The idea behind financial independence is that your passive income — typically through investments — is enough.

But how much is enough? Enough for what?

The typical reaction that many people have to this question is to define “enough” based on their current standard of living.

For example: “Right now, my spouse and I are 27 and 29, with one child, age 2, and we live in San Diego, and our expenses are $5,000 per month. That’s our definition of enough, and as soon as we reach $5k per month in passive income, we’ll be financially independent (FI).”

Hmmm. I don’t think you need to be a master logician to spot the holes in this reasoning.

First, your current standard of living is a dynamic number. You could, with some effort, reduce your living expenses; the FI movement is based on this premise. Sure, your mortgage might be $2,500 per month, but guess what? You can move. You can sell your home, or rent a room on Airbnb, or rent out the entire house and move your family into a tiny house or RV.

Your standards might also increase. You may, over time, develop a penchant for $100 restaurant meals, Prada handbags and nicer furniture. Suddenly, you cannot imagine buying used furniture, like a dingy peasant.

Silly examples aside, there are legitimate reasons why your standards may rise.

Perhaps you discovered FI in your twenties, while living with random roommates from Craigslist. Maybe you live in a crowded apartment, with 5 or 6 people splitting the rent on a 3-bedroom. Sure, you can calculate FI based on your current standard of living, but do you want to live this way forever? Or do you, at some point in your life, want to experience the lifestyle inflation of living without roommates?

You may have one child right now, but do you want three or four? How will that impact your definition of enough?

The takeaway: Your standards may increase and that’s not a bad thing.

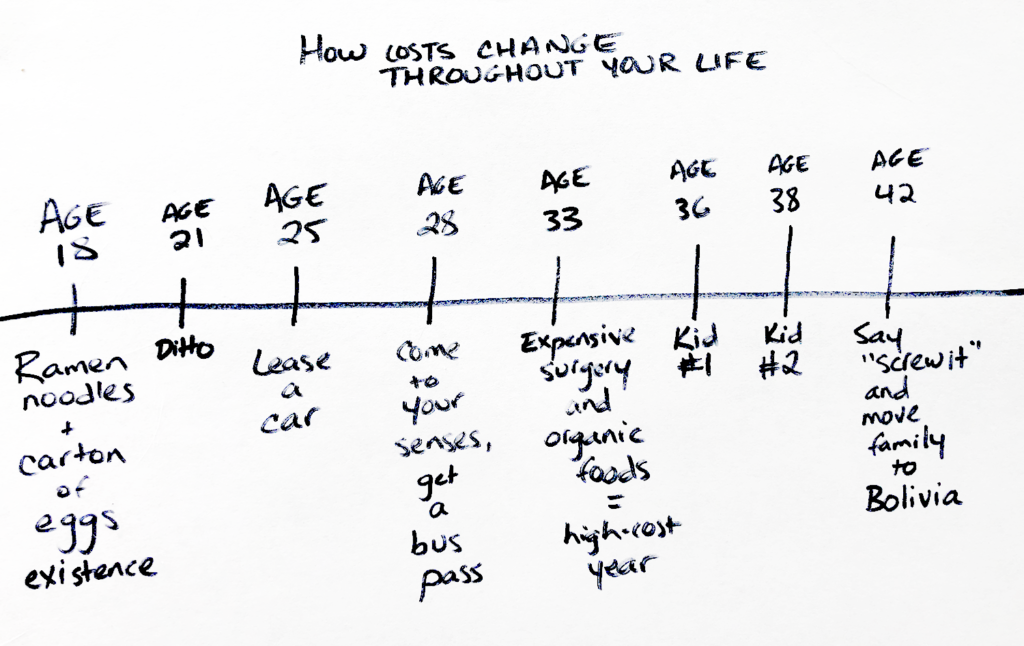

Furthermore, no matter how fat or lean your current lifestyle, it’s true that your standards have changed over time. Your living standards at age 18 were different than age 22, which differed from age 26. To define FI based on your current standards is to choose a randomized data point across the graph of your life, and select this as the defining yardstick for no reason other than recency bias.

“Standard of living,” in other words, is an arbitrary and fluctuating metric. If we use this as a barometer to measure FI, this means that FI itself is also arbitrary and fluctuating.

Yet this is how many people measure their progress:

- “I’ll be FI when my net worth equals 25x my expenses.”

- “I’ll be FI when my passive income equals my expenses.”

These are common remarks within the FI community, and both peg the definition of FI to current living standards. But there are huge holes in this approach.

Here’s an improved attempt at a definition: Financial independence is the point at which your passive income is enough to cover your basic needs.

On the surface, this makes more sense. Your expenses can be roughly divided into two camps: needs and wants. Needs are fixed and non-negotiable, while wants can fluctuate. It’s logical that if your passive income can cover your necessities, everything else becomes a choice; if you choose to engage in paid work, it’s because you want to, not because you need to.

Fair enough.

But even this definition has problems.

First, distinguishing between needs and wants is tougher than it might appear. It’s easy to generalize that mortgage and groceries are needs, while clothing and vacations are wants, but reality is more granular. Housing is a need, but your specific rent or mortgage payment, which I’m guessing is not the rock-bottom-cheapest-possible-student-housing in the city, reflects a degree of want. Grocery staples are a need, but certain line items on your grocery bill, like tequila and Oreos, are a want.

What about living in a high-cost city like San Francisco or New York? Is this a need or want? For that matter, what about living in the U.S. as compared to expatriating* to a less expensive nation like Thailand or Colombia? Need or want? Could you be conditionally FI as long as you live in Guatemala? Is this “less than” being FI in the U.S.?

Second, your basic cost of living will change in the future, as:

- You have kids.

- Your kids become adults.

- You encounter medical crises and costs.

- Health insurance premiums rise. (Or fall … j/k.)

- You pay for major one-time expenses, like college tuition or IVF treatments or legal fees.

- You shoulder caregiving responsibilities for other family members, like grandparents, parents or siblings.

What should you do? Do you annually re-adjust your barometer of basic costs? Do you set a new FI benchmark every year, because “net worth = 25x my spending” is always in flux?

Does that mean you could be FI in the year 2022, but not FI anymore in the year 2023, and then FI again in the year 2024?

Or do you throw up your hands and say, “this is ridiculous; I don’t know how to measure FI, but I know it when I see it.”

I’d advocate the latter.

I’ve begun believing that FI is a feeling, not a number.

FI is the art and science of having enough. To quantify FI, we need to quantify enough. But there’s no yardstick for enough. There’s not even a good yardstick for “bare minimum enough,” or as it’s known in certain circles, “lean FI.” We could create a metric based on today’s numbers, but today is a random point in history. There’s no reason it should take precedence over any other day, month or year.

FI is not a finish line that we cross once.

“Once upon a time, I wasn’t FI, then I embarked on my protagonist hero’s journey, now I’m FI and living happily ever after.” This is the mythology of FI, and if you think about it long enough (and you will, once you no longer have a job), it makes no sense.

FI is not a destination. It’s not a number. It’s not a portfolio balance. It’s not a yardstick. It’s not a binary, yes-or-no distinction.

It’s a state of mind and a philosophy of living.

It is, simply, the art of enough.

Let me take another crack at defining FI:

Financial independence is the state in which your potential passive income, typically through investments, is enough that you could make decisions from a place of hope and desire, rather than fear or obligation.

Here’s how I break this down, phrase-by-phrase:

- “Financial independence is” — Duh. Self-explanatory.

- “the state in which” — It’s a state of being.

- “your potential passive income” — The operative word is “potential.” There are many people in the FI community who build investment portfolios of $800k or more, which at the 4 percent withdrawal rate, could generate $32,000 annually, enough to cover a reasonable cost of living in many locations across the U.S.

Yet they don’t harvest their passive income. They reinvest.

This confuses others who are new to the community — “wait a second, you talk so much about building passive income, but then you don’t bother to live on this money?”

Yep. Often, knowing that the money is there is enough. That’s why it’s critical that “potential passive income” be part of the definition; reaching FI creates the option, not the obligation, to live on your investments.

- “typically through investments” — I include the word “typically” because you could create passive income in other ways, such as by collecting royalties on a book, music or software. However, investments are the most common route.

- “is enough” — oooohhh here we go!

- “that you could make decisions from a place of hope and desire, rather than fear or obligation.” — I include the word “could” because FI will not cure your fears. You might still be afraid, anxious or nervous. You might make choices for the wrong reasons. But your potential passive income is enough that you could make choices that are not based around the obligation to buy milk and bread (er, sorry … almond milk and gluten-free paleo bread) or pay the electricity bill.

Screw it, or we could throw out this whole discussion, and say that FI is when your net worth = 25x your (basic?) spending.

Sure, it would be an easier definition. But my gut says that this concept extends beyond numbers.

Thoughts?

*Note: I always thought it was funny that if you move from a less-developed nation to a richer nation, you’re an immigrant. But if the tables are turned, you’re an expat.