You’re trapped by debt.

You want to quit your suffocating job.

You feel stuck.

Or not?

Maybe you love your job. You’re debt-free. And you’re just trying to figure out how stay awesome.

Regardless of your situation, there’s a basic formula for taking control of your money.

This is a simple, three-step formula, ideal for people who want to keep it simple.

Master these three steps, and you won’t have to sweat about your bank balance anymore.

The Ultimate Beginner’s Guide to Financial Awesomeness

At the basic, bare-bones level, follow three rules:

- Live debt-free.

- Keep cash reserves.

- Invest.

Do these three things, and you’ll be awesome.

It’s simple. It’s basic. It’s as pared-down as possible.

How do you achieve this?

How to Live Debt-Free:

Mind the gap.

You earn $X. You spend $Y. The difference between these two is “the gap.”

Make this gap as large as possible.

How? Here’s my favorite tactic:

- Choose a savings rate.

- Pull these savings directly from the top.

- Live on whatever money is leftover.

I call this the “anti-budget,“ thanks to its simplicity. You don’t need to create an elaborate spreadsheet detailing how much money you spent on dog food.

Save first. Spend the rest.

This is perfect for lazy people (like me) who want the easiest, most automated budget on the planet.

How much should you save? Twenty percent is the bare minimum. More is better.

But if you can’t reach that number yet, start by taking the One Percent Challenge: boost your savings rate by just one percent this month.

How much is that?

- If you earn $2,000 per month, one percent is $20.

- If you earn $4,000 per month, one percent is $40.

- If you earn $6,000 per month, one percent is $60.

Boost your savings by one percent this month.

Save one additional percent next month. And the month after that.

Within a year, you’ll be saving 12 percent more.

By “save,” I’m referring to anything the boosts your net worth, including:

- Paying off debt

- Investing (such as buying a rental property)

- Literal savings in the bank

“How can I spend less?”

Restaurants are a luxury, not a human right. Same goes for cable TV, a new shirt, and prime cuts of meat from the store.

(You can splurge on this later, when you’re debt-free.)

How to Create Massive Cash Reserves:

Next, keep at least 3 months of expenses tucked away into a savings account.

How can you create that cash? At the risk of sounding obvious: Mind the gap. Earn more, spend less.

Let’s look at both options.

The two best ways to supercharge your income are:

- Get a promotion.

- Develop a lucrative side hustle.

Since promotions are rare, I like to focus on the second option: hustling during your time off.

- Erika earned an extra $20,000 per year while also working full-time and attending grad school.

- Julia boosted her income from $8.50 per hour to $250 per hour.

- Randy bought an income-producing rental property while supporting a family of five.

Most people aren’t willing to hustle. Most people are broke.

If you want to attack the “spend less” side of the equation, focus on your housing costs. Housing is probably the single biggest expense.

The average American spends between 28 to 33 percent of their take-home pay on housing. Chop this in half, and you’ve just increased your savings by around 15 percent.

How to Max Out Your Investments

Here’s the simple formula:

- Contribute to your 401k up to your employer match.

- Pour every dime into paying off your debt.

- Afterwards, choose your favorite investment (real estate, 401k, IRA, HSA, etc.)

If you boost your income by $330 per week, you’ll have an extra $17,160 per year. That’s almost enough to max-out your 401k.

If you boost your income by $330 per week, you’ll have an extra $17,160 per year. That’s almost enough to max-out your 401k.

Shave an extra $500 per month from your housing costs — that’s $6,000 annually — and you’ve just maxed-out your IRA, as well.

Or you could use this as a downpayment on a real estate investment.

Score!

If you decide to invest in the stock market, should you listen to your cousins’ best friends’ brothers’ hot-stock-tip recommendation? Hell no.

Here’s a simple, easy investment plan:

Adopt a three-fund portfolio.

Choose index funds (or commission-free ETFs) from Vanguard, Schwab or Fidelity. These are some of the lowest-cost brokerages in the U.S.

Be frugal about your investment fees.

If you use Vanguard, I like these three:

- VTSMX — Total (US) Stock Market Index

- VGTSX — Total International Stock Index

- VBMFX — Total Bond Market Index

(They also have even-cheaper Admiral Shares versions of those funds, if your balance is large enough to qualify).

If you use Schwab, I enjoy these three:

- SWTSX — Total (US) Stock Market Index

- SWISX — International Index Fund

- SWLBX — Total Bond Market Index

If you use Fidelity, check out these three:

- FSTVX — Total (US) Stock Market Index

- FSIVX — Total International Stock Index

- FSITX — Total Bond Market Index

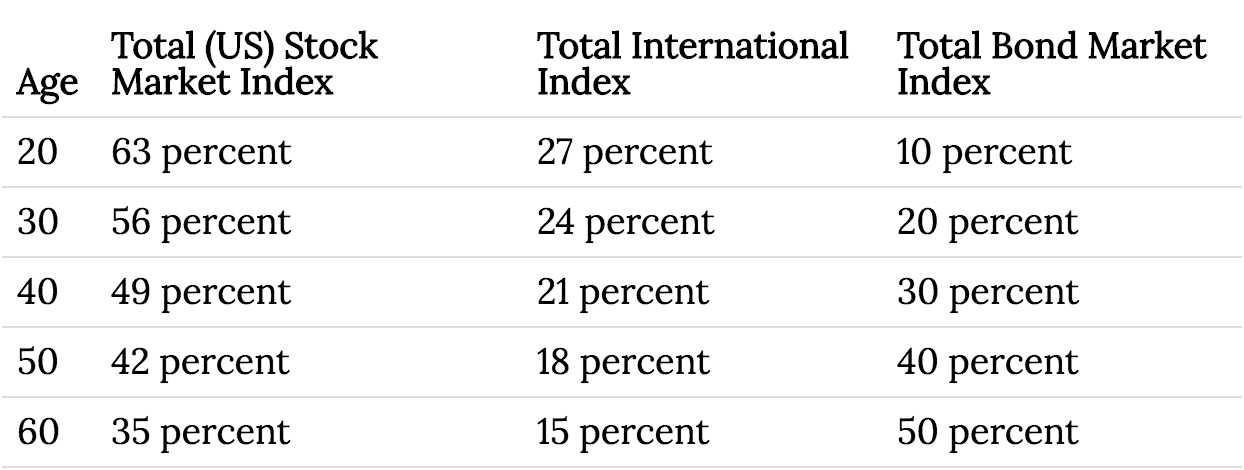

Rule 2: Try this general rule-of-thumb:

Your age minus 10 = the percentage you invest in bond funds, with the rest in stock funds. For example:

- If you’re 20, put 10% in bond funds and 90% in stock funds.

- If you’re 30, put 20% in bond funds and 80% in stock funds.

- If you’re 40, put 30% in bond funds and 70% in stock funds.

- If you’re 50, put 40% in bond funds and 60% in stock funds.

How should you split the “stock fund” portion between U.S. and international funds?

The rule-of-thumb is between 20 to 40 percent of your stock funds should be invested in the International Index Fund, with the other 60 to 80 percent of your stock funds in the Total (US) Stock Market Index.

Let’s say you’re going to invest 30 percent of the stock portion of your portfolio in International Funds. Here’s how it would break down:

Throughout the year, some funds will rise while others fall. Once a year, rebalance so that you’re back at your ideal percentages (shifting slightly for your age).

And … that’s it.

Simple, eh?

The Beginner Formula for Financial Awesomeness

The three steps above are beginner baby steps.

You’ll notice that I didn’t discuss investing in sector-specific funds, or allocating a small percentage to individual stocks, or buying rental properties.

I specifically advocated a three-fund portfolio: I didn’t discuss diversifying based on size (large-cap/small-cap), style (growth/value), and geography (developed/emerging/frontier).

I have a deliberate reason for this.

The Three Beginner Steps are the equivalent of writing a chocolate-chip cookie recipe that says:

- Turn on the oven.

- Divide store-bought cookie dough into chunks.

- Place on baking tray.

Can you develop more elaborate recipes? Of course.

Will they taste better? Only if you get it right.

If you get it wrong, the cookies will taste horrid. (Yuck.)

Don’t bake from scratch if you can’t turn on the oven yet.

The 80/20 rule of thumb says that we get 80 percent of our results from 20 percent of our efforts.

Buying store-bought cookie dough represents that 80 percent. It propels us from “not eating cookies” to “eating cookies.” It’s good enough.

If you want to further optimize, you can start testing recipes that involve baking soda, vanilla extract, and expeller-pressed oils. The financial-geek equivalent is investing in REITs, tax liens, and ultrashort bond durations.

If you’re devoted enough to dig “in the trenches,” you’ve earned the right to take those risks.

But don’t jump the gun. (I know — I’m mixing metaphors. Cookies and guns.) “Done” is better than “perfect.”

This isn’t a guide for advanced investors.

It’s a guide for beginners who want to stop stressing out about the fact that they want to get started but they’re not sure how, and they’re overwhelmed.

Start small. Start simple. Start slow.

Start now.

Avoid This HUGE Mistake …

One huge mistake that beginners make is forgetting that they’re beginners.

Too many people try to jump from “beginner” to “advanced” without taking the intermediate steps.

- They follow water-cooler “hot stock tips.”

- They buy stocks based on gossip and hunches.

- They dive into real estate investing based on wild ideas rather than careful systems.

That’s the financial equivalent of burning an entire tray of cookies.

As a beginner, be neither swayed nor scared.

Don’t Be Swayed —

Don’t be swayed by some get-rich-quick hot stock tip. (And NEVER utter the phrase: “I’ll live in this house, then rent it out for awhile, and hope it’ll rise in value.” That’s not a business strategy; that’s gambling.)

Raise your right hand, and make the following pledge: “I will ONLY buy a rental property AFTER I learn how to calculate cap rates and cash-on-cash returns.”

Don’t Be Scared —

Don’t be scared by the fancy suit-and-tie professionals who want you to believe that you need to diversify into 50+ mutual funds, based on criteria such as size, style, geography, duration, bond-rating, liquidity, sector-specific, precious metals, commodities, and management style.

Many people in the financial industry like to overcomplicate things. In fact, they make money when you feel overwhelmed.

They know you’ll throw your hands in the air and say, “Oh, screw it. You handle it. Make decisions for me. Here’s your fee.”

Investing doesn’t need to be complicated. Or expensive. Or dependent on a “hot tip” from your second-grade-teachers’ uncles’ dog-sitters’ third-cousin.

Just stick to the beginner recipe:

- Live debt-free

- Keep cash reserves

- Invest

You’ll be ahead of the crowd.