You can smash almost any limit.

You can escape the cubicle. You can fire your boss. You can overcome your internal self-doubts.

You can sculpt a flat stomach, make dozens of new friends, and speak a foreign language. Heck, you can even learn to dance.

Limits don’t apply to you.

Well, most limits.

Unfortunately, there’s one limit that we can never shatter: our time on this planet. Time is our most limited, and therefore our most valuable, possession.

Yet the majority of us are trading that precious resource, time, for something that’s near-infinite in quantity, money.

That’s unsustainable. Keep it up, and we’ll exhaust our supply of time.

But there is a way out.

You see, money is a renewable resource. It can automatically regenerate itself. Money is self-sustaining.

Time is not. It’s limited, it’s non-renewable, and once it’s gone, it’s gone forever.

Rather than trade time for money in perpetuity, it makes far more sense to momentarily trade time for money, and then harness that money into renewing itself.

Lather, rinse, repeat. Soon the money will sustain itself enough that our time becomes fully ours again.

****

But we can’t quit the time-for-money trade tomorrow. Freedom comes in stages. And that’s why I’d like to chat about three types of freedom:

- Debt Freedom

- Location Freedom

- Financial Freedom

Stage One: Debt Freedom

This variety of freedom is self-explanatory. When you experience Debt Freedom, you don’t owe a dime to any lenders. Screw you, MasterCard!

Many people describe Debt Freedom as the day that they felt a massive, crushing weight lifted off their shoulders.

I applaud them, but I have to admit, I’m also a little bit befuddled by that description.

Because even after you’ve achieved Debt Freedom, you still have the rather irritating responsibility of needing to feed, bathe and clothe yourself and your family. And unfortunately, you must resort to the dreaded time-for-money exchange to achieve this.

That’s why the quest for freedom can’t stop here. Debt freedom is the starting point on a much longer journey …

Stage Two: Location Freedom

Location Freedom is the ability to spend your time anywhere on the planet, anytime you have a hankering to travel there.

Want to explore the jungles of Borneo next week? Sip coffee in Paris? Snorkel the Great Barrier Reef? You got it.

You live in the 21st century, you lucky duck, and that means that you possess more location flexibility than any human being at any point in history. You have cheap airfare + ubiquitous internet connectivity at your disposal, and by golly, you’re not going to squander that opportunity.

Location Freedom is a stepping stone. Some people leap from Debt Freedom to full-fledged Financial Freedom without experiencing this intermediate level along the way. They trade a few grueling years of shackled hard labor in order to fast-track a lifetime of passive income.

Other people, myself included, cultivate Location Freedom to make those intervening years more enjoyable. We tend to prefer “multiple mini-retirements” throughout every stage of life.

Stage Three: Financial Freedom

Financial Freedom is the ultimate independence. You no longer need ride the time-for-money carousel.

At this point, you can do anything you damn well please. If your job is your life’s mission and calling, and you’d love nothing more than to continue working, you’re free to continue working. Likewise, if you want to move to Tahiti and read books on the beach all day, you’re free to do that as well.

Here’s Where We Get Nerdy …

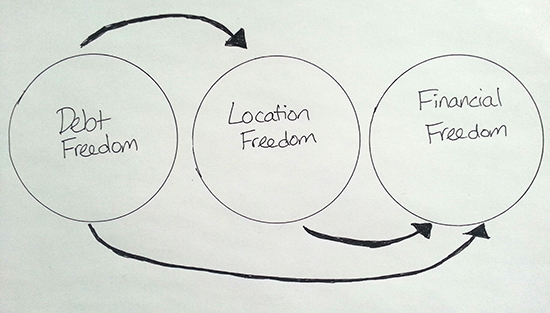

Now here’s a head-scratcher: Are these consecutive levels, like you’re advancing from freshman to senior year? Or can you leap from one stage to the other as though you’re playing hop-scotch?

I’ve laid these out as stepping stones that gradually carry you across the freedom spectrum. Like this:

(Yeah, I hand-drew this. Because I suck at Photoshop.)

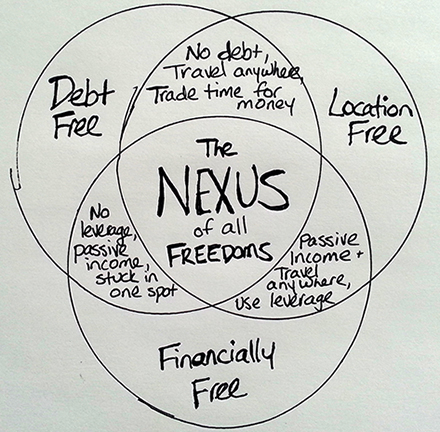

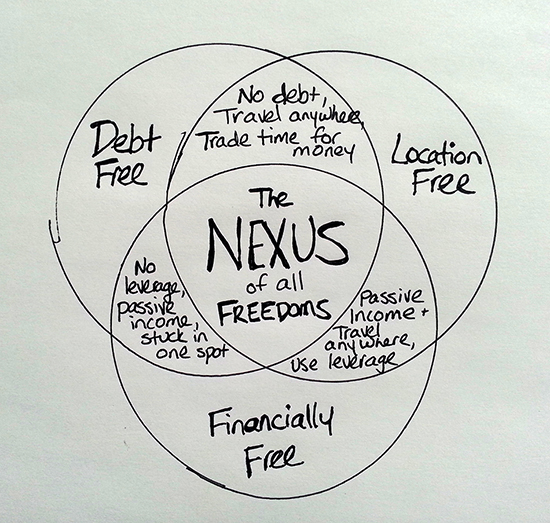

But some people say all three are independent of one another. You can hopscotch from one stage to another.

Kinda like this:

Who doesn’t love a good Venn Diagram? (C’mon, humor me.)

Who’s right? I’m don’t think it matters.

People can get stuck spinning their wheels about Awesome Life Theory. They’ll spend an hour debating between the four types of retirement. Or they’ll argue that this whole model isn’t scalable because “if everyone ditched the cubicle, our economy will collapse.”

They’ll postulate and rationalize and absolve themselves of any need to improve their station in life. Then they’ll battle rush-hour traffic, sit in a crummy cubicle with a flickering florescent light overhead, and fume that the cards are stacked against them.

Instead of debating Awesome Life Theory, how about taking some action? Pay an extra $200 towards your debt. Negotiate with your boss to work remotely every Friday. Put $100 into a dividend stock fund. Toss an extra $400 into your savings accounts. Read one book about how to buy a rental property. (Better yet, buy the damn property).

If conceptualizing the three stages of freedom as a linear 1-2-3 progression motivates you, then embrace that worldview. If conceptualizing the three stages as a Venn Diagram / game of hopscotch motivates you, do it. If adopting a totally different paradigm lights a fire under your butt, then go for it.

Just don’t sit around debating the minutia of awesomeness.

Instead, take action. Start smashing limits. Start building a big ol’ heap of savings. Start negotiating with your boss, or building your side business, or buying some investments.

Reclaim your time. It’s all you’ve got.