“I’m scrounging dollars to fill my gas tank. I don’t make enough money to save. At the end of the month, there’s nothing left.”

If this feels like you, gear up for a radical shift that will change your life.

Last month I announced the One Percent Challenge, a quest for Afford Anything Rebels that can turbocharge your financial life.

The concept is simple: save one percent more than usual. Regardless of how much you’re currently stashing, boost this number by one extra percent.

How much is that? Picture your monthly income and move the decimal point two spaces left.

Repeat this every month. By the end of the year, you’ll boost your savings by an extra 12 percent.

Fail-Proof Saving Tips

To fuel the rebellion and help you turbocharge your savings, I’ve created an ultra-awesome One Percent Challenge Facebook Group where rebels can swap stories, tips and ideas about how to spur your savings. Join the party!

(Note — As of 2018, the Facebook group has shifted its focus to encompass the entire community rather than just the One Percent challenge. You can still party with us, though.)

It’s filled with savings tips. Some are actionable, some motivational, and some provide a new mental framework to understand money.

Here are some tidbits I hope you’ll enjoy:

Here’s a “quick win”:

Most grocery stores will show how much money you “saved” by having a loyalty card and/or buying discounted products.

But it’s not savings until you save it.

Make a note of the savings balance printed on your receipt. Move that money into a savings account. (Transfer this money instantly through your phone or by sticking cash in an envelope.)

This tactic helps you save your savings — rather than buying an impulse latte.

Want motivation to save? Figure out how little you’re making.

The results might be sobering. (Literally. You can’t afford booze anymore.)

Here’s how:

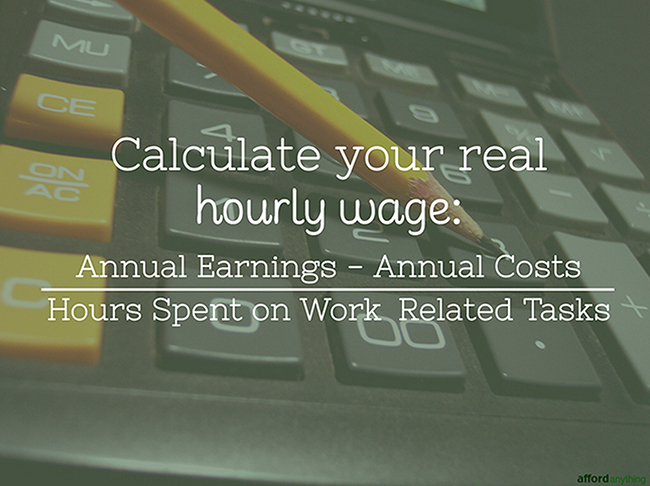

Annual Income: Duh. This is printed on your paystub, unless you’re an entrepreneur, successful side hustler or passive income ninja. In that case, use last year’s tax figures.

For bonus points, figure out your after-tax income. That’s the only income that matters, anyway.

Annual Costs: Subtract work-related costs. If you’re a 9-to-5-er, these include:

- Commuting: Gasoline, maintenance, wear-and-tear, or if you’re a big-city-slicker, bus/train/subway passes

- Fancy Clothes: Suits, ties, belts, heels, wingtip loafers or trophy handbags that you’re expected to carry to the boardroom, and dry cleaning for the whole shebang

- Convenience Foods: No matter how carefully you plan, you’ll still grab the occasional lunch/coffee on-the-go

- Daycare/Childcare: $$$$

- Fast Travel: How much extra do you spend on expedient vacations because you don’t have the luxury to enjoy slow travel? #HiddenCostofWorking

If you’re an entrepreneur you’ll have a weird gamut of other business expenses, which I know you’re judiciously tracking through your bookkeeping software. Right? (Ahem.)

Subtract B from A, and you’re left with your net income for the year. Yes, even traditional employees experience a gap between “gross” and “net” earnings. This gap can be substantial.

Divide this by the number of hours you spend on all work-related activities, including:

- Commuting

- Ironing your shirts

- Hauling your damn suits to the dry cleaners again

- Suffering through an interminable dinner with your boss

- Traveling to that conference that zapped 3 days from you life

Your work-related hours might look like:

- Work: 40 hrs/week, 50 weeks/year

- Commute: 30 min/day, 5 days/week, 50 weeks/year

- Prep Time: Same as commute

What’s your “real” hourly income? Here’s an example:

Income: $52,250 (U.S. median household income in 2013, according to the Census Bureau. We’ll pretend this is after-tax for the sake of example.)

Work Expenses: $5,000 (gasoline, vehicle wear-and-tear, lunches out, work clothes, childcare)

Net Income: $47,250 per year

Hours: 2,250 hrs/year

Net Income/Hours = $21 per hour

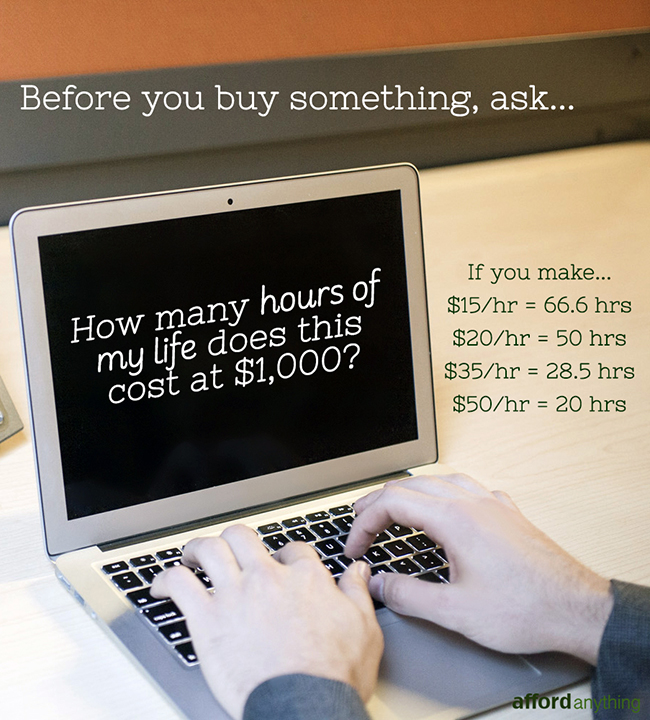

Your “real” hourly rate is a sharp weapon in your Rebel arsenal. It helps you resist the tempting lure of an impulse buy that’s “only $20, what’s the big deal?”

You’ll know it’s a “big deal” because it represents an hour of your life.

Psst. If you want to save money on car insurance, and you have a short commute or you work from home, check out Metromile – car insurance that starts at $29/month + a few cents for every mile that you drive. Get a free quote – it’s risk-free. Only available in CA, VA, WA, OR, IL, PA, NJ, and AZ.

This leads to the next tidbit:

If you’re tempted to drop $1,000 on a big-ticket item, like a new sound system or a slick new TV, remind yourself of how much of your life that represents. If your “real” hourly rate comes to $20/hr, that upgrade represents two weeks of your life.

By the way, I know I’m harping on this trading-time-for-money equation. And while it might seem like the takeaway lesson is “spend less,” that’s too simplistic.

First, I don’t object to spending — I object to wasting. Spend lavishly. Spend your time and money on high-value projects, whether that’s traveling, hanging out with your friends and family, or working on a cool new business venture.

Don’t waste money on useless plastic junk, any more than you should waste time on low-value unproductive tasks that won’t get you closer to your wealth and freedom goals.

Second, look for the sustainable escape:

Break the time-for-money cycle. Create passive income through rental properties, stock investments, royalties and hands-off businesses, so you can stop selling off the hours of your life.

If there’s one cornerstone value that anchors the Rebellion, it’s that freedom equals shattering the time-for-money hamster wheel. I’ll repeat this credo for as long as the internet will allow me.

So … The One Percent Challenge?

Back to the challenge at hand —

As you embark on the One Percent Challenge, don’t force yourself to suffer by giving up the things you love.

If you LOVE dining out every Friday night, embrace it.

If you feel alive every time you drive to the beach to surf and paddleboard, stay beach-bound. Don’t cut corners depriving yourself from that tank of fuel.

If happiness comes from travel or snowboarding or hot yoga or Crossfit or your annual family trip to the water park, don’t cut these expenses.

Cut the crap.

- Cut the excessive bank fees.

- Cut the excessive auto/car/home/health/life insurance premiums.

- Cut high trading costs from your investments.

- Cut high expense ratios from your mutual funds.

- Cut high taxes legally by learning tax law and capitalizing on every exemption you qualify for. (This is one of the best uses of your time — FAR better than clipping coupons or mowing your lawn.)

- Cut the unauthorized charges that the phone/cable/internet company mysteriously tacks onto your bill.

- Refinance your mortgage if it makes sense.

None of these sacrifice your quality of life. But taken together, they could save one percent of your income (or more) every month.

Don’t forget to join the uber-awesome Facebook Group to connect with people in the community!