When I started investing in rental properties, I didn’t have a clue about what I was doing.

I held many common misconceptions. I missed many opportunities. I learned tough lessons through hard, expensive mistakes.

I’ve noticed that many people hold the same misconceptions that I used to have.

My goal is to clear these myths and misunderstandings. I believe transparency helps people make more informed decisions. That’s why I decided to reveal our monthly rental property cash flow.

I’ll give you the facts. You decide.

From October 2015 to December 2017 I publicly disclosed my monthly income, expenses and cash flow from my rental properties. I also documented the time investment. Money is meaningless without its time context.

I hope my transparency helps you:

- Destroy myths, such as “I’ll need to fix toilets at 2 a.m.”

- View swings and volatility.

- Get a behind-the-scenes peek at the life of a real estate investor.

- Decide whether or not rental property investing appeals to you.

Readers — especially new readers — often ask me the same questions, over and over.

That’s why I created this page, the Real Estate FAQ HeadQuarters (FAQ HQ).

This is a centralized, one-stop-shop where I introduce new readers to the backstory and answer the most frequently-asked questions.

Here we go!

Cash Flow Reports

Notes:

- “Income” is money that enters my business bank account.

- “Expenses” is money that exits my business bank account.

- “Cash flow” is income minus expenses.

“Income” is after property management fees, when applicable. These get taken-from-the-top, before the money hits my account.

December 2017: $3,509.17

November 2017: (-$6,433.26)

October 2017: $7,929.71

September 2017: $2,342.29

August 2017: (-$398.82)

July 2017: $3,789.71

June 2017: $11,604.82

May 2017: $6,933.66 in 1 hour

April 2017: $567.74 in 25 minutes

Mar 2017: $3,905.59 in 4.5 hours

Feb 2017: $5,326.68 – no time spent

Jan 2017: $4,212.78 in 15 minutes

Dec 2016: (-$10,593.13) in 16 hours

Nov 2016: (-$1,180.13) in <30 minutes

Oct 2016: (-$5,196.01) in 4.5 hours

Sept 2016: (-$6,133.46) in 8.75 hours

Aug 2016: $4,386.57 in 6.5 hours

July 2016: (-$7,100.24) in 38.75 hours

June 2016: $5,139.13 in 8 hours

May 2016: $1,184.50 in 5 hours

April 2016: $3,931.62 in 3.5 hours

Mar 2016: $7,461 in 5.5 hours

Feb 2016: $5,604 in 5 hours

Jan 2016: $3,580 in 1 hours

Dec 2015: $4,895 in 5.5 hours

Nov 2015: $2,209 in 2.5 hours

Oct 2015: $6,102 in 3 hours

We stopped meticulously tracking our time after May 2017.

Frequent Real Estate Investment Questions

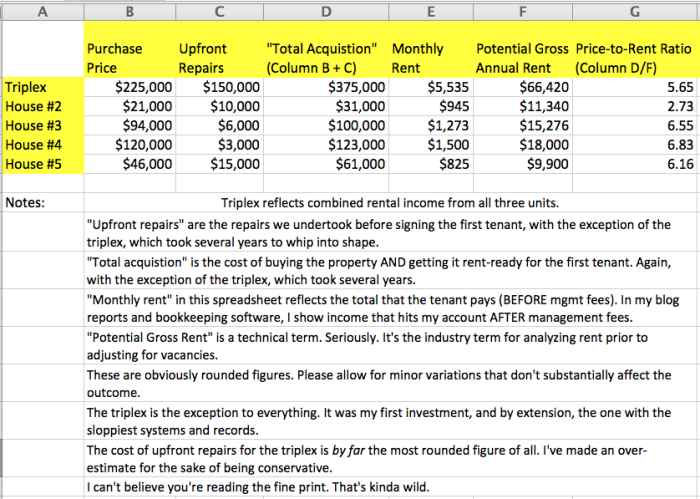

How much did every property cost?

Check it out — I made a swanky little spreadsheet:

What’s a triplex?

It’s a three-unit building. Imagine a duplex, but with three units instead of two.

What were the original rental rates, cap rates and cash-on-cash returns at the time you bought each property?

I document these in the articles announcing the purchase of each property, which you can read here, here, here, here and here.

What is a “cap rate” or a “cash-on-cash return”? I’m not familiar with fancy investor jargon.

Here’s an epic article explaining how to analyze and calculate these metrics (and why they’re critical!)

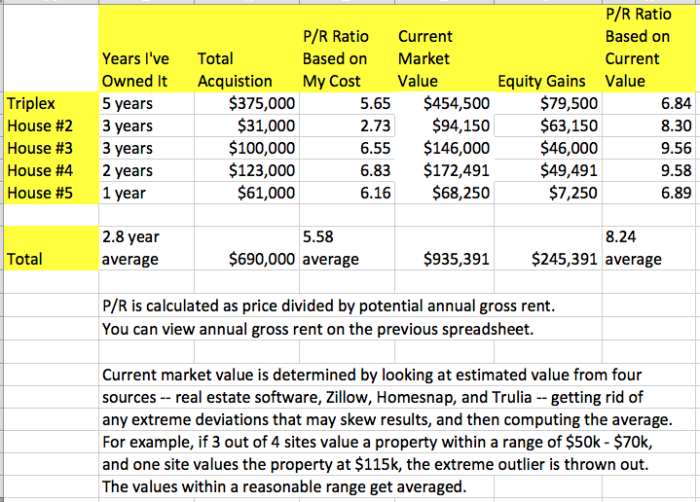

What are the properties worth today?

Here, I made a nifty spreadsheet (as of December 2015):

Why do you use the word “nifty,” given that you’re under the age of 94?

Hmm. Good question.

What bookkeeping software do you use?

I used to use Less Accounting to create automations that handle the bulk of the bookkeeping. For example, I might create an automation that says:

- If an expense contains the words “Home Depot,” categorize as “repair/maintenance” — or —

- If a deposit is in the amount of $1,895, tag as “House #4.”

I have since switched from Less Accounting to Quickbooks Online. I recommend checking out Freshbooks, especially if you’re a small business owner.

I don’t recommend manual bookkeeping through a spreadsheet. When I first started investing, I tried manual spreadsheet tracking, and my books were a complete mess. Spreadsheets lack automation. Manually inputting every little Home Depot receipt is a gigantic pain, and if you overlook just one expense, the whole system collapses.

How do you plan for big-ticket renovations, like replacing the roof?

Big-ticket renovations and upgrades are called “capital expenditures,” or CapEx. These fall under two categories:

- Necessary upgrades, such as replacing the roof, gutters, windows, siding, HVAC, etc.

- Optional upgrades, such as replacing white appliances with stainless steel.

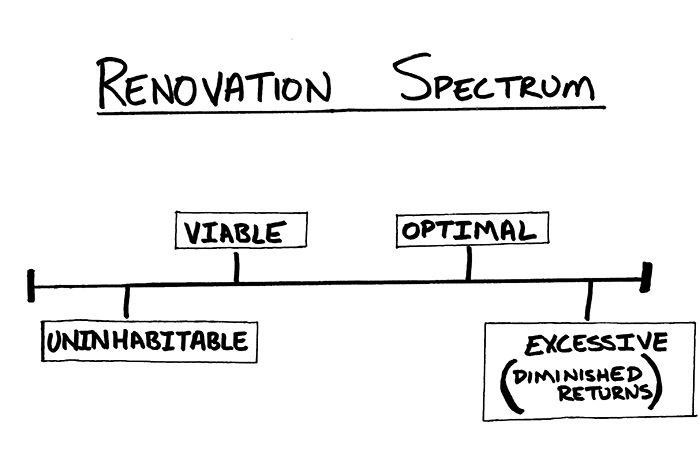

These fall along a Renovation Spectrum:

Necessary upgrades make a home viable. Optional upgrades make a home optimal (or excessive).

As a generalized rule-of-thumb, a reasonable level of renovations (viable/optimal) will cost one percent of the home value over the long-term. In other words, a $100,000 home should hold a budget of $1,000 per year, or $83 per month, for these big-ticket capital expenditures (CapEx).

Obviously, this is a flawed rule-of-thumb. Home values fluctuate. The state of the economy doesn’t affect the lifecycle of a roof. That’s why it’s a generalized rule-of-thumb, not a firm rule.

This rule-of-thumb, however, reflects the idea that a more expensive home will have (1) nicer finishes and (2) a larger footprint. These both affect the CapEx budget.

“But if I have to make one big-ticket repair, all my profits are wiped out!!”

Real estate is the long game.

If you spend $25,000 on a roof that lasts for 25 years, then the roof costs $1,000 per year.

Yes, it’ll wipe out your cash flow in the specific year that you pay that bill — but by the same token, you get a “free” (prepaid) roof for the next 24 years.

The better vantage point comes from zooming out and looking at the big-picture view. For example:

- Windows cost $12,000 to replace and last for 24 years; this costs $500 per year.

- Carpet costs $2,000 to replace and lasts for 6 years; this costs $250 per year.

- Roof costs $25,000 to replace and lasts for 25 years; this costs $1,000 per year.

Crunch those numbers down into the monthly view (in this example, $83/month for roof, $41/month for windows and $21/month for carpet), and you’ll see how much these big-ticket items cost every month.

“Why aren’t you subtracting CapEx reserves from your monthly expenses?”

This is not a report of hypothetical numbers. It’s raw, real-time cash flow.

This is a cash flow report, designed to show you the monthly volatility (the rollercoaster) you’ll experience in the world of investing.

If I subtracted CapEx estimates from every report, I’d have to artificially add it back once the bill is actually paid.

For example, let’s say that a property manager replaces a leaky window for $650. The manager pays the window company directly, and then deducts $650 from the income — the rent payment — that she transfers to me.

If I adjusted my cash flow reports for CapEx, the expense would be double-counted: once when holding CapEx reserves and again when paying those actual bills.

This means that every time I pay a repair bill, I’d have to somehow add this $650 back into my income, to avoid double-counting.

And that would turn into a confusing spaghetti mess, full of hypothetical numbers. It would confuse more people than it would enlighten; myself included.

Instead, I’m showing you raw, real cash flow reports. Some months you’ll see high highs, other months you’ll see low lows.

Some months, CapEx will cause my free cash flow to contract into small numbers, even into the negatives. Other months, I’ll have no CapEx and walk away with ample cash flow. By documenting this month-after-month, my readers can witness this volatility and understand how to plan for it.

You’ll laugh, you’ll cringe, you’ll cry, you’ll celebrate.

Or maybe you’ll get bored and turn on an episode of Dancing with the Stars. How about that Bindi Irwin, eh?

Do you manage the properties yourself? Or do you hire a property manager?

I’ve hired property managers to represent my Class C properties. I myself manage the Class A properties.

Why this strategy?

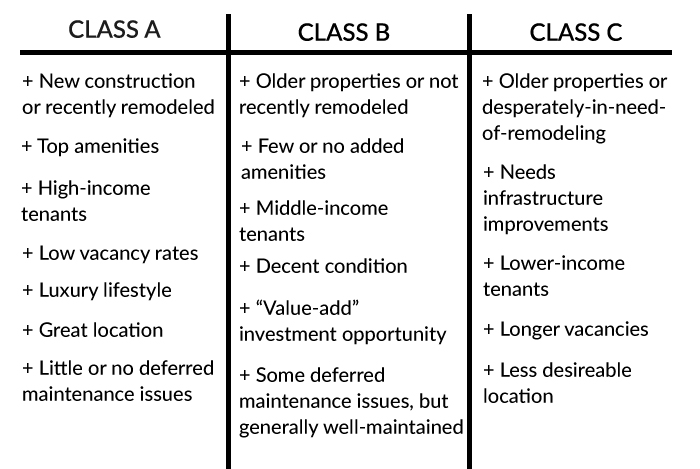

First, let’s explain the difference between Class A, B and C properties.

There’s also another category known as “Class D”. Unless you’re an experienced full-time investor, please don’t touch Class D properties.

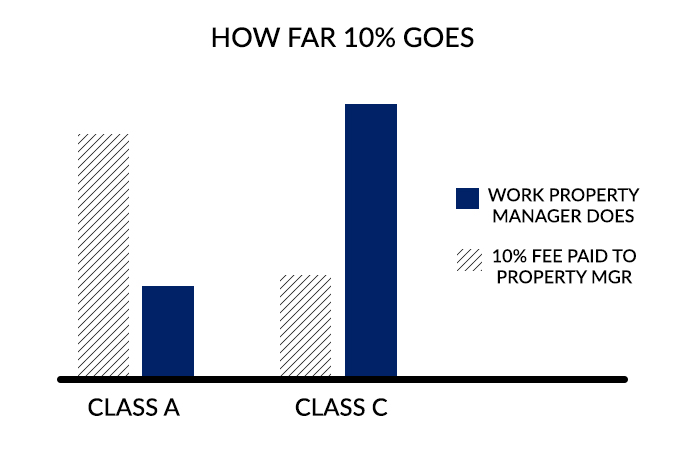

Now let’s do a little math.

Let’s assume that you own two single-family residences.

Class A: $1,500 per month in gross rent

Class C: $800 per month in gross rent

Your property manager charges 10 percent. How much do you pay?

Class A: $150 per month

Class C: $80 per month

Can you guess where I’m headed with this line of logic?

Class A properties cost the most to outsource, but require the least management.

Class C properties cost the least to outsource, but require the most management.

Guess which one is a better deal? 🙂

Caveat: This conversation applies to residential rental properties (single-family homes, duplexes, triplexes and 4-plexes). Managing Class A commercial properties, such as large apartment complexes, is an entirely different topic.

Taxes, taxes …. I have some questions about taxes?

“Profits,” in the tax sense, are different than cash flow.

When I replace a roof, windows or appliances, I can’t write-off the expense during the year it’s incurred. I have to depreciate those items over their IRS-approved lifespan.

The tax bill is generally minimal, thanks to depreciation from prior years. However, during years with major capital outlays, cash flow can constrict (because you can’t write-off the entire expense).

Bottom line: hire an awesome CPA who holds plenty of experience working with real estate investors and small business entrepreneurs.

I’m happy to recommend mine — just email my assistant Erin (erin [at] affordanything [dot] com).

How do you organize receipts, etc.?

All checking account deposits, credit card expenses, etc., automatically get pulled into the bookkeeping software.

If I have any physical receipts, I’ll scan these and upload them into a Dropbox folder, labeled “Real Estate Shoebox [YEAR].” If needed, I’ll also upload these into my bookkeeping platform.

One HUGE passive barrier is using poor-quality equipment, like a flatbed or weak all-in-one scanner, which requires you to feed receipts and documents excruciatingly slowly. This scanner is lighting-fast, rarely jams, and feels like you can feed it a pile of crumpled trash and still get clean scans on the other side.

Would you consider taking out a loan against the homes you own outright to acquire more property?

Let me rephrase your question:

Do I prioritize owning houses free-and-clear?

Or do I prioritize leveraging into more properties?

I grapple with a modified version of this question when I decide whether to repay a mortgage vs. save cash to invest in another property. By NOT aggressively repaying a loan, I’m forfeiting the opportunity cost of otherwise owning that home free-and-clear.

- If I use my free cash flow to purchase another property, I’m prioritizing acquiring more investments rather than de-leveraging.

- If I use my free cash flow to aggressively repay loans, I’m deciding that minimizing debt is more important than acquiring additional investments.

Borrowing against the free-and-clear homes is a 3rd option.

But first, I need to pick a goal: acquisition vs. aggressive de-leveraging.

I decided to take a balanced approach:

I stockpile cash into a savings account. Once it accumulates into the $50,000 – $150,000 range, I face three choices:

- (1) I can pay cash for a cheap rental house

- (2) I can make a downpayment on a higher-priced rental property

- (3) I can wipe out an entire mortgage in one fell swoop.

At that point, I look at the market.

If there’s an awesome property up-for-grabs, I’ll jump on that opportunity. This is how I bought House #5 (paid-in-cash with a purchase price of $46,000 and then renovated-in-cash for $15,000).

On the other hand, if there’s nothing desirable available, I’d use that money to wipe out a mortgage. (I haven’t done that yet, but that’s a serious option.)

How do you choose a property management company?

Four recommendations:

(1) Get references from trusted investors;

(2) Look for people who specialize in the specific neighborhood and housing class that characterize your properties;

(3) If you invest across multiple neighborhoods, use different PM’s for each neighborhood;

(4) Hire multiple PM’s and keep only the best.

Here’s a review I wrote of a good book on property management — the first half is about DIY management and the second half covers hiring criteria.

What resources can help me learn home repair?

I like Home Depot’s line of books (at the beginner level). Home Improvement 1-2-3 is a good overall primer, and they also have good specific books on Wiring, Plumbing, and Kitchens & Baths.

I’d recommend starting with these book for a basic overview, and then turning to YouTube for specific, pointed questions (such as “how to install a repair flange.”)

“Can you retroactively share financial data prior to when you started publishing public income reports in July 2015?”

That would be a gigantic pain-in-the-ass, due to the following factors:

Factor #1: Blurred Lines from Living in the Triplex

One of the reasons I waited until now to start reporting the data is because we lived in the triplex until July 2015. That makes the accounting messy.

Under normal circumstances, people would simply use data from 2/3rds of the triplex, noting that we occupied the other 1/3rd. But to complicate matters, we lived in the triplex with roommates, so really, we occupied — maybe 1/7th of the building? Or 1/8th of the building? Or 1/9th?

And should that be measured by dividing the number of bedrooms in the building? Or is it measured proportionately by square footage?

What about home maintenance costs? What fraction of that rightfully should come from our own personal pockets, and what fraction should be included as operating overhead?

How about shared utility costs, like water?

Our CPA figured this out from a tax perspective, but like I said above, taxable profits are very different from actual cash flow.

Given these variables, and given how “sloppy” the math becomes when you’re living in part of the home (and thus consuming the opportunity cost associated with not renting that portion of the home to a paying tenant), I decided that I couldn’t accurately display information about our numbers while we’re living in the triplex.

The best way to report these numbers to the public is by first creating a clean division between “personal” and “business,” by moving out of the triplex. This allows 100% of the income to come in the form of cash (rather than coming in the form of a “free place to live,”) and 100% of the expenses to be pure operational overhead. In short, it makes the numbers simpler, cleaner, and easier to make an apples-to-apples comparison.

That’s why I chose to start disclosing numbers after I moved out of the triplex, and that’s why any data that I’m choosing to share with my readers will start on this date and extend into the future, rather than the past.

Factor #2: Reconciling Different Bookkeeping Methods

In 2015, we switched our accounting software to a new platform, which is the data you’re seeing in the income reports. Creating the cash flow reports for this series is incredibly different than tax accounting that we’ve done in the past.

Retroactively scanning through all of our files, and trying to square our tax-accounting-data with this new style of cash-flow-data, would require dozens upon dozens of hours of additional effort.

I believe my readers will get sufficient benefit from seeing monthly data in the upcoming series, without requiring me to spend days buried under a pile of ten-year-old spreadsheets and lengthy tax documents.

To me, the prospect of generating all of this old data sounds like as fun as … doing five years worth of taxes and bookkeeping all over again.