Last year I blindfolded myself, threw darts at a list of stocks, and bought the first 10 that I hit.

I let them ride for a year and showed you the results.

This year I’m embarking on a ploy that’s a tad less crazy, but far more heated:

I’m competing against 19 financial writers in a tournament to see who can rock the hottest investment gains.

Here’s how it’s going down:

#1: At the beginning of January, 20 financial writers each invested $500(-ish) across a maximum of 30 stocks. All of us received this money from Motif Investing.

#2: Each of us created a “motif,” a basket that collects the entire investment.

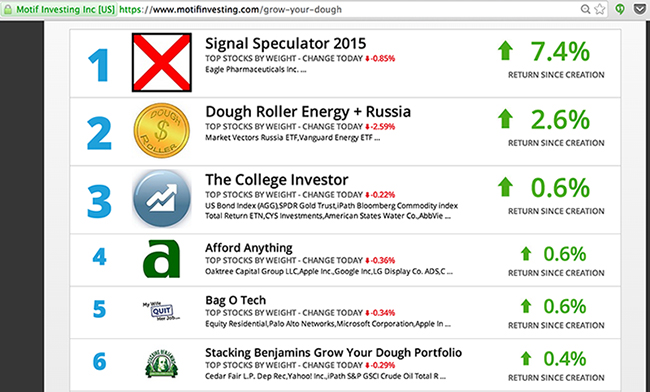

#3: Every motif is tracked on a scoreboard.

As of this morning, the Afford Anything motif holds the #4 position. C’mon, say it with me: “We’re number four! We’re number four!”

The 20 competitors will track our investments for a year.

Next January, the winner takes the crown. (Um, the metaphorical crown.)

No-Fee and Low-Fee

“Hold on — investing in 30 stocks would trigger massive trading fees. Wouldn’t it?”

Awesome question!

As I mentioned in my last article, fees consume a HUGE bite from your gains.

Back in the day, I used to pay $10 to trade a single stock. Bleech.

The errors of youth.

We’re using Motif Investing for this year’s competition, which charges $9.95 to buy a “motif” (basket) of up to 30 stocks. You can custom-build your own motif or use one of theirs.

Their motifs capitalize on the ways our world is changing, offering themes like “BioTech Breakthroughs,” “Fossil Fuel Free,” “Fighting Ebola” and “Tablet Takeover.” These motifs track companies related to a trend.

The “Wearable Tech” motif, for example, tracks everything from Garmin and GoPro (brands you know) to the behind-the-scenes manufacturers and suppliers that play a crucial role in creating the critical chips and components within every FitBit or Jawbone or Apple Watch.

Motif “mimics what many of the best global hedge fund managers do,” notes the managing editor of Forbes, Matt Schifrin.

Obviously, I prefer paying $0 in trading fees. But paying $10 to buy a curated basket of 30 stocks (that’s 33 cents per stock) is a screamin’ deal, considering that you get access to almost any stock you want.

What Did You Invest In?

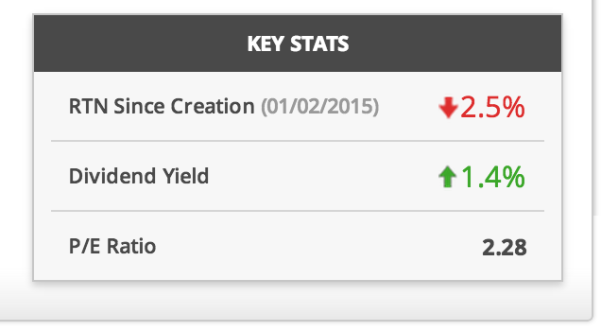

The Afford Anything motif is filled with cheap stocks. If you’re going to bargain-hunt anywhere, do it in your investments!

It features an average price/earnings ratio (also known as P/E ratio), a measure of the share price relative to per-share earnings, of only 2.28.

If you’re not familiar with P/E, suffice to say: that’s cheap. The average P/E of the S&P 500 is historically around 15 and currently 21.3.

The companies within the Afford Anything motif represent wearable technologies, diabetes treatments, energy companies and a few others.

Point. Counterpoint. What’s the Point?

“I don’t understand — What’s the point of entering this competition?”

Part of my mission is to destroy myths around investing, which include:

1) Investing is complicated.

2) Investing is risky.

3) Only rich people invest.

By showcasing investing in a fun, friendly and lighthearted way, I’m hoping more of you will feel comfortable investing.

I want to show you:

- It’s easy to start

- It’s fun

- You can start with tiny sums of money

- You don’t need a fancy diploma

Speaking of which, let’s tackle those three myths I listed above:

Myth: Investing is complicated.

Reality: Investing is a skill, like tying your shoelaces. The more you practice, the easier it gets.

Have you tried to teach a child how to tie shoelaces? (Or do you remember learning it yourself?)

Have you noticed how the kid looks overwhelmed at the complex labyrinth of twists and loops and knots?

If you don’t possess a skill — ANY skill — that action feels infuriating, overwhelming, impenetrable.

But once you’re practiced, that action becomes old hat. You can tie your shoelaces while jamming out to music and thinking about an upcoming meeting and gnawing on a burrito filled with four types of salsa and extra guacamole. (Wait, is that just me?)

Investing is the same — regardless of whether you’re operating in the world of index funds, rental properties or analyzing sector-specific funds. When it’s new, it feels complex. Once you know what you’re doing, it’s infinitely easier.

(By the way, check out my Ultimate Beginner’s Guide if you’re new to this scene.)

Myth: Investing is risky.

Reality: Investing is risky if you don’t know what you’re doing.

The word “investing” is that this term gets thrown around by people who are speculators and gamblers, rather than true investors.

- “I’ll buy this rental property, even though it doesn’t come close to meeting the one percent rule, because I’m hoping it’ll rise in value.”

- “The markets rose 12 percent last year. It’ll do the same this year, right? Riiiighhhtt?“

- “I bought 400 shares of XYZ Corp. at $8 per share and sold them a week later for $12. I made $1,600 in a week! I’m a pro!”

What’s the common thread? There’s no strategy in the statements above. Hope is not a plan.

Myth: Only rich people invest.

Reality: That makes as much sense as saying, “Only healthy people eat well and exercise.”

“Investing” isn’t confined to only the stock and bond markets. Investing encompasses creating any asset — such as launching your own business, selling your own creative works, or building a portfolio of rental properties.

You’re a rebel. Think outside the 401k.