The FIRE movement is misunderstood. The drama of the last two weeks proves it. The question is, how can we fix this?

Ohhh we have a new supporter!!

Last week, Suze Orman called FIRE “dumb and stupid.”

“When I was 30 I was dumb and stupid as well, okay?,” she said in an interview with Yahoo! Finance, adding that she’s “pissed off” at people pursuing early retirement.

But since then, she’s taken more time to learn about the movement — and she’s in support.

In a Facebook post titled “What I Hate — and Love — about FIRE,” Suze writes:

“Financial independence – count me in!

“Retire early – yikes, that’s where I jump off the bandwagon.

“… in my world, retirement means not working. Full stop. I was told that this was indeed the focus of FIRE, and that early was 30s or 40s, not 55. The math of that makes absolutely no sense. And I said so.

“But now I realize that I was given bad information. Retire Early for FIRE followers is not about stopping work completely. It is about stopping work that you don’t like, or just do for the money, and finding work that you actually enjoy, and that fulfills you.

“Hello! We are so on the same page. In fact, I have been telling people that they should never work at a job they hate … If you want to retire from a long commute, a corporate hierarchy you loathe and work that you don’t look forward to, I am 100 percent cheering you on. But that assumes your next goal is to segue into a new ‘career’ that speaks to you, and that yes, brings in some money.”

WHOA!! Welcome to the FIRE movement, Suze!

⠀

First, props to her for researching the FIRE movement, rethinking her position, and revising her statements publicly. ⠀

⠀

Second, I hope this is a symbol of what can happen when we listen and ask questions, rather than argue. I spent the interview trying to deeply understand her position rather than argue for my own. I did the opposite of what you see on the prime-time cable networks. And it looks like it worked.

⠀

When you model listening, others tend to listen in return. Maybe not right away. But eventually.

I read her words from London, where I’m traveling with family. I started this trip with the release of her explosive interview, and I’m ending it with her reflective remarks.

I’ve been spending the afternoons strolling through Hyde Park and Kensington Gardens and visiting free museums and doing the things a person does when they have complete control of their time. You know, FIRE life. ⠀

⠀

Her words give me a spark of hope that maybe, just maybe, other people who misunderstand the movement will come around. ⠀

⠀

Maybe more people will reject consumerism because they understand that time is more valuable than money. ⠀

⠀

Maybe it’s time.

This opens up a few remarks:

1) This Isn’t (Just) About Suze Orman.

This story isn’t about Suze. She’s the catalyst, but this story is bigger than one individual. This is about the misunderstanding of the movement.

This misunderstanding seems to stem from the word “retirement.”

“Retirement” is apparently a loaded trigger word. Everyone has their own interpretation of the R-word, which they project onto the rest of the planet.

Jacob from Early Retirement Extreme explains that there are three definitions of retirement:

- To dispose of something, e.g. “we retired that piece of equipment.”

- To grow older and collect Social Security.

- To accumulate enough assets that work becomes optional.

Most people think only about the second definition on that list. And that’s from where the confusion stems.

“When bloggers talk about ‘retirement’ concepts with the intent to reach other people, they have to use the word ‘retirement’ even if their concept doesn’t match the concept of the majority,” Jacob says. “However, many people don’t try to understand before they start complaining … It’s way easier for someone to say that they ‘somehow can’t wrap their heads around it, so therefore it’s impossible.'”

This misunderstanding gave rise to the Internet Retirement Police, a force that monitors the activities of the retired and penalizes anything involving payment. They’ve decreed that volunteering for a nonprofit is a retirement activity, but receiving payment from a nonprofit is not. Writing is a retirement activity, but publishing is not. Taking care of your children is retirement, unless your spouse works, in which case you’re a stay-at-home parent who’s not retired, regardless of your volume of assets or influx of passive income.

Just to be clear.

In order to sidestep this confusion, a handful of people — myself included — advocate dropping the R-word and referring to this concept as “financial independence.” This would allow us to stop having semantic arguments and move onto more important matters like “index funds vs. rental properties, which is more awesome?”

(Answer: Both.)

Financial independence might itself be hard to define (I call it the point at which your potential passive income is enough), but at least this phrase wouldn’t trigger knee-jerk reactions.

But there are two sides to every coin. Sure, “financial independence” wouldn’t trigger an instant backlash, but it might not build intrigue, either. The word “retirement,” for better or worse, is a more evocative term. And so the R-word word appears to be here to stay. The movement is called FIRE rather than FI, and that’s just the way it goes.

This means that some people will immediately gloss over the concept, because they “love their job and don’t want to quit.” They won’t stick around long enough to hear the FIRE movement’s response to their objection — that if you love your job, that’s fantastic. Nobody is going to drag you, kicking and screaming, away from your office. You’ll probably love your job even more when you have $1 million in your portfolio. Why not build that, just in case?

And sometimes, a major celebrity will have an extremely strong response to something that she knows nothing about.

Maybe that’s a good thing. Suze’s remarks became a bullhorn for the FIRE movement. Thousands of people who had never heard of this concept now know about it. And Suze herself has taken the time to dig deeper into the subject and find common ground.

FIRE has spread further, in part, due to the misunderstanding around “retirement” and the subsequent outcry. Many people don’t relate to it at first. But once people dig deeper into the topic, their resistance softens. Including Suze’s.

So that’s the first thing.

2) This is a Culture’s Conversation with Itself.

We cannot have a conversation about the misunderstanding of FIRE without implicitly or explicitly also talking about how we ourselves define FIRE. What is it? Could anyone achieve it? How do you know when you’re FIRE?

What are the principles? Do you have to identify as anti-consumerism, or as a minimalist, or as an enthusiastic investor and entrepreneur? What if you’re not?

What if your “fat FIRE” (a term for a well-funded portfolio) involves massive conspicuous consumption? What if you love brand-new BMWs? What if you really do want to sneeze into Gucci-branded Kleenex?

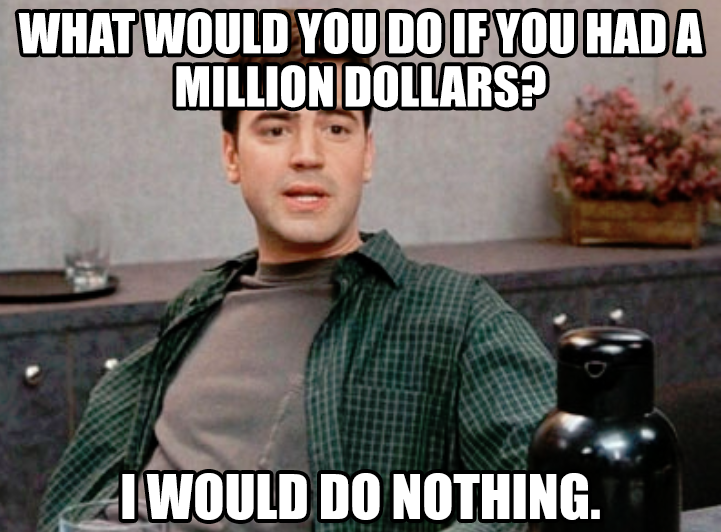

What if your version of “retirement” really does involve doing absolutely nothing? What if you dream of sitting on the couch eating Cheetos while wearing Spongebob underwear?

What do you need to believe in order to be part of the FIRE movement? Are you obligated to start a side hustle? Is DIY plumbing a requirement? What if you want to send your kids to an expensive summer camp; is that okay? What characteristics unite this community together?

These are the — ahem — “ancillary” questions (bonus points if you catch that reference!!) that stemmed from the FIRE community’s response to the Suze Orman interview.

And that’s beautiful.

Good journalism is a culture’s conversation with itself. This is what the Suze interview unlocked.

FIRE is a subculture. This is our subculture’s conversation with itself. This is our collective exploration of identity.

3) The FIRE is Growing Hotter.

The fact that this interview went viral is made possible by one crucial underlying condition: the FIRE movement is big enough to attract this level of attention.

We are big enough to be criticized. And we are big enough that this criticism turns into a headline. The FIRE is growing hotter.

First they ignore us, then they hate us, hate us, hate us. Then they listen.

4) Accept the Olive Branch

Finally, I know that there’s mixed reaction to Suze’s most recent remarks. Some people have questioned her motives, while others applaud her for learning and adapting her stance.

My feelings? I love that she’s decided to embrace the FIRE movement.

When a person extends an olive branch, accept it.

Accept it with a smile and a hug. Accept it with a dinner invitation. Accept it unconditionally.

Let’s look in one direction only: forward.

Why? Well, try this:

Go to your neighbor’s house and ask if you can watch their TV, since I’m sure you don’t own one, and if you do, you certainly don’t pay for cable.

Turn on cable news. (Then promptly turn it off.) You’ll see arguments, divisiveness, grudges. You’ll see drama disguised as current events.

Let’s be better than that.

Let’s be the haven on the Internet where people listen to a wide array of ideas. Where we ask questions with a spirit of openness. Where we role model the practice of empathy and acceptance. Let’s be the space where humans find common ground.

Let’s welcome our newest supporter to the FIRE community.

And then, let’s turn our attention to more important matters. Like index funds vs. rental properties; which is more awesome? And let’s invest in both.