The investor community is split into two factions: FIRE vs. YOLO.

The YOLO crowd includes the people who read Reddit’s r/WallStreetBets, who chase speculative trades, who place margin trades on Robinhood.

They share stock tips on Discord and bet on whatever appears in their chat feed. Earlier this week they piled investments into Galway Metals, Inc., briefly shooting up the trading volume, for no reason other than that its ticker symbol is GAYMF.

They poured into Dogecoin last night, a cryptocurrency with the face of a dog that started as a joke, causing the price to skyrocket 205 percent in a single day.

They’re placing margin bets on GameStop, triggering a short squeeze, and riding it to the moon.

They treat the stock market like a casino; they feed off tales of survivorship bias. They’re seeking alpha*, buying meme stocks**, and turning their $600 stimulus checks (“stimmies”) into the ultimate prize: enough profits to purchase a meal of chicken tenders, or “tendies.”

They’re nothing like the FIRE folks.

The FIRE crowd is passionate about index funds, passive investing, and long-term buy-and-hold. We prefer Vanguard over Robinhood and embrace the Boglehead investing philosophy.

We hope to keep pace with the overall market, not beat it, and we cite academics and advisors with peer-reviewed research to back up our ideas.

We debate about whether the 4 percent withdrawal rule is too conservative or aggressive; should it be adjusted to, say, 3.5 percent – 4.5 percent? We agonize over asset allocation and wonder whether we should add a REIT or international equities component to our two-fund portfolio. We know the expense ratio on our Vanguard target date fund.

The YOLO crowd thinks the FIRE crowd is boring, slow, conservative.

The FIRE crowd thinks the YOLO crowd is bro-ey, speculative, and unmoored from reality.

For years, the FIRE and YOLO camps maintained a peaceful coexistence, blissfully ignoring one another, each crowd living in its own universe.

We were content to ignore them; they were content to ignore us.

That changed yesterday.

Yesterday, major trading platforms did something so outrageous that their actions triggered a Congressional request for a Dept. of Justice investigation, inspired a class action lawsuit, and rapidly united the FIRE and YOLO camps into strange bedfellows.

What did they do?

They blocked us from the markets. They didn’t let us trade.

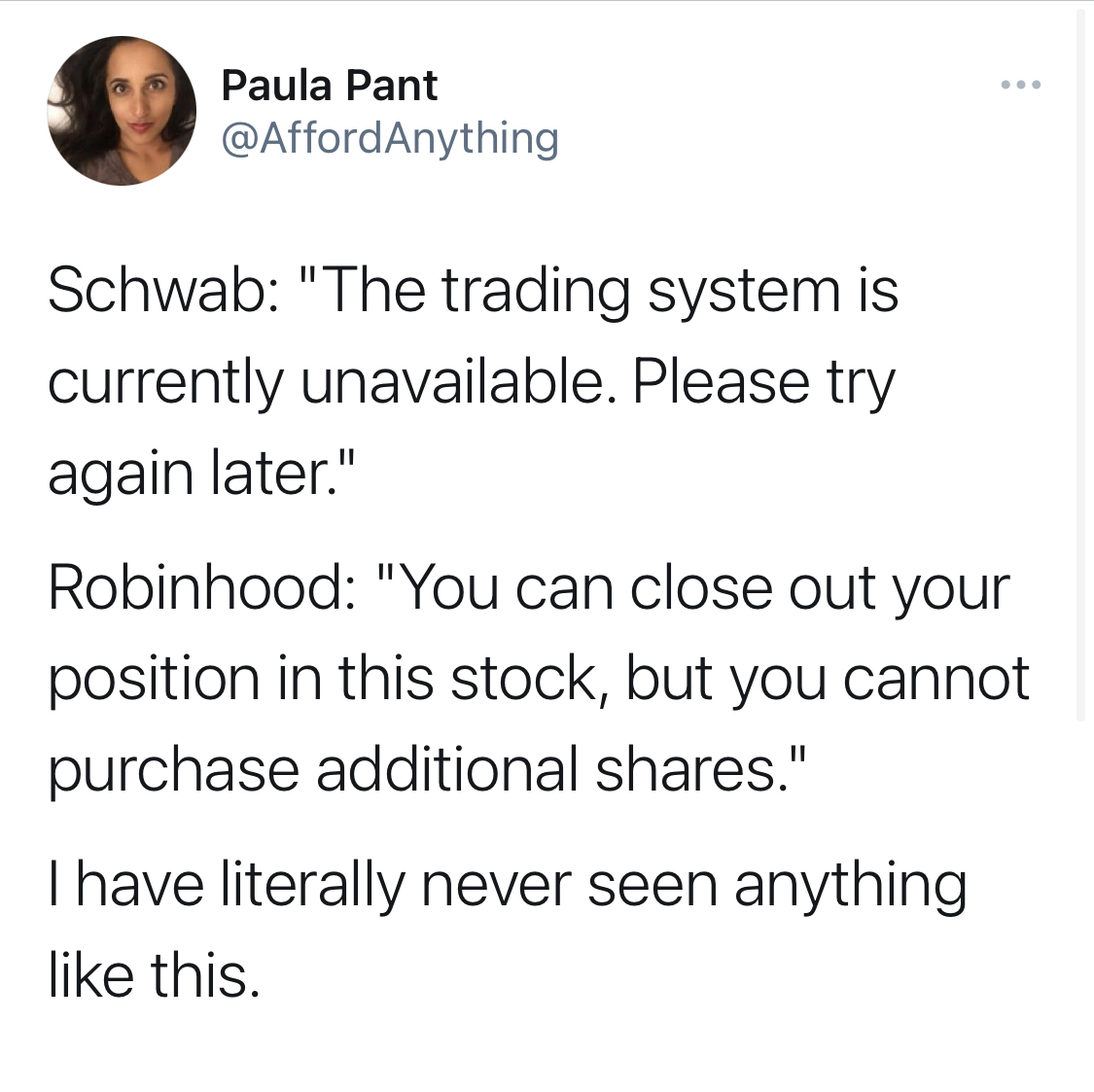

Yesterday, almost every major brokerage, including Robinhood, Schwab, Ally, Fidelity, and TD Ameritrade, halted trades on many high-profile stocks, freezing retail investors like you and me out of the game.

They targeted the trading freeze on stocks targeted by the Wall Street Bets subreddit, including GameStop, Nokia, Blackberry and AMC Theaters.

This means individual investors — you, me, Grandma — literally could not get in on the action.

To be fair, this is standard protocol when prices change too rapidly; it’s a safeguard to prevent another 2010 ‘flash crash.’ But typically, these types of trading halts affect everyone, both institutional and individual investors alike. That didn’t happen yesterday.

Individual investors (also known as ‘retail investors’) who wanted to sell were sidelined, watching prices fluctuate on assets that they wanted to liquidate, but couldn’t. They watched their gains evaporate while only a limited segment of the market — the major hedge funds and institutional investors — could freely transact.

Congressman Paul Gosar, in his request for a DOJ investigation, described this as “a concerted effort to de-platform and silence individual investors.”

When trading resumed, many brokerages — most notably Robinhood — only offered one-way trades: you could sell, but you couldn’t buy.

This is a move that drives markets. If the only choices are to hold or sell, eventually retail investors must unload, driving prices down. It reeks of market manipulation.

It outraged every individual investor.

Yesterday, FIRE and YOLO united under a common banner:

Let the people trade.

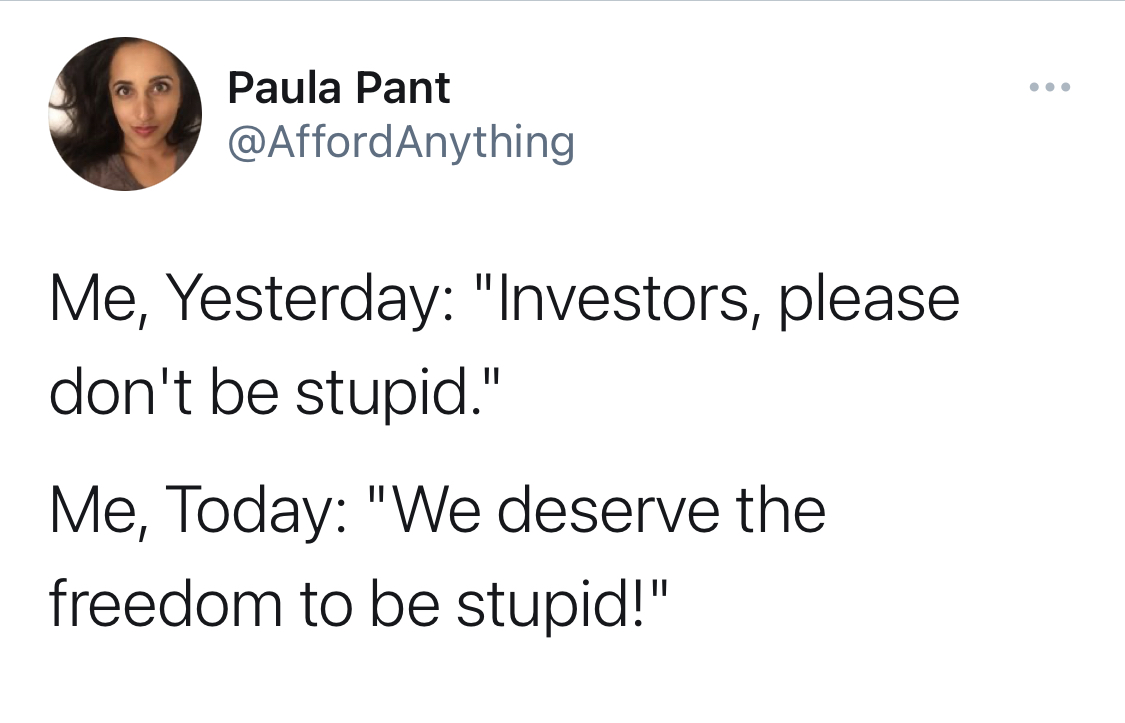

On Wednesday afternoon, I recorded a 20-minute podcast episode outlining the FIRE perspective on the GameStop rise.

I explained the history of meme stocks, the mechanics of short sales, and how the speculative frenzy over GameStop can be framed into a broader context.

On Thursday morning, when trading halted, I recorded another 9-minute episode explaining why this is an affront to all individual investors.

“Yesterday, I advised you not to be stupid,” I said. “Today, I defend your right to be stupid.”

If you want a rundown of everything that’s happened this week, listen to those two episodes.

There’s enormous context and depth to this story.

It’s a David vs. Goliath narrative — with a myriad of reasons why that narrative shouldn’t be taken at face value.

It’s a behind-the-scenes story of market makers and high-frequency traders.

It’s a story involving SEC regulations, credit line limits, and unanswered questions about decisions made in the days before the trading halt.

It’s a story of social media vs. Wall Street …⠀

… and the innocent bystanders who get caught in the crossfire. ⠀

It’s a story of stonks, stimmies, tendies, and the rise of meme stocks.

It’s a story of market manipulation and the reality that a subreddit can move markets faster than the Treasury Department. ⠀

I’ll write a detailed article next week providing context and history around Wall St Bets, GameStop, and the rise of meme stonks.

For the moment, if you want a primer on the craziness of this week, here’s where to look:

- Listen to both the 20-minute episode and following 9-minute episode for a rundown.

- Tune in on Twitter and Instagram, where I’m publishing the latest updates in real time.

Until next week,

Paula

*“seeking alpha” is a phrase used by investors to indicate that they’re aiming for better-than-market returns.

**a “meme stock” is any stock that gets bid up based on a groundswell of enthusiasm from individual investors, not as a result of fundamentals but rather as a result of flash trends.

Credit for tweets: @joelight and @netw3rk