Lately I’ve been getting emails from readers with the following situation:

“I’ve pinched every penny and slashed every expense. But I still can’t pay my bills. Help!”

If I accept your premise — if you’ve slaughtered your expenses to the brink of extinction — then you don’t have a spending problem. You have an income problem.

The best solution is to start a side business, also called a “hustle.” Here’s why.

Five Ways to Earn More Money

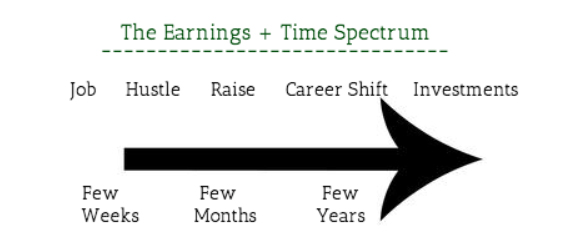

You have five choices when it comes to boosting your income:

- Get another J-O-B

- Flex your hustle muscle

- Score a raise at work

- Switch careers

- Create investment income

I’ve ranked those five choices in order from “immediate” to “eventual” in terms of payoff.

Today’s article is dedicated to people who need extra money immediately, so let’s focus on the two shortest-term options.

The Dreaded J-O-B

When most people need money, they search for a job.

“Maybe I can get a job at the mall. Yes, they’ll need extra help during the holidays. I think Clothes Emporium starts at $12.75 per hour.”

We’re trained (brainwashed) to think this is our only option.

Show of hands: How many of you worked crappy jobs when you were 16? Fast-food? Retail? Did you start at minimum wage and feel overjoyed when your McManager gave you a 50-cent-per-hour raise?

Yep, me too.

A few of my friends were brilliant enough to begin microbusinesses before they graduated. They disassembled old computers and sold the parts on eBay. They bought furniture at yard sales, refurbished it, and flipped it on Craigslist for 10x more.

Meanwhile, I was the chump slinging french fries for $5.15 per hour.

D’oh!

I could have been teaching myself how to build websites during the late 1990’s, but instead I slung greasy fries at my McJob.

The takeaway lesson? The fastest way to earn more money is by creating the opportunity.

Flex Your Hustle Muscle

“Hustling” isn’t snagging a second job.

It refers to launching a micro-business in which you choose your hours and prices. This gives you the leverage to charge what you’re worth.

You’re creating opportunity rather than competing for positions. Your boss can’t keep you down when you are the boss.

Think about any long-term goal: lose weight, build muscle, learn another language. You’ll start seeing small results in a few weeks, but it takes months to achieve major results.

Starting a side business is the same. It doesn’t happen overnight, but the result is worth the effort.

How do you turn this hustle into a reality?

If you Google “how to develop a side hustle,” you’ll find approximately 9,492,193 websites with a list of ideas: “App developer! Airbnb host! Amazon retailer!”

“Baker / Barber / Babysitter / Bartender / Bouncer / Blogger / Bohemian hairstylist!”

Ideas are cheap. And useless.

Most advice you’ll read online regurgitates this tired old advice:

- Create an account on Upwork

- Compete for the same crap: data entry, article writing, SEO.

- Set your rates low enough to compete with 12-year-olds

- Curse your life

I realize sarcasm is hard to convey online, so let me clarify: This is NOT how to hustle.

Here’s a better approach:

Step 1: Find Problems

Everyone has problems: they’re busy, bored, stressed, disorganized, frustrated.

Pay attention to problems that affect people around you. For example:

- Many real estate agents in my neighborhood don’t run their own website. Their only online presence comes from their broker’s website. Could they profit from their own online platform?

- Most of the people I see inside local shops are regulars. How can small businesses in my neighborhood — like the deli, the dry cleaner, the boutique — attract more walk-by customers?

- Many “stroller parents” spend afternoons at the park, where there are no diaper changing stations. The park doesn’t have a public restroom. What happens when nature calls?

This exercise is geared to getting the creative juices flowing. Notice that in this step, you’ve made observations and created hypotheses.

Next let’s put your ideas to the test.

Step 2: Eliminate

Eliminate everything other than your top one or two choices. You can’t validate every idea at the same time. Pick one; focus here first.

Step 3: Ask

Write a description of your target customer.

- Where do they live?

- What are their goals?

- What are their struggles?

- What websites do they visit?

- What books do they read?

Here’s an example:

- Amateur classical musicians

- Live in Cleveland

- Age 40+

- Not tech-savvy

- Want more “gigs” (weddings, etc.) but don’t understand online marketing

Once you’ve developed this “avatar,” find at least 3 people who represent your target customer. Check online forums, meetup.com, or talk to people you know.

Once you find these target customers, ask to interview them for 10 to 20 minutes.

Your request should emphasize:

- You’re not trying to pitch any products. You just want feedback on an undeveloped business idea.

- You’ll accommodate their schedule.

- You’ll respect their time (e.g. “15 minute call.”)

If this step induces panic, remember: “Interview” is just a fancy word for “conversation.”

During the interview, avoid flat-out asking “what problem would you like someone to solve?” Most people can’t articulate their obstacles or challenges.

Instead, ask probing questions, such as:

- Describe a typical “day in the life.”

- What goals would you like to achieve in the next 6 months? Year?

- What projects are you focusing on?

- What skills have you acquired to get where you are today?

- What new skills are you trying to develop?

At the end of the interview, say: “I’d like to run a few business ideas by you. Please let me know if you think this would be helpful or not.”

Then listen . Don’t try to respond; just listen.

Step 4: Develop, Test, Repeat

You now have a better idea about (1) what problem you can solve; (2) who needs this help.

Here are some examples:

Problem: When people want to buy or sell their home, they’ll Google “real estate agents in Cincinnati.” This leads them to huge brokers like Keller Williams or Re/Max. This means that John and Jane Smith of Mom-and-Pop Brokers, LLC., aren’t getting search traffic leads.

Target Customer: Independent real estate brokers and agents living in Cincinnati, Ohio, who struggle with finding online leads.

Solution: Create WordPress website. Write search-engine-optimized articles. Manage social media calendar and email list.

Pricing Model: One-time fee for website installation and design. Ongoing monthly fees for blog content, social media management, email list management and website maintenance.

Marketing Model: Make free, value-packed presentations about online marketing at local industry events. Offer a 10 percent discount to any client who refers your business to a friend or associate.

Startup cost: Free.

No Skills? No Problem

Worried you don’t have the skills needed?

“I don’t know how to write / build a website / design / program / sew / build things / etc.!”

No skills? No problem. Here are a few choices:

- Teach yourself that skill by reading blogs, books, and taking online courses.

- Team up with a partner through a “joint venture” model. (You share the work, though each of you holds a unique skill.)

- Find leads for other entrepreneurs through a referral model. (You find the business and pass it along for a commission.)

You don’t need a fancy diploma to create a side hustle. You need creativity, optimism, and the willingness to learn.

If you’re still concerned about lack of skills and lack of time, here’s another alternative (especially for those who love pets): become a pet sitter or dog walker for Rover!

Why is this a solution if you’re limited on time? Because Rover takes care of everything. You don’t need to market your services to get customers, or figure out how to keep track of your clients.

Once you complete the sign up and registration process, you get listed on their site and promoted to a huge network of pet parents. How awesome and hands-off is that?

As a bonus, you can still create your own schedule, and many sitters and dog walkers for Rover earn $100/week or more.

How’s that for a side hustle?

Mind the Gap

Let’s look at the big picture:

The ONLY way to improve your finances is by minding the gap between your income and expenses.

What does that mean? There’s a gap between your income and spending. Make that gap as big as possible. Invest this money. Repeat.

There are only two ways to widen that gap: Earn more and spend less.

Most people who are new to personal finance focus on cost-cutting, because it provides an instant payoff. Cut your cable package, limit restaurants to special-occasions-only, and voila: you’ve saved $150 per month.

But cost-cutting is limited. You can’t frugal your way to wealth.

If you earn $30,000 per year, take home $26,000 after taxes, live on half and save the other half, you’re extra-extra-frugal. You don’t have a spending problem.

But you’ll spend years amassing the down payment on a rental property.

Here’s the harsh reality: You might save 20 percent, 30 percent, or even 50 percent of your income. That’s fantastic. But 50 percent of “not much” is not much.

That’s why boosting your income is life-changing.