Want to retire early? You’ll need at least $5 million, more likely $10 million, says famous financial personality Suze Orman.

I should know. She said that to me, directly, on my podcast.

I asked Suze for her opinion about a frugal, flexible person who wants to retire early with a $2 million portfolio. She warned that retiring would be a massive mistake.

“Two million dollars is nothing,” Suze said. “It’s nothing. It’s pennies in today’s world, to tell you the truth.”

Wait, what?

“Listen,” she said. “If you have $20 [million], $40 [million], $50 [million] or $100 million dollars, be like me, okay. If you have that kind of money … and you want to retire, fine.”

“But if you only have a few hundred thousand dollars, or a million, or $2 million, I’m here to tell you … if a catastrophe happens … what are you going to do? You are going to burn up alive.”

But what’s wrong with retiring early on $2 million? Assuming it’s invested 50/50 in equities and bonds and harvested at a 4 percent withdrawal rate, a portfolio of $2 million could create annual investment income of $80,000. Surely that’s enough, right? Riiiight?

Nope. Suze says that’s not enough.

“I think that in the long run, $80,000, especially after taxes and as you get older, is not going to be enough. You may think it’s going to be enough, but it’s just not,” she told me on the Afford Anything podcast.

“You can do it if you want to. I personally think it is the biggest mistake, financially speaking, you will ever, ever make in your lifetime.”

I asked her if a $3 million portfolio at a more conservative 3 percent withdrawal rate would be okay for an early retirement. She said no.

“Think about it logically,” she said. Supporting a disabled family member who needs full-time care could cost $250,000 per year, she said. Ordinary cost-of-living would cost another $100,000 per year. This means you’ll need $350,000 per year after taxes to cover your costs, which is $500,000 per year before taxes, which at a 5 percent withdrawal rate means that you’d need a portfolio of $10 million.

If you don’t have at least $5 million or $10 million, don’t retire early, Suze said.

“Here’s what the FIRE people, you are not thinking about, so I’m going to give it to you straight here now,” she said.

She described the possibility of getting sideswiped by massive taxes and catastrophic emergencies. What if your home gets destroyed by an earthquake or flood and insurance denies your claim? What if you’re in a tragic car accident and you need full-time care? What if the U.S. experiences 25 percent unemployment, which means you won’t be able to find another job if you wanted one? What if your investment income gets consumed by massive future tax hikes?

“When you get older things happen,” Suze said. “You’re hit by a car, you fall down on the ice, you get sick, you get cancer. Things happen.”

“Alright, you can do it if you want to,” she said. “I’m just telling you, you will get burned if you play with fire.”

(props to reader Alexander for sharing that.)

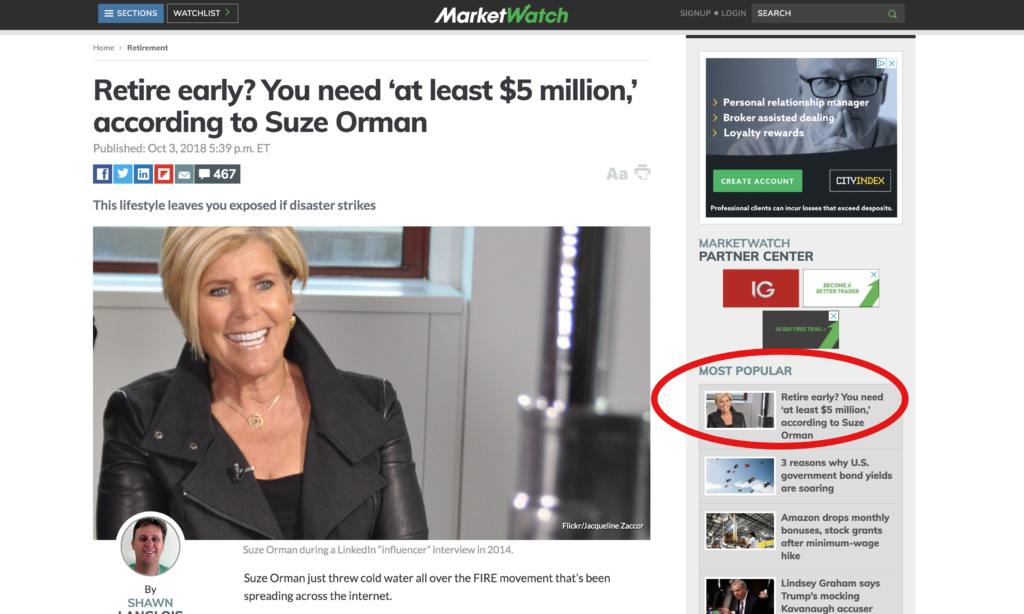

I released this podcast episode on Monday and … the internet exploded.

Our interview became the top story on Marketwatch. They later followed it with a second article offering a rebuttal against Suze’s comments.

Time Magazine (time.com), Yahoo and other major media outlets picked it up. The story hit #3 on Yahoo. The interview started trending on Reddit. Syndicated radio host Clark Howard offered a rebuttal (it starts at 19:04.) My phone blew up with texts from friends whom I hadn’t heard from in years who stumbled across the story in various, far-flung parts of the internet.

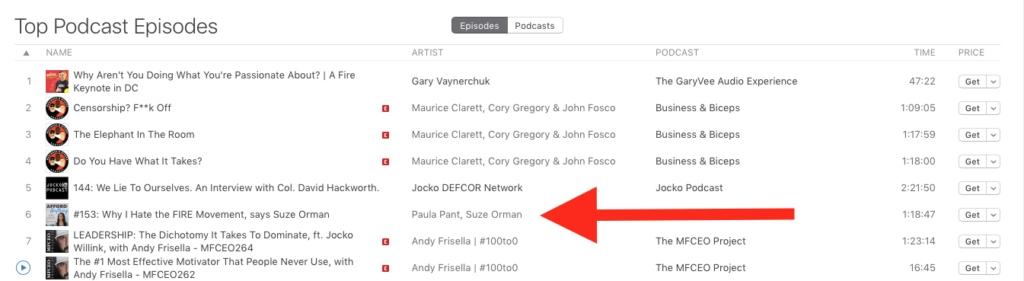

The Afford Anything podcast has been downloaded more than 67,000 times in the last 4 days. Can we pause for a second here? That’s only in the last four days! WOWZA! The episode hit the #6 spot in our iTunes Business subcategory.

More than 210 people left comments about our interview on the podcast show notes and its corresponding blog post, with hundreds more chiming in on Instagram, Facebook and Twitter. The response has been so mature and insightful that it’s (almost) restored my faith in the Internet. Person after person has chimed in to say, “I disagree, but she raises good points.” In this divisive and polarizing world, a community that recognizes nuance and celebrates intellectual complexity is a breath of fresh air.

Sure, there were plenty of ad hominem attacks (and funny jokes). But included within that came overwhelming recognition that perhaps the FIRE community should look past the delivery and examine the message, to see whether or not we can find wisdom that can help us along our journey.

Today I released a bonus podcast episode that covers the impressive community response. If you’re interested, you can listen here:

Enjoy!

– Paula

P.S. If you’d like to read the Suze interview, you can download a free transcript here:

Photo Credit: Jacqueline Zaccor