There are countless lazy articles on the Internet about how to save more money, 99.9% of which are detached from reality.

This is not one of those.

Everyday I get emails from readers that say things like:

- “I want to travel / quit my job/ retire in 10 years. But I don’t have the savings.”

- “I have big dreams … and big debts.”

- “There’s no way I could save more. I’m barely treading water.”

Does this sound familiar?

If so, how would you feel with a giant cash cushion at your disposal?

Imagine that you have an extra $10,000 floating around. You can crush your debts. You can invest. You can take your family on a month-long trip to Argentina. You can sleep more peacefully at night.

A magical genie isn’t going to bequeath you with $10,000. And guess what? That’s okay. You can be your own genie. You can build these savings in tiny steps, in increments of $10 or $100 or $1,000.

The best part of all? Anyone can do it.

This is where The One Percent Challenge kicks in. I’m challenging readers to boost their savings rate by one percent each month.

Why? Because anyone can find an extra one percent. And even though you’ll never miss that money, it triggers a powerful change in your life.

To calculate one percent of your income, figure out what you earn monthly. Then move the decimal point two spaces left.

- If you earn $2,000 per month, one percent is $20.

- If you earn $4,000 per month, one percent is $40.

- If you earn $6,000 per month, one percent is $60.

Boost your savings by this amount during the first month. Then continue boosting your savings by one additional percent each subsequent month. After a year, you’ll be saving 12 percent more than you were a year ago.

When I say “save,” I’m referring to any action that boosts your net worth, including:

- Crushing your debts (paying more than the minimum).

- Investing in real estate, retirement accounts, or launching a business.

- Literal savings in the bank.

This money can wipe out your student loans. It can put a huge dent in your mortgage balance. It can build investments. It can buy you a $5,894 jar of caviar. (Yeah … I get a kick out of surfing Amazon with the “price high to low” function.)

This Challenge is a bit like losing one pound per month. At first, it feels like nothing. One pound? Who cares?

But after a year, you’ve lost 12 pounds — and that feels awesome.

I invited Challengers to share their tips, advice, questions, struggles and more on within our Facebook community.

What’s Your Savings Personality?

The first thing I noticed is that Challengers tend to save in one of two ways:

- The Anti-Budgeter. Some readers open another account and hide money from themselves. Once that money is ‘out of sight, out of mind,’ they’ll naturally readjust their lifestyle. They don’t have a specific plan. They just pull savings from the top, and live on the rest. This strategy is part-intuition, part-leap of faith — and it always seems to work.

- The Pinpointer. Other readers pinpoint specifically where they’ll pull savings from. Found a cheaper grocery store? That’s an extra $10 per week in the savings account. Switched to a cheaper cell phone plan? That’s another $20 per month.

Most people practice a blend of both, but tend to lean in one direction. Intuition or numbers? Conceptual or details?

Both styles are effective. Pick whichever suits you.

Try the Anti-Budget

“I can’t save a dime. I need every dollar.”

The Anti-Budget is simple:

- Decide how much you want to save

- Pull those savings from the top

- Relax about the rest

Boom! That’s it. There’s no reason to line-itemize the amount you spend on toothpaste vs. coffee. Just pick a savings goal, hide this money from yourself, and continue living your life.

“But I seriously can’t save anything!”

Start with just one percent of your income. That’s $10 for every $1,000 you earn.

The idea that your income is precisely the same as your expenses is a mental block, a limiting belief. (You bring home $4,241 per month and your expenses are $4,241 per month? Really??)

If you’re suffering from this limiting belief, your mind might not be in mood for pinpointing savings. Fine, fair enough.

Just take a leap of faith and hide one percent of your income from yourself. Then see what happens.

Slow and Steady … or Fits and Starts

Some Challengers literally save one percent each month, while others save in leaps and bounds — such as 3 percent one month, but only a fraction of a percent the next month.

Both strategies are fine. The overall trajectory matters most — and in both cases, that trend is positive.

Back to the weight-loss analogy: you may not lose precisely 1 pound each month. You might lose 2 pounds in July, when you’re running and swimming more. But then you’ll gain 1 pound in December during the holidays. No big deal — the trend matters more than any isolated data point.

Here are two reasons saving can be sporadic:

- One-Time Costs. You might get hit with one-time or annual expenses. You move to a different state. You travel more during the summer. Your refrigerator stops running (hehe, cue the joke). Savings drops for a month, but then it’s back on-track.

- Saving in Chunks. This highlights the difference between The Anti-Budgeter vs. The Pinpointer. If you’re pinpointing precisely where your savings come from, you’ll find these in odd chunks. Switching insurance plans? That saved 2.49 percent of your monthly income. Moving to a cheaper apartment? That saved 8.32 percent. Life doesn’t happen in neat little round numbers, and that’s okay. In fact, that’s awesome.

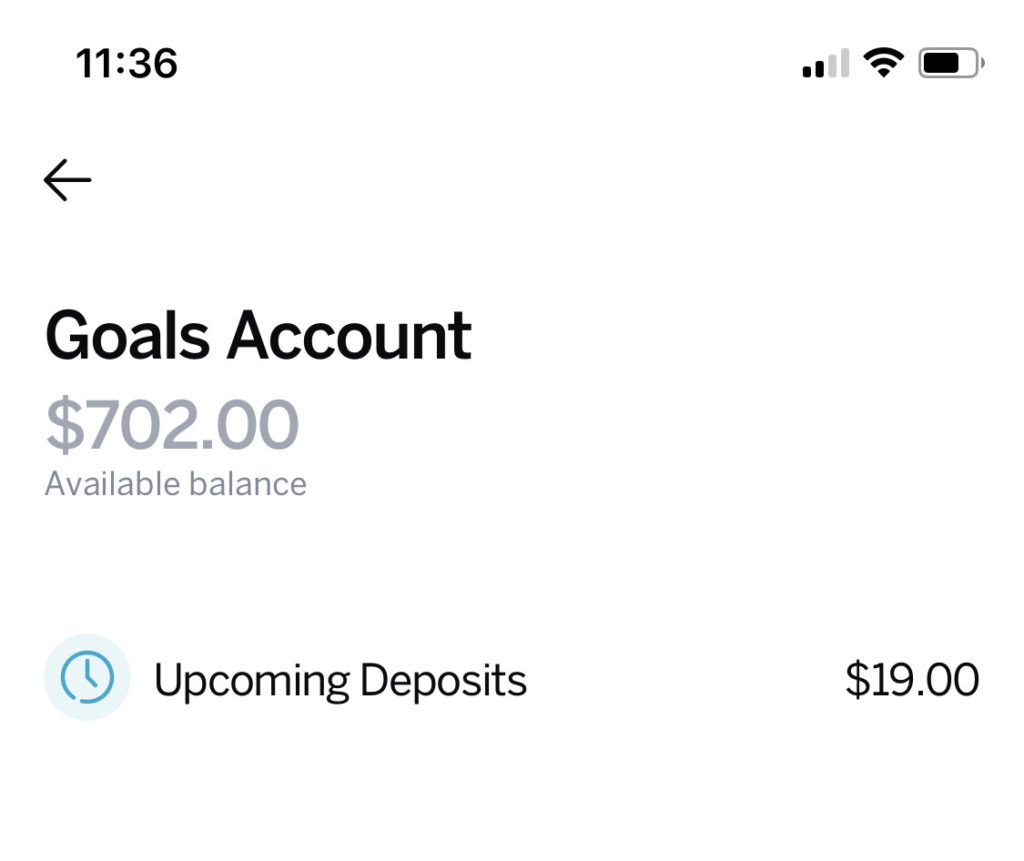

Dude, Where’s My $702?

In my younger, scrappier days, I budgeted in excruciating detail — not because it was natural, but because it was necessary. Money was so tight, I needed to pinpoint.

Now that I have more breathing room, I practice the anti-budget.

One of my friends introduced me to Qapital, which turned out to be the perfect platform for my casual money-management style. It’s a paid service that scans your spending habits and automatically tucks away tiny amounts of money into “invisible” savings. Out of sight, out of mind.

I joined on a whim a few months ago, ignored my Qapital balance for a long time, checked it today, and saw this:

Holy mackerel! Really?

The funny part is that I didn’t notice the missing $702. It came from my account in tiny increments — $7 here, $19 there — and I never felt the pinch.

So …. yeah. Big fan of these guys. I recommend checking out Qapital if you have a relaxed budgeting style. (If you use the code ‘paula’, you’ll get a bonus $25 after you make your first deposit — score!)

Recurring Savings > Willpower

Willpower is weak. Relying on sheer willpower to prevent overspending is ineffective, unreliable, and just plain sucks.

The better way to save money is by automating it into your daily life.

Yes, you should automatically pull money from each paycheck. But don’t stop there. Accelerate your automation by creating recurring savings.

Recurring savings are more powerful than one-time feats.

- One-Time: If you’re eating a Chipotle burrito and you order tap water instead of a $2 Coke … sorry, but that’s bulls**t savings. You’re spinning your wheels. A one-time savings of $2 won’t move the needle. It won’t nudge your net worth, grow your investments or help you escape the rat race. (Plus, you’ll probably spend that $2 somewhere else. It’s not ‘savings’ until you save it.)

- Recurring: If you lower your electricity bill by $20 per month AND funnel this into an account that’s earmarked for savings/investments, congratulations. You’ve actually moved the needle.

Build recurring savings of $20 and $200 and $2,000 into your life. This changes your life in ways that skipping a $2 Coke never could.

In fact, here’s a bonus challenge: Build one recurring habit into your life each month. After a year, you’ll have a dozen great habits on auto-pilot.

Here are three easy, recurring ways to save more than $1,000 per year:

- Compare Insurance Plans. One afternoon per year, compare quotes on auto/health/home/life insurance policies. Let’s say you find comparable coverage that’s $30 per month less. Boom. That’s $360 a year. You can enjoy a lot of tacos and beer for that money.

- Downgrade Cell Phone Plans. Let’s say you switch to a plan that’s $25 per month less. Voila — another $300 per year for less than one hour of work. Nice hourly rate.

- Invest in Efficiency. One Challenger switched her old lightbulbs to energy-efficient LEDs. She now saves $365 per year on her electricity bill. Time commitment? Minimal. Payback period? Quick. And her savings will continue recurring for years.

Find Your Trigger

One final savings tip: pay attention to triggers.

What happens immediately before you decide to spend money? What’s the trigger?

Here’s an example from my own life:

I used to spend a lot (more) money dining at restaurants. I tried to willpower myself to stop, but that attempt fell flat on its face.

So I began paying attention to triggers. After all, there are dozens of reasons why a person might go out to eat: convenience, taste, quality, ambiance, nostalgia, socialization. Which of these factors was triggering my drive?

I became conscious about my internal decision-making. I began paying attention to behavioral triggers.

I realized that throughout most of the day, I have no desire to head out to a restaurant. But by 5 pm or 6 pm, I’m antsy to leave the house. I’m typically home all day, usually wearing yoga pants and a messy ponytail. Hitting a restaurant incentivizes me to — you know — take a shower and get dressed. It gets me out of the house and puts me in the company of other human beings.

In other words, I don’t want a $14 cheeseburger (even though that’s what I’m buying); I want to feel like a functioning member of society.

Once I realized that, I began finding other ways to fill this same need: spend the afternoon in a coffee shop, join a gym, find a yoga studio (hey, I’m already wearing the right pants.)

The Internet is filled with countless lazy one-size-fits-all listicles on how to save money: skip lattes! Exercise at home! But these don’t honor the deep-seated triggers that drive our spending decisions.

The better way to reduce spending (or, more accurately, to redirect spending in accordance with your priorities and values) is to pay attention to triggers. Once you know why you spend, you’ll know how to find a satisfying alternative.

If you’d like to take an updated form of this challenge, we created a program called One Tweak a Week that encourages you to make one small tweak each week that will improve your finances. You can find out more about it here – it runs year-round!