One reader asks:

I’m young (23), and my fiancee and I are looking at getting her a used car to replace her old clunker.

We’re looking in the $6,000 – $10,000 range and easily have the cash to pay for the car. (This is seperate from our emergency fund, we both have 401ks, etc).

I’m a fan of the “pay cash” option. I’m a big hater on debt (neither of us have college debt).

She has heard that to build credit history for a mortgage in the future, we should take out a car loan.

We’ve both had credit cards, never missed payments but neither of us have ever had a loan in our name.

Thoughts?

— Spencer

Dear Spencer:

You’ve never had a loan in your name? Wrong.

Your credit card is a “loan,” so to speak. It’s an open line of credit. It’s one that you’ve used responsibly for years. It forms the backbone of your credit history.

By focusing on your credit card alone, you can build excellent credit. Getting a car loan to improve your credit score is a waste of time and money.

In this article, I’m going to explain the five factors that comprise your credit score — and show you how 90 percent of your score is comprised of factors that DON’T rely on an auto loan.

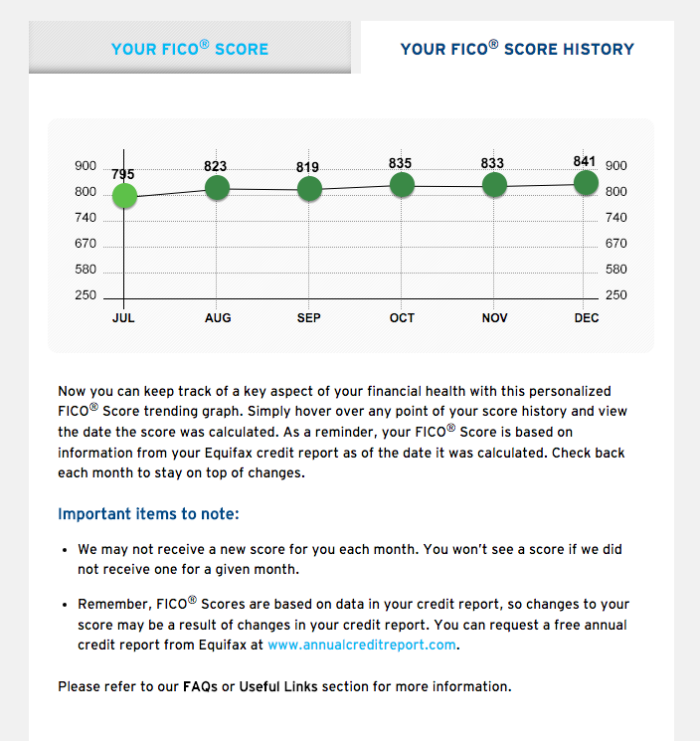

By the way, I’ve never had a car loan, and my FICO credit score is 841:

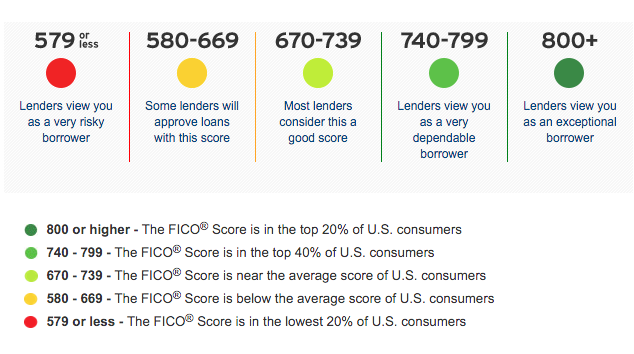

Why is this important? Because my 841 credit score allows me to qualify for the best loans on the market:

How is this possible?

How did I create this credit score without a car loan?

- I understand the factors that build credit (listed below).

- I focus on improving those factors, based ONLY on responsible credit card use (I pay the balance in full, and I’ve spent $0.00 in credit card interest over my lifetime).

Keep reading for details about how you can create an 800+ credit score …

Why a Car Loan to Improve Your Credit Score is a Waste of Money

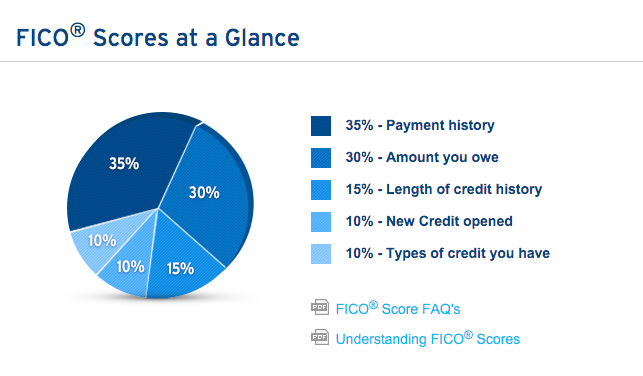

Your credit score is based on 5 factors:

#1: Payment History

Do you make on-time payments? Have you ever been late in making a payment? If so, how late — 30 days? 60 days? 90 days?

This is the single most critical factor. It counts for 35 percent of your total credit score.

#2: Utilization Ratio

How large is your outstanding balance, relative to your total credit limit?

- Outstanding Balance — How much you owe

- Total Credit Limit — The maximum you’re allowed to borrow

Ideally, you should use 20 percent or less of your total credit limit. In other words, if you have a $1,000 credit limit, you should borrow no more than $200 per month.

Here’s the kicker: This rule applies even if you pay the balance in full each month.

If you have a $1,000 credit limit and you rack up a $700 balance, you’ll be seen as someone who uses 70 percent of their total credit limit — even if you pay-in-full at the end of the month.

Best practices: Ask for a higher credit limit. Charge smaller amounts. Or — (my personal favorite) — pay off your cards weekly, instead of monthly.

Your utilization ratio counts for 30 percent of your total score.

#3: Length of Credit History

How old are your accounts?

The older, the better, which is why you shouldn’t close old credit cards, even if you’re not using them. Getting a new credit account (e.g. getting a car loan) could hurt your score by reducing the “average age of your accounts.”

Best practices: Keep your oldest accounts alive. If you don’t use that credit card anymore (e.g. perhaps you get better rewards from a different card), keep the account active by making a small monthly purchase, like your Netflix subscription, on your old credit card. Automatically pay the bill, so you’ll never miss a payment.

This constitutes 15 percent of your credit score.

#4: New Credit

No one likes a desperate fellow.

The more you apply for credit — especially in a short amount of time — the more your score drops.

Credit agencies interpret this as a sign that you’re desperate for funds. (Why else would you be asking for credit?)

And — like in dating — desperation is a turn-off.

Applying for a car loan can hurt you if you’re getting a mortgage soon.

Best practices: Avoid applying for credit (e.g. car loans, credit cards) within 6-12 months of applying for a mortgage.

This affects 10 percent of your score.

#5: Types of Credit in Use

Okay, here’s where we can make the “get-a-car-loan” argument.

There are two types of credit:

- Installment credit — You make fixed, regular monthly payments. Examples: Car loans, Mortgages, Student Loans.

- Revolving credit — You have an open line of credit, with fluctuating balances and payments. Examples: Credit cards.

Credit-scoring agencies view installment credit more favorably than revolving credit. This is where the “getting a car loan improves your credit score” myth comes from.

But the type of credit you use (installment vs. revolving) counts for only 10 percent of your total credit score. That’s not significant enough to justify getting a car loan, especially you consider that your credit score will suffer when you apply for a new line of credit and reduce your average account age.

The other four factors that I’ve listed above constitute 90 percent of your score. Focus on those.

Bottom Line

A car loan will do more harm than good — especially if you already have good credit.

The best way to build credit is to:

- Maintain one or two credit cards. (The older, the better.)

- Pay your cards in full every month. (Or every week, as I do.)

- Never, ever, EVER be late on a payment. Like, ever. (Easiest way to do this? Automatic payments.)

- Keep your “utilization ratio” under 20 percent. (Easiest way to do this? Pay in full weekly.)

P.S. – Want to check your credit score and monitor it for free? Sign up for Credit Sesame.