Finance nerds have strange habits.

Here’s one of mine:

Once a year, I lock myself in a room with nothing but a laptop, spreadsheet, and boatloads of determination.

The mission: Decipher my savings rate.

Am I saving 30 percent of my income? 40 percent? 60 percent?

As longtime readers might recall, my then-partner (now ex) and I saved half of our income in 2012. We did this by following one simple rule: Pretend we’re a one-income couple. Live entirely on one partners’ salary, and invest 100 percent of the others’ (after taxes).

Since we earned roughly the same amount, we ended up investing about 50 percent of our income in 2012.

In 2013, we didn’t follow any strict rules about spending from one bank account or the other. But both of our earnings escalated, and I suspected this might translate into a turbocharged savings rate.

(After all, the best way to fast-track your savings is by earning more, and saving every dime of that extra income.)

I crunched the numbers, and made two shocking discoveries:

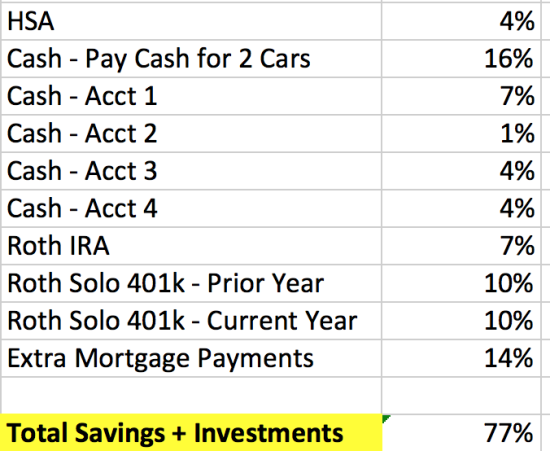

- We have a 77% savings rate

- That statistic is meaningless

Here’s why that factoid is crap – and how to find the metric that really matters.

Measure the Metric That Matters

I don’t want to wax philosophical – at least, not too much.

But before this conversation can continue, we need to discuss an important question: How do you define ‘savings’?

Is saving the absence of spending? Is it the money remaining at the end of the month?

— Or —

Is it cash that’s set aside for a specific goal?

If so — Does the timeline of that goal matter? Does it qualify as “savings” if the goal is five years away? Five months? Five days? What’s the cutoff?

Furthermore, does the content of the goal matter? Are certain goals, like retirement, more worthwhile? What about world travel – is this a worthy goal, or a frivolous expense?

You can see where the definition of “savings” gets hazy.

Here’s the crux of the problem:

“Savings” is money that you’re setting aside for the future. Which means that “savings” is deferred spending. When you save money, you’re saying: “I’ll spend this later.”

But spending later won’t get you closer to financial freedom. There’s a better metric that we can track — one that’s even more important than savings. (We’ll come back to that metric in a moment.)

But first:

Back to my meaningless savings rate.

****

This issue arose during a conversation with a friend who happens to work as a financial planner. We were chatting about income (yeah, I’m a fun conversationalist) and he asked how much I had saved in the past year.

I took out my laptop, showed him the spreadsheet … and drew a blank.

Because here’s what it says:

Look at that second line-item: “Pay Cash for 2 Cars.”

Last year, both of us paid cash for our cars. I bought a 5-year-old Honda Civic; he bought a 7-year-old Acura.

So …

Is this “savings,” because we saved enough money to buy cars in cash? Or is this “spending,” because we spent the money on cars?

“It’s savings,” my financial planner friend remarked. “‘Spending’ is month-to-month.”

I contemplated that remark for a long time. I’m not sure if I agree — but then, it doesn’t matter.

Because within those reflections, I realized: We’re discussing the wrong metric. Savings won’t bring you financial freedom. Investing will.

That’s the metric we should track.

Saving is Awesome … But Investing Creates Freedom

Savings are great. They help you pay for big-ticket items like cars, graduate school, medical bills, world travel and a wedding. But savings – alone – won’t help you achieve financial independence.

“Savings” is a feel-good word that means, “I’ll spend this money later.” While that’s great for buying big-ticket stuff, it won’t move the needle on creating your life’s freedom. It won’t help you reach the retire early.

“Investing,” on the other hand, allows you to supercharge your net worth.

So …

I need to throw away my so-called savings rate, and focus on my investing rate.

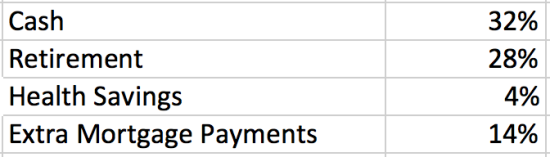

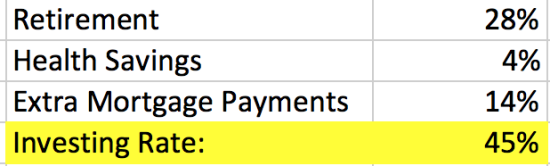

I tightened those line-items into a more condensed version. Here’s the breakdown:

Let’s attack this.

“Cash” represents money that will morph into refrigerators, washing machines and other junk that doesn’t command a return. Sure, these purchases are important — I need a fridge to keep my food cold — but it won’t move the needle.

Let’s throw it out.

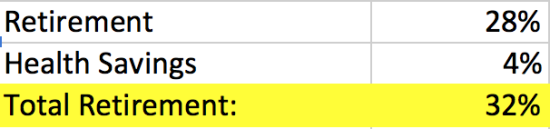

Next, let’s look at the “Health Savings” line.

Prior to a few months ago, I would have thrown out that line for the same reason – this money will get spent on wisdom tooth extractions and blood tests. (Those are important expenses, for sure, but our mission is to track financial freedom.)

But then I learned how to hack your HSA: leave money inside the account, so it can grow tax-deferred. Pay out-of-pocket for medical costs. Conceptualize the HSA an a “bonus” retirement account.

Brilliant idea. I can’t believe I didn’t think of that.

So my total retirement investing rate is:

Next come the extra mortgage payments. I’m paying down my rental properties (so that they’ll produce even stronger passive income.) Extra principal payments comprised 14 percent of my income last year.

What happens when we add these figures?

Now we’re reading the metric that matters.

We’re focused on investing, not savings.

And that moves the needle.

Updated in 2020 to reflect relationship status.