between borrowing against your home equity and putting your money in the market, rather than using that cash to build more home equity?

“Um … those loans have closing costs.”

Fine. Imagine that I’ll give you the $2,000 to cover closing costs, if you take a massive loan against your house and shove all that money into the stock market.

“Uh, I still don’t want to.”

Why not?

“It’s uncomfortable.”

Again, what’s the difference? Aren’t you borrowing against your house, either way?

“Uh …”

Boo-yah!

This is one of the most compelling “Crush Your Mortgage” arguments I’ve heard.

Actually, it’s a great litmus test. Would I be willing to borrow against home equity and use that money to buy more rental properties? You betcha. Absolutely. In fact, that’s how we bought House #4.

But would I be willing to borrow against home equity and give it to Wall Street? Hahahaha … No.

No-no-no-no-no.

Championship Victor

Which fighter wins the round? “Crush Your Mortgage” vs. “Keep Your Mortgage”?

There’s no clear victor.

There are rock-solid arguments for both.

You’ve gotta call the winner in your own game.