How often have you heard people defend flagrant spending with the following words: “Ah, c’mon. It’s only $25!”

How often have you heard people defend flagrant spending with the following words: “Ah, c’mon. It’s only $25!”

Hogwash. That’s the wrong way to think.

The better mental shift is to think: “That cost one hour of my life.”

****

Unless you’re magical, $25 doesn’t appear out of thin air. You get that money in exchange for goods or services.

Ultimately, you want to escape this vicious time-for-money cycle by creating passive investment income.

But if you’re not living on passive income (yet), you exchange time for money (which is a terrible long-term plan.)

That means every time you make a purchase, you’re trading part of your life away.

The U.S. Census Bureau says that the average American worker earns roughly $50,000 per year, so let’s start with that as our Model Reader. Let’s imagine that you earn the national average. You have one of those fancy-pants 401(k) matches and health insurance, so your total compensation is $54,500.

Now let’s take two assumptions: One that’s straightforward, and one that’s unconventional.

Straightforward: A person earning $54,500 a year earns $27.25 per hour (working 40 hrs/week, 50 weeks/year). They lose 28% of their income to taxes, so their take-home pay is $19.62 per hour.

Filling a $50 tank of gas = 2.5 hours of their life.

Buying a $100 jacket = (Actually costs $108 after taxes) = 5.5 hours of their life

If you can shave $150 off your weekly expenses, you’ve given yourself every Friday off. You’ve saved an entire working day of your life, every week.

Do that 125 times, and you’ve “saved” 6 months of your life. That’s enough to quit your job (or take an extended sabbatical) and travel the world.

Unconventional Thinking About Money

Let’s get weird: Here’s the part where I argue that a person earning $54,500 is actually bringing home far less than $19.62 per hour — and therefore loses many more hours of their life with every purchase.

Imagine that you work from 8:30 a.m. to 5:30 p.m., with a one-hour break for lunch/errands. That’s an 8-hour workday. Normal enough, right?

Except that to start work at 8:30 a.m., you need to wake up at 7 a.m. From that moment forward, you’re preparing to go to work — pulling on fancy office clothes, suffering through your terrible commute. The same thing happens at 5:30 p.m., in reverse — you endure your terrible commute, then arrive home ready to iron your shirts.

As I detailed in this post, Can You Figure Out What This Woman Earns?, a person who works an 8-hour day is really working 12-13 hours per day, after you factor for all the “prep time” that goes into each workday. If you do any business travel, the numbers get even worse.

If you count “prep time” as part of the “Total Time Cost of Working,” you’re devoting 60 hours per week (12 hrs/day, 5 days/week) to working. Divide that by your salary, and you earn $18.16 per hour before taxes, or $13.07 per hour after taxes.

But wait! Next, subtract out the “Financial Cost of Working” from your gross income. After all, you need to buy work clothes, pay for gas, maybe get dry-cleaning. Your boss might expect you to answer email round-the-clock, so you get a $89/month smartphone in order to stay connected. You’re also expected to keep a printer, computer and perhaps a scanner at your house — none of which are tax-deductions, because you’re someone elses’ employee.

These expenses could easily knock you down to a total take-home pay of $11 an hour. And that doesn’t even touch on the ridiculous cost of childcare.

Sound extreme? I know. This is meant to shock you. You might not earn as much as you think. And when you spot something that’s “only” $25, it might cost 2-3 hours of your life.

Mental Shift > Complex Budgets

Like most issues in personal finance, the solution boils down to two things: Earn more, spend less.

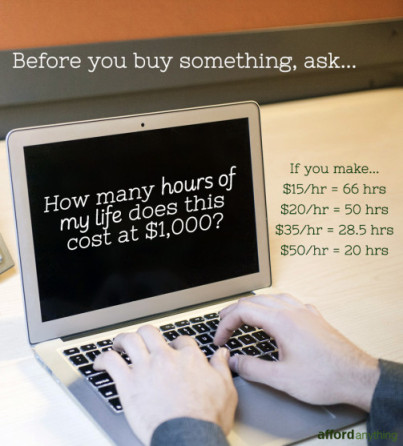

Every time you buy something, ask yourself: “How many hours of my life did this cost?” That single mental shift, alone, will pare down your spending more than any complicated budget spreadsheet ever will.

On the other side of the coin, earning more will make the biggest difference in your life. Saving only goes so far, but it’s ultimately limited. Upping your earnings game, on the other hand, is limitless. Switch into a more lucrative career, start a side hustle, raise your rates. Start earning $150,000 a year, instead of $50,000.

Most importantly, invest. After you “up your earnings game,” shovel your newfound dough into index funds and rental properties. Investing is the ONLY way to break out of the unsustainable time-for-money exchange.

Photo credit: Flickr / Tax Credits