Would you rather:

- Save $12 per year?

- Save $1,045 per year?

Go ahead, think it over. Consult with your family. I’ll wait.

[Taps foot. Looks at imaginary watch.]

“I have a question, Paula.”

Yes?

“$1,045 is 87 x greater than $12.”

Yes. Um, that’s not a question.

“Does saving $1,045 require 87 x more time, effort or hassle?”

Great question, my invisible friend. The answer is no. The move that saves $1,045 per year requires — at best — equal effort, and at worst, roughly 30 minutes per month (a pay rate of $174 per hour).

“How do I save $12 per year?”

Order tap water instead of a $1 Coke when you’re at lunch.

“And I can save $1,045 with a roughly similar amount of effort?”

Yep.

“Then I’d prefer Option B.”

Great choice. Now let’s talk about your credit score.

“BOR – IIING! Credit scores? What a snoozefest.”

Hold it right there, buddy. Taking control of your credit score is one of the most crucial moves in Mastering Your Money. The difference between a “Good” score vs. an “Excellent” score — as you’re about to see below — can save you $31,366 over the span of a 30-year mortgage, which works out to $1045.53 per year.

“Whatever. Credit is Snooza-palooza.”

Okay. Here’s a YouTube video of puppies dancing to Gangnam Style.

“Hehehehe. That’s awesome.”

Now that that’s out of your system, are you ready to talk about saving thousands — not just a few measly bucks?

“Alright, fine. Hit me.”

Let’s begin.

Why This Stuff Matters

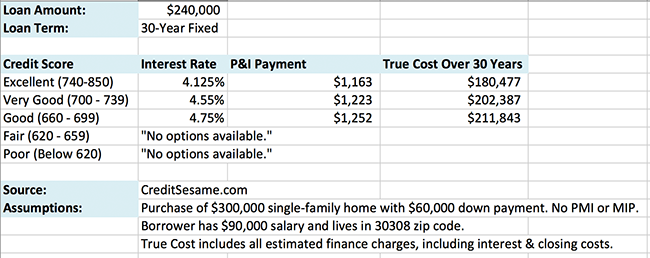

First, let’s chat about why credit is a crucial weapon in your Awesomeness Arsenal. This chart says it all:

Read that column on the left like a report card: A, B, C, D and F.

You might think that “Good” means “Good,” but it’s akin to getting a “C.” It’s a passing grade — barely. Anything less could knock you out of the running.

And unlike your third-grade report card, which (ahem, let’s face it) doesn’t really matter in the real world (at least, not as much as they led us to believe it would), this “C” carries expensive consequences.

In the world of credit, “Good” — rather than “Excellent” — results in tens of thousands in additional interest over the life of a loan.

In the example above, Average Joe buys a $300,000 house. He slaps a 20 percent downpayment onto the table, borrowing the other 80 percent. If his credit score is “Excellent,” he pays $180,477 over the life of the loan.

If his credit score is merely “Good,” however, he pays an extra $89 per month in pure interest, and shells out an unnecessary $31,366 over the span of his mortgage (hence the $1,045 per year). Ouch.

The moral of the story: Your credit score matters.

Here’s how to improve it.

Credit Basics

Five factors determine your credit score:

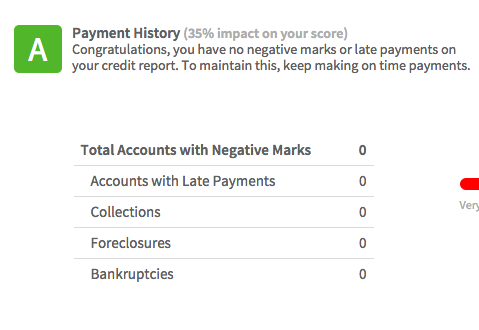

35% Payment History

This is self-explanatory: pay your bills on-time. One single late payment can damage your score. Also, the longer you’re overdue (30 days, 60 days, 90 days, 120 days), the worse.

The best hack: Automate it. Set all your cards to “pay in full” monthly. (If you can’t pay in full, at least auto-pay the minimum monthly. Then quit using your cards until you can pay them in full.)

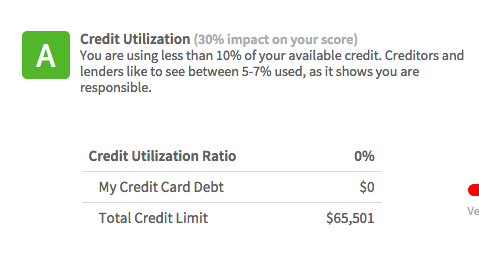

30% Amounts Owed

This is the “trick question” of credit reporting.

Credit bureaus look at your “debt utilization ratio” — how much you owe, relative to your total limit. If your credit limit is $10,000 and you owe $2,000, you’re utilizing 20% of your limit. Ideally, you want to stay at 10% or less.

Here’s the catch: This ratio is measured by the amount you charge, even if you pay your bill in full every month. In other words, you could be debt-free, pay $0 in interest, use your credit card as a proxy for cash — and yet still hold a damaging utilization ratio. This is mega-important, so I urge you to re-read this paragraph.

Don’t worry, you can work around this with two clever hacks:

- Ask your credit issuers to raise your limit. This organically drops your utilization ratio. I ONLY recommend this for people who never carry a balance.

- Pay your bill weekly (or daily). I love getting credit card rewards, especially airline miles, so I charge everything to my card. But to make sure my utilization ratio stays ultra-low, I pay my credit card in full roughly once a week. (This also naturally protects me from overspending).

- If I buy a big-ticket item, I’ll pay the card in full that same day (sometimes while the charge is still “pending.”)

- I automate “pay in full” on every card as a backup — a failsafe mechanism to preserve my payment history.

15% Length of Credit History

This is also self-explanatory: the older your accounts, the better.

Do you carry old credit cards that you rarely/never use? (I have an old student credit card, for example, that I opened when I was a college freshman. I don’t use it anymore because it offers terrible rewards.) Don’t cancel these accounts; they skew your “average account age” to a more impressive number.

The best hack: Keep a small recurring bill on these cards — like your Netflix subscription — and set up monthly auto-pay in full. Your account will stay open and active, and you won’t need to worry about a thing.

10% Credit Inquiries

Every time you apply for new credit, your score gets dinged. (Ironic, isn’t it?)

Ideally, keep your number of new inquires to less than 2 per year.

10% Account Mix

There are two types of credit:

- Installment — You pay fixed, regular installments. Examples: Mortgage, auto loan.

- Revolving — You have an open line of credit. Examples: Credit card, HELOC.

All else being equal, lenders like to see a mix of both, and installment credit is more favorable than revolving.

How to Hack Your Score (in Five Sentences)

Are you familiar with the 80/20 principle? This states that you’ll get 80% of your results from 20% of your effort. In other words, focus your time and energy on the most critical stuff; let go of the rest.

Only three factors — your payment history, utilization ratio and average account age — comprise 80% of your credit score. Focus on keeping those three things as awesome as possible: automate paying on time, raise your limits, keep old accounts open.

(The 80/20 Principle, by the way, is why it’s fine to spend $1 per month on a Coke instead of tap water — as long as you move the needle in major ways. YOLO!)

How to Check Your Score for Free

There are two things you should read: Your credit report and your credit score.

Three bureaus issue your credit report: Experian, Equifax and TransUnion. Each will show you your report once a year for free. Here’s how to systematize it:

- Create three calendar reminders, spaced 4 months apart: January, May, September.

- At each 4-month interval, check your report (for free) from one of the three bureaus. It doesn’t matter which order, as long as you check it from each bureau once a year.

For an easier hack:

- Go to annualcreditreport.com (free) and check your report once a year. (NOTE: Don’t go to copycat sites. If a website demands your payment info, run away.)

This will show you your credit report, but it won’t tell you your credit score.

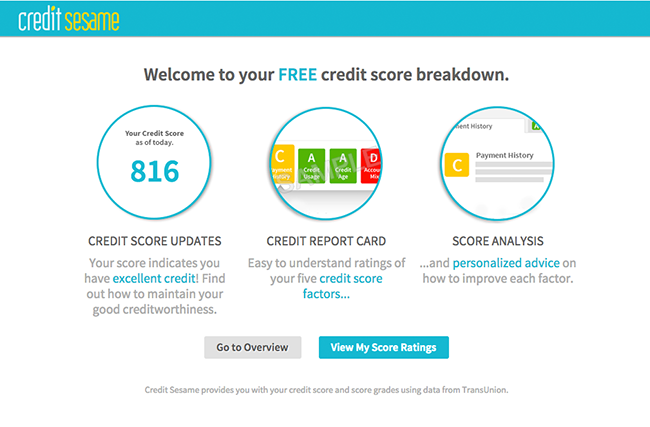

Until a few years ago, it was next-to-impossible to see your score for free, but fortunately this has changed.

There are a handful of websites that will (legitimately) show you your free score, without bait-and-switching you into some unwanted monthly recurring bill. I personally use Credit Sesame, as you can see from the screenshots I’ve posted here. Other stand-alone services include Credit Karma, Quizzle and Credit.com. Your credit card company may also offer to report your score for free.

Myths About Credit Scores

Myth: Carrying a balance will improve your score.

Fact: At best, it’ll have a neutral response (no impact). At worst, it’ll damage your score due to keeping you at a higher utilization ratio.

Myth: Getting unnecessary debt (a car loan, a student loan) will improve your score. You should get one purely for the sake of boosting your credit, even if you don’t need the loan.

Fact: Applying for this loan will damage both your average account age and your credit inquiries, which collectively comprise 25% of your score. Yes, it’s nice to have some installment loans on the books, but that’s only 10% of your score.

Basic math: If you damage 25% of your score for the sake of improving 10% of your score, what happens? Anyone? Anyone? …. That’s right, net damage! In other words, this does more harm than good. Plus, it’s a waste of your money.

Myth: If you pay your bill in full every month, you don’t need to worry about “amounts owed.”

Fact: Wrong-o. Your utilization ratio is based on the statement balance reported to the credit bureaus monthly — regardless of whether or not you carry that balance over to the next month. In other words, even if you pay in full, you could still have a damaging utilization ratio (“amounts owed.”)

Myth: Closing your credit card improves your score.

Fact: Closing cards damages both your average account age and your utilization ratio. Keep old accounts open. Put a tiny payment on them — a stick of gum, once every six months — just to keep them active.

Myth: You’re penalized for checking your credit score.

Fact: You’re only penalized for “hard inquiries” — applications for credit and inquires from outside parties. Checking your own credit score constitutes a “soft inquiry,” which doesn’t hurt you.

Myth: Your income affects your credit score.

Fact: Your income is irrelevant, other than its indirect role in qualifying you for a loan. Your utilization ratio — amounts owed relative to credit limit — affects your score.

Myth: Once you close a credit card or account, it disappears from your credit report.

Fact: All credit cards and accounts, open or closed, stay on your report for a predetermined number of years (typically 7 to 10 years.)

“I’m Anti-Credit Score.”

There’s a vocal minority of anti-debt crusaders who don’t believe in credit scores. Their premise is that if we’re committed to debt-free living, then credit shouldn’t be a concern. Let’s chat about that idea.

“What if I plan on living a debt-free life?”

I’ve never held a car loan, credit card balance or any other debt — so for many years, I thought credit scores didn’t affect me. I understand where you’re coming from.

But there are two instances when I rely on my credit score: Buying a home (or in my case, buying several houses, all of which are cash-flow-positive investments) and earning frequent-flyer miles that cover my international flights.

Even if you prefer to live a debt-free (and a credit-card-free) existence, most people use credit at least once in their life: when buying (or refinancing) a home. And as the chart at the beginning of this article shows, that’s where the difference between “Good” vs. “Excellent” can result in tens of thousands of dollars in avoidable interest.

“Not me. I plan on buying all my houses in cash.”

Until you reach that point, you’ll need a credit score to rent a home. Landlords scrutinize your credit, myself included. I’ve seen the credit scores of all my tenants.

You might also need it to get a job, since many employers also check your credit score — especially if you’re applying at a large company, for a government position, or for anything that needs a security clearance.

“Not me. I’ll write my future landlord/employer a letter, explain that I’m credit-free, and ask him to consider alternative criteria.”

Wow, you enjoy complicating your life, don’t you? Why not just build a score?

“Because I’m a conscientious objector to the tyranny of credit scores.”

Alright. It’s your party. Just don’t email me in 6 months, telling me you’re upset because the employer/landlord declined your request for special treatment, so you missed the opportunity to land your dream job/home.

“That’s a small price to pay for defending my ardent anti-credit-score beliefs.”

Okay.

“You’re not going to argue?”

If you accept that your choices have consequences, and you’re okay with living with the ramifications, then more power to you. The world needs both pragmatists and idealists. You’re clearly the latter.

In the meantime, I offer this credit score advice for the rest of us — those of us who are focused on results, rather than ideology.

“Um — cool.”

Fistbump.