The Federal Reserve is expected to cut rates. Inflation data is sending mixed signals. Social Security faces insolvency warnings. And the stock market looks both unstoppable and precarious.

The Federal Reserve is expected to cut rates. Inflation data is sending mixed signals. Social Security faces insolvency warnings. And the stock market looks both unstoppable and precarious.

What should investors and everyday savers do in this moment of uncertainty?

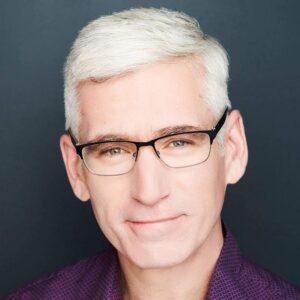

In this special bonus episode, we sit down with Rob Berger — former attorney, Forbes deputy editor, founder of the Dough Roller blog, host of the Rob Berger Show on YouTube, and author of Retire Before Mom and Dad. With more than a quarter-million subscribers, Rob is known for his clear, kind, and fact-driven financial insights.

Together, we unpack today’s shifting economic landscape — from Fed policy to retirement strategies across generations.

What You’ll Learn in This Episode

- Why the Fed is caught between fighting inflation and protecting jobs — and what a rate cut could signal.

- The risks of stagflation and why markets remain richly valued despite economic uncertainty.

- How “the Magnificent 7” tech giants skew the S&P 500 — and what true diversification looks like.

- Smart asset allocation rules of thumb for different life stages.

- What Social Security insolvency really means, and how to plan for possible benefit cuts.

Key Takeaways

- Expect uncertainty. Predictions about rate cuts and inflation are shaky at best — plan for volatility.

- Diversify beyond the S&P 500. International funds, small caps, REITs, and bonds can balance your portfolio.

- Social Security isn’t disappearing — but benefits could shrink. Build contingency plans now.

- If you’re underfunded near retirement, act quickly. Spend less, save more, and prepare for difficult tradeoffs.

- Young investors should focus on control. Education, savings rate, and priorities matter more than macro conditions.

Resources & Links

- Rob Berger’s Website

- Rob Berger Show on YouTube

- Retire Before Mom and Dad by Rob Berger

- Related Episodes:

Glossary

- CPI (Consumer Price Index): A measure of inflation tracking the average change in prices for goods and services.

- Stagflation: A rare economic condition where inflation remains high while economic growth stalls.

- Basis Points: One-hundredth of a percentage point (0.01%). A 25-basis-point rate cut = 0.25%.

- S&P 500: A stock market index tracking 500 large U.S. companies, often used as a benchmark for U.S. equities.

- TIPS (Treasury Inflation-Protected Securities): Bonds that adjust with inflation to preserve purchasing power.

Chapters

- 00:00 – 02:40 Introduction and why this is a bonus episode

- 02:40 – 04:00 Rob Berger’s background and credentials

- 07:27 – 13:00 Fed rate cuts, inflation, and stagflation risk

- 13:00 – 18:00 Market valuations, diversification, and the “Magnificent 7”

- 18:00 – 22:00 Social Security’s solvency and retirement planning in your 50s and 60s

- 22:00 – 25:00 Gen Z financial challenges and what’s still within their control

- 25:00 – 27:00 Predictions (and why predictions usually fail)

- 27:00 – End Where to find Rob Berger and closing thoughts

Final Thoughts

Economic uncertainty doesn’t mean financial paralysis. As Rob Berger reminds us, we should focus on what we can control: how much we save, how we diversify, and what priorities we choose.

🎧 Tune in to this timely episode, share it with friends, and subscribe so you never miss our smart, approachable conversations on money and freedom.

Thanks to our sponsors!

Mint Mobile

Get this new customer offer and your 3-month Unlimited wireless plan for just 15 bucks a month at mintmobile.com/paula

Wayfair

“Cozify” your space with Wayfair’s curated collection of easy, affordable fall updates. Find it all for way less at wayfair.com

Shopify

Sign up for your one month, one dollar per month trial period and start selling today at shopify.com/paula

Indeed

If you’re looking for amazing talent to bolster your team, you need Indeed. Go to indeed.com/paula and start hiring with a seventy-five dollar sponsored job credit.