After I graduated from college and accepted an entry-level job, I received a starting salary of $21,000 per year.

Adjusted for inflation, that’s $24,100 in today’s dollars.

I was a diligent saver, even then. I directed 15 percent of my pre-tax income into my 401k and another 5 percent into a Health Savings Account. I forced myself to live on whatever was leftover.

(I freelanced in the evenings, and saved this money for travel.)

When I told the “grown-ups” around me that I was investing 20 percent of my income into retirement and health accounts, they complimented me. They told me I’m making excellent progress.

They were wrong.

I wasn’t progressing. Not really. Here’s the sad truth that nobody discusses: 20 percent of “not much” is not much.

Don’t get me wrong: I’m glad I did it. And I recommend it. Something is better than nothing.

But it’s not enough.

Even with a 20 percent retirement savings rate, I was still saving only $4,200 per year. That’s not even enough to max out an IRA.

Forget about amping up to “Full Max” Status, which happens when you max out your 401k, IRA and HSA. That prospect was literally impossible – it was more than my salary.

And if I wanted to save for the downpayment on a home? Or buy rental properties?

Fugghedaboutit. #NotGonnaHappen

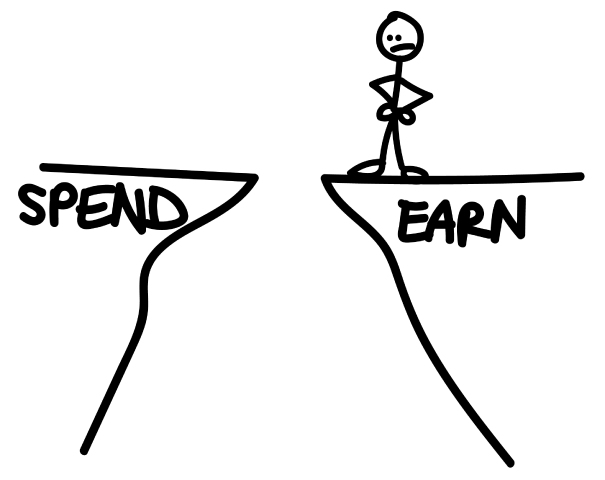

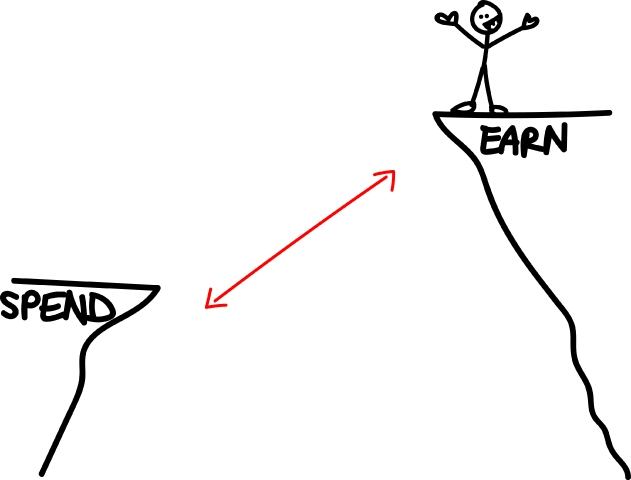

Mind the Gap

In between “what you earn” and “what you spend,” there is a gap.

Your job is to make this gap as wide as possible. Mind the gap.

There are two ways to increase this gap:

- Earn More

- Spend Less

Both are critical. But the more you make, the easier it is to save – and the more substantial those savings become.

Frugality is necessary, but not sufficient.

Earning more, on the other hand, fast-tracks your path to freedom in ways mere penny-pinching never could.

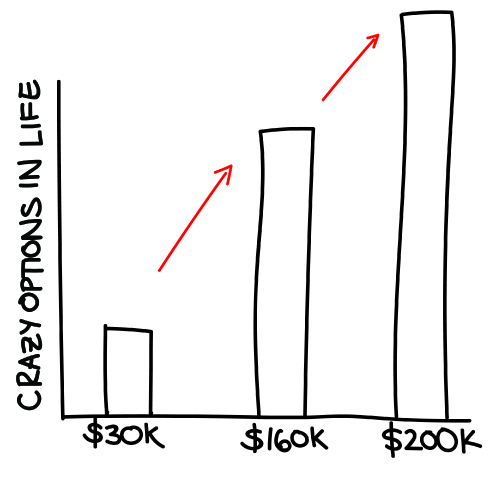

Let’s say you earn $30,000 per year. You’re a rockstar at frugality. You live in grandma’s basement. You eat Ramen noodles and wear used underwear. You sock away 50 percent of your pre-tax income — $15,000.

That’s not going to get you very far.

You can almost max out your 401k with that money. Almost, but not quite.

You can’t “Full Max” your retirement accounts. You can’t save for a house – unless you’re willing to rob your retirement contributions for funds. You’ll never become a landlord (unless you’re willing to look into those risky, no-money-down options, in which case you’ll be swimming in debt.)

But what if you earn $160,000 per year?

Your options explode. You can move into a nice apartment, drive a car, and buy produce at the grocery store – and still save 50 percent of your income, or $80,000 per year, with virtually zero hassle or inconvenience.

(You’d live on $32,000 – totally reasonable for a single person or frugal couple — pay $48,000 in taxes, at an effective 30 percent rate, and save $80,000.)

You could “Full Max” every retirement account AND have enough money leftover to cash-flow a rental property, travel, buy your dream home, send yourself to grad school, or pay for your kids’ college.

Imagine buying a house. In cash. Every year.

If you’re a high-earner, paying cash for houses – consistently – isn’t that far-fetched.

Two Incomes = Turbocharge

Now, imagine that you’re part of a dual-income couple.

Two people can live almost as cheaply as one. You’ll share one mortgage/rent payment, one electric bill, one water bill. You’ll consolidate insurance accounts, cook in bulk, and perhaps even share a car.

Next, imagine that both of you are high-earners. Let’s say you make $200,000 combined. You live (pretty lavishly) at $40,000 per year. (That’s $1,330 per month for your rent/mortgage, and $2,000 per month for everything else.)

You pay $66,000 in taxes, at a 33 percent effective rate. You save $94,000 per year.

That’s $7,800 per month – in pure savings.

Once you start saving that much, freedom is just around the corner.

But you need to boost your income in order to get there.

Your mental bandwidth is limited, and if you devote your precious brainpower to clipping coupons and chasing buy-one-get-one-free deals, you won’t widen the gap – not in any meaningful way.

Sure, you’ll pat yourself on the back. You’ll feel better about yourself. You can even brag to your friends: “Check out this free bottle of ketchup! I stacked a manufacturer’s coupon with a store coupon and then mailed-in a rebate …”

Stop.

You’re chasing immediate gratification. You want the “buzz” of scoring free ketchup. But you’re not moving the needle. You’re not minding the gap.

Do You Want Immediate Gratification? Or Real Progress?

Without disclosing my actual income, I can tell you this much:

- I max out every retirement account available to me: Roth Solo 401k, Roth IRA, and HSA.

- I’ve bought houses in cash.

- I’ve travelled across Europe, the Caribbean, Southeast Asia and plenty of other corners of the globe.

If I still earned $21,000 per year, I couldn’t even think about doing this.

The more I make, the more substantial my savings.

The more I make, the greater the “gap” between income and expenses.

Mind the gap. If I can distill personal finance advice into three words: Mind the gap.

Focus on ramping up your income, while keeping your expenses the same or less. That gap will naturally grow wider and wider.

That moves the needle.

Okay, so earning more and minding the gap is important. I get it. But I want no idea where to start!

Fair enough. Below are some articles I’ve written that might help you out, but here’s an easy suggestion that allows you to take action right now, especially if you love pets:

Become a pet sitter or dog walker with Rover! You can earn $100/week or more on your schedule. To get started, sign up here and complete the registration process, and Rover will take it from there.

Want to Read About Accelerating Your Awesomeness?

- Read about How Erika Earned $20,000+ in Her Spare Time

- Read this Ultimate Beginner’s Guide to Financial Awesomeness (twice the awesome)

- Discover The 4-Step Plan to Escaping the Ordinary

Photo credit: Flickr / Powel Loj