It doesn’t (necessarily) wear gothic or punk clothing. It doesn’t skateboard or spray-paint or smoke pot.

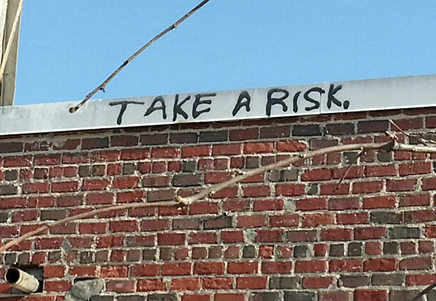

The new rebel is quietly subverting the status quo.

But you’d never know by looking at them.

If you pass the new rebel on the street, you’d see an ordinary person.

The new rebel isn’t defined by their clothing, music or hobbies. They could wear hipster plaid or preppy polos. Their earbuds might pump Miley Cyrus or Mozart. They might work as artists or accountants.

The new rebel doesn’t care about those superficial qualities. This doesn’t define their movement.

The new rebel rejects the ordinary in the ways that matter:

- The conformist majority is broke. The new rebel builds wealth.

- The conformist majority toils in a cubicle, endures a long commute, then stares at the TV like a glassy-eyed zombie. The new rebel maximizes life.

Rebellion now takes the form of eating organic produce and opening a Roth IRA.

Let’s explore further, shall we?

#1: The Debt-Free Rebel

Debt is a synonym for “self-imposed shackles.”

But that doesn’t stop the conformist majority from piling up debt faster than they pile pancakes onto their plate at an all-you-can-eat breakfast buffet.

If you ask them about their self-inflicted confinement, you’ll hear them say: “Oh, debt is normal.”

Who cares if it’s normal?!

Do you want to be average? Fine. Guess how much debt the average American carries?

(Hint: It’s a five-figure whopper.)

The average American owes $10,300, according to this breakdown of statistics from a 2012 Federal Reserve report.

That doesn’t include a mortgage.

But it does include $3,000 in student loans, $2,200 on credit cards, $2,200 in auto loans, $1,800 on a home equity line of credit, and $1,100 in other debt.

Yikes.

Want to pursue a dream job, launch your own business or travel the world? Too bad. If you’re normal, you’ve got a credit card balance that’s racking up 14 percent APR.

So I’ll say it again: Normal sucks.

#2: The Rebel with a Retirement Plan

The conformist majority are shackled to their jobs.

Don’t believe me? Let’s look at Americans between the ages of 55 to 64.

Guess how much money the majority of people in that age bracket have saved for retirement?

(Seriously, close your eyes and take a guess.)

My guess would be “$1 million.” Research indicates that once you retire, you should withdraw 4 percent from your portfolio each year. This is (appropriately) called the “4 Percent Withdrawal Rule.”

With a retirement nest egg of $1 million, you should withdraw $40,000 per year. So I’m going to guess that most people can hit that modest goal.

After all, creating $1 million is not that hard. If you invest $500 per month in index funds that bring you 8 percent annualized returns, you’ll have a $1 million nest egg in 33 years.

You’d be a millionaire in the time it takes to pay off your house. Talk about a double-win.

And that’s from modest effort. Just pay your damn mortgage and save $125 a week.

So …

I’m going to guess that the majority of people on the brink of retirement have $1 million saved.

Right?

Riiiight?

No.

Two-thirds of people verging on retirement have median savings of only $12,000, according to the National Institute on Retirement Security.

Twelve thousand. That’s not a typo.

And these are people ages 55 to 64.

Can you imagine?

“Okay,” you’re probably thinking, “but what about the other one-third of people in that age bracket?

“Did you weed them out because they skew the statistics?”

Yes.

“Ah! So I bet they’re the one-third that saved prodigiously and became self-made millionaires …

No.

One-third of Americans ages 55 to 64 have saved zero for retirement.

Zero. Zippo. Zilch.

Ladies and gentlemen, this is the conformist majority. In our nation, it’s considered “normal” to abandon your own future.

Don’t follow the herd. Be a rebel.

#3: The Rebel with a Rich Life

Seven out of 10 Americans don’t have a passport, according to CNN.

That’s right: 7 out of 10 don’t have a passport. If a free trip to Shangri-La fell into their laps, they wouldn’t get past airport security.

The same number of Americans – 70 percent – hate their jobs, according to a 2013 Gallup survey.

And even more Americans, 76 percent, live paycheck-to-paycheck, according to CBS News.

In other words: Almost 3 out of every 4 people in America are broke, stuck, and hate their job.

But it doesn’t have to be this way.

This blog is for the 1 in 4 that believe life can be better than this.

This blog is for the rebels.

If you like this post, please share it. #NormalSucks