It’s time to wave the truce flag over one of personal finance’s greatest battles.

One of the most spirited debates in personal finance circles is the classic “earn more” vs. “save more” standoff.

The “earn more” crowd argues that raising your income is the best way to reach financial independence. There’s no upper limit to this potential, especially if you’re an entrepreneur.

The “save more” crowd argues that, left unchecked, income and spending naturally scale together. Focusing on frugality, therefore, is a better method for creating financial independence.

Here’s what neither side admits:

Both hold unstated assumptions. The “earn more” crowd believes that they’ll spend a fixed amount, regardless of their income. The “save more” crowd believes that they’ll spend a percentage of their income.

The debate boils down to this difference in worldview.

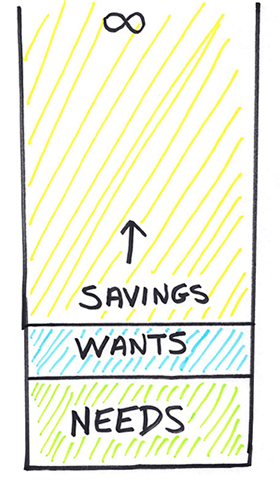

The classic argument “if you earn more, you’ll spend more” is based on behavior and mindset. It argues that people spend a proportion of their income — 90 percent, 80 percent, 50 percent, whatever — regardless of how much they earn.

The counterargument “the more you earn, the easier it is to save” focuses on math and logic. It argues that you need a baseline foundation to cover your cost-of-living plus reasonable comforts. The surplus goes directly to savings; therefore, higher surpluses equal more savings.

Both sides, though, focus on growing the gap between income and spending. And that’s where this conversation needs to turn.

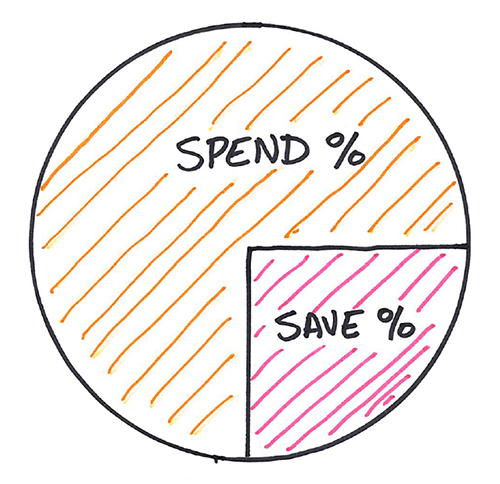

The gap should be our one and only focus. Here’s how I define this gap:

You earn $X. You spend $Y. The gap is the difference, $X-$Y.

Your job is simple: make this gap as large as possible. You can push $X higher. You can drive $Y lower. You can attack both simultaneously. The size of the gap matters more than the method you choose.

Once you’ve grown the gap, invest this into anything that creates cash flow. “Cash flow” are the critical words. Your home is not an investment. It’s cash-flow-negative. Rental properties, index funds, and owning a business, however, enhance your account balances rather than deplete it. These are great uses for the gap.

Let’s look at the power of the gap.

You earn $100,000 annually after taxes. You spend $60,000 and create a gap of $40,000 per year, which you invest in index funds that grow at 7 percent compounding annually. After 19 years, you’ve grown $1.5 million.

If you quit working and withdraw 4 percent of this, you’ll have $60,000 per year before taxes for the rest of your life. That’s financial independence in less than two decades (or faster, if you fling raises into investments).

Can we pause for a moment? We just outlined $0 to retirement in 19 years. Nineteen years. And this happened while living on a comfortable $60,000 of annual spending, which isn’t a fringe extreme.

In fact, let’s take a step back. Let’s imagine a different situation. You want to retire to a balmy beach in Thailand on $40,000 per year. How much money will you need? Let’s figure this out in our heads, within a few seconds, using easy back-of-the-napkin rules-of-thumb.

If you prefer index funds:

The 4 Percent Rule: You can sustainably live on 4 percent of your investments every year. In other words, $1 million in your portfolio means you can live on $40,000, adjusted for inflation, every year.

The 25x Rule: Calculate the amount you want to live on. Multiply by 25. This is the size your portfolio needs to be. Notice the relationship to the 4 percent rule — $40,000 x 25 equals $1 million.

If you prefer rental properties:

The 1 Percent Rule: Your rental properties should collect one percent of their value in monthly rent. In other words, $1 million worth of rentals should collect $10,000 per month in top-line revenue. (“There’s nothing in my area!” — Go where the money is.)

The 50 Percent Rule: Half of the rent will get gobbled up by operating costs, such as repairs, maintenance, management, etc. The implication: if you hold free-and-clear properties that meet the 1 percent rule, you can expect to pocket 6 percent of the home’s value every year, after expenses.

How soon can you retire to a tropical Thai island, based on these general parameters? If you invest in index funds, you’ll need $1 million. If you invest in rental properties, you’ll need $660,000 in properties free-and-clear.

Your target, therefore, is to build $660,000 – $1 million worth of investments. Reach this singular goal, and you’ll receive $40,000 in passive income for the rest of your life. If that income feels too low, double everything. You’ll need $1.3 – $2 million to create $80,000 in passive income per year.

Some of you might be thinking: “Really? That’s it?,” while others might think these numbers sound daunting. To those in the latter group: everything worthwhile feels daunting at the start, and even the most complex situations feel easy in hindsight.

You’ve mastered driving a car, memorizing all 50 states, filing taxes, and all types of other cognitively complex behaviors. You can manage this, too. You’ve already taken the first step. You’ve built the map. You know the goal. Now the focus is growing the gap.

Financial independence boils down to one simple focus: the gap. Grow it. Invest it. Repeat. There’s not much more to say. We can draw diagrams and build models under a hailstorm of variables, juicing ourselves with pure nerd-fun along the way. But this spreadsheet tinkering isn’t necessary.

The only road to financial independence comes from focusing on the gap. Do this one thing, and everything else falls into place.