A few weeks ago, I received an email from Suze Orman’s publicist, asking if I’d be interested in interviewing Suze on my podcast.

“Duh,” I replied.

Suze is a legend in the world of personal finance. She’s appeared on Oprah multiple times, published 10 mega-bestselling books, and hosted The Suze Orman Show on CNBC from 2002 to 2015. She’s one of the most famous voices in this space.

I read her most recent book, Women & Money, and sketched out a framework for the interview. Then I threw it away, feeling dissatisfied with my questions, and I turned to the Afford Anything community on Facebook and Twitter.

“I’m interviewing Suze Orman,” I wrote. “What would you like me to ask her?”

Dozens of questions flooded in, but one stood out above the others: What does Suze think of the FIRE movement?

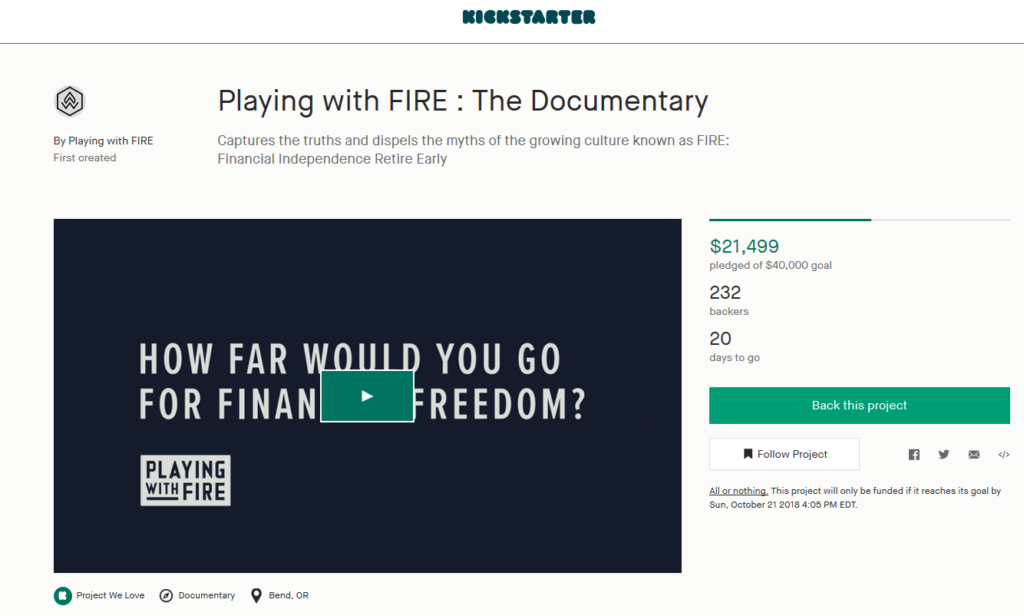

FIRE, an acronym for Financial Independence, Retire Early, is rapidly catching mainstream attention. Several major media outlets have recently run stories on the movement, and an upcoming documentary, Playing with FIRE, raised more than $20,000 through its Kickstarter campaign in only a few days.

While FIRE has existed for decades (preceding Vicki Robin’s publication of Your Money or Your Life in 1992), the movement had a surge of popularity in the last three years, coinciding with Suze’s own retirement from ages 64 to 67. She recently came out of retirement, citing boredom, which made this a perfect opportunity to ask about her opinion of the movement.

A couple weeks ago I sat down in my recording booth, which is inside of my closet, next to a pile of laundry. I sipped a glass of water. I double-checked the audio levels. I opened Skype, fidgeted, and checked Instagram out of habit. And then Suze Orman called me on Skype, and I opened the interview with a straightforward question.

“Have you heard of the FIRE movement?,” I asked.

“Yes, of course I have,” Suze said. “And I hate it.”

“Really?”

“I hate it. I hate it. I hate it,” she said. “And let me tell you why.”

She spent the next 30 minutes, approximately half of our interview, giving FIRE the “Suze slapdown.”

Suze said that $2 million isn’t enough for early retirement. At a 4 percent withdrawal rate, that’s $80,000 per year, which she says isn’t enough to protect you “when the floods come.”

“If you only have a few hundred thousand, or a million, or two million dollars, I’m here to tell you … if a catastrophe happens, if something happens, what are you going to do? You are going to burn up alive.”

Ouch.

“What if you have a $3 million portfolio, split 50/50 between equities and bonds, that you draw down at a 3 percent rate?” I asked.

She said that’s still not enough.

Hmmm.

“What if you’re a service worker, and you earn $50,000 per year, and through diligent savings and thoughtful investing, you accumulate a retirement portfolio of $2 million?,” I asked.

Then you’re fine!, she replied.

“What’s the difference?,” I asked.

The service worker will probably retire at age 65 or 70, she replied, while the FIRE enthusiast will retire at 35. And that’s the biggest mistake a person could ever make in their life, she said.

Listen to the full interview below. You don’t want to miss this one.

Or download it here:

Subscribe to the podcast to catch community reactions to the interview, which we’ll air later this week. [Update 10/6: we just aired the community reaction episode!]

And share your thoughts below.

Photo Credit: Jacqueline Zaccor