Pop quiz: You’re buying airline tickets to visit grandma for the holidays. She lives on the other side of the nation, too far away to drive.

Pop quiz: You’re buying airline tickets to visit grandma for the holidays. She lives on the other side of the nation, too far away to drive.

You’ve budgeted $400 for holiday travel, but you can’t find airfare for less than $575.

What do you do?

a) Tell grandma she’ll have to spend Christmas alone.

b) Spend it. You’ll claw the money from somewhere else — maybe you’ll cut back on restaurants or skip your spring vacation.

This is just a hunch, but I’m willing to bet that most people pick Option B.

Next question: Your adorable kitten (or puppy) needs an emergency life-saving procedure. It’ll cost $400. You don’t have a dime in savings.

What do you do?

a) Kill the kitten!

b) Spend it. You’ll figure out some way to come up with the money before the end of the month, even if it means mowing lawns, shoveling snow, teaching guitar, picking up freelance work, or selling the junk that’s piled up in your garage.

I’m certain you’ve picked Option B. (In fact, some of you are probably offended that this is even a question. Who would chose Option A?!)

What’s the common thread between these two scenarios? Ruthless prioritization. If something is important enough, you grit your teeth, furrow your eyebrows, and find a way to make it happen. It’s during these moments that you realize: “I really can afford anything. Not everything, but anything.”

But what if you can avoid these financially stressful situations altogether? What if you save ruthlessly in advance, so that when emergencies crop up, you’re completely chilled out?

Yank Your Savings from the Top; Go Wild with the Rest

I’m a massive advocate of the easiest, laziest, more awesome budget hack: Yank your savings from the top and go wild with the rest.

Here’s how it works:

- You get paid. (Yippee!)

- You instantly pull your savings from the top. Set up automatic transfers into a combination of savings, investment and retirement accounts.

- Force yourself to live on whatever is leftover.

No tracking pennies, no scrutinizing receipts. No brainpower whatsoever. (Which is why I like it. Hey-o!)

Health and fitness bloggers advocate various types of diets — paleo, primal, vegan, raw food, wheat belly, whatever — based on the idea that if you’re eating the “right” foods, like vegetables, you don’t need to bother tracking calories. You won’t gain belly fat by binging on broccoli and brussels sprouts, and counting calories is a chore that has low long-term adherence.

In other words: If you want to give yourself the best chance of success, make a plan that’s as easy as possible.

Take a minimalist approach. Swallow — as Tim Ferris says — the “minimum effective dose;” the smallest dose needed to gain results.

This budgeting hack is the equivalent of not counting calories. It’s impossible to overspend if you’ve pulled your savings off the top first.** And since those savings are tucked away somewhere safe, you can run wild with the rest of your money, guilt-free.

It’s the anti-budget: the budget for people who hate budgets.

“But I Can’t Save!” and Other Limiting Beliefs

Every time I advocate this budget hack, someone emails me to say:

“I don’t earn enough to start saving. I need every dollar.”

Fascinating. You’re telling me that your take-home pay is $2,772 per month, and your expenses are exactly $2,772 per month? That’s a mathematical impossibility.

“Actually, it’s a mathematical improbability.”

Whatever.

“I can’t save” is a limiting belief – a false belief you acquire through negative influences. Once you adopt and internalize this belief, it becomes true — until you let go of the belief.

Examples:

- “I’m bad at running.” (I was the slowest runner in 4th grade. As a result, I continue to believe I’m a terrible runner — and because of this ridiculous limiting belief, I avoid running, creating a self-fulfilling prophecy.)

- “I’m bad at sports.” (Ditto.)

- “I’m bad at computers.” (I’m probably good with computers. But I continue to believe I suck because I didn’t learn DOS commands in the 1990’s.)

Likewise, “I can’t save” is a mental block, not a logistical one. If you lack confidence in your ability to be resourceful, committed and creative, you might adopt the belief that you can’t save. This is a psychological barrier, not a mathematical one.

The best way to break this barrier is by proving to yourself that you have this innate ability. And the most effective way to do this is one step at a time — or, in this case, one percent at a time.

Here’s my challenge to you:

Starting today, save an additional one percent of your earnings.

If you normally save nothing, save one percent. If you already save 5 percent of your paycheck, save 6 percent. If you currently save 10 percent, save 11.

“How much is that?”

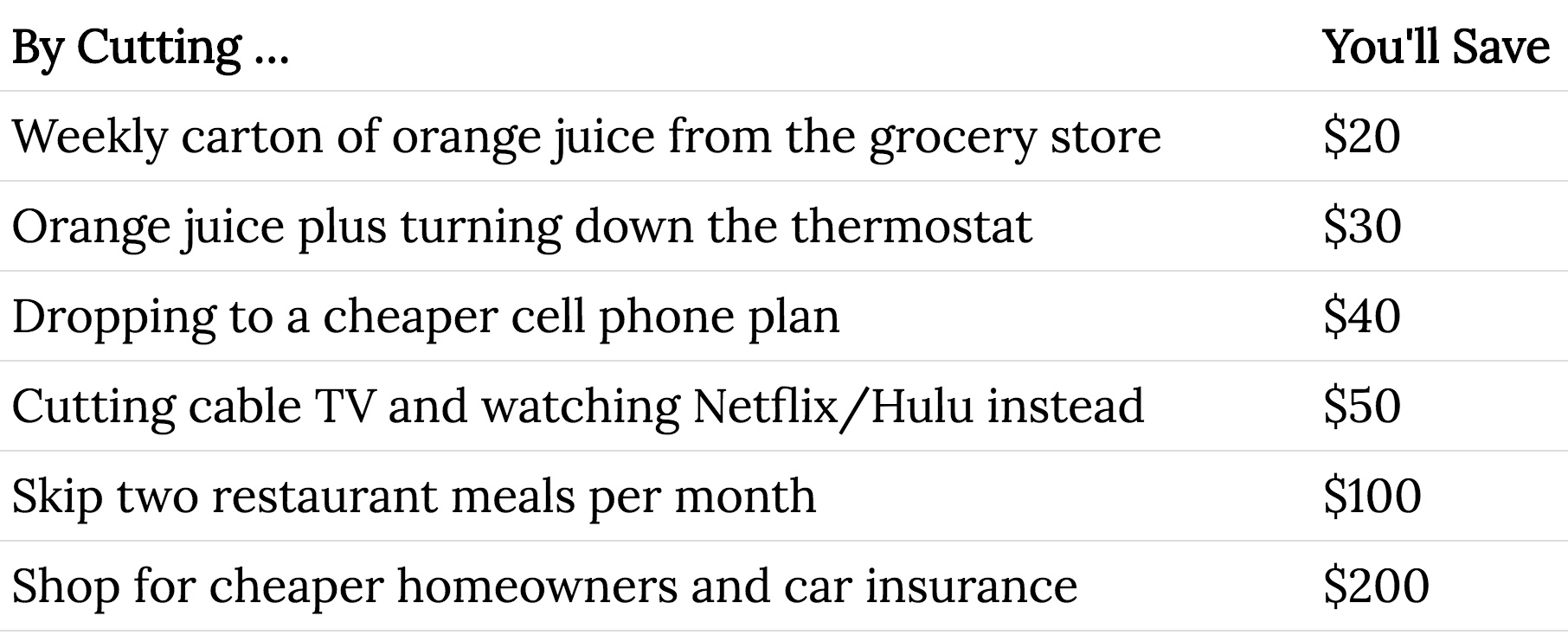

Lop off the last two digits of your monthly income. If your after-tax income is:

“I don’t know how much I currently save.”

Don’t worry about that. Just save one percent more. Do you know what you earn? Then check out the chart, figure out the value of one percent, and shovel that much more to the side.

Set up an automatic transfer that directly puts that money into a high-interest savings account.

Adjust to this lifestyle for a month. You’ll hardly feel a difference.

Okay, ready for the next step?

During Month #2, increase your savings by another one percent. In Month #3, add an additional one percent. Within a year, you’ll be saving an extra 12 percent of your paycheck.

Taking the plunge from 0 to 12 percent overnight is tough. Taking baby steps — one percent per month — makes it much easier.

“What if I don’t know how much I earn?”

As an entrepreneur, I have no clue what I’ll earn next year. My income fluctuates every month, sometimes quite dramatically.

Don’t worry. Just pick a number.

You can use:

- The amount you earned last year

- The amount you think you’ll earn this year

- Some other number entirely.

Don’t get too caught up in making it perfect — just pick a number and get started. “Done” is better than “perfect.”

So let’s gear up for the One Percent Challenge: the easiest possible way to boost your savings by 12 percent within a year. Are you in? Throw me — and your fellow rebels — a comment below.